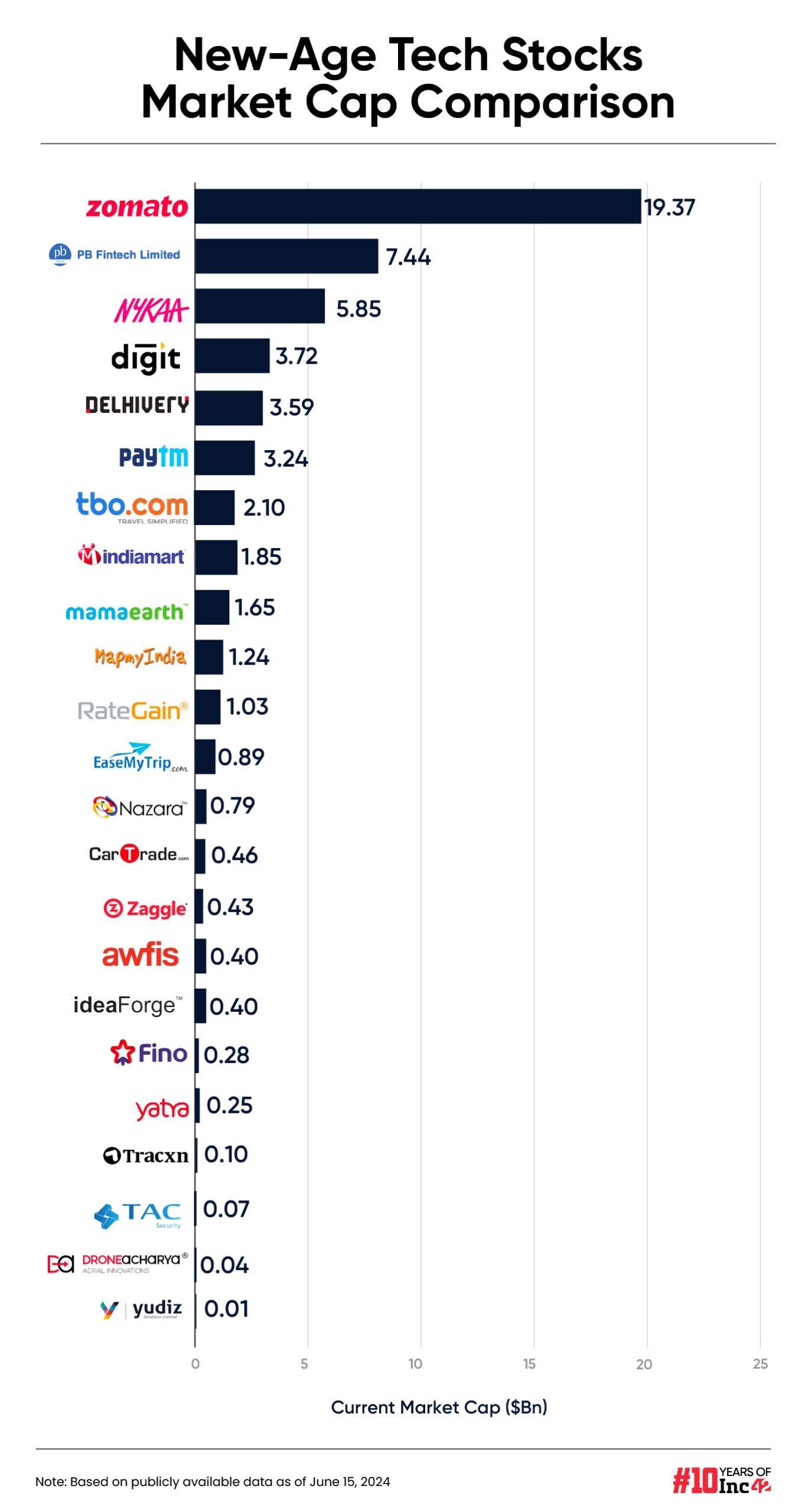

Eighteen out of the 23 new-age tech stocks under Inc42’s coverage gained this week in a range of 0.1% to over 27% with TAC Infosec emerging as the top gainer

Following a major block deal, Mamaearth became the biggest loser this week; shares fell 2.2%

Benchmark indices Sensex and Nifty50 gained 0.39% and 0.75%, respectively. While Sensex ended the week at an all-time high close at 76,992.77, Nifty50 too ended at a record close at 23,465.60

Riding on the back of the bull run in the broader market sentiment, Indian new-age tech stocks witnessed significant northbound momentum this week.

Eighteen out of the 23 new-age tech stocks under Inc42’s coverage gained this week in a range of 0.1% to over 27%. TAC Infosec emerged as the top gainer, followed by Yudiz. Both the NSE Emerge-listed stocks rallied over 27% during the week.

Among the other gainers were ideaForge (up 13.2%), Paytm (up 11.5%), DroneAcharya (up 11.1%), Awfis (up 8.4%), Nazara, and PB Fintech (both up over 6%).

Meanwhile, following a major block deal, Mamaearth became the biggest loser this week. Its shares fell 2.2%.

Despite its shares touching an all-time high mid-week following strong FY24 earnings, newly-listed Go Digit also fell 0.3% this week. The insurance tech platform posted over a 400% jump in profit after tax (PAT) to INR 182 Cr FY24 from INR 36 Cr in the previous fiscal year.

The other losers of the week were Tracxn, CarTrade, and MapmyIndia.

In the broader market, benchmark indices Sensex and Nifty50 gained 0.39% and 0.75%, respectively. While Sensex ended the week at an all-time high close at 76,992.77, Nifty50 too ended at a record close at 23,465.60.

Speaking on the market performance this week, Vinod Nair, head of research at Geojit Financial Services, said that the mid and small-cap sectors demonstrated outperformance during the week, on positive sentiment for growth-based stocks.

Meanwhile, domestic CPI data suggests a gradual decline in inflation, he noted.

“Though the last mile towards the inflation target remains sticky, given the expectation of a normal monsoon, investors are hopeful that the MPC will be one step closer to the easing cycle,” Nair said. “In the upcoming week, attention will be on the release of industrial production data from India, China, and Eurozone inflation as investors seek insights into the economic outlook of these countries.”

Meanwhile, the US Federal Reserve kept its key interest rate unchanged this week and signalled just one cut before the end of the year.

Prashanth Tapse, senior VP (research) at Mehta Equities, said that as expectations start building up from the government in the run-up to the Budget next month, markets might face bouts of intra-day volatility going ahead.

Next week will also see the listing of another new-age tech stock, ixigo. This week, the traveltech startup’s public issue was oversubscribed 98.34X.

Now, let’s dive deeper into understanding the performance of the new-age tech stocks this week.

The 23 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $55.2 Bn as against around $54 Bn last week.

Paytm’s Mixed Week

After being under selling pressure for months, shares of fintech major Paytm witnessed a sudden rally this week. The stock gained about 11.5%, ending the week at INR 424.9 on the BSE.

The company’s shares last closed above the INR 400 level at the beginning of April this year.

Though the shares rallied largely on the back of positive developments around restructuring, it was a mixed week for the company.

In The News For:

- Inc42 learned from multiple sources that Paytm has been asking employees to resign voluntarily or face disciplinary action. Besides, the company is also trying to retrieve various bonuses already paid to the employees. The company has denied the allegations.

- Paytm informed its stakeholders about a few positive developments, including its partnership with Samsung Wallet for flight, bus, movie, and event ticket bookings.

- The Insurance Regulatory and Development Authority of India (IRDAI) has accepted Paytm General Insurance’s registration withdrawal application. Paytm will now focus on the distribution of insurance products of other insurers.

Booking some profit from the share price surge, hedge fund Marshall Wace offloaded 5.85 Lakh shares worth INR 25.08 Cr in the company in a block deal on Friday (June 14). The shares were lapped up by BNP Paribas.

Though Paytm shares gained quite a bit this week, Rupak De, senior technical analyst at LKP Securities, said that currently there is no clear trend emerging from the movement.

De sees support for the stock in INR 420-INR 400 range while he has a bullish stance on Paytm if it crosses INR 440 level.

Paytm is still trading over 33% lower year to date.

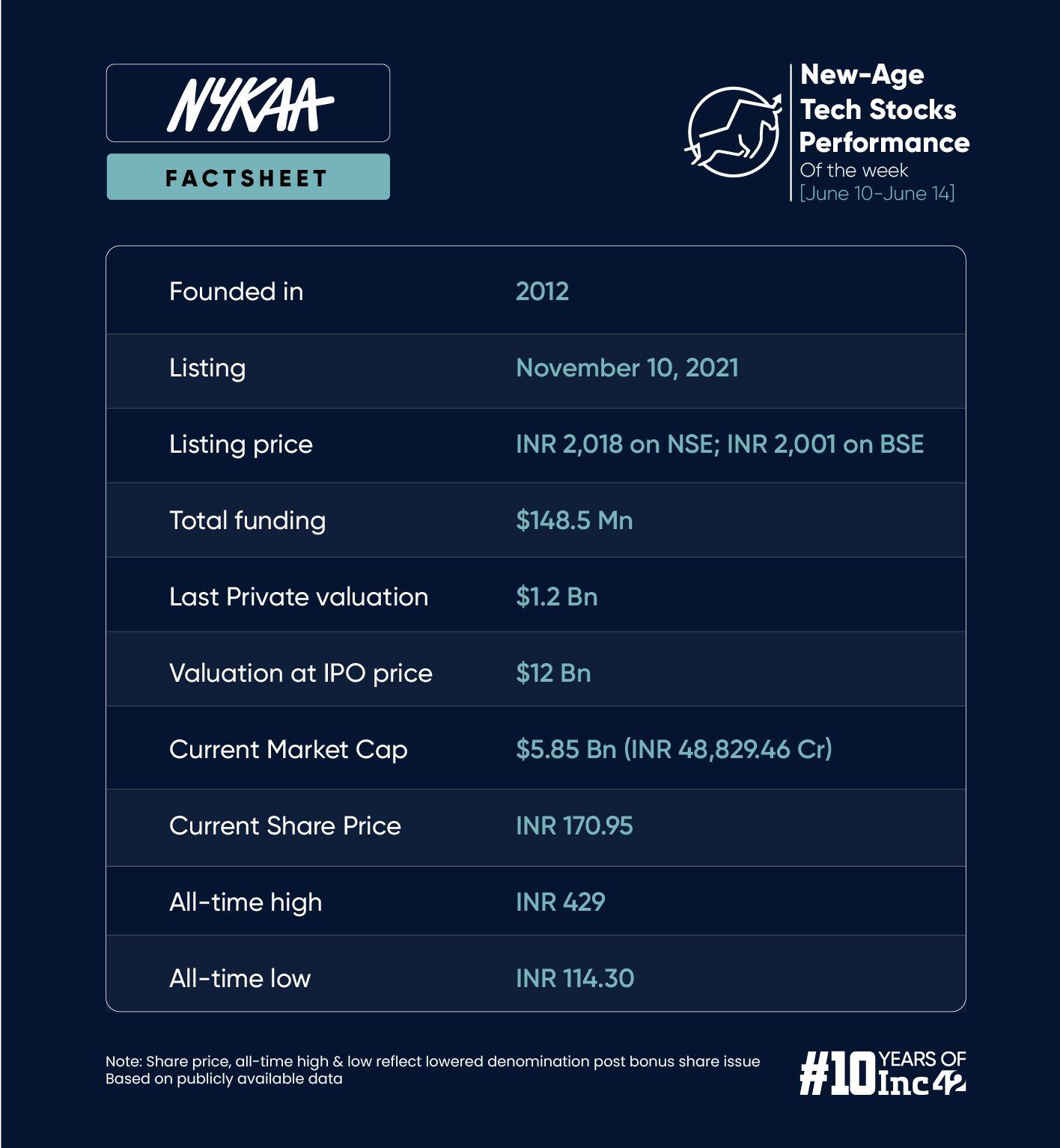

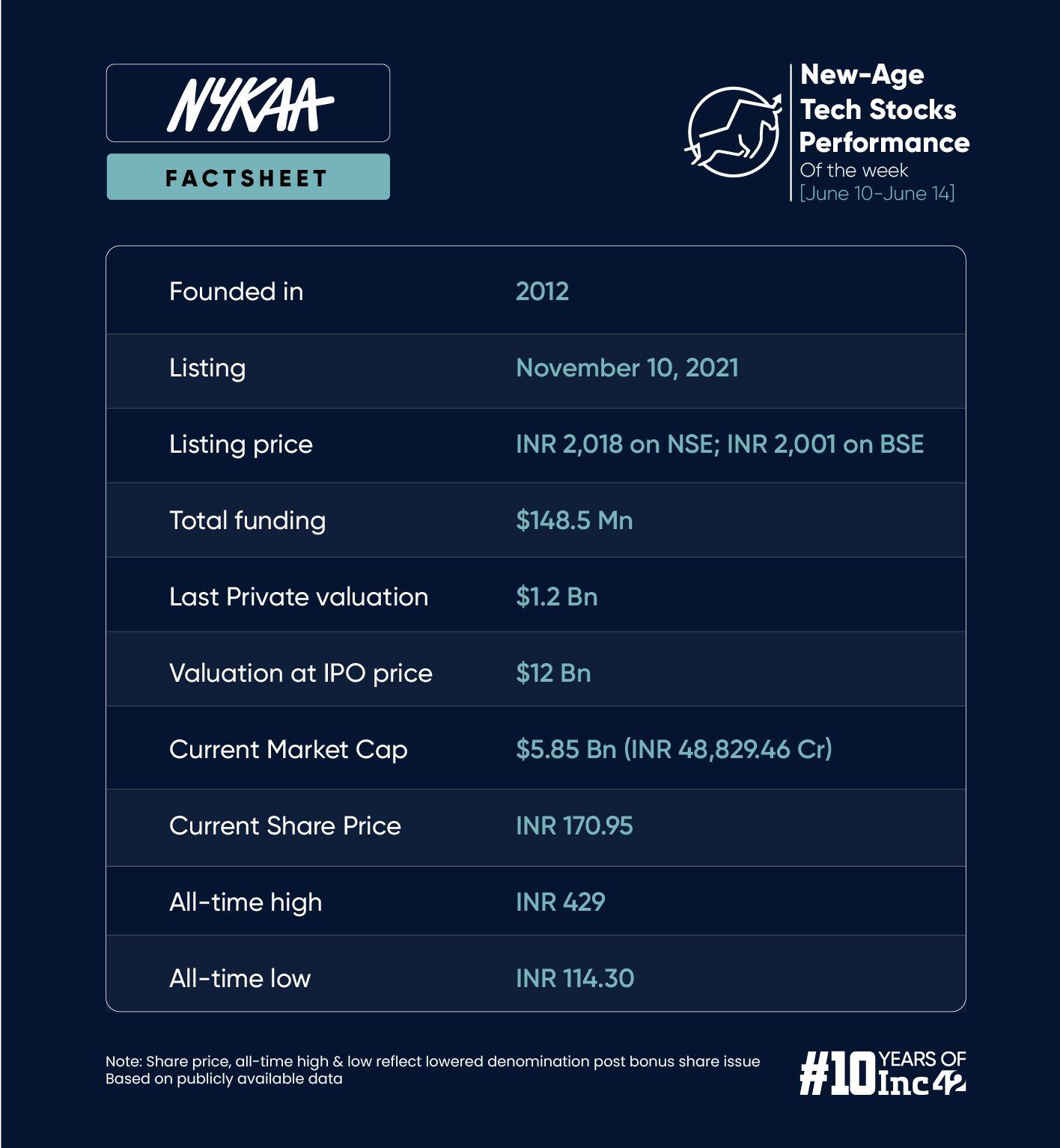

Nykaa’s Growth Projections

Shares of Nykaa continued to trade sideways this week. The stock gained 0.6% overall, ending the week at INR 170.95 on the BSE.

However, on the company’s ‘Annual Investor Day’ on Friday, its shares surged almost 5% to INR 175.15 during intraday trading.

Here are a few key developments from the meeting:

On the other hand, Nykaa also announced expanding its ESOP pool size by allocating more than 4.73 Lakh equity shares to its employees. The newly allotted shares are worth over INR 9.72 Cr.

It is pertinent to note that shares of Nykaa have largely witnessed a range-bound movement since the beginning of the year. LKP Securities’ De sees INR 167 as the immediate support for the stock.

He sees a bull case for the stock only after Nykaa closes above INR 174.

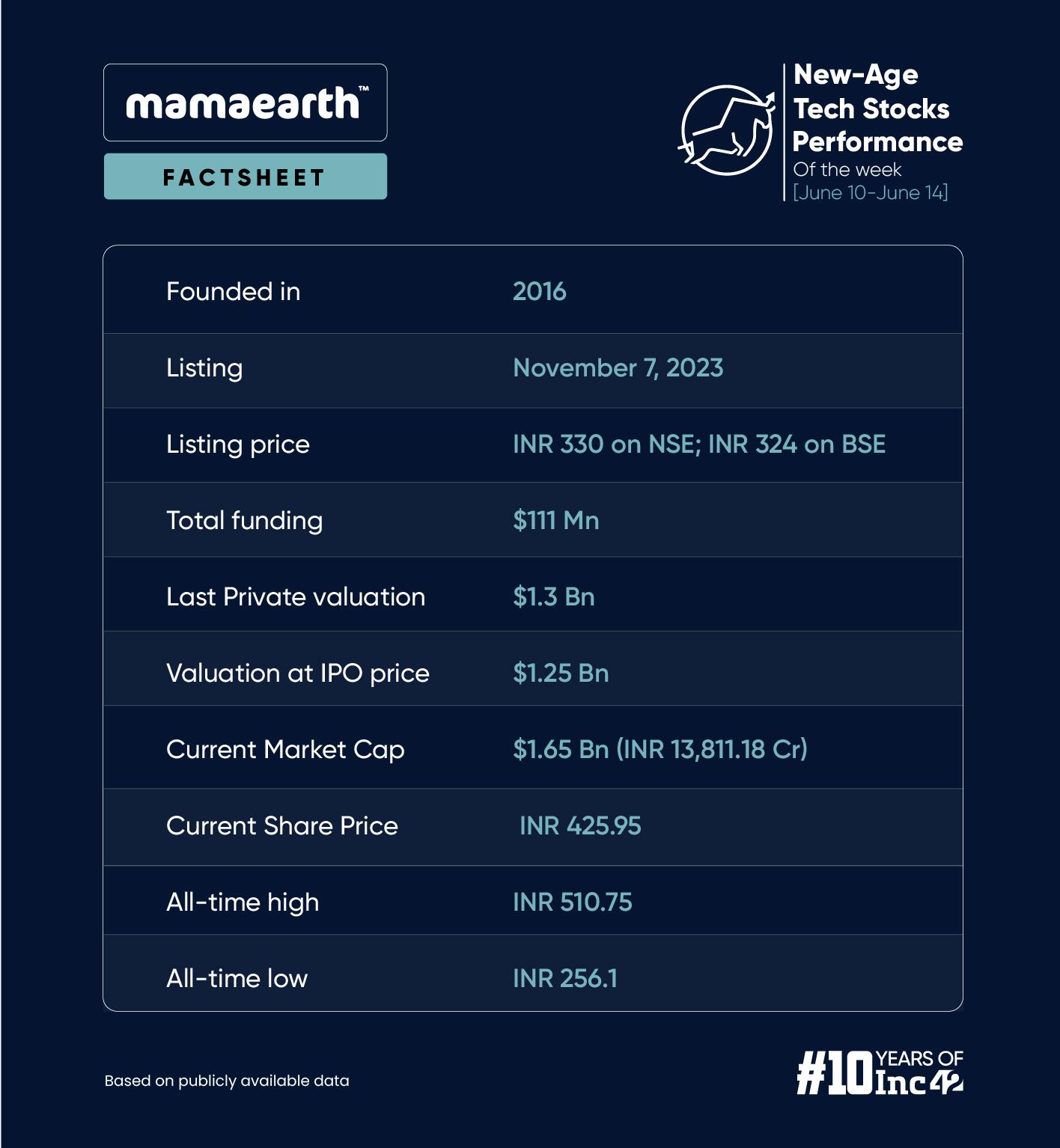

Large Block Deal At Mamaearth

Shares of D2C beauty brand Mamaearth were volatile this week. Partially hurt by two large share offloading, the stock fell 2.2% during the week to end at INR 427.65 on the BSE and emerge as the biggest loser.

Its two major pre-IPO shareholders, Fireside Ventures and Sofina Ventures, offloaded 32.42 Lakh shares each in the company worth INR 141.21 Cr and INR 141.06 Cr, respectively.

In the quarter ended March 2024, Fireside held 1.71 Cr shares and Sofina held 1.99 Cr shares in the company.

Following the offloading on Tuesday (June 11), Mamaearth shares fell almost 5% on the day. The next day, its shares fell further.

Meanwhile, the company also announced this week that its partnership with Reliance Retail has taken its store count to 1,000 in Smart Bazaar or Smart Point stores.

Shares of Mamaearth are currently trading 2.9% lower year to date.