Shares of Mamaearth surged over 11% this week, followed by Tracxn Technologies (up nearly 10%)

Recently-listed ixigo zoomed 8.7% this week after it reported over 200% year-on-year jump in its net profit to INR 73.1 Cr in FY24

Sensex and Nifty50 gained 1.22% and 1.3%, respectively, this week on the advancement of monsoon and anticipation of the upcoming Union Budget

Indian new-age tech stocks rallied significantly this week as the broader market continued the upward momentum, helped by positive domestic and global cues.

Twenty one out of the 24 new-age tech stocks under Inc42’s coverage gained during the week in a range of 0.4% to over 11% on the BSE.

D2C beauty brand Mamaearth emerged as the biggest winner this week, with its shares surging 11.1%. It was followed by Tracxn Technologies, which jumped 9.8%.

Shares of recently-listed ixigo also zoomed 8.7% on the back of its strong FY24 earnings. Shares of Paytm, TAC Infosec, and CarTrade also surged over 8%.

MapmyIndia, Awfis, RateGain, ideaForge, and Nazara Technologies were among the other gainers.

However, shares of Delhivery fell about 1.1% this week after the announcement of it expanding its ESOP pool.

Meanwhile, PB Fintech and TBO Tek declined 1.1% and 3.2% on the BSE, respectively, after being the top two gainers last week.

In the broader market, benchmark indices Sensex and Nifty50 gained 1.22% and 1.3%, respectively. However, Sensex ended marginally lower at 79,996.6 on Friday while Nifty50 closed marginally higher at 24,323.85.

Vinod Nair, head of research at Geojit Financial Services, said that the domestic market maintained its upward momentum on the advancement of monsoon and anticipation of the upcoming Union Budget.

Besides, a reduction in US personal consumption expenditure inflation has also raised hopes for a Fed rate cut in September, he said.

“As the market enters the earnings season, starting with IT bellwether TCS, expectations are for better results. Investors will closely watch management commentary for insights into the sector’s outlook. Overall, Q1 expectations remain subdued. However, recent high-frequency economic indicators, the RBI’s upgrade for FY25 GDP target to 7.2% from 7%, with a Q1 forecast of 7.3%, and easing global inflation reduce the likelihood of weak corporate results,” Nair added.

It is pertinent to note that the Budget session of the Parliament will commence on July 22, with the first Union Budget of the Narendra Modi government’s third term to be presented on July 23.

Meanwhile, Siddhartha Khemka, head of retail research at Motilal Oswal, sees the market consolidating at a higher zone after gaining nearly 7% in the last month. In the coming week, more stock and sector-specific actions are expected as the market starts taking cues from Q1 FY25 earnings, he added.

Overall, the 24 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $59.85 Bn versus $58.42 Bn last week.

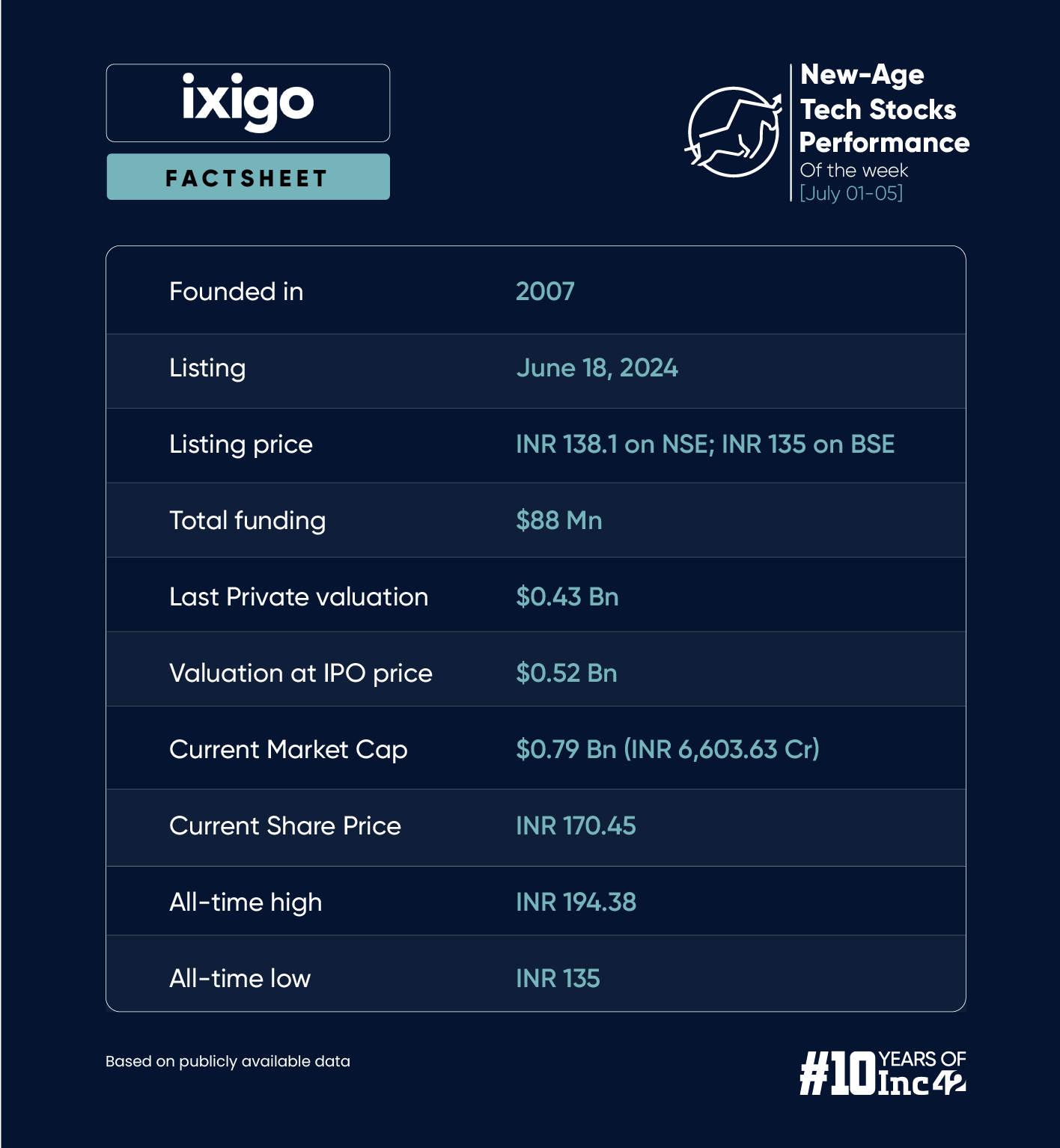

ixigo’s First Earnings Report After Listing

After its stellar debut on the Indian bourses last month, ixigo posted its March quarter and FY24 earnings results on Thursday (July 4).

While its net profit more than tripled year-on-year (YoY) to INR 73.1 Cr during the year, operating revenue increased almost 31% to INR 655.9 Cr.

Shares of ixigo rose 4.8% on Thursday ahead of the result announcement. The shares jumped over 7% during the intraday trading on the BSE on Friday but ended the week’s last trading session about 4% higher at INR 170.45.

Speaking on the stock’s performance, Prashanth Tapse, senior VP, research analyst at Mehta Equities, said that following the rise in the share price post its listing, the valuations seem overstretched currently.

“Given ixigo’s strong presence in rail bookings and a significant market share through ixigo and ConfirmTkt, the company is well-positioned in the rapidly growing travel sector. Hence, only risk-taking investors can continue to hold on to risk for a long-term perspective, while conservative investors should wait and watch for any dips to enter,” he added.

ixigo’s current market cap stands at INR 6,603.63 Cr as against INR 6,275.87 Cr on the listing day.

Meanwhile, Riyank Arora, technical analyst at Mehta Equities, said that the stock is trading below its immediate resistance level of INR 177.5 and above the major support level of INR 150. A move above INR 177.5 is likely to generate momentum, pushing the rally towards INR 197.5 and then INR 225.

“Traders and investors should consider buying on dips around INR 165-INR 167 with a firm stop loss at INR 150,” Arora added.

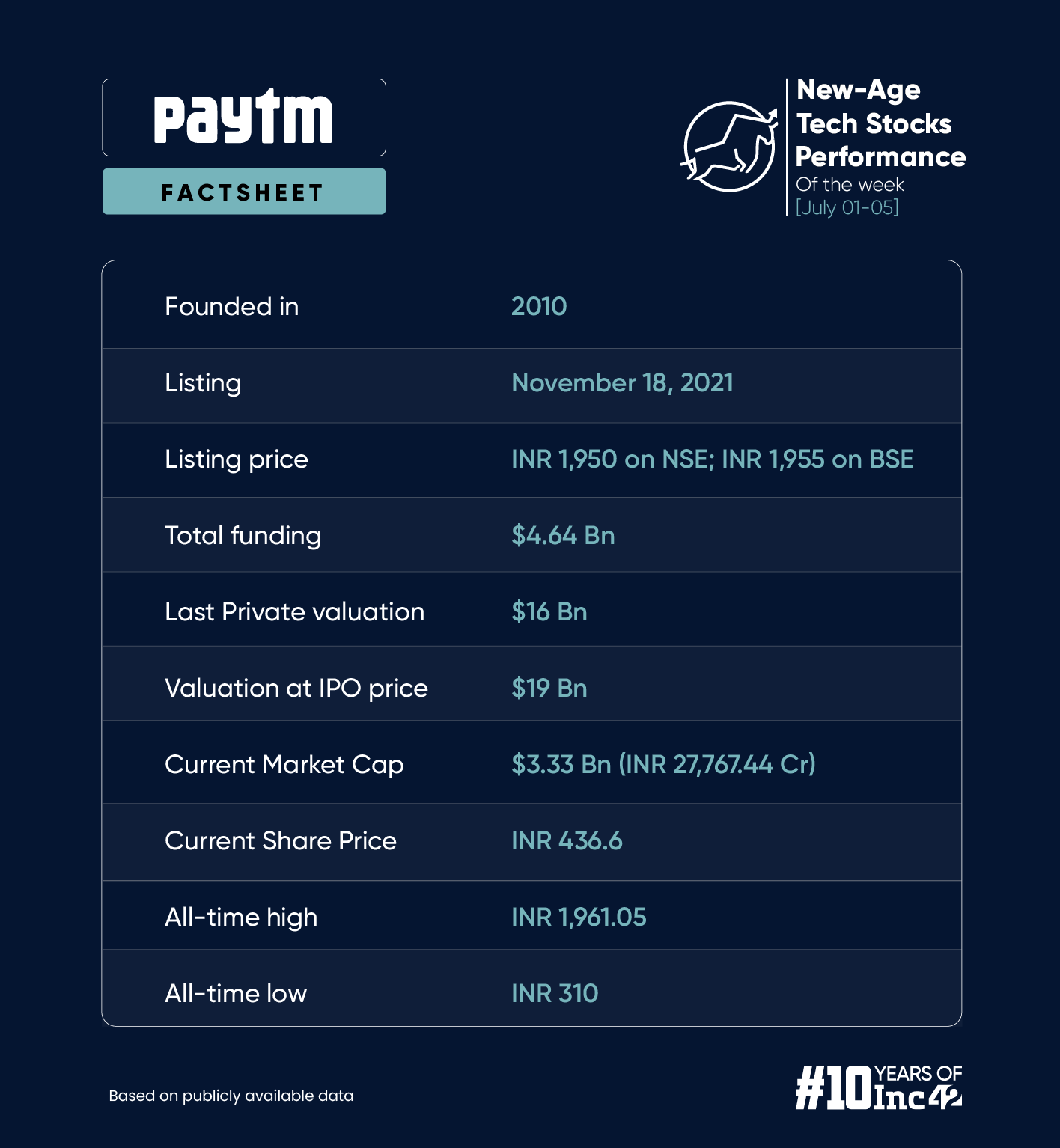

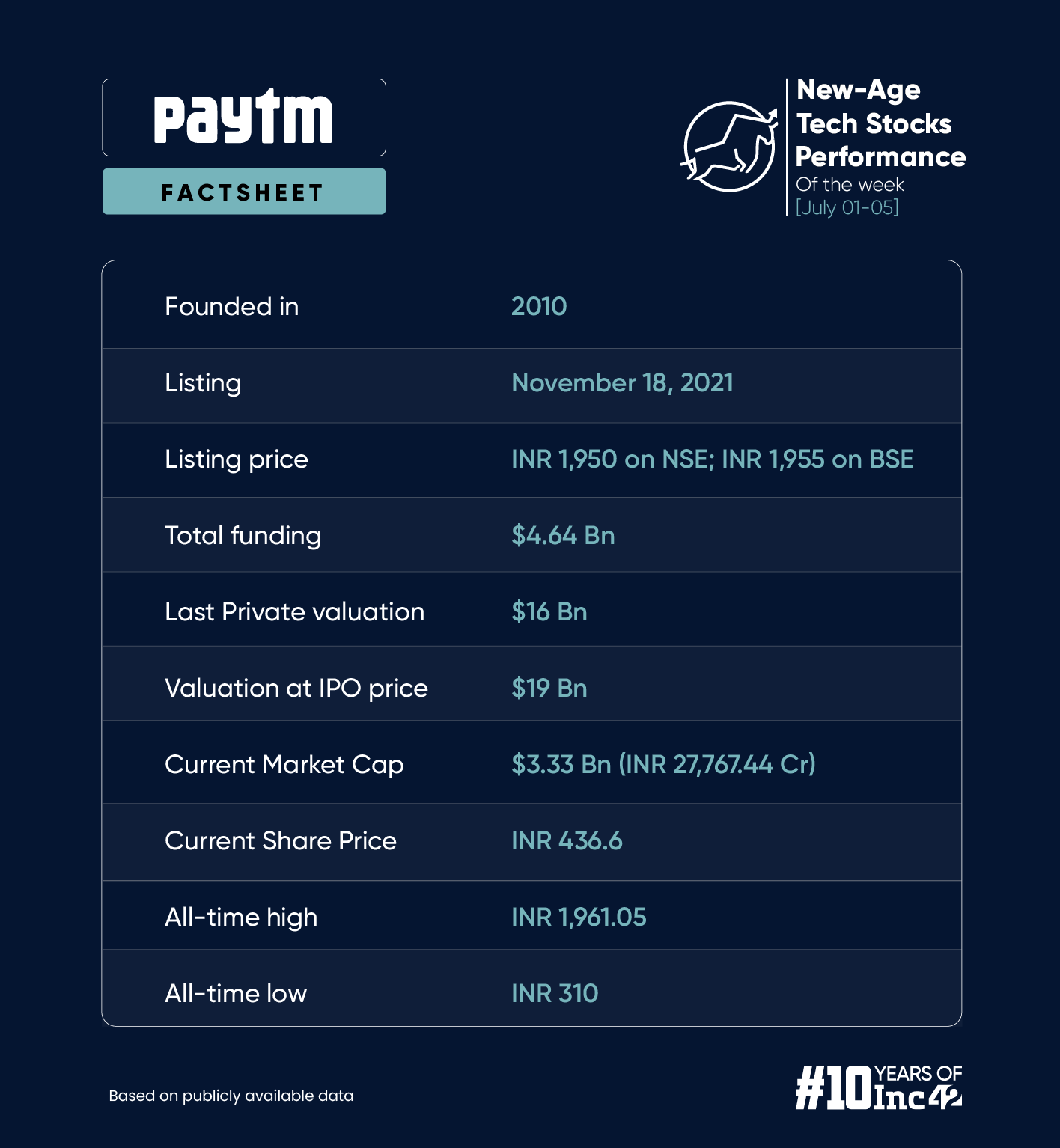

Paytm Regains Some Momentum

Shares of Paytm jumped 8.5% this week to end the last trading session at INR 436.6 on the BSE.

Amid significant volatility, Paytm has largely been trading sideways. However, it managed to close above the INR 430 level this week, the highest since the beginning of February this year, when the stock traded above the INR 440 level.

However, the shares are still trading 43% lower than the INR 760 level last seen at the end of January this year, just before the RBI’s clampdown on Paytm Payments Bank.

This week, the shares gained some momentum on the back of a few developments in the company. Earlier this week, Paytm rolled out a new health and protection plan, ‘Paytm Health Saathi’, for its merchant partners to facilitate them with affordable and comprehensive healthcare benefits.

Meanwhile, a report said that Paytm Payments Bank Ltd is at odds with its auditor JC Bhalla & Co. over the certification of its FY24 accounts.

Over the last one month, Paytm shares have gained over 28% on the BSE.

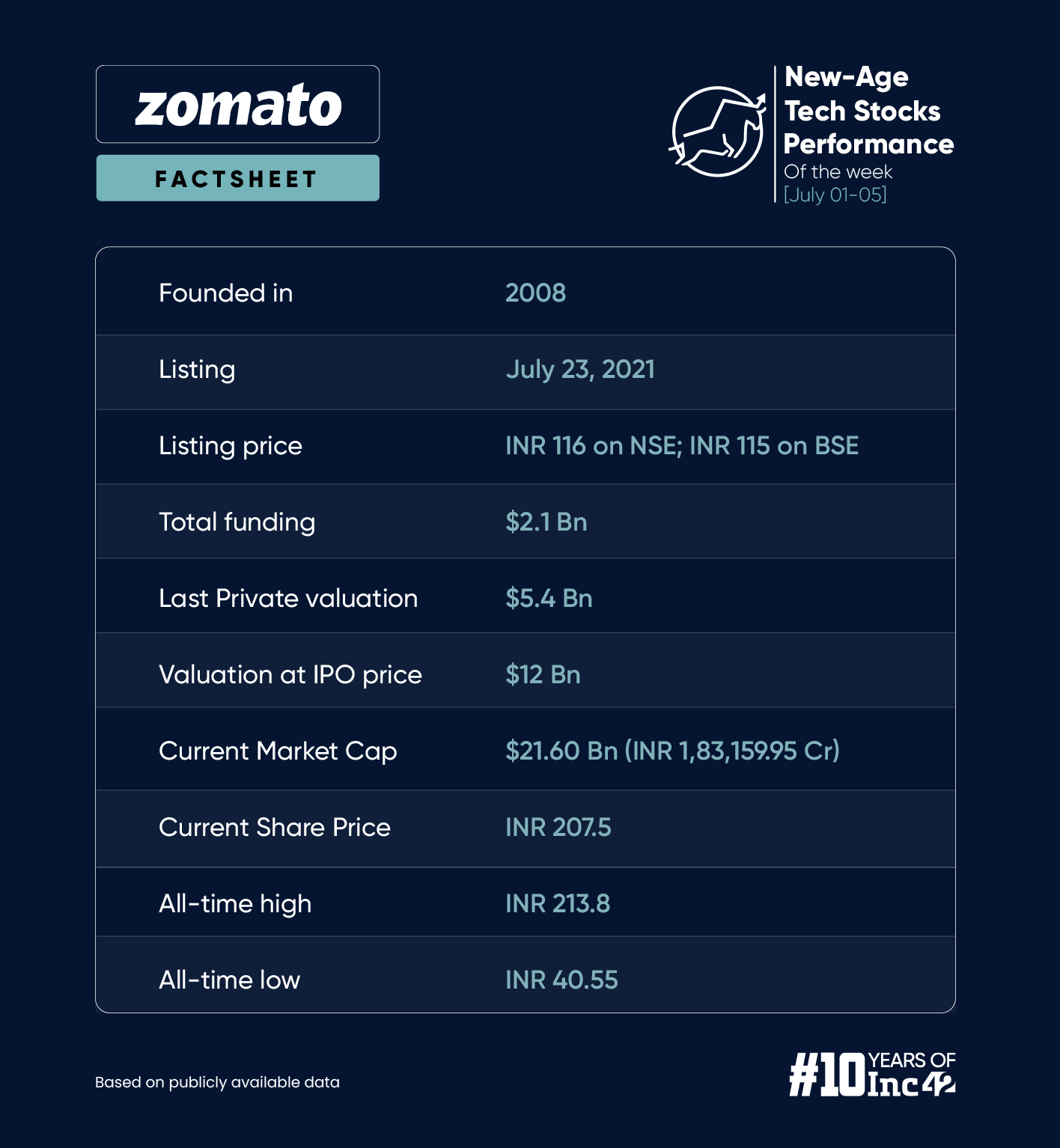

Zomato Touches A Record-High

Shares of Zomato saw a strong uptrend earlier this week but lost some gains in the latter half. Overall, the stock gained 3.6% to end the last trading session at INR 207.5 on the BSE.

The shares touched a new record high at INR 213.8 on Wednesday (July 3). This also came amid multiple business developments in the company.

In The News For:

Though the company received a new goods and service tax (GST) demand notice of INR 9.45 Cr from the Assistant Commissioner of Commercial Taxes (Audit) in Karnataka, the news development failed to show any major impact on the stock this week.

Meanwhile, reiterating its ‘buy’ rating on the stock and a fair value of INR 225, Kotak Institutional Equities, said in a new research report that it expects Zomato to report healthy Q1 FY25 results, driven by 23% YoY growth in food delivery GMV and 113% YoY growth in Blinkit GMV.

“We expect both businesses to report sequential CM (contribution margin) improvement, driven by better take rate (higher platform fee in food delivery) and advertising income (in Blinkit),” the brokerage added.