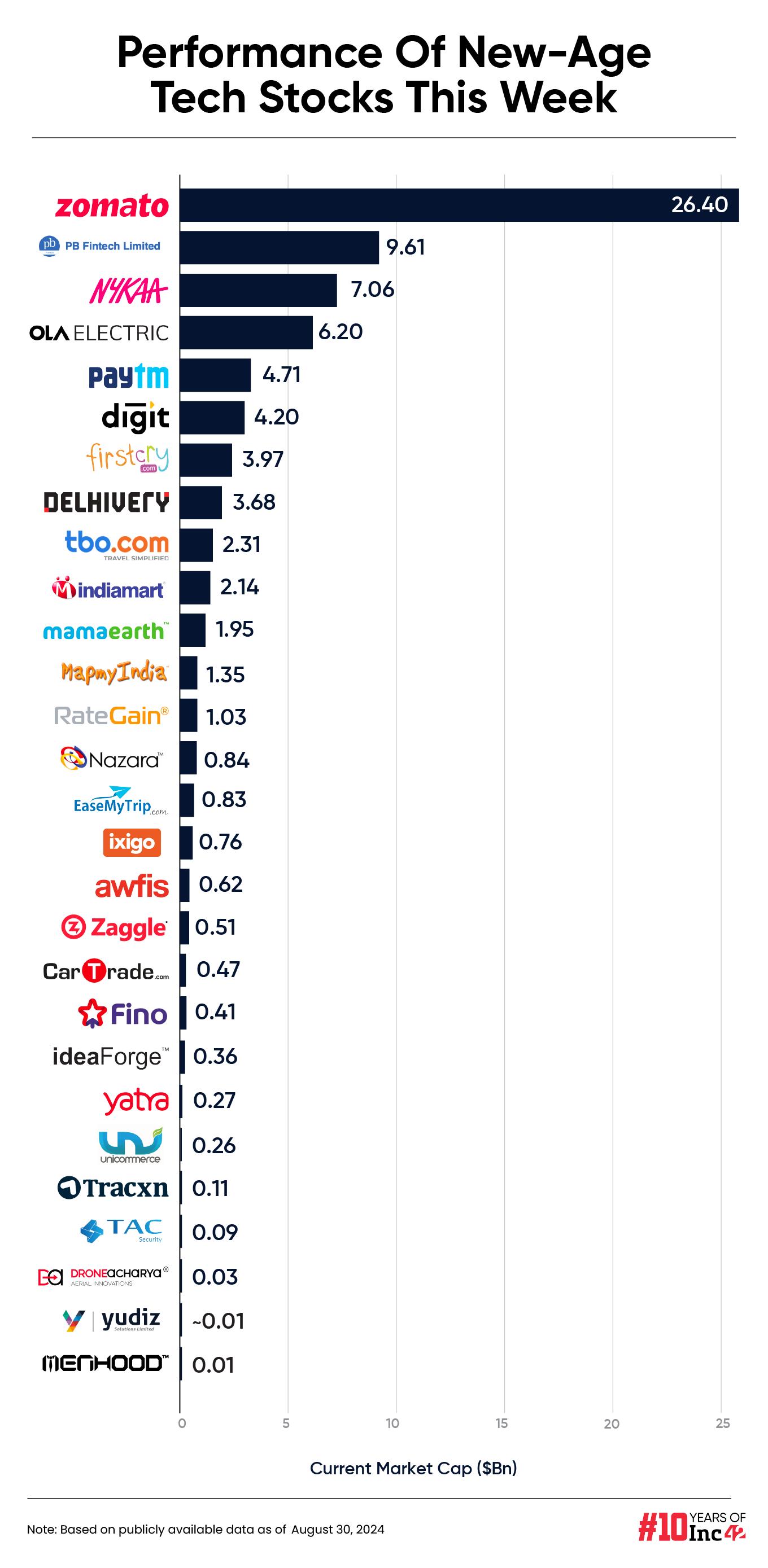

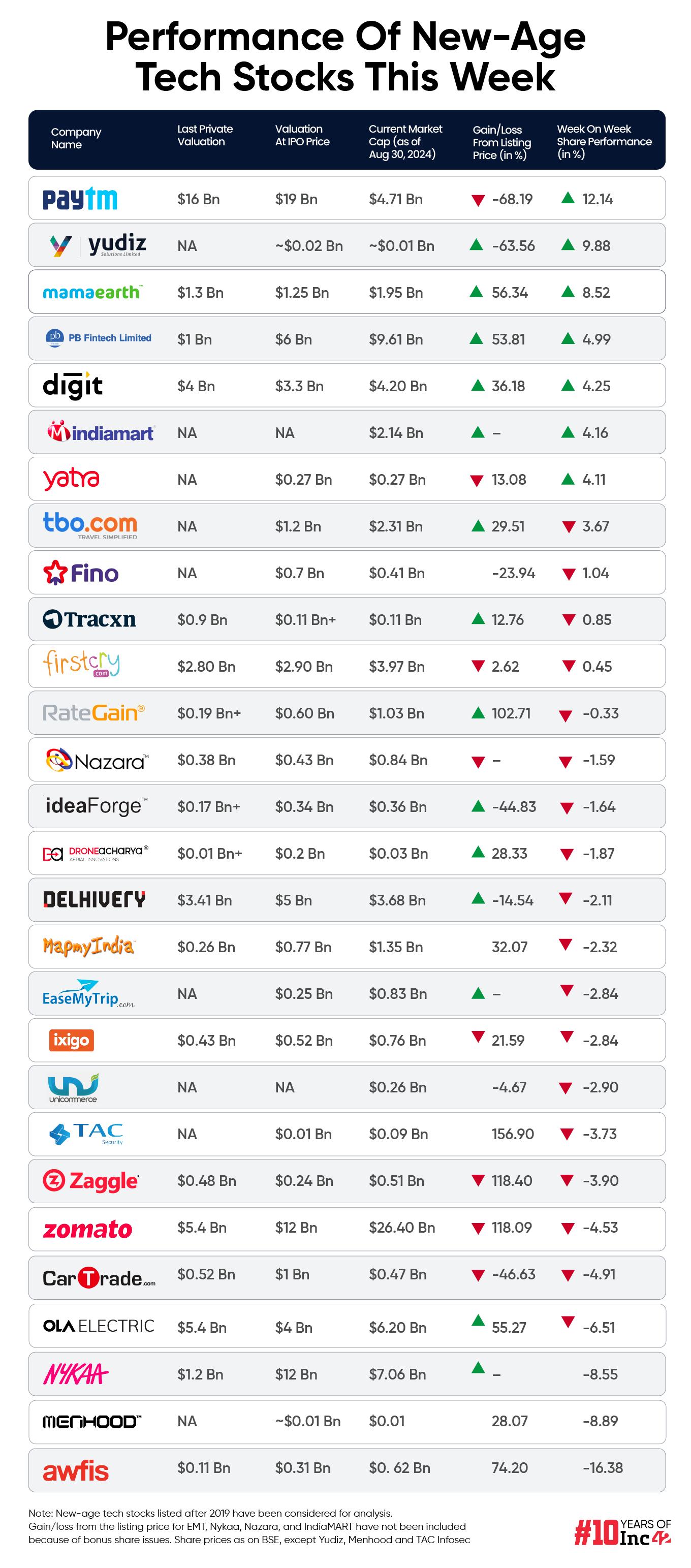

Seventeen of the 28 stocks under Inc42’s coverage fell in a range of 0.33% to over 16%

Awfis emerged as the biggest loser this week, with its shares crashing 16.38% to end at INR 749.05

While Paytm emerged as the top gainer, Go Digit, TBO Tek, PB Fintech, and Honasa were among the eleven winners this week

Despite a prolonged bull run in the Indian stock markets, investors turned bearish on new-age tech stocks in the final week of August. Seventeen of the 28 stocks under Inc42’s coverage fell in a range of 0.33% to over 16%.

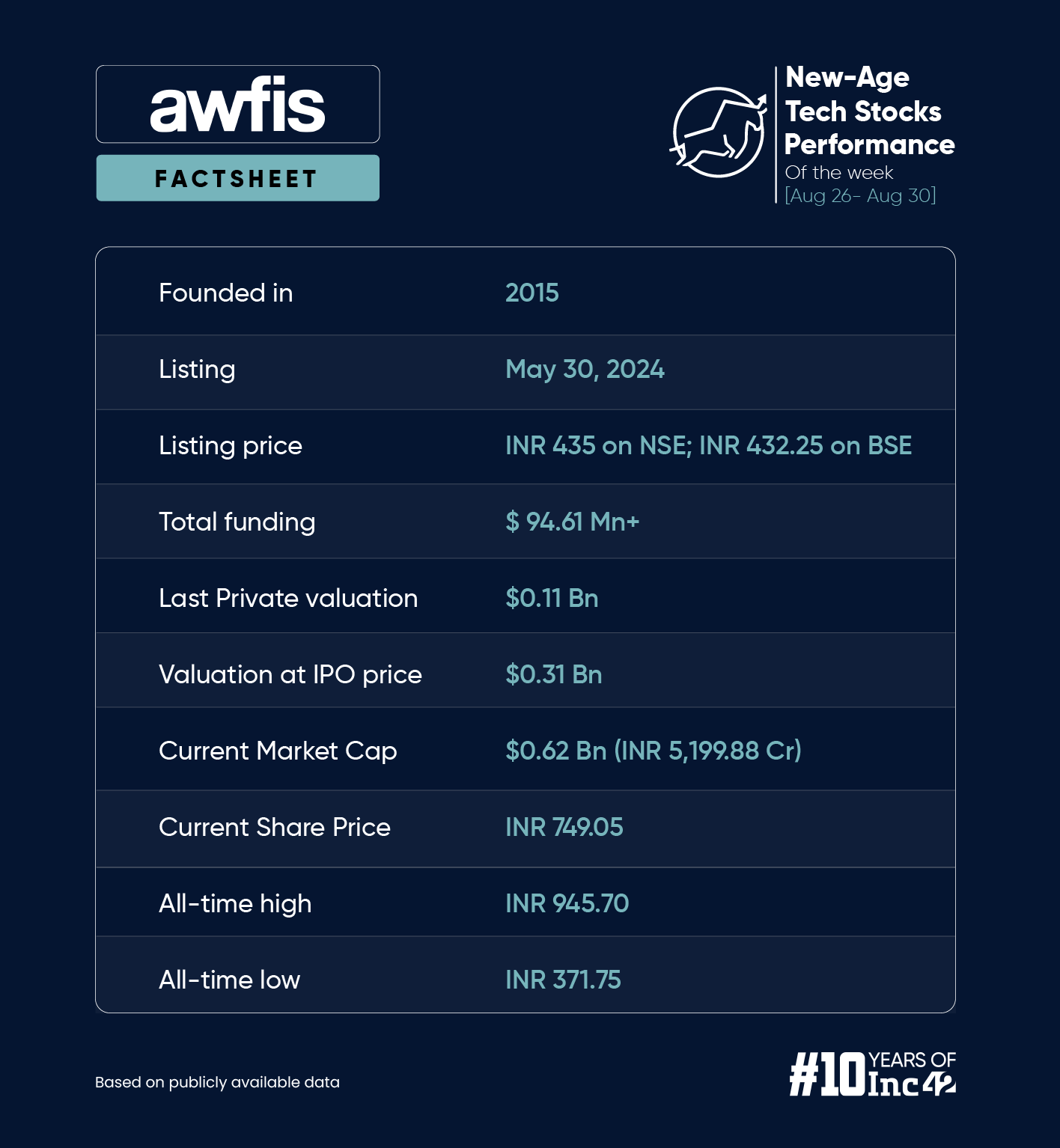

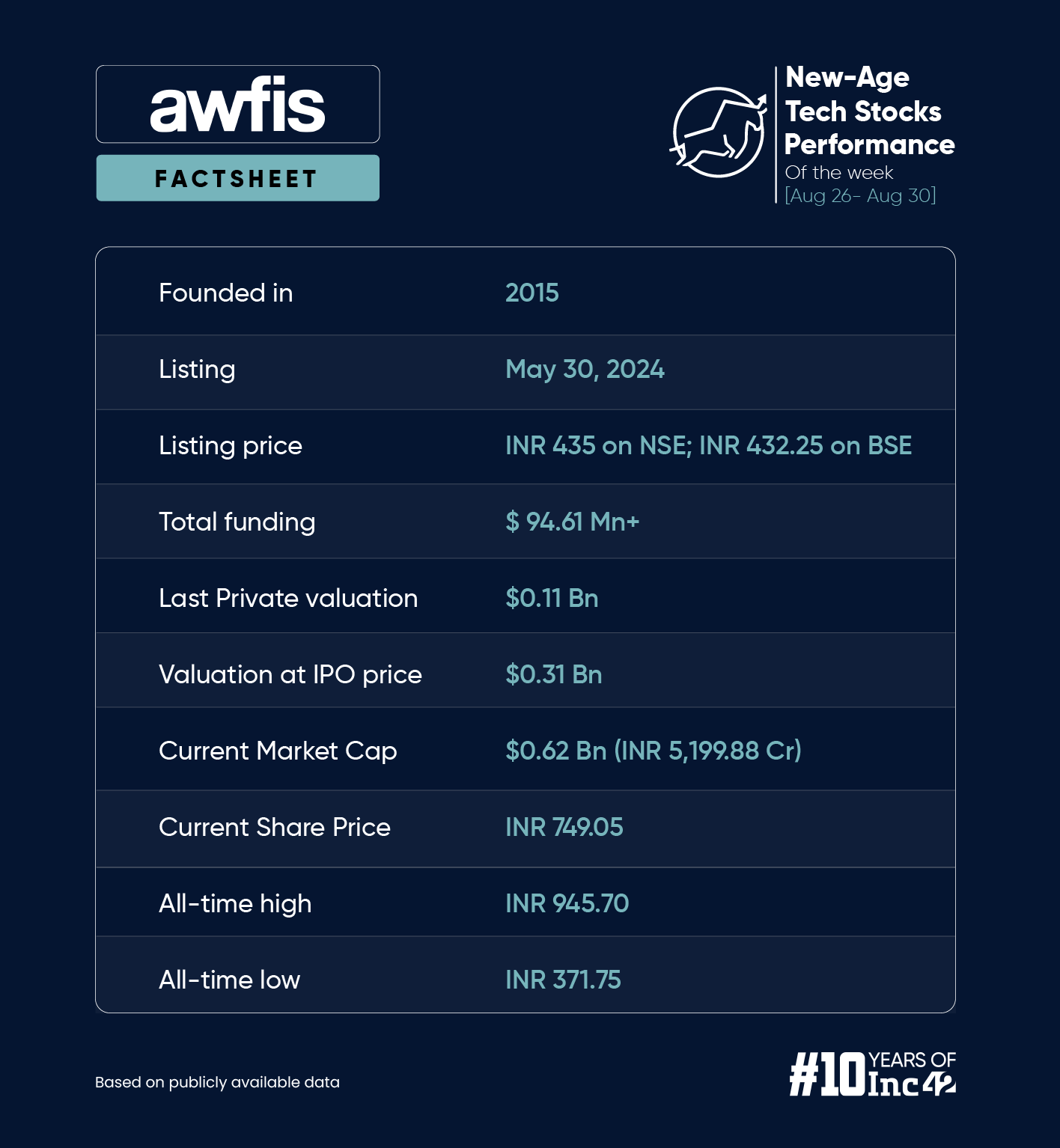

Awfis emerged as the biggest loser this week, with its shares crashing 16.38% to end at INR 749.05. Last week’s top gainer TAC Infosec, Zomato, Ola Electric were among the other major stocks which declined this week.

Meanwhile, 11 new-age tech stocks rose in a range of just under 1% to over 12% this week. While Paytm emerged as the top gainer, Go Digit, TBO Tek, PB Fintech, and Honasa were among the other winners this week.

It must be mentioned that two startups touched fresh all-time highs this week. Shares of Mamaearth parent Honasa touched an all-time high of INR 528.9 on Monday (August 26) and ended the week 8.52% higher at INR 506.05 on the BSE.

TAC Infosec extended its bull run into the first half of the week, with its shares touching an all-time high of INR 853.15 on Tuesday (August 27). However, the cybersecurity SaaS startup’s shares lost steam in the latter part of the week. Overall, the stock declined 3.73% this week to end at INR 745.

In the broader market, Sensex grew 1.5% to end the week at 81,086.21 and Nifty 50 jumped 1.6% to end at 25,235.90.

Motilal Oswal Financial Services’ research head Siddhartha Khemka attributed Moody’s upgrading India’s GDP growth forecast to 7.2% for 2024 and 6.6% for 2025 from the earlier estimates of 6.8% and 6.4%, respectively, as one of the reasons for the rally this week.

“This (GDP forecast update) and healthy MSCI inflow took markets to new highs. We expect the market to continue its northbound journey with stock-specific action,” he said.

Meanwhile, D2C meat delivery startup Zappfresh became the latest new-age business to join the queue for a public listing. Earlier this week, its parent DSM Fresh Foods Ltd filed its draft red herring prospectus (DRHP) for listing on the SME platform of the BSE, BSE SME.

On the IPO trend, Pantomath Capital Advisors said that 17 companies filed their DRHPs with SEBI in the month of August, making it the highest number of monthly filings in over a year. Pantomath anticipates this trend to continue for the remainder of the year.

“Recently listed IPOs have performed exceptionally well, boosting confidence among both companies and investors. This renewed optimism is prompting investors to look at opportunities in the primary market and driving promoters to raise funds through IPOs,” it said.

Overall, the total market capitalisation of 28 new-age tech stocks under Inc42’s coverage stood at $80.19 Bn at the end of this week as against $81.39 Bn last week.

Now, let’s take a deeper look at the performance of some of the new-age tech stocks this week.

Good News For Paytm

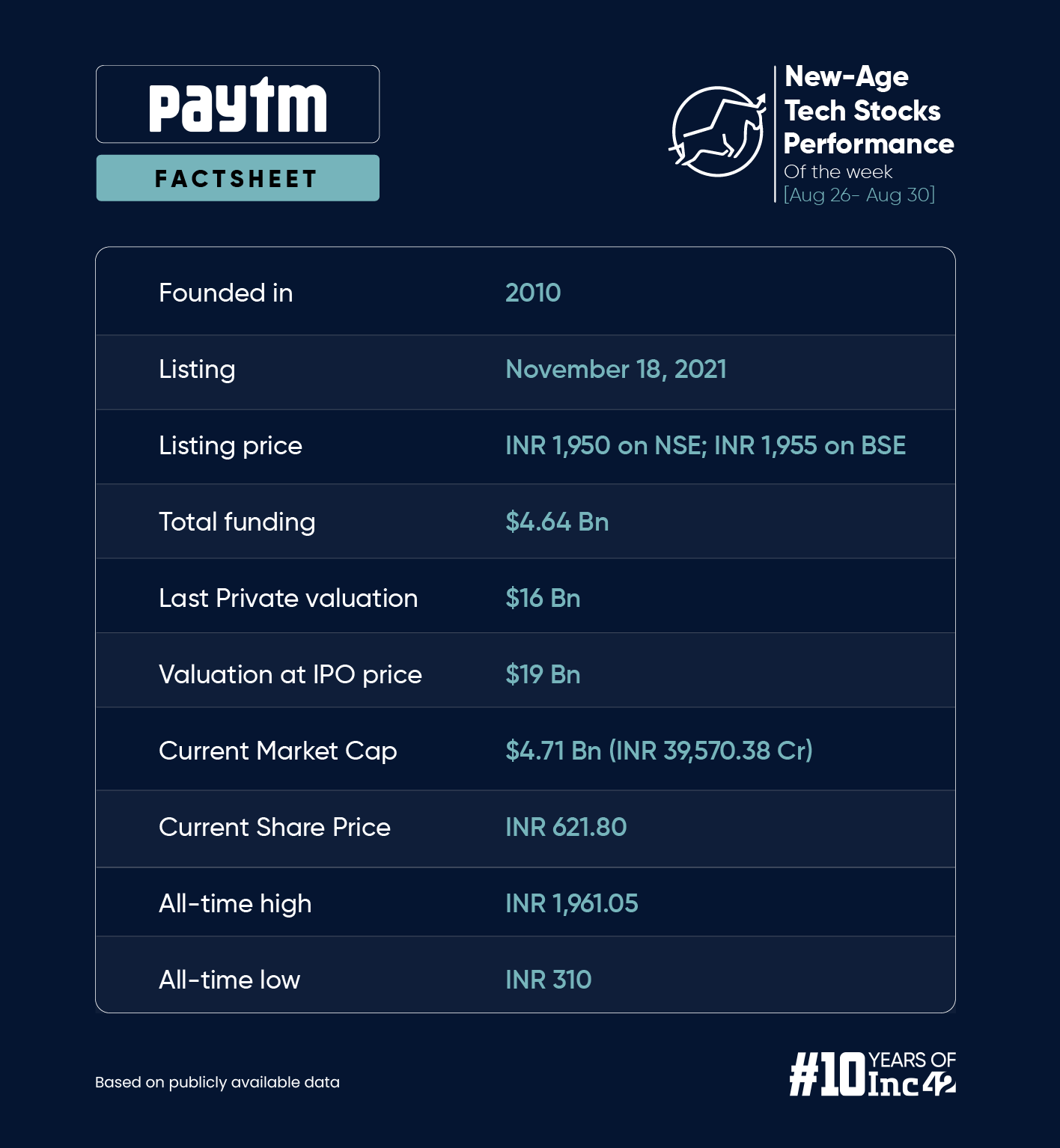

Paytm, which has been hit by regulatory troubles this year, saw a couple of positive developments bolster investor sentiment towards the stock. Shares of Paytm gained 12.14% this week to close at INR 621.80.

Here’s more on the developments:

- The Vijay Shekhar Sharma-led startup sold its events and movies ticketing business to Zomato for INR 2,048 Cr in an all-cash deal.

- Paytm received the long-pending approval from the Centre for its investment in its payments arm, Paytm Payment Services Limited (PPSL). With this, it will reapply for a payment aggregator (PA) licence from the Reserve Bank of India (RBI).

Getting the PA licence will help the company add new customers for providing online payment aggregation services.

In a report, brokerage Jefferies said that the immediate business impact of the licence could be marginal for Paytm. However, it has a price target (PT) of INR 420 on the stock, representing nearly 32% downside from its last close.

Besides, Motilal Oswal, on the Zomato-Paytm deal, said that the sale of the entertainment business would offer a financial boost to Paytm, generating significant cash that can be reinvested into other high-potential areas. It maintained a ‘Neutral’ rating on Paytm with a PT of INR 550, and expects the company to turn EBITDA positive by FY27.

Awfis’ Bull Run Ends

After an extended bull run on the bourses, shares of recently listed coworking space provider Awfis crashed this week.

The startup’s shares plunged 16.38% to end the week at INR 749.05. Earlier on August 22, the stock had touched an all-time high of INR 945.70.

During the week, Awfis announced a partnership with Nyati Group to set up an additional 3 Lakh square feet of Grade-A workspace in Pune.

Through the partnership, Awfis will introduce premium flexible workspaces in Nyati Group’s commercial properties of Nyati Empress in Pune’s Viman Nagar and Nyati Enthral in Kharadi. It will add 1,67,206 square feet of built up office space in the city.

Awfis currently offers 1,12,038 seats across 185 centres in 17 cities. Moving forth, the startup plans to further expand across India by adding 40,000 new seats in FY25, taking the total seat count to 1,35,000.

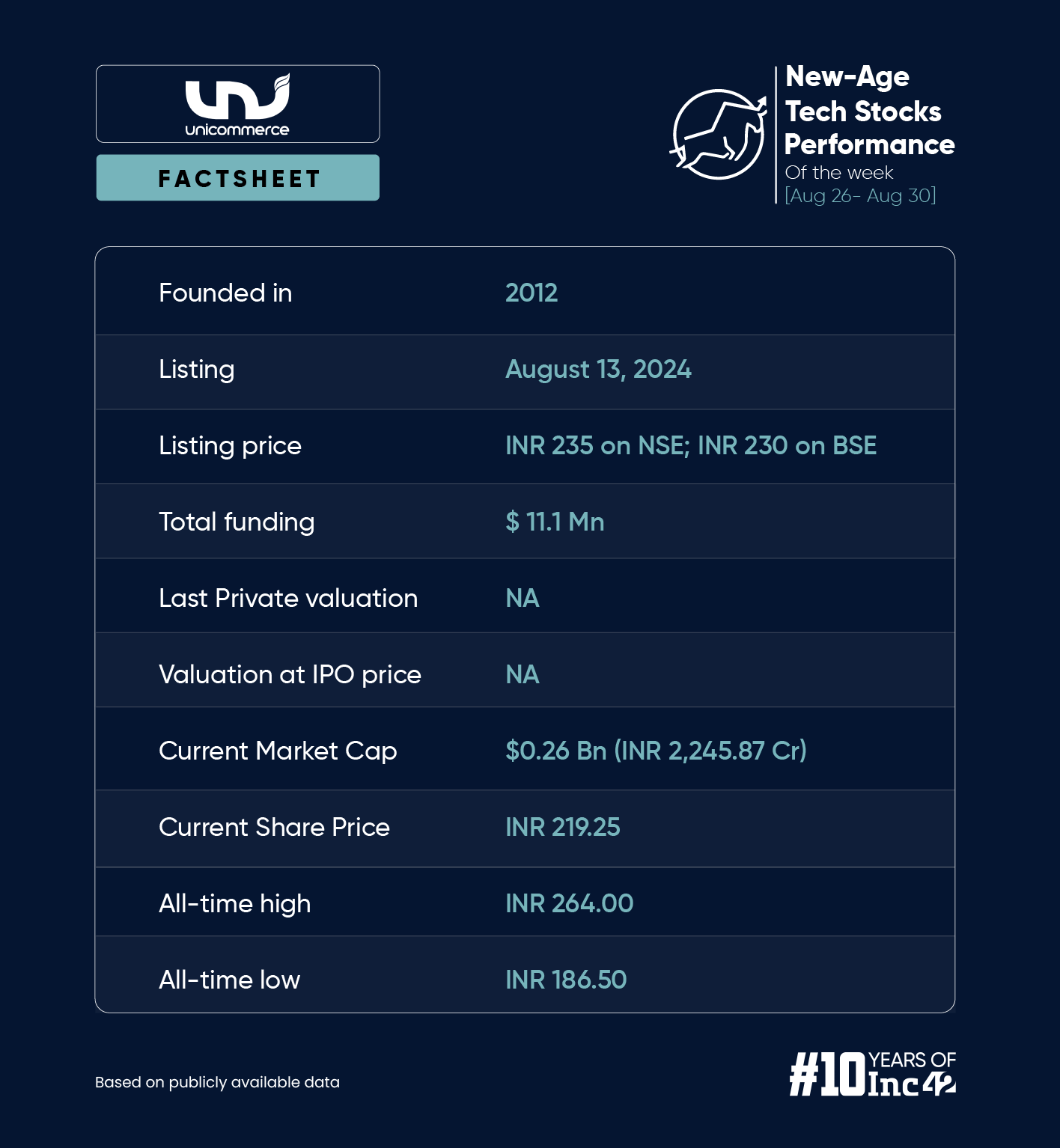

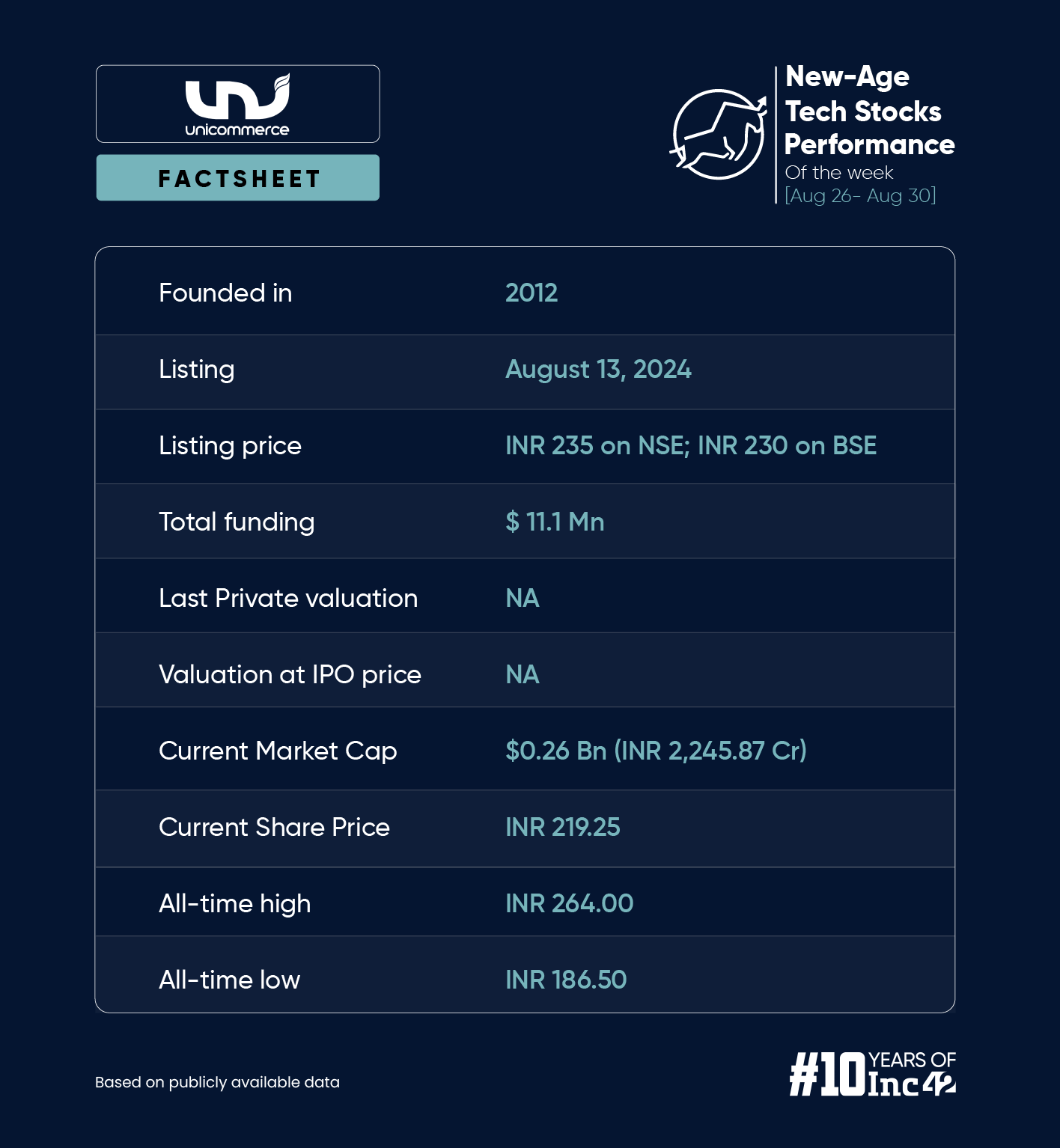

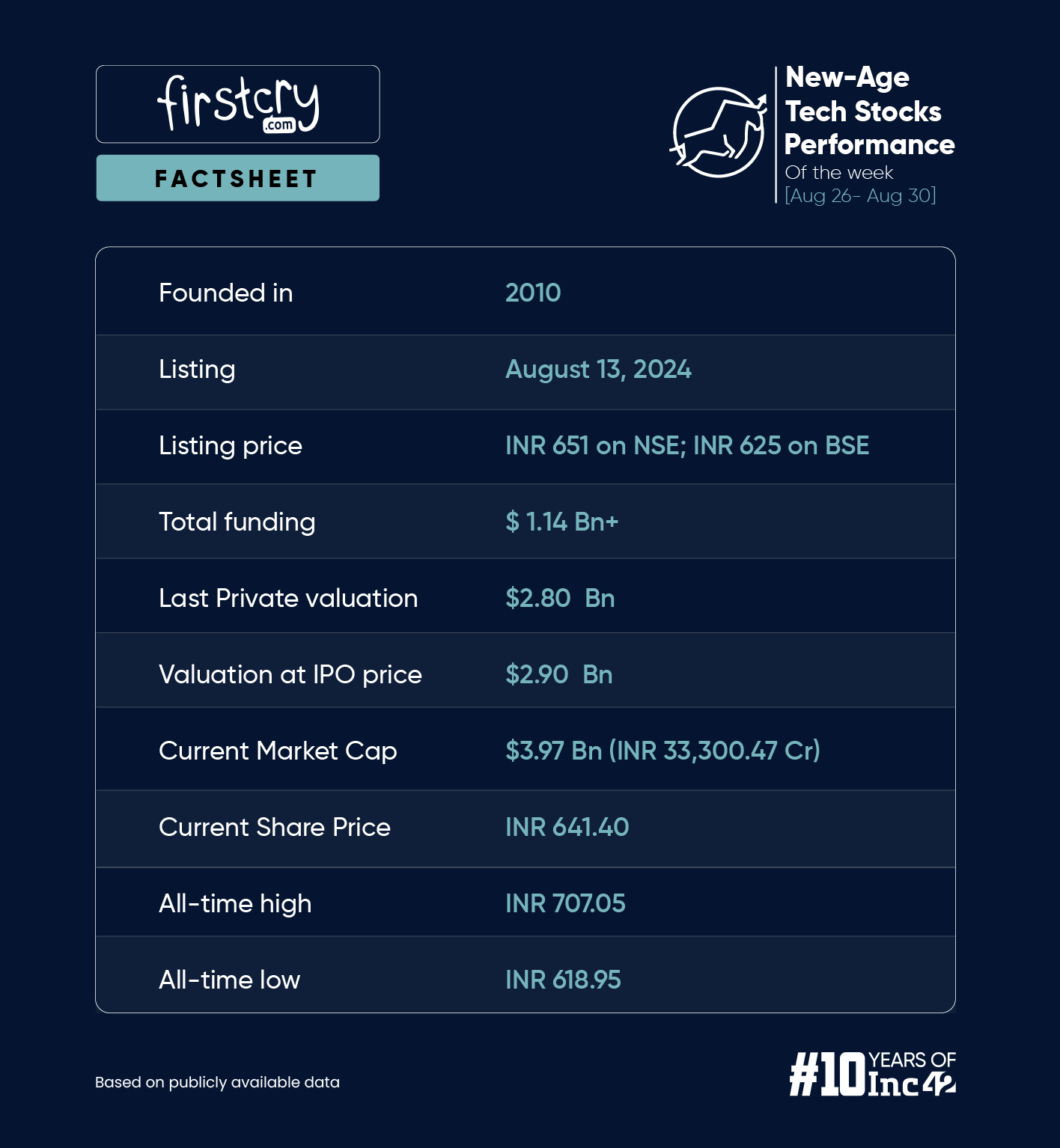

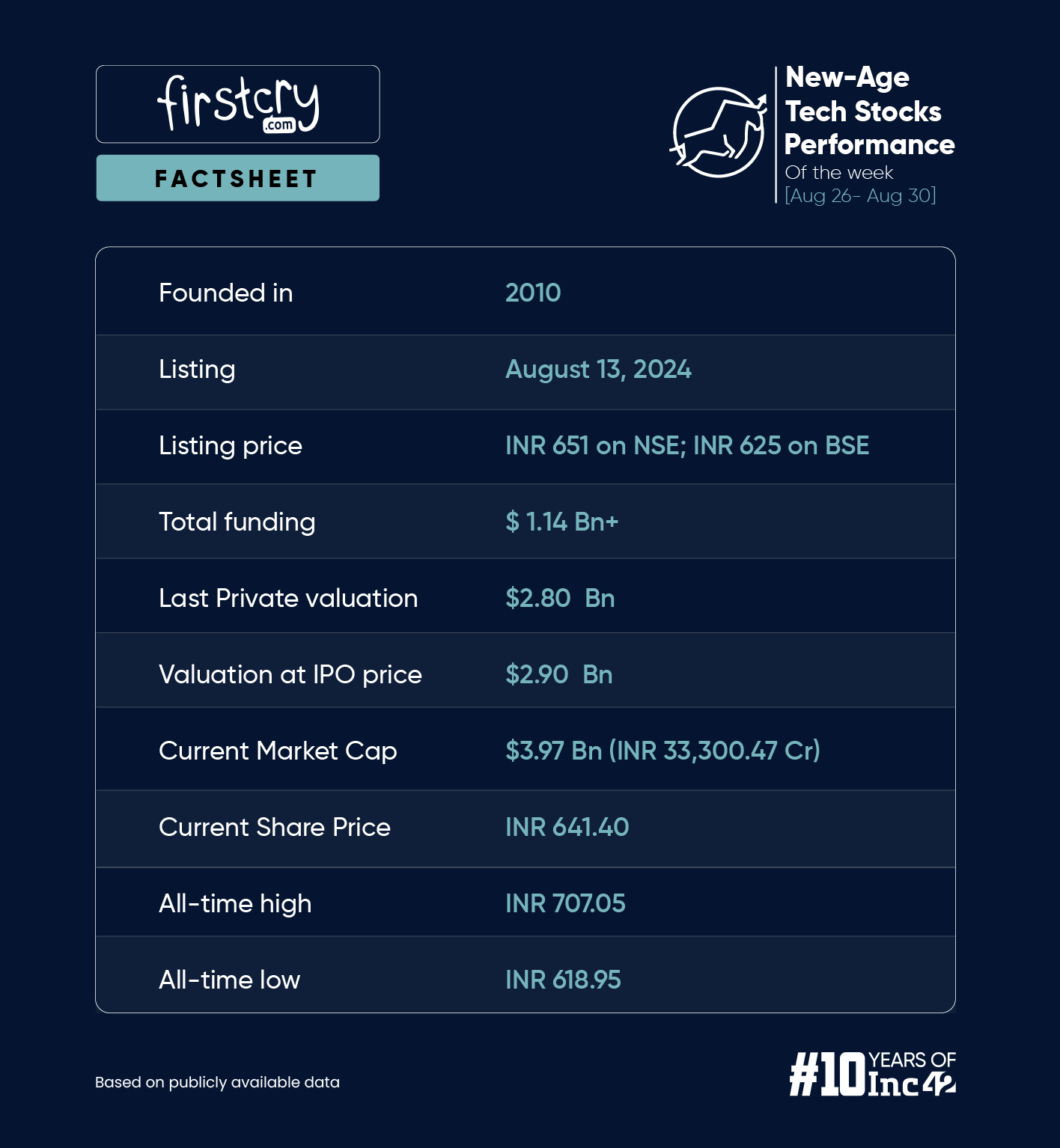

Unicommerce, FirstCry Post First Financials After Listing

On Friday (August 30), recently listed kids-focussed omnichannel retailer FirstCry and SaaS startup Unicommerce released their first financial results post their listing on the bourses earlier this month.

FirstCry’s parent Brainbees Solutions reduced its consolidated net loss by 31% to INR 75.68 Cr in Q1 FY25 from INR 110.42 Cr a year ago. Operating revenue increased 10% to INR 1,652.07 Cr from INR 1,496.93 Cr in Q1 FY24.

The company’s consolidated adjusted EBITDA surged 106% YoY to INR 74.3 Cr, with GMV rising 17% YoY to INR 2,318.3 Cr. FirstCry said it plans to invest INR 100 Cr in its UAE subsidiary to boost operations in the UAE as well as Saudi Arabia.

The company released its financial numbers after market hours. Prior to that, its shares closed at INR 641.40, which was a gain of 0.45% on a weekly basis.

Meanwhile, Unicommerce reported a 31% increase in profit after tax (PAT) to INR 3.51 Cr in Q1 FY25 from INR 2.68 Cr in the same quarter last year.

Revenue from contracts with customers grew 9.2% year-on-year to INR 27.46 Cr, while total expenses rose 7% to INR 24.28 Cr. Further, its EBITDA surged 61% to INR 4.2 Cr, with EBITDA margin expanding to 15.3% from 10.4% a year ago.

Unicommerce also declared its numbers after the close of the market. Its shares ended the week 2.90% lower at INR 219.25 on the BSE.