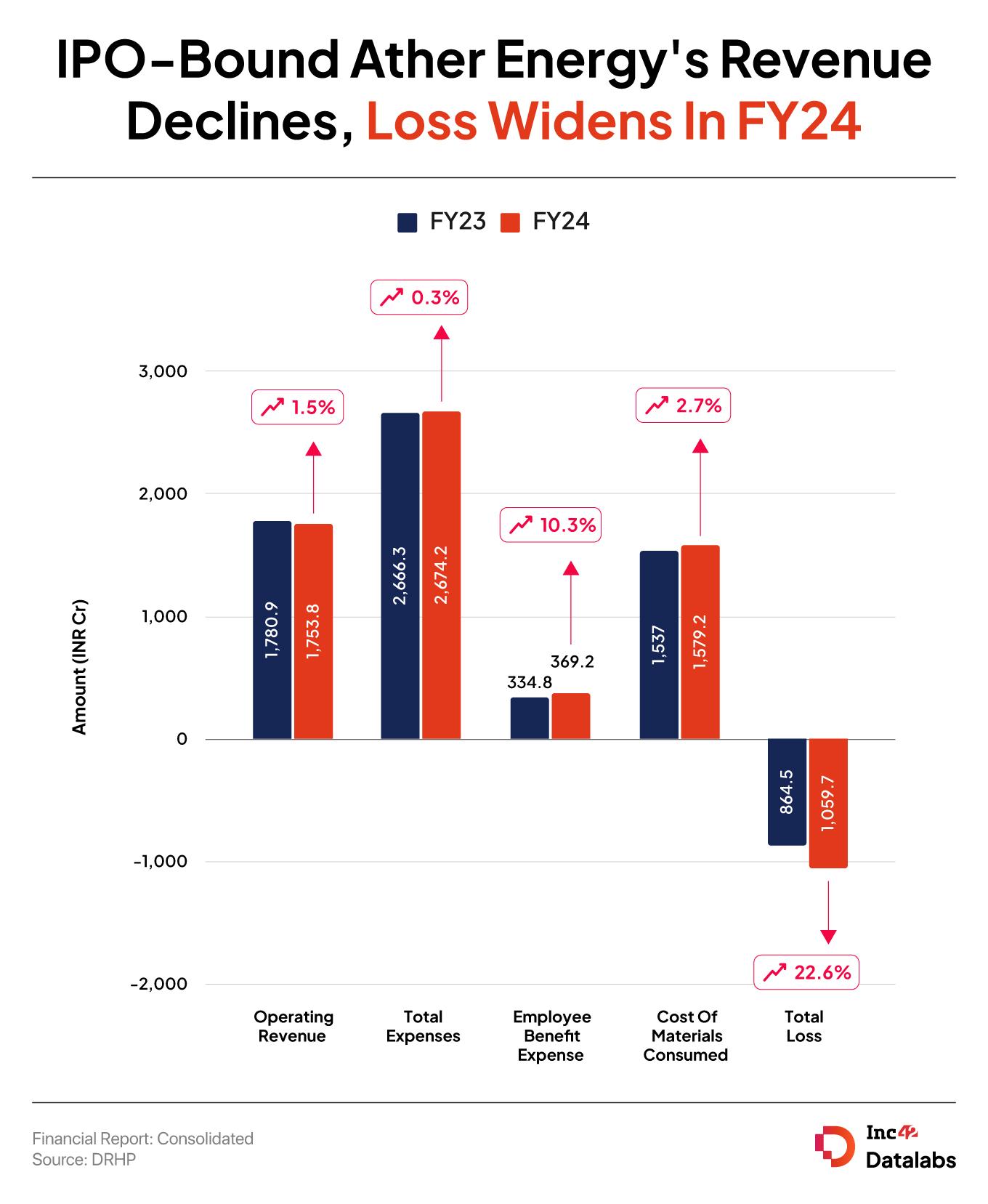

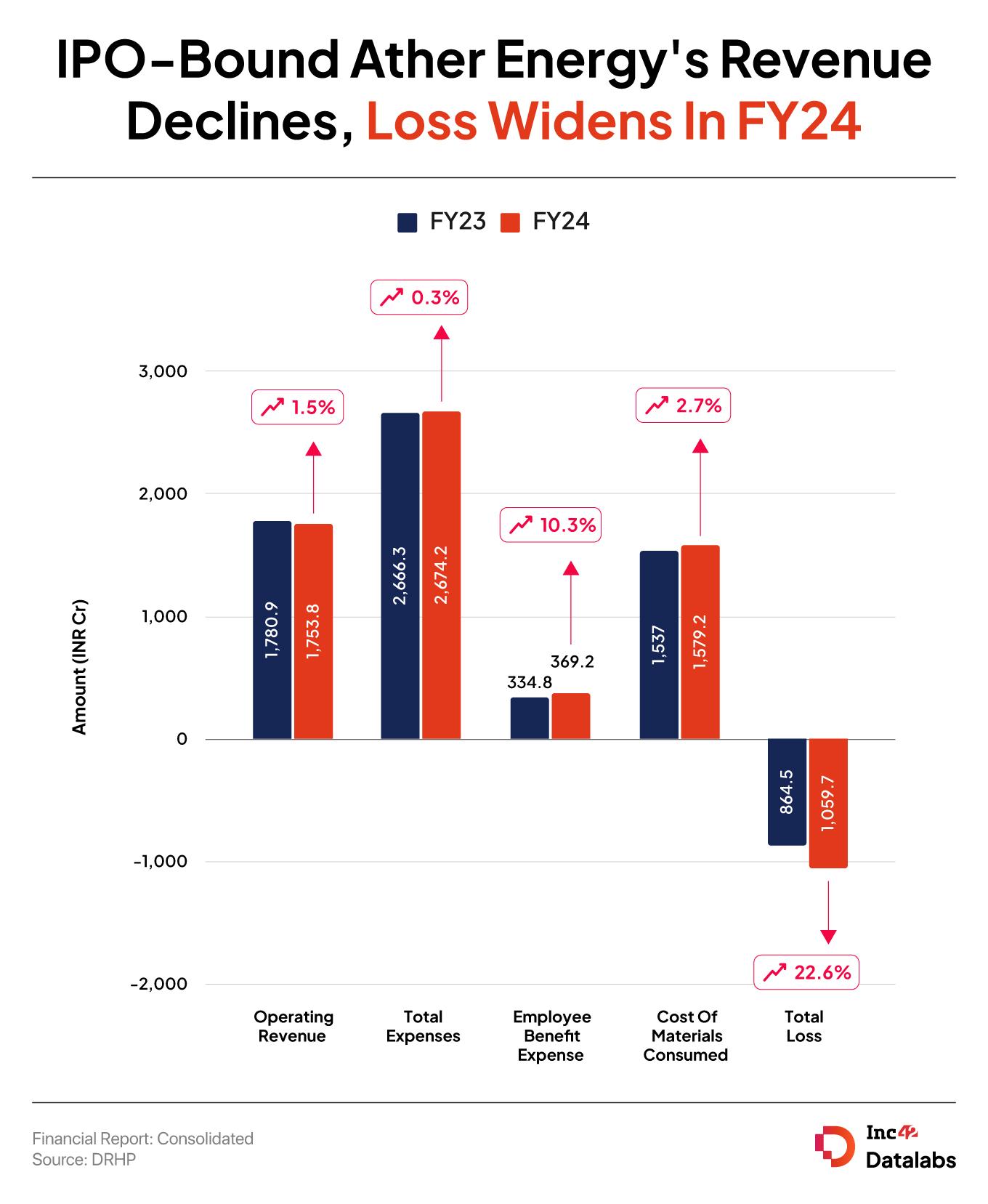

Ather’s operating revenue declined 1.5% YoY to INR 1,753.8 Cr in FY24, hurt by the reduction in FAME subsidy provided by the government

In FY23, Ather’s operating revenue had seen a sharp 335% YoY jump to INR 1,780.9 Cr and net loss also widened 2.5X YoY to INR 864.5 Cr

Ather, which has filed for a more than INR 3,100 Cr IPO, spent INR 2,674.2 Cr in total in FY24

IPO-bound electric two-wheeler player Ather Energy’s operating revenue declined 1.5% year-on-year (YoY) to INR 1,753.8 Cr in the financial year 2023-24 (FY24), while net loss widened over 23% to INR 1,059.7 Cr.

As per the company’s DRHP filed with SEBI for more than INR 3,100 Cr IPO, Ather’s top line was hurt by the reduction in FAME subsidy provided by the government.

In FY23, Ather’s operating revenue had seen a sharp 335% YoY jump to INR 1,780.9 Cr. In line with the EV startup’s growth, its net loss also widened 2.5X YoY to INR 864.5 Cr.

On the reduction in revenue, Ather said in the DRHP, “Government of India has in the past recalled and scaled back, and may in the future recall or scale back, the benefits available to EV manufacturers under its schemes, increasing the costs borne by EV manufacturers. For example, pursuant to a notification dated May 19, 2023 from the Ministry of Heavy Industries, Government of India, the cap on incentives for the FAME scheme was scaled back from INR 15,000 per kWh to INR 10,000 per kWh, with effect from June 1, 2023. As a result of the reduced subsidy, our customers faced an increase in the retail price of our E2Ws ranging from INR 20,434 to INR 30,285. This contributed to a slight decrease in our revenue from operations.”

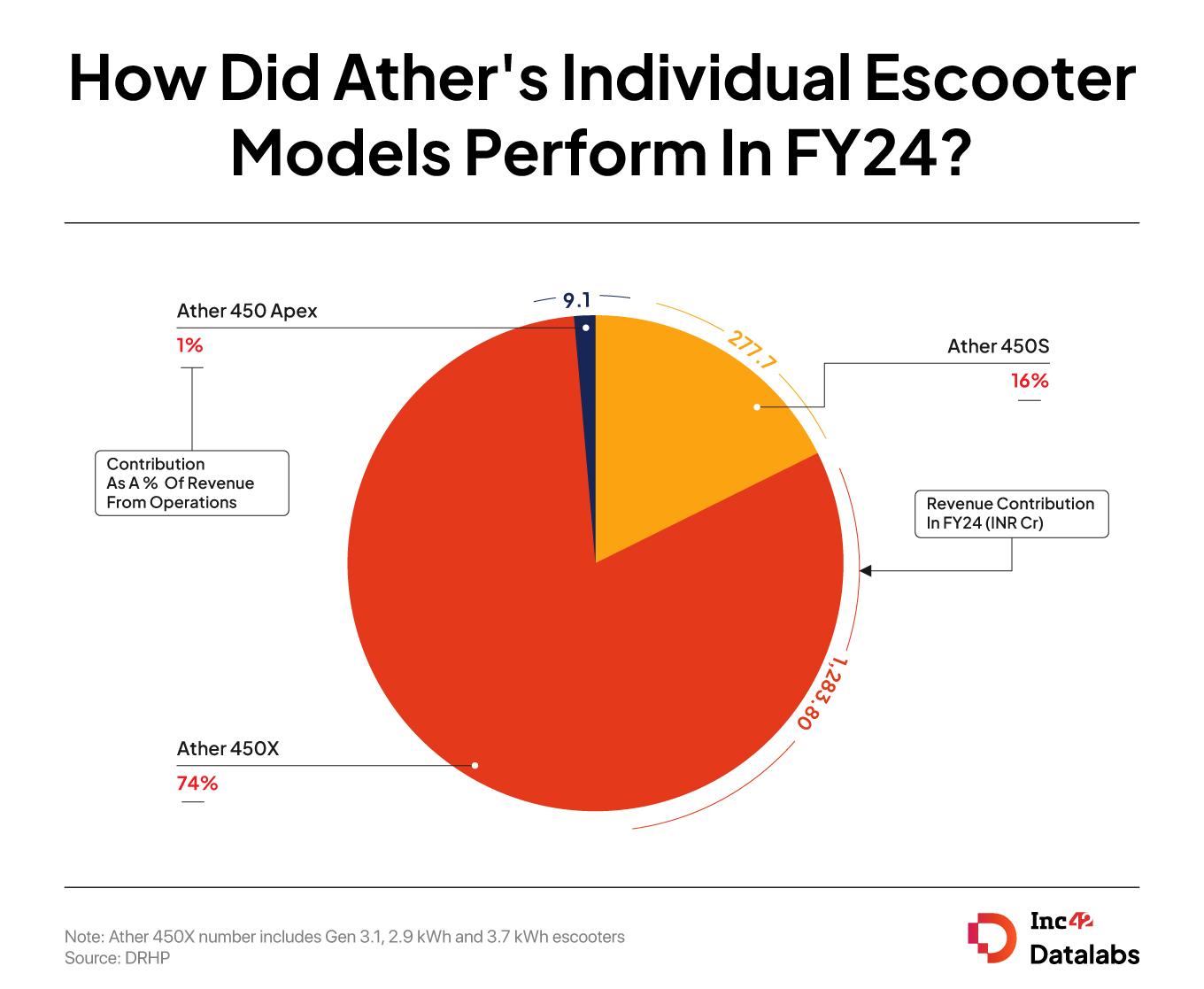

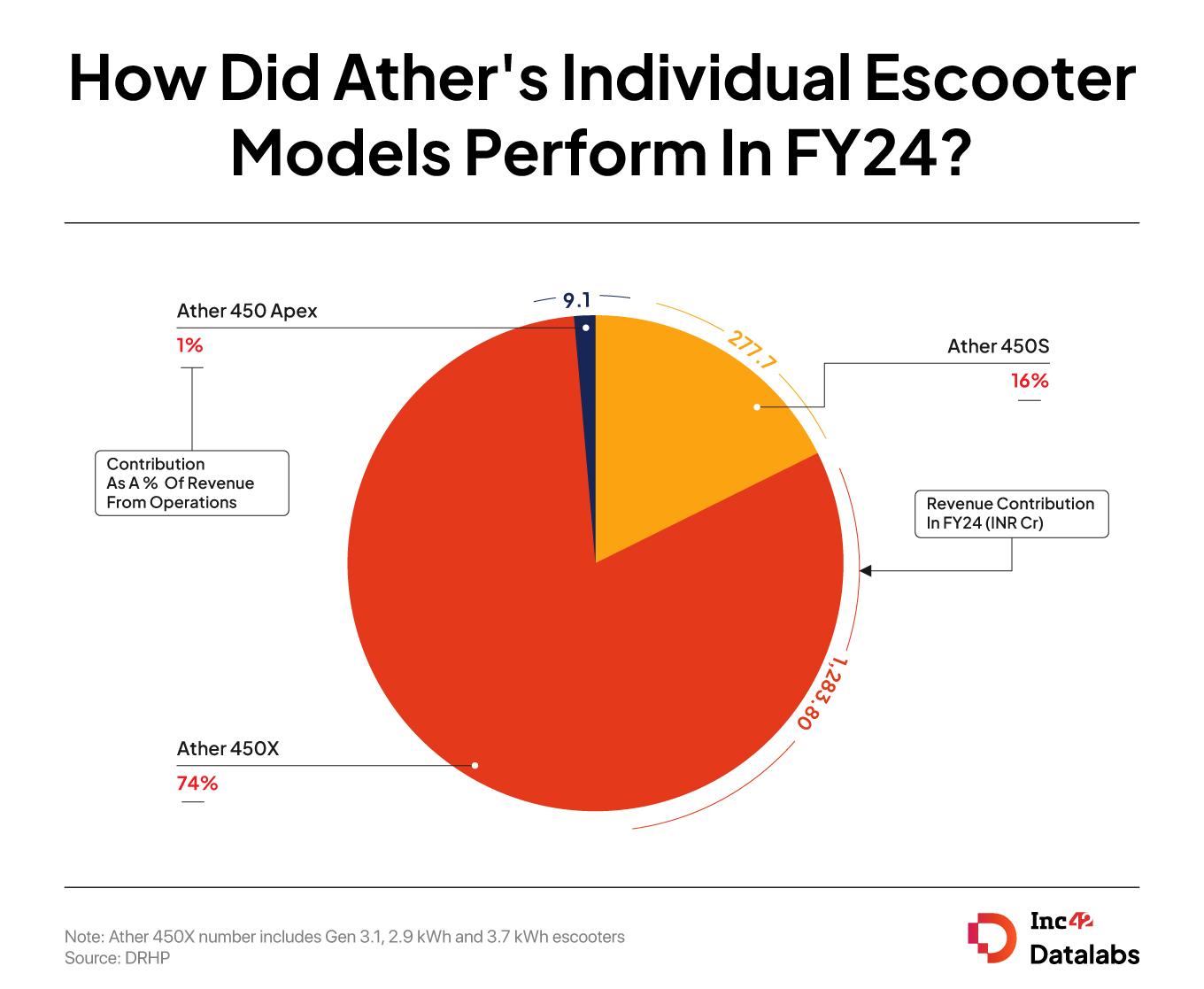

Founded in 2013 by Tarun Mehta and Swapnil Jain, Ather is one of the leading Indian two-wheeler EV manufacturers. It also manufactures its own battery packs and operates its own charging network. After building its market on its 450 series of escooters, which comprises Ather 450S, Ather 450X, and Ather 450 Apex, the startup recently launched a family escooter series Rizta and also forayed into the smart helmet category.

Ather’s first model, Ather 450X – with its three variants – was the biggest contributor to the revenue in FY24. The total revenue generated by this series of vehicles stood at INR 1,283.8 Cr. In that, Ather 450X with 2.9 kWh capacity contributed 9% to the total operating revenue and Ather 450X with 3.7 kWh capacity contributed 31%.

Meanwhile, the startup generated INR 277.7 Cr in revenue from Ather 450S and INR 9.1 Cr from Ather 450 Apex.

In FY24, Ather sold 22,712 units of its Ather 450S, 86,315 units of 450X and 550 units of Ather 450 Apex. Ather Rizta’s deliveries began in the current fiscal year, from May 2024.

While Ather’s sale of finished goods, comprising its escooters, increased in FY24, the sale of its stock-in-trade, comprising EV-related accessories, spare parts and merchandise plummeted almost 76% YoY.

The EV major’s sale of services, which it primarily derives from the sales of Pro Pack, which consists of Atherstack features, three years of access to Ather Connect features and the extended battery warranty, saw almost a 15% YoY decline during the year under review.

Zooming Into Expenses

Ather’s total expenses in FY24 stood at INR 2,674.2 Cr, rising marginally from INR 2,666.3 Cr in the previous year.

Cost Of Materials Consumed: The EV OEM spent the largest portion of its total expenses under this head, which increased 2.7% YoY to INR 1,579.2 Cr in FY24.

It comprised raw materials and components Ather buys from its vendors for use in the manufacturing of scooters. Besides, it outsources manufacturing of components like chassis, battery management system (BMS), vehicle control unit, motor controller, and raw materials.

Employee Cost: Ather’s total employee benefit expenses rose 10.3% to INR 369.2 Cr in FY24 from INR 334.8 Cr in the previous year.

The company had 1,458 on-roll employees and 996 off-roll employees as on March 31, 2024.

Advertisement & Marketing: Ather’s expenses under this bucket declined a massive 55% to INR 90.7 Cr during the year under review from INR 203.8 Cr in FY23.

The startup said that this reduction in marketing efforts was mainly done to optimise marketing spends, foreseeing a slowdown in consumer demand given the reduction of regulatory incentives under FAME-II.

R&D Expenses: Ather’s expenditure here increased to INR 236.5 Cr in FY24 from INR 191.6 Cr in the previous fiscal year.

Quick View Of The Proposed IPO

As per Ather’s DRHP submitted on Monday (September 9), its IPO will comprise INR 3,100 Cr worth of fresh issue and an OFS component of 2.2 Cr equity shares.

Cofounders Mehta and Jain will be offloading 10 Lakh shares each as part of the OFS. Among the other selling shareholders are Caladium Investments, National Investment and Infrastructure Fund II, and Tiger Global’s Internet Fund III. Hero MotoCorp, the biggest shareholder in Ather, will not sell any stake in the IPO.

Ather’s IPO comes on the heels of its competitor Ola Electric going public by raising over INR 6,145.6 Cr in total.

Like Ola, Ather is also going public as a loss-making entity with no clear path projected to profitability.

In fact, the recently turned unicorn said in its DRHP that its ability to achieve profitability, positive cash flows from operating activities and a net working capital surplus will depend on factors like cost control, increasing sales of escooters in India, Nepal, and Sri Lanka and any other international markets.

Recently, Ather expanded its business to Sri Lanka, marking its second overseas foray after Nepal.

“We cannot assure you that our expansion into international markets will be profitable, nor can we guarantee that our products can be sold at favourable margins,” the EV major said.