When an unprecedented funding winter freezes a vibrant ecosystem, do all startups suffer equally? For Indian startups, 2023 had been a challenging year as overall funding hit a seven-year low, tumbling to the levels of 2017. As capital dried up across sectors and genres irrespective of funding stages, many women-led startups failed to attract venture capital despite the big strides made towards gender inclusivity.

India is not the lone sufferer. Globally, too, female founders lacked the much-needed financial backing from investors due to gender-based stereotypes and a limited number of iconic role models. According to PitchBook-NVCA Venture Monitor, U.S. startups with at least one female founder bagged 26.1% of the VC pot in 2023, while all-women founding teams secured less than 2% (1.8%, to be precise) of the total deal value in the same year. Even in 2021, a year flush with VC money, female-led startups in the EU barely raised 2% of the funding, per a Reuters report.

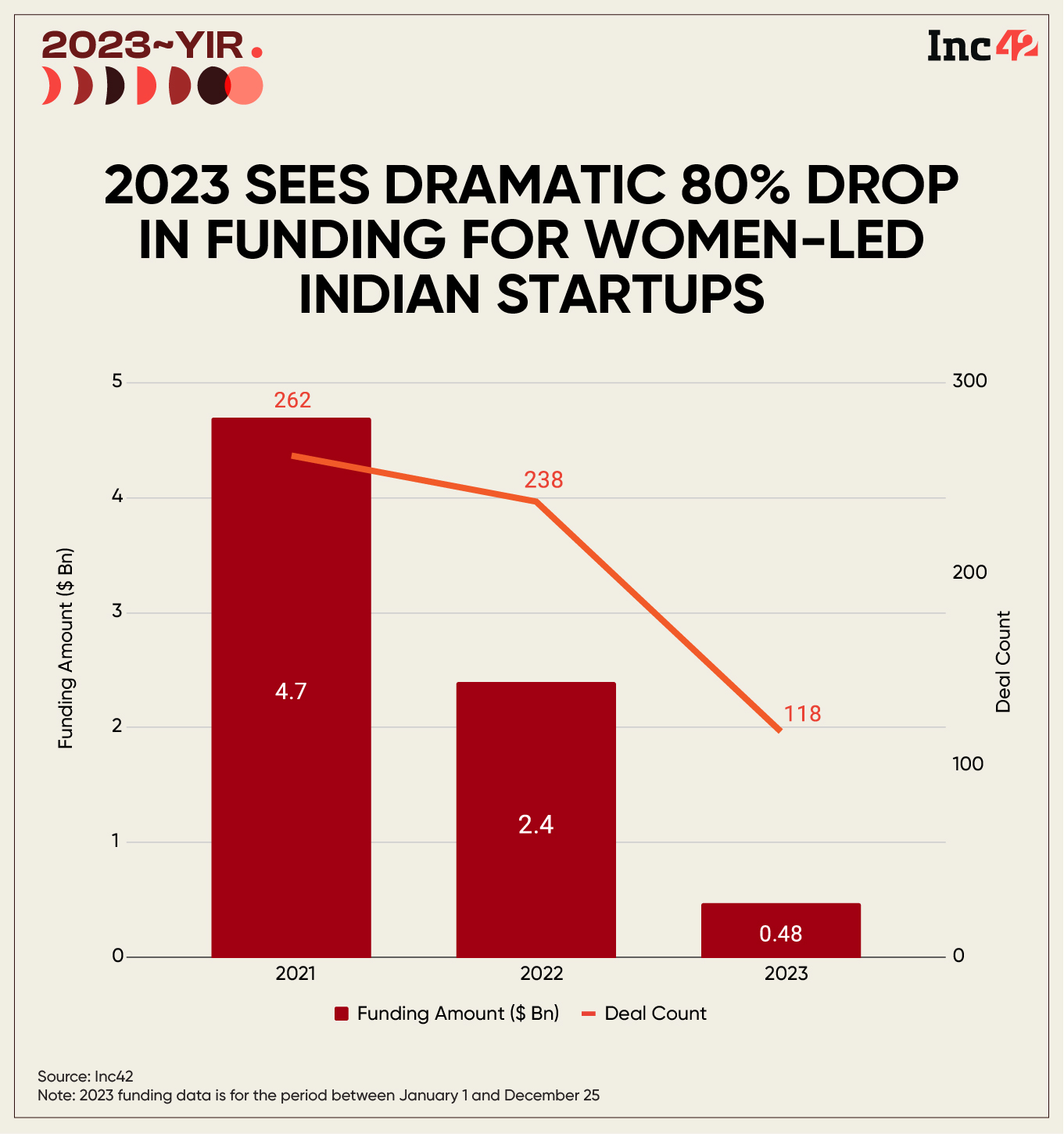

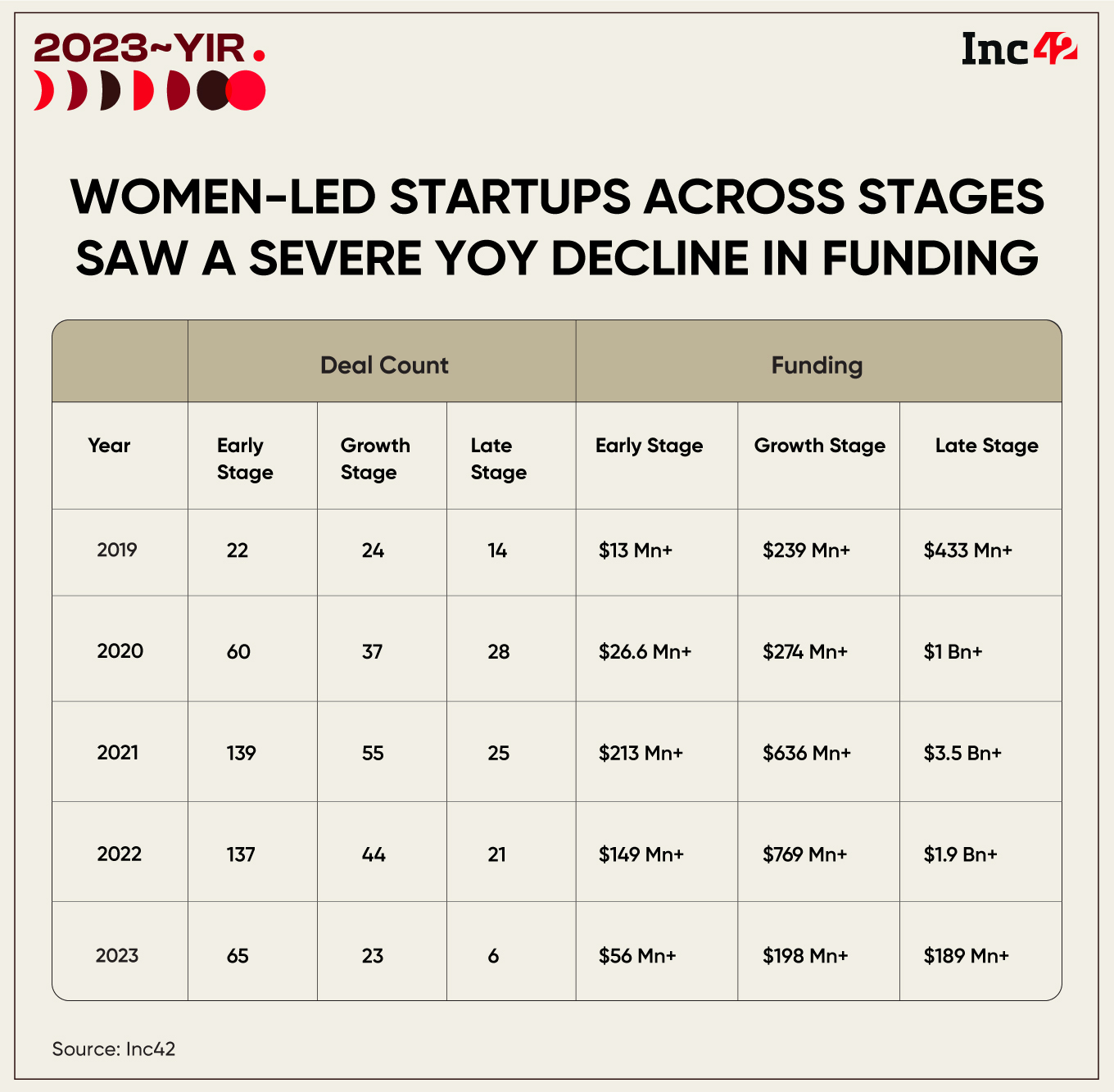

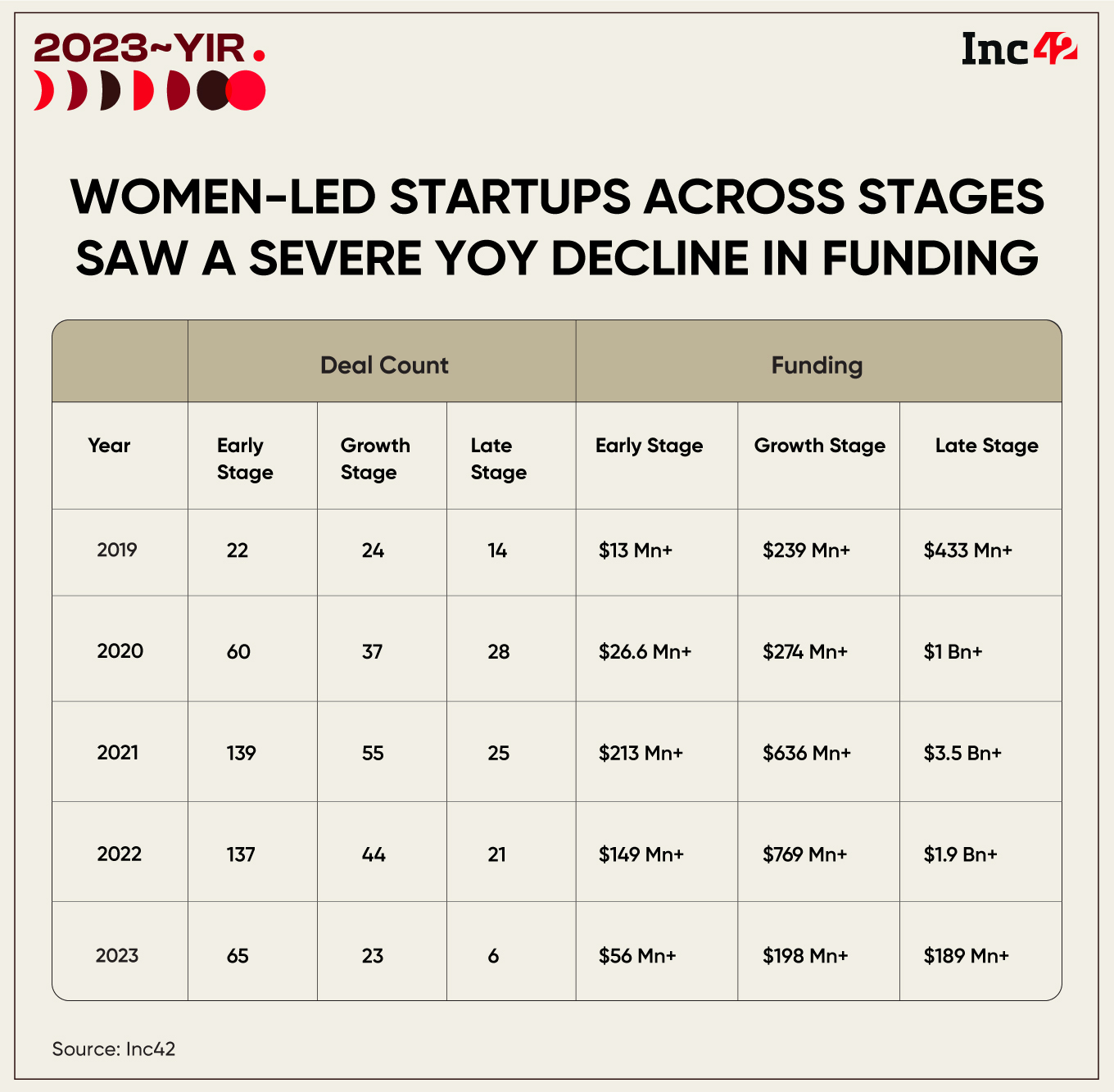

Closer home, women-led startups raised $480 Mn+ in 2023, an 80% decline compared to $2.4 Bn+ secured in the previous year, according to Inc42’s Indian Tech Startup Funding 2023 Report. As for deal count, women-led startups saw a more than 50% dip in 2023 to 118 from 238 in 2022. In the Indian context, we have included co-led entities with at least one female founder, all-women teams and female solopreneurs.

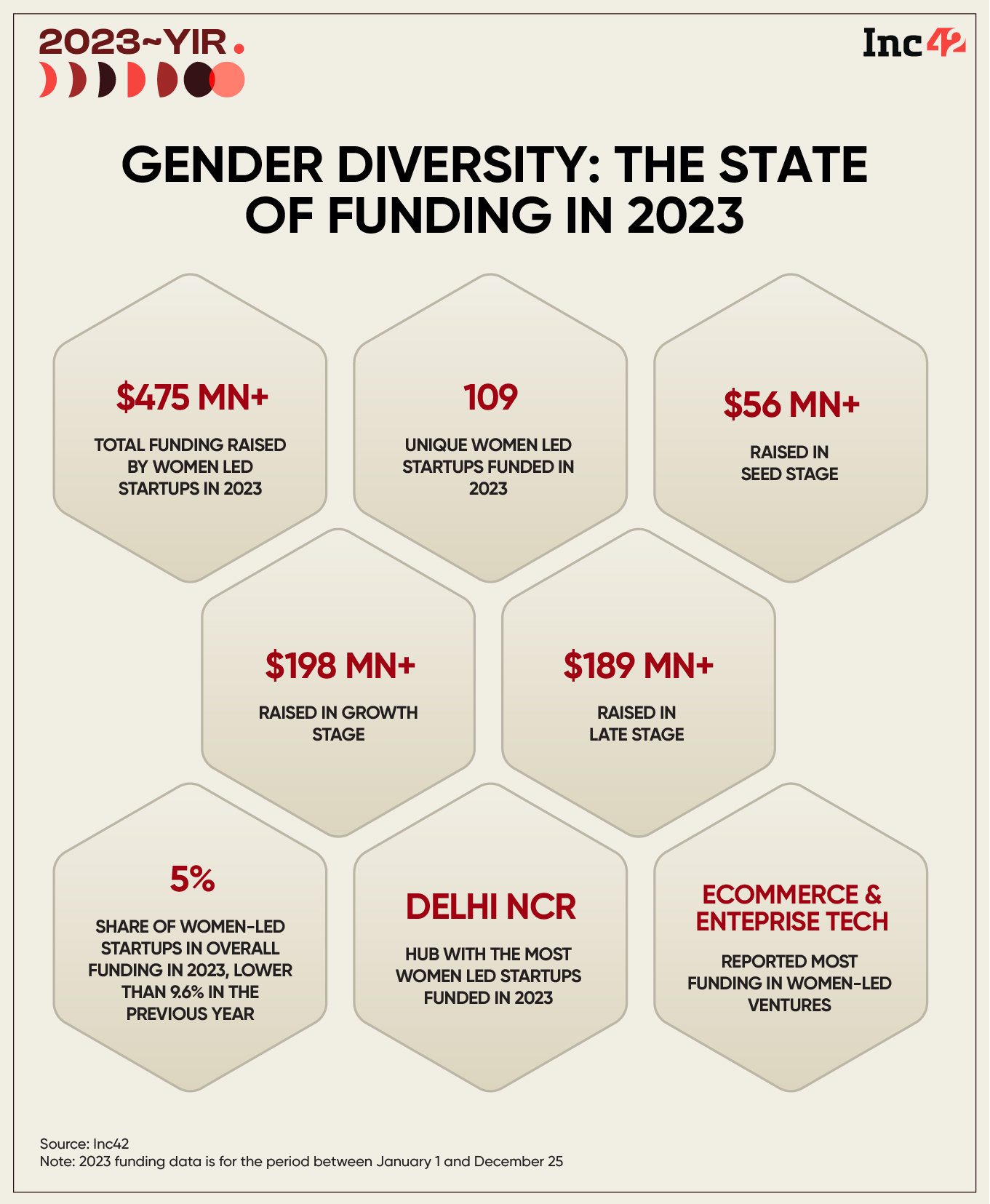

Of the $10 Bn collectively raised by the Indian startups in 2023, 5% was scooped up by women-led businesses. It was lower than the previous year, when women entrepreneurs bagged $2.4 Bn+, or 9.6% of the $25 Bn funding.

Nevertheless, the highest amount in 2023 was raised by Pixis, a co-led martech startup founded by Shubham A Mishra, Vrushali Prasade and Hari Valiyath. It offers a codeless AI infrastructure for scaling up marketing efforts and has raised $85 Mn from a clutch of investors, including Touring Capital, Grupo Carso, General Atlantic, Celesta Capital and Chiratae Ventures.

Several startups with at least one female founder also raised significant funding rounds. Blue Tokai Coffee, Aviom, LEAD School and Mad Street Den were among these.

When it comes to sectors, women-led startups in the ecommerce space saw the highest number of deals (42) in 2023, followed by enterprise tech (18) and edtech (12). However, enterprise tech took the lead in deal volume and raised $157 Mn, followed by ecommerce ($114 Mn) and fintech ($52 Mn) as per Inc42 report.

Are Female Founders Falling Prey To Gender Bias?

According to Inc42 data, women-led early stage startups raised the lowest funding in 2023 at a little over $56 Mn, while growth and late stage businesses secured $198 Mn and $189 Mn, respectively.

In recent months, Inc42 spoke to many female founders and investors to learn more about prevalent sexism, which tends to run deep across geographies.

Surprisingly, most say gender bias does not impact funding decisions much when startups enter the growth stage. At that point, the most critical metrics will be a company’s growth rate and scaling capacity.

The initial doubts regarding a woman’s leadership skills, risk appetite and the need for work-life balance (A Forbes article called it Talent Beyond Childbirth) are over by then, and investors are more open to diversity/inclusion if a business is doing well.

Why doesn’t the funding community foster a gender-neutral approach during early stage funding or stick to a much-needed gender-lens investing? A key reason could be the parameters investors tend to prioritise when supporting new ventures on the block.

According to Seema Chaturvedi, founder of AWE (Achieving Women Equity) Funds, early stage startups heavily rely on their founders, their operations and decisions. Therefore, investors may have conscious or unconscious bias, making them doubtful about the wholehearted commitment of female founders (work-life balance and childcare may play a vital role here). Also, can women make tough decisions and execute those as and when needed? Are they willing to embrace a fast and furious growth path if required? Such doubts usually stem from persistent social bias and gender stereotypes.

Quizzed about the ground realities, Smiti Bhatt Deorah, cofounder and COO of Advantage Club, a global employee experience platform, said, “I haven’t faced any bias while seeking funding. But Sourabh [my husband, who is the cofounder and CEO] and I have encountered unique questions about our dynamics at work. Investors occasionally enquire about our chemistry at work and how we manage the workload as a couple. It’s interesting to note that businesses set up by siblings or friends do not often encounter such queries. It highlights a nuanced aspect of gender dynamics in entrepreneurship.”

Mamaearth founder Gazhal Alagh and SUGAR Cosmetics founder Vineeta Singh also shared their experiences in media interviews, underscoring innate biases when looking for initial funding.

“In my interactions with female founders, they often discuss the bias that cuts sharp through the boardroom when it comes to questioning decisions, thereby forcing women leaders to defer decisions to male cofounders,” said Garima Mitra, cofounder of Treelife that provides legal and financial assistance to startups.

Of course, a handful of success stories are sprinkled across the ecosystem. Think of Falguni Nayar, an investment banker-turned-entrepreneur at 49 and India’s richest self-made female billionaire. Her beauty and personal care marketplace Nykaa raised $215 Mn before going for an IPO. It was the country’s first woman-led unicorn to hit the Indian bourses, valuing the company at around $13 Bn.

Other big names are also there, companies solely led by female founders who have raised Series C rounds and above. Among these are Hardika Shah’s Kinara Capital (lending tech), Anjana Reddy’s Universal Sportsbiz (celeb-associated apparel brand), Saroja Yeramilli’s Melorra (fine jewellery) and Kajal Ilmi’s Aviom (housing finance).

What The Indian Government Is Doing To Fix Skewed Funding

Although late stage and women-led tech startups like Pixis, Aviom, Zypp Electric (an EV-as-a-service platform) and SirionLabs (smart contract management) have won investor trust, an underlying lack of confidence in the potential of female founders to lead better and achieve more seems to persist.

Smriti Irani, Union minister for women, child development and minority affairs, criticised venture capital funds last year for not supporting women-led startups adequately. She emphasised how women entrepreneurs are venturing into the science and technology space, but many cannot secure enough funding.

According to industry insiders, it is high time that investors and entrepreneurs shed the burden of gender stereotypes and work towards bridging the gap.

Furthermore, the government is taking significant steps to introduce more programmes that support women entrepreneurs. In 2022, DPIIT (Department for Promotion of Industry and Internal Trade) announced setting aside 10% of the SIDBI-operated Fund of Funds for Startups Scheme for women, amounting to INR 1K Cr. This initiative aims to increase cash flow through debt and equity to encourage women entrepreneurs.

The same year, President Droupadi Murmu introduced a platform for women entrepreneurs called Her Start. Developed by the Gujarat University, this initiative supports founders running seed-stage ventures and provides them access to essential resources.

Meanwhile, NITI Aayog’s Women Entrepreneurship Platform (WEP), launched in 2017, aims to nurture a conducive ecosystem. WEP provides access to incubator and accelerator programmes, skilling and mentorship, marketing assistance, funding and financial support, compliance and tax guidance and community and networking opportunities.

What Will Change The Funding Landscape For Female Founders?

The investment gap is real, whether we like it or not, but there are ways to close it, given the solutions at hand. For instance, VC funds, other investors and communities that consistently support women entrepreneurs are well-positioned to bring about a positive change in the long term. It will also benefit the startup ecosystem as gender-diversified businesses tend to perform better.

A look at these funds and support systems further ascertains that the country is on the right track. In June 2023, AWE Funds announced the first close of its maiden fund in India at $15 Mn. Known as the Achieving Women Entrepreneurs Early Growth Fund I, this one aims to raise a total corpus of $45 Mn, with a greenshoe option of $15 Mn.

In the same year, Google unveiled a list of 20 startups for its Startups Accelerator: Women Founders programme. Google said it had received more than 300 applications for the 12-week training, designed to empower women entrepreneurs who use technology to solve complex problems and make a positive impact.

Again, Kalaari Capital, SAHA Fund, Shecapital and Arise (StrongHer) Ventures are some of the major funds focussing on female founders. Additionally, India has seen a rising class of women investors, bringing years of experience to the table and emerging as role models for the country’s youth.

Women-led communities like Womennovator, leap.club, HEN India, the Federation Of Indian Women Entrepreneurs (FIWE) and the Women Entrepreneurs’ Council – AIAI India are also maturing fast and playing a pivotal role in fostering entrepreneurship among women. They help develop leadership acumen and provide robust networking platforms to connect women founders with external resources.

These are sound endeavours, but are they enough to reduce the gender disparity in venture funding?

Pearl Agarwal, the founder and managing director of Eximius Ventures, noted that out of the 100 pitches the pre-seed VC fund receives, 85% come from startups led by men. It means, despite the concerted efforts of many VCs, communities and support groups, the systemic biases against women in startups continue to exist, resulting in scant participation and a persistent imbalance in the funding ratio even in later stages when performances matter most instead of perception.

There is a pressing need for heightened gender neutrality and an equitable evaluation process for more equitable funding across the investment ecosystem. With investors sitting on more than $23 Bn dry powder, 2024 may bring new hopes for female founders if the stage is set for diversity and growth.

[Edited by Sanghamitra Mandal]