At a time when the entire world is focussed on the usage of green energy in a bid to reduce its carbon footprint, India, too, isn’t far behind. The country is seemingly doing everything in its power to meet its net zero emission goals.

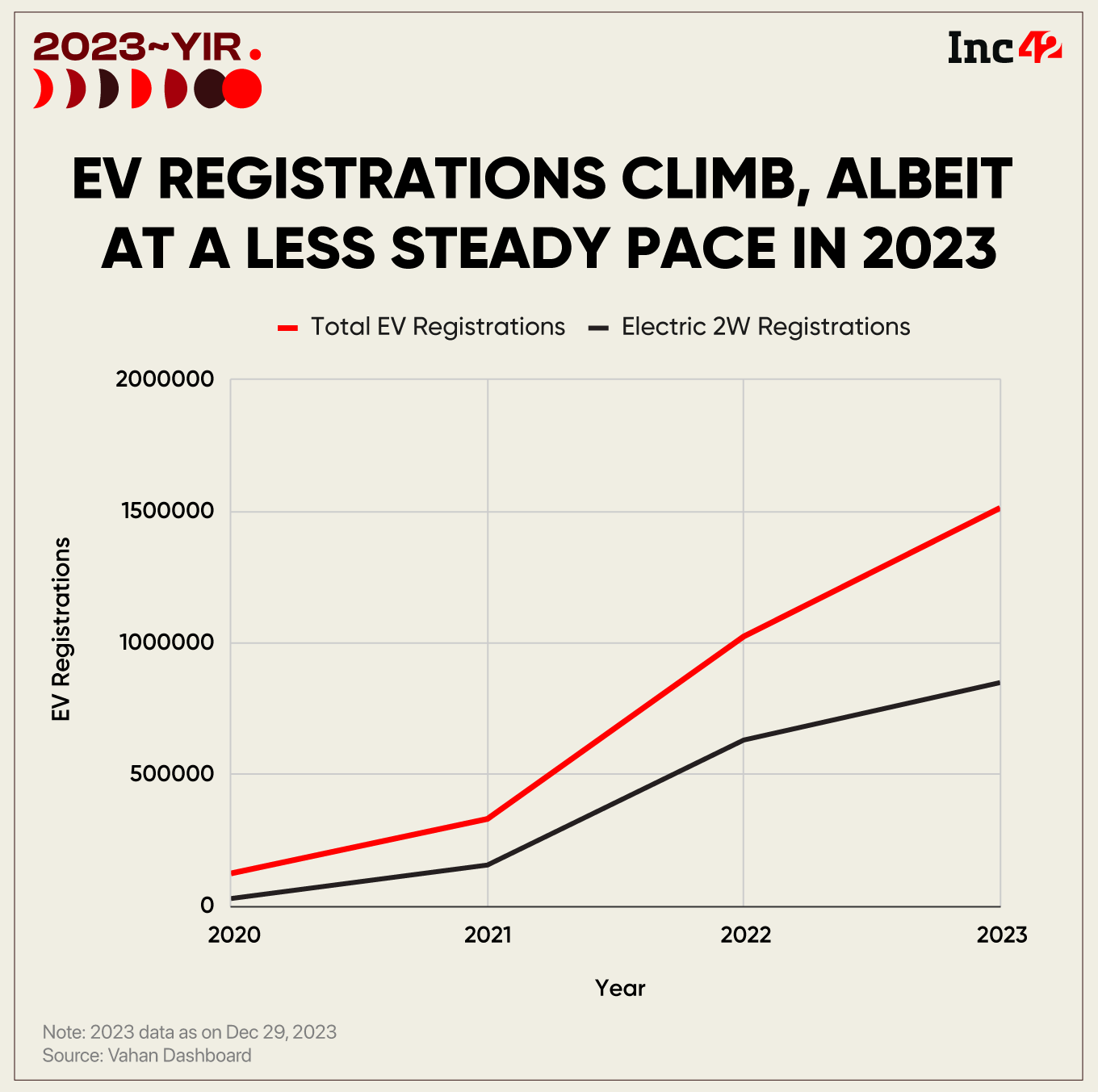

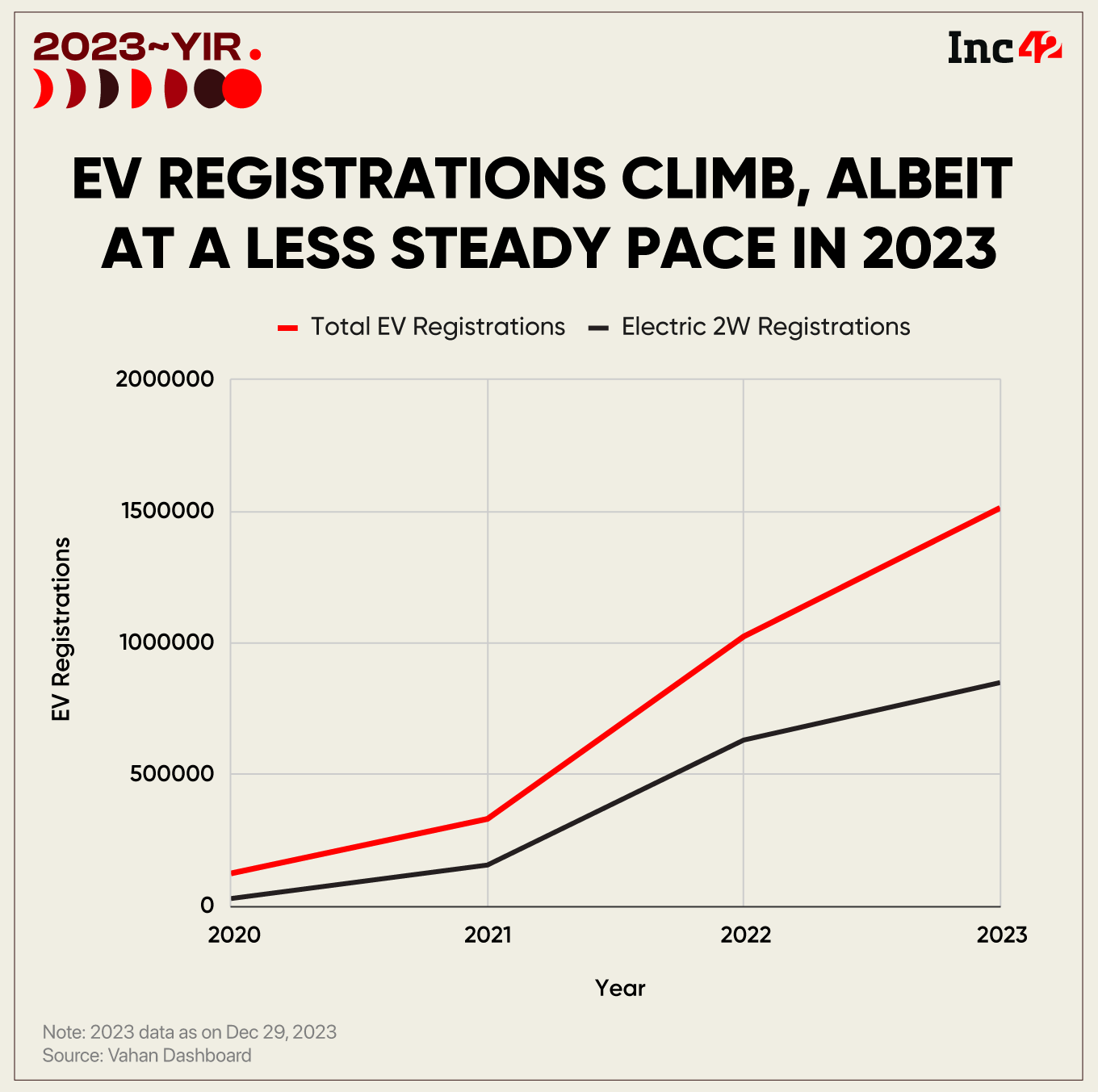

The endeavour is visible in the fact that the electric vehicle (EV) adoption in the country has grown about 50% this year. According to Vahan data as of December 29, the registrations of EVs in the country rose to 15.13 Lakh units in 2023 from 10.25 Lakh units in the previous year.

Within the EV segment, two-wheelers continue to lead the space. The registrations of two-wheeler EVs in the country grew 34% year-on-year (YoY) to 8.49 Lakh units in 2023.

This increase happened despite over a dozen companies in the category getting involved in FAME-II controversies and the government slapping crores of fines on original equipment manufacturers (OEMs). As such, the increase in sales could have been even higher if the FAME-II fiasco had not taken place.

Meanwhile, the year 2023 also saw a major consolidation in the segment.

A Trend Shift?

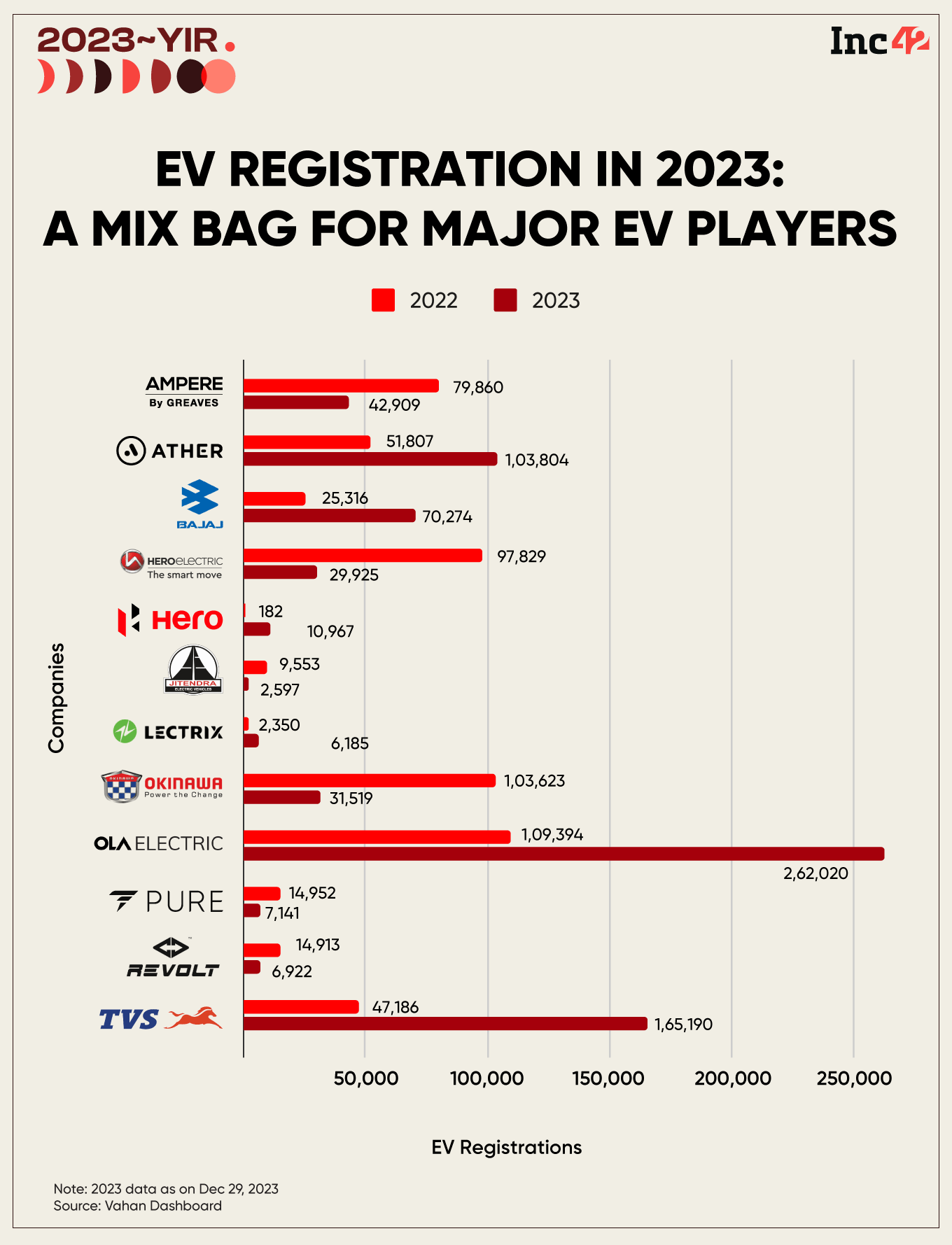

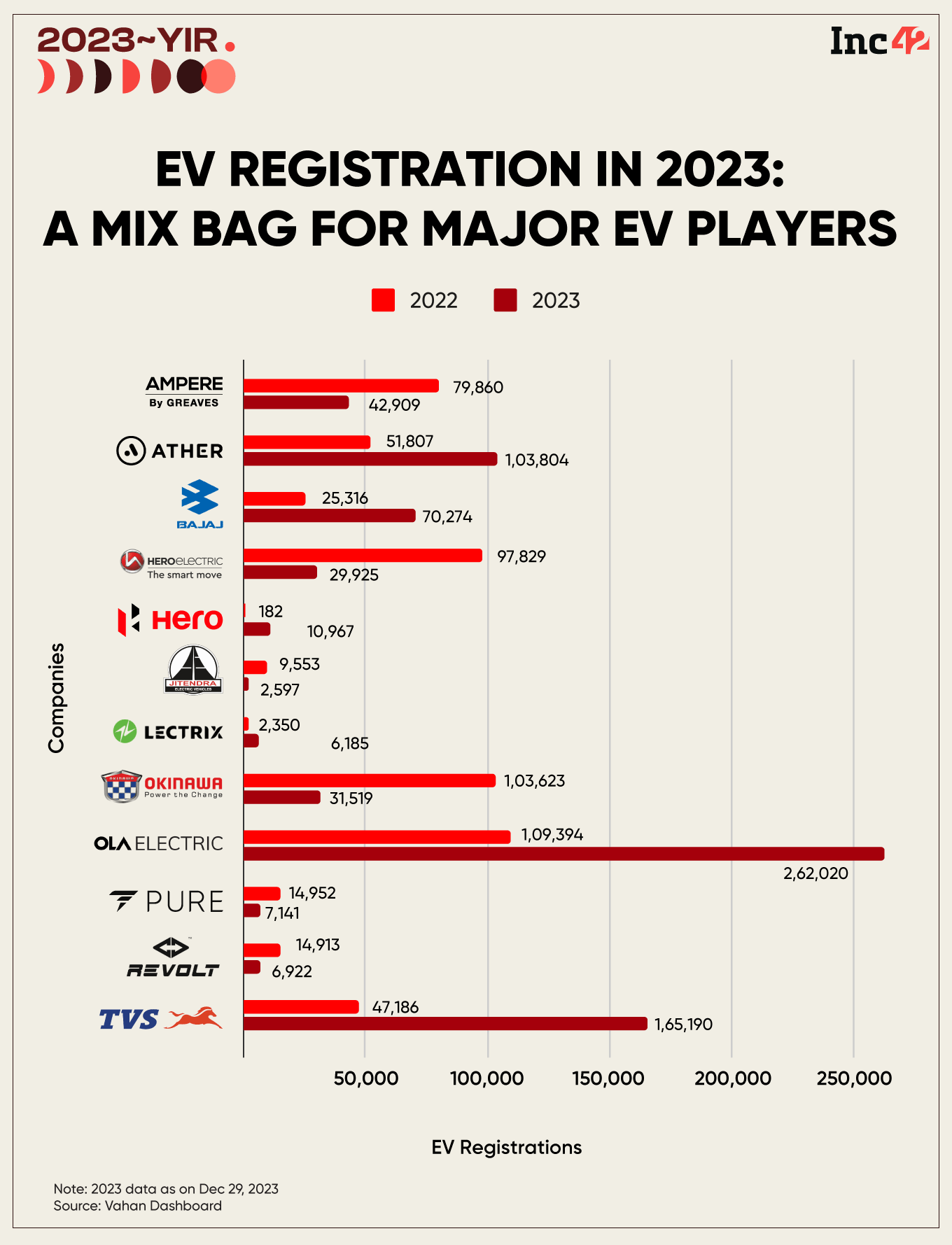

Though electric two-wheeler sales increased, only a handful of players – either legacy automotive manufacturers or deep-pocketed startups – ruled the space this year.

For instance, Bhavish Aggarwal-led IPO-bound Ola Electric witnessed around a 140% surge in its vehicle registrations in 2023 to 2.62 Lakh units from 1.1 Lakh units last year.

Similarly, Ather Energy, which raised around INR 1,000 Cr this year in fresh funding, witnessed an over twofold rise in its vehicle registrations to 1.04 Lakh units.

On the other hand, legacy two-wheeler player TVS Motors emerged as one of the key names in the EV segment this year, with its vehicle registrations increasing 250% YoY to 1.65 Lakh units in 2023. Hero MotoCorp and Bajaj Auto also saw a big increase in their EV registrations.

While some of these top players of 2023 were also embroiled in FAME-II controversies and saw a muted start to the year, they managed to regain momentum by August.

BGauss, iVOOMi Energy, Kinetic Green, Lectrix EV, and Okaya were among the other names that saw a rise in sales on a YoY basis.

However, the most prominent players of 2022, including Okinawa Autotech, PureEV, Hero Electric, Ampere, and electric motorcycle manufacturer Revolt, lost much of their charm this year.

Let’s take a look at the performance of some of the most prominent electric two-wheeler players in 2023 and their month-on-month performance over the last three months:

However, despite the electric two-wheeler segment selling a record number of vehicles this year, the pace of growth clearly slowed down. Last year, the electric two-wheeler registrations had jumped over 300% YoY to 6.31 Lakh units. In 2021, the jump was over 400% YoY.

Some experts Inc42 spoke to are also of the opinion that the FAME-II subsidy issue was a major setback for India’s EV growth story this year.

For instance, Vinkesh Gulati, chairman research & academy, Federation of Automobile Dealers Associations (FADA), had told us earlier this year that in a country like India, which is largely dependent on imports of batteries and cells for EVs due to scarcity of resources, raw materials, and infrastructure, adhering to localisation norms is very difficult.

“FAME-II scheme was the best catalyst to increase sales, but as of now, it is a deterrent for some of the manufacturers,” Gulati had said.

However, some industry players also said then that the industry cannot grow by depending on subsidy alone and there was a need to crackdown on the EV players that functioned more as assemblers of imported parts rather than manufacturing them as per India’s road and climatic conditions.

The FAME-II Controversy & The Path Ahead

The root of the problem was a series of EV fire incidents that grabbed the headlines in the summer of 2022. Ola Electric, Okinawa Autotech, Jitendra, and multiple other players found themselves surrounded by controversies due to the fire incidents – a few of which also claimed lives.

With the rise in such incidents, the government initiated a probe into the matter. The investigation revealed problems associated with the batteries used in these vehicles – either their battery management system (BMS) lacked certain basic safety features or the batteries were of inferior quality.

In any case, it was evident that many electric two-wheeler players were using batteries manufactured in other countries that were not built for India’s climatic conditions. Besides batteries and cells, some players allegedly imported most other parts used in their EVs.

Soon after, the Centre started doubling down on domestic value addition by EV OEMs. It also tightened the battery testing norms.

Following these measures, a dozen two-wheeler EV manufacturers, including Okinawa Autotech, Revolt, Hero Electric, and Ampere, came under the government’s scanner for allegedly claiming subsidies under FAME-II without adhering to the minimum localisation norms prescribed under it.

Starting with holding back the release of some FAME-II subsidies, the ministry of heavy industries (MHI) took multiple steps which slowed the sales growth of these players. The ministry put an embargo on some of the manufacturers from listing their sales on the official National Automotive Board (NAB) portal, slapped heavy penalties, and issued notices to the OEMs to return the subsidy amounts, among others.

Meanwhile, another problem was brewing, which involved Ola Electric, Ather Energy, TVS Motor, and Hero MotoCorp. A whistleblower alleged that these players were selling their chargers and proprietary software separately at an extra price to keep the vehicle prices under the INR 1.5 Lakh cap to avail subsidies under the FAME-II scheme. They were also penalised by the MHI but the adverse impact did not last long.

Many of these players increased their vehicle prices as FAME-II incentives were slashed.

These controversies also resulted in significant volatility in two-wheeler registrations throughout 2023. Starting with 64,693 units of registrations in January, the volume peaked at over 1 Lakh in May but slumped again and remained volatile. After rising more than 22% month-on-month (MoM) to 91,718 units in November, two-wheeler EV registrations fell over 23% to 70,206 units in the last month of 2023.

Meanwhile, the FAME-II scheme is expected to end in March 2024. While there have been demands for the extension of FAME-II and reports around the launch of a new FAME-III, the government hasn’t confirmed either of the developments, officially. Recently, a media report also claimed that the government is considering an extension of the existing scheme till FY25.

However, an industry source told Inc42 that it is highly unlikely that the government would further invest in it right now, particularly with FAME-II being a major “mess”.

“Also, the most important thing is the matter is now in the court. The MHI has erred in many ways, it has been withholding money that it had promised to give the OEMs… and just squeezed out some OEMs for no reason. I doubt the government would add money to the coffers of any ministries’ activity unless it’s clear which way the court decides,” said the person.

“If the court decides that the MHI was completely wrong, then the INR 1,200 Cr that has been held back has to be paid to the OEMs along with the INR 500 Cr claimed from some of these OEMs,” the person added.

It is pertinent to note that the MHI disbursed INR 5,228 Cr in subsidies till December 1, 2023, supporting 11.5 Lakh EVs sold.

At the time of its announcement, the scheme had an outlay of INR 10,000 Cr with an aim to support 7,090 ebuses, 5 Lakh electric three-wheelers, 55,000 electric four-wheeler passenger cars, and 10 Lakh electric two-wheelers.

Will 2024 Accelerate The EV Growth Story?

Rising awareness about the need to combat pollution, improvement in technology, and the government’s promotion of EVs are expected to lead to further increase in EV sales growth in 2024.

Amid these, deep-pocketed players who can survive without government subsidies, are expected to emerge as winners. Besides, the private funding for EV OEMs could also witness a decline with the sentiment now shifting towards supporting the other sub-segments.

According to industry experts Inc42 interacted with throughout the year, the electric two-wheeler market, which is currently cluttered with around 200 players, will witness consolidation going forward as the technology matures and people opt for superior quality products.

Meanwhile, there is an increasing number of electric motorcycle players that have started entering the electric two-wheeler market now, which is also likely to push up two-wheeler EV sales in the coming years.

While established names like Royal Enfield are working on EV launches, many startups are also trying to disrupt the Indian motorcycle market.

Ultraviolette, Orxa Energies, Matter, Oben Electric are among the several VC-backed startups that are expected to start the deliveries of their EV motorcycles in 2024 or scale up deliveries further. Ola Electric also aims to launch its electric bikes next year.

Speaking to Inc42, Mohal Lalbhai, founder and CEO of Matter, said that there is a rising demand among motorbike riders to go electric but there is a supply crunch of affordable and decent mass-market products.

“The motorcycle market is where consumers have been desperately waiting for the supply of a product which is affordable, has a decent range and performance… without these aspects, you will not see enough growth in the electric motorcycle segment. It’s honestly because of the lack of options that consumers are sticking either to ICE or other options,” he said, adding that it is the largest untapped market as far as the two-wheeler EV space is concerned.

As such, the Indian two-wheeler EV market seems well poised for rapid growth over the next few years. However, it remains to be seen how the regulations for the sector evolve and how OEMs deal with them.

[Edited By Vinaykumar Rai]