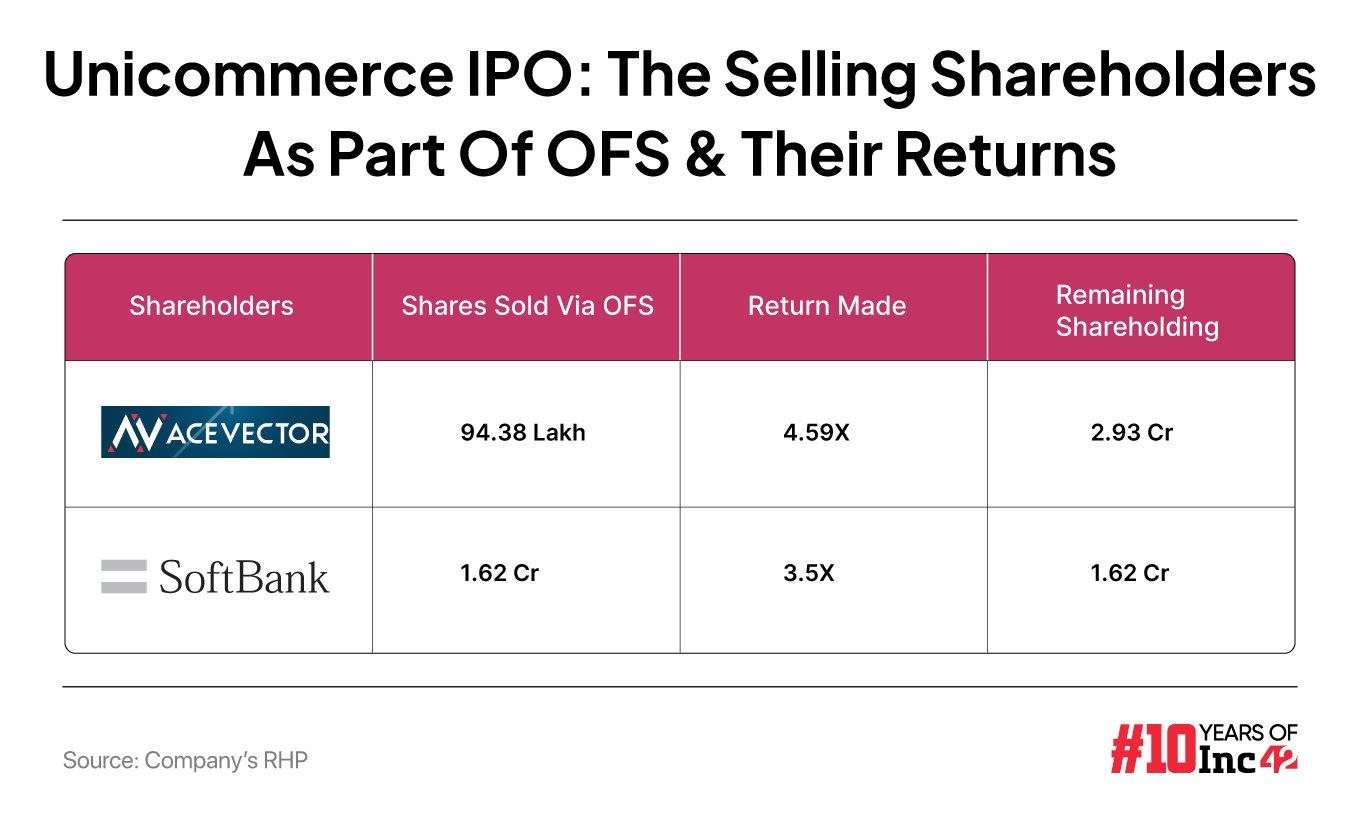

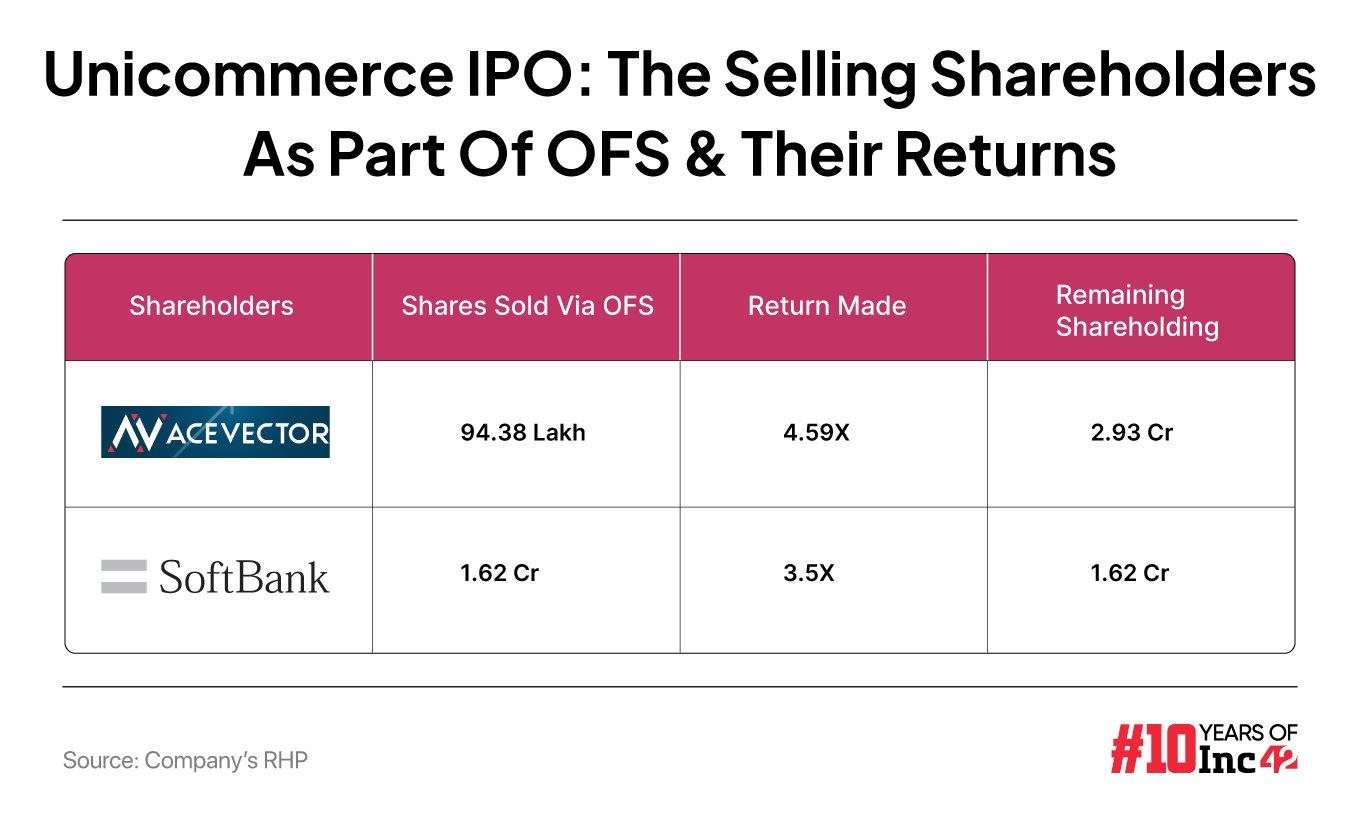

AceVector (formerly Snapdeal) is offloading 94.38 Lakh shares of Unicommerce via the OFS component of the IPO

Unicommerce’s IPO included only an OFS of 2.56 Cr shares. The startup set the price band at INR 102-INR 108 per share

SoftBank, which is also selling some shares in FirstCry IPO, will make 3.5X returns by offloading a part of its stake in Unicommerce

AceVector Limited (formerly Snapdeal), the promoter of Unicommerce, is set to make 4.6X gains from the SaaS startup’s initial public offering (IPO).

As part of Unicommerce’s IPO, which included only an offer for sale (OFS) component of 2.56 Cr shares, AceVector is offloading 94.38 Lakh shares of the startup. While the weighted average cost of acquisition of these shares was INR 23.52 apiece, AceVector is now selling them at INR 108 per equity share, which would translate to 4.59X returns.

Post the offer, AceVector will continue to hold 2.93 Cr shares of the startup. It is pertinent to note that Snapdeal acquired Unicommerce

Unicommerce set a price band of INR 102-108 per equity share for its IPO. At the issue price of INR 108, the startup is set to raise INR 276.57 Cr via the OFS.

Besides promoter AceVector, SoftBank’s SB Investment Holdings (UK) Limited is also offloading 1.62 Cr shares as part of the OFS.

While SB Investment Holdings had invested around INR 50 Cr to buy these shares of Unicommerce, currently it is selling them for INR 174.6 Cr, translating to 3.5X returns on its investment.

SoftBank is also set to make 3X gains from its share sale in FirstCry IPO.

As per Unicommerce’s draft red herring prospectus (DRHP), its OFS comprised 2.98 Cr shares. As part of this, B2 Capital Partners, the promoter entity through which Snapdeal cofounders Kunal Bahl and Rohit Bansal hold a stake in the company, was also to sell 22 Lakh shares.

However, B2 Capital dropped out of the OFS later. B2 Capital continues to hold 1.1 Cr shares, or a 9.91% stake, of Unicommerce on a fully diluted basis.

Founded in 2012, Unicommerce is an ecommerce SaaS startup that helps businesses manage inventory across all online marketplaces.

Review Of Unicommerce’s IPO So Far

In its red herring prospectus (RHP) submitted on July 30, the startup reduced its issue size at a time when investors seem to be closely looking at IPO sizes and valuations.

In most of the recent tech startup IPOs, either the primary capital size or the OFS component has been lowered. For instance, coworking startup Awfis brought down its fresh issue size to shares worth INR 128 Cr from INR 160 Cr proposed earlier. However, it raised its OFS component to 1.23 Cr shares from 1 Cr shares earlier.

Meanwhile, electric mobility major Ola Electric reduced the OFS component of its IPO to 8.49 Cr shares from 9.51 Cr shares proposed earlier in its DRHP.

FirstCry, which like Unicommerce is also set to list on the bourses on Tuesday (August 13), lowered the fresh issue of shares to INR 1,666 Cr from INR 1,816 Cr earlier.

Analysts expected Unicommerce IPO to receive muted response compared to other startup IPOs as its IPO didn’t have any fresh issue of shares. However, Unicommerce’s public issue saw overwhelming interest. Its IPO, which opened on August 6 and ended on August 8, was subscribed 168.3X.

Non-institutional investors’ (NIIs’) portion was oversubscribed the most at 252.46X, followed by qualified institutional buyers’ (QIBs) portion at 138.75X. The retail investors’ portion was also oversubscribed 130.9X.

Recommending a ‘hold’ on the stock, Prashanth Tapse, senior VP (research) at Mehta Equities, said, “Considering the strong subscription demand, Unicommerce became the second biggest in terms of subscription so far in 2024 and understanding the market mood, we expect there is a good room for healthy listing gain in the range of about 40% and above against the issue price of INR 108 per share.”

“Investors should also look at IPO offers which come with 100% OFS… which is an area of concern for new investors. But with its unique technology capabilities and continuous innovation, we believe the company is well positioned to capitalise on the expanding ecommerce enablement sector,” Tapse added.

Earlier, giving a ‘subscribe’ rating to the public issue, BP Wealth said that though Unicommerce’s issue looks rich in terms of valuation, the company’s strong business performance and industry tailwinds provide an opportunity from a medium- to long-term perspective.

While Ola Electric, which listed last week, and FirstCry are loss-making entities, Unicommerce is profitable. Its net profit more than doubled to INR 13.1 Cr in FY24, while operating revenue increased 15% year-on-year to INR 103.58 Cr.

Meanwhile, Swastika Investmart suggested a cautious approach for Unicommerce IPO given its premium valuation and the absence of listed peers to make a comprehensive valuation comparison. It suggested that only well-informed investors should consider the IPO for potential listing gains.