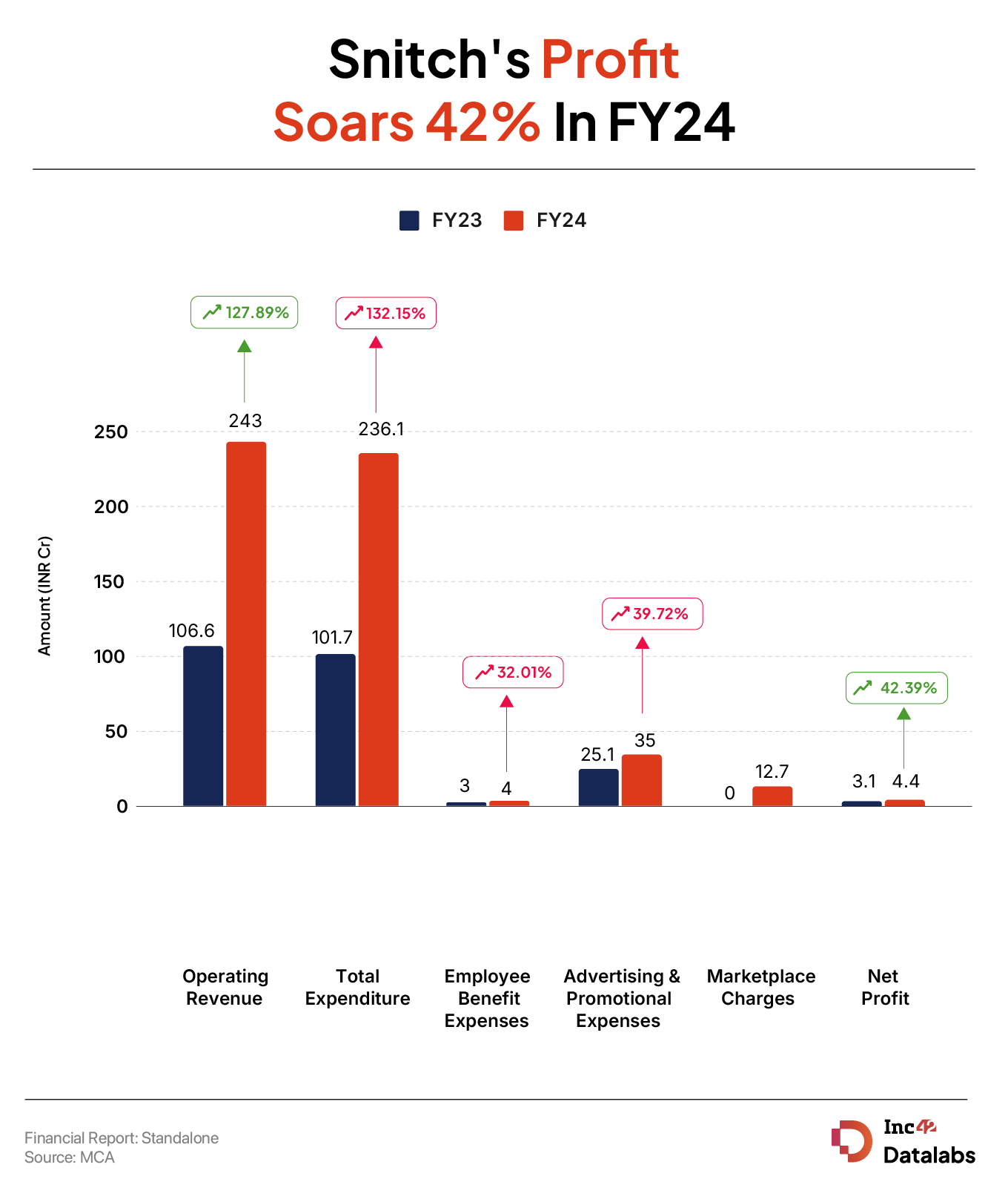

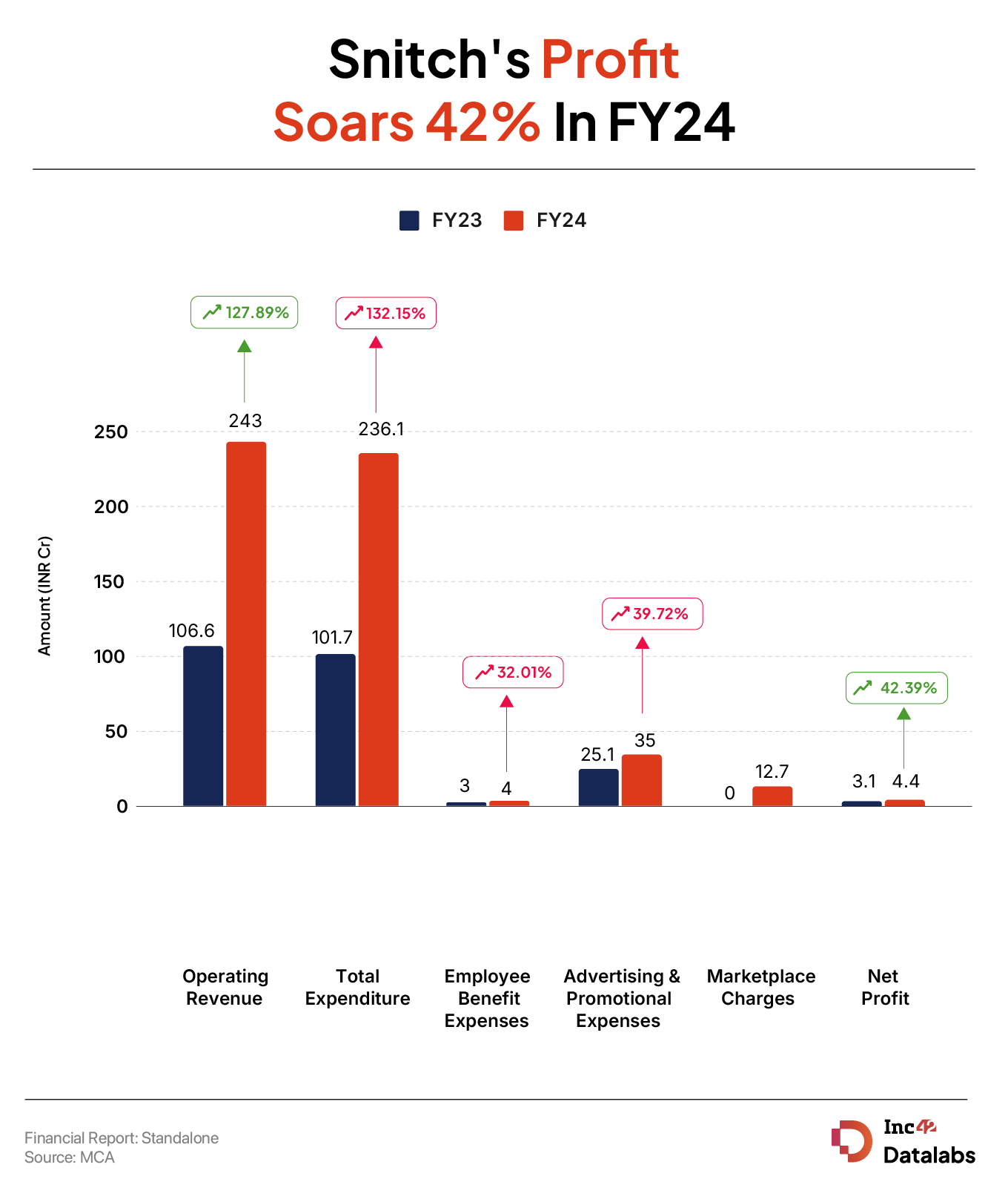

Snitch saw its net profit zoom 1.3X to INR 4.4 Cr in the financial year 2023-24 (FY24) from INR 3.1 Cr in FY23

The startup’s operating revenue surged 127.89% to INR 243 Cr during the year under review from INR 106.6 Cr in FY23

Snitch’s expenses jumped 132.15% to INR 236.1 Cr in FY24 from INR 101.7 Cr in the previous fiscal year

D2C fashion brand Snitch

The startup’s operating revenue surged 127.89% to INR 243 Cr during the year under review from INR 106.6 Cr in FY23.

Founded in 2019 by Siddharth Dungarwal, Snitch started its journey as an offline retail brand. It pivoted to online sales a year later as stay-at-home mandates amid the pandemic shut physical retail stores across the country.

Snitch sells a range of men’s apparels, including shirts, jackets, hoodies, co-ords, sweaters, innerwear, among others.

The startup appeared on Shark Tank India 2023, securing an all-shark deal of INR 1.5 Cr from Aman Gupta, Namita Thapar, Anupam Mittal, Peyush Bansal, and Vineeta Singh.

It last raised INR 110 Cr ($13.19 Mn) in its Series A funding round co-led by SWC Global and IvyCap Ventures.

Building An Omnichannel Brand

Dungarwal credited product expansion and increase in online sales for the revenue growth.

“Our revenue growth in FY24 was fuelled by robust enhancements in our supply chain, supported by deeper investments in data-driven demand forecasting and AI-powered decision-making,” Dungarwal told Inc42.

He said that the startup’s focus on profitable growth in online marketplaces and a strategic push for its iOS and Android apps were the key drivers of success. The founder highlighted that online sales now account for 70% of its total sales.

Pilot categories such as shoes, accessories, and perfumes benefitted significantly from the data-driven insights. “We used data from our online footprint to strategically optimise store locations,” he said.

Looking ahead to 2025, Snitch is prioritising offline expansion while maintaining its strong digital presence. It launched 34 offline stores in the last eight months and is looking to add 10 more in January 2025 alone.

“Our goal is to aggressively expand our offline footprint to 100 stores this year by adding over 65 new outlets,” Dungarwal shared.

According to him, this hybrid approach is expected to drive a 125% increase in revenue in FY25, with offline stores projected to account for 30% of the total sales. The remaining 70% sales will continue to come from digital channels.

Zooming Into Expenses

In line with the increase in revenue, Snitch’s expenses jumped 132.15% to INR 236.1 Cr in FY24 from INR 101.7 Cr in the previous fiscal year. Here’s a breakdown of its expenses:

Employee Benefit Expenses: The startup’s employee costs rose 32.01% to INR 4 Cr from INR 3.1 Cr in FY23.

Advertising & Promotional Expenses: Spending on advertising and promotions surged 39.72% year-on-year (YoY) to INR 35 Cr in FY24.

Marketplace Charges: The startup’s expenses under this category stood at INR 12.7 Cr in FY24. This cost was nil in the previous year as it didn’t have a presence on marketplaces in FY23.