We’re thrilled to unveil the second edition of MoneyX — an exclusive, investor-only conference designed specifically for India’s leading General Partners (GPs), Limited Partners (LPs), VCs, angel investors, and family offices

MoneyX 2.0 will bring together 300+ of the biggest investors to decode the patterns of capital movement across the startup lifecycle, connect with industry leaders and more

Set to be organised in Delhi NCR on September 26, Inc42’s MoneyX is a pulpit where the brightest minds in the investment community come together to decode the patterns of capital movement across the startup lifecycle

India’s startup landscape is fast evolving from a few concentrated urban hubs into a vibrant, nationwide ecosystem of innovation. This shift is evident in the rise of startups, which have skyrocketed from 300 in 2016 to 1.4 Lakh+ by 2024, according to DPIIT.

No longer confined to traditional centres like Delhi, Mumbai and Bengaluru, the wave of entrepreneurship is now sweeping across the country, unlocking untapped economic potential and fuelling new growth opportunities.

In many ways, the surge in startup activity is unprecedented and has largely defied global economic headwinds.

Consider the funding winter: Despite the market slowdown, India remained a hotbed for early-stage investments, with over 60% of new funds dedicated to nascent startups. In 2023 alone, Indian VCs launched 31 such funds, amassing a total corpus of $1.8 Bn.

The fact is that disruptive businesses are on the rise, and investor enthusiasm shows no signs of waning. Indian startups raised $5.3 Bn in the first half of 2024 across 504 funding deals alone, highlighting a strong interest in the country’s innovation landscape.

However, amid the current scheme of things, some key questions remain unanswered for investors: Where is the startup ecosystem headed? Which trends should investors be watching out for, and which emerging sectors promise the highest returns?

It is precisely these and many more such questions that we will be looking to answer at the second edition of Inc42’s MoneyX — an exclusive, investor-only conference designed specifically for India’s leading General Partners (GPs), Limited Partners (LPs), VCs, angels and family offices.

Inc42’s MoneyX is a pulpit where the brightest minds in the investment community come together to decode the patterns of capital movement across the startup lifecycle, connect with industry leaders and strategise on investments that will shape the future .

While networking events are aplenty, MoneyX offers a carefully curated experience tailored to India’s unique investor ecosystem. It’s a strategic forum where like-minded peers converge to unlock new avenues for partnership and collaboration.

MoneyX 2.0 is set to take place at The Oberoi, Gurugram on September 26.

India’s Largest Angel & VC Conclave Is Back

We envisioned MoneyX with a simple yet powerful goal — to address the gap in India’s startup ecosystem, where domestic capital accounts for less than 10% of the total investment in Indian startups. Despite the abundance of opportunities, this disparity remains a challenge. Also, while India boasts over 125 angel networks and syndicates — a number projected to exceed 200 by 2030 — investors aren’t fully capitalising on this opportunity.

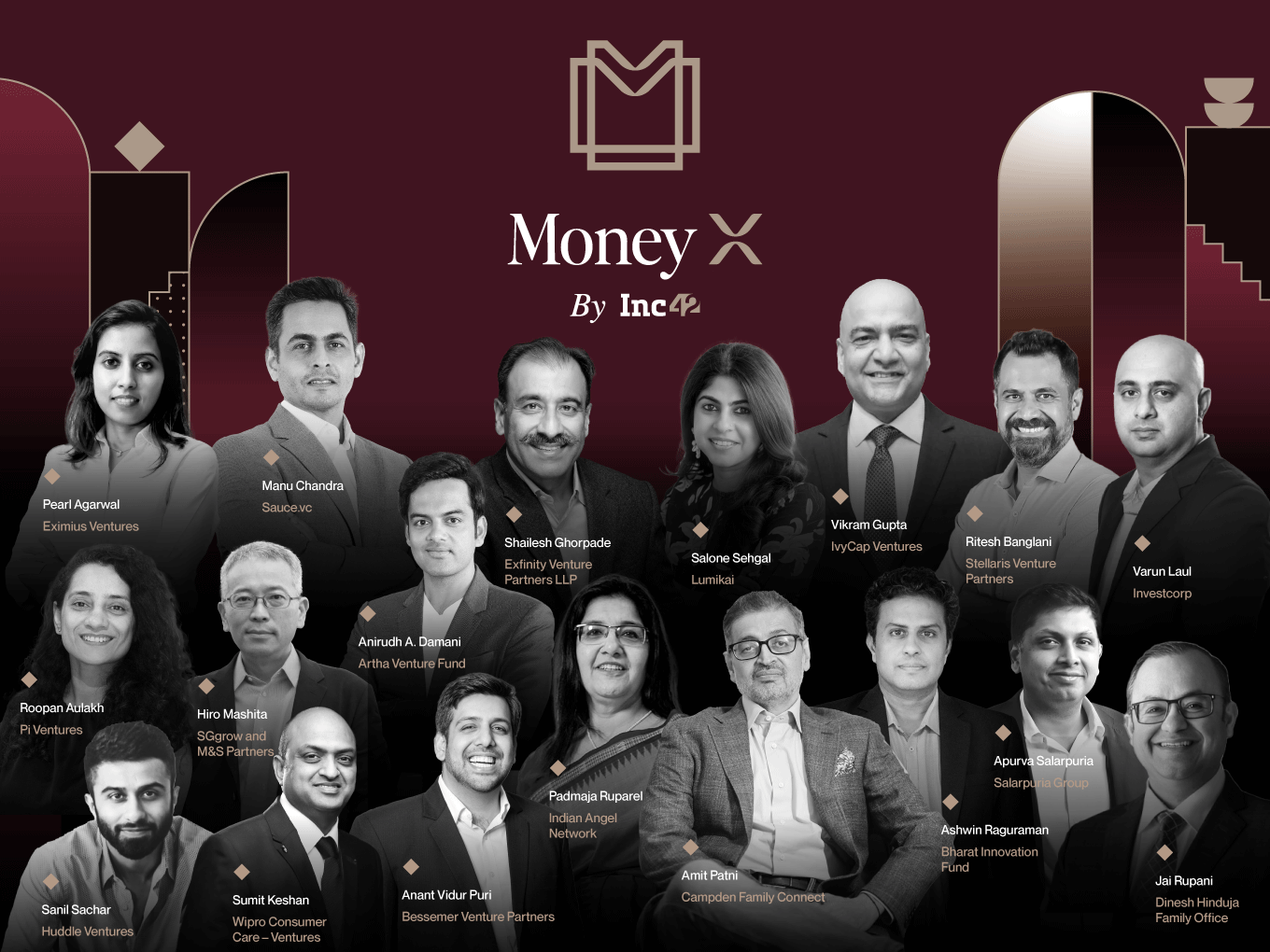

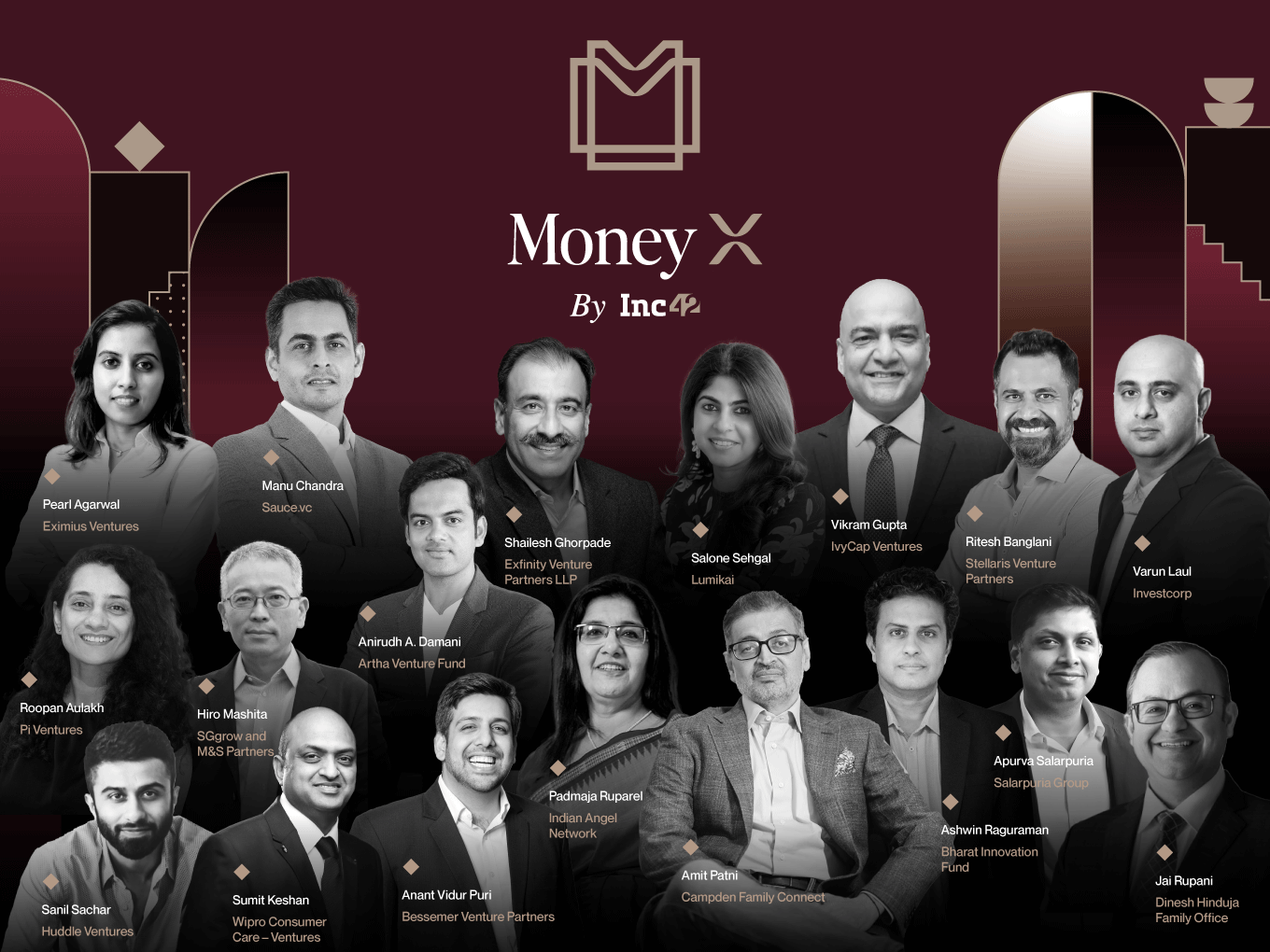

To address this, we launched MoneyX last year, bringing together India’s top 1% of investors, who collectively manage portfolios worth over $100 Bn. Across 15+ sessions and 10+ hours of intensive networking, these industry leaders converged at a full-day event, which was a hotbed of insights, connections and collaborations.

The attendees left with invaluable learnings and fresh perspectives after hearing about the investment journey of veteran investors like Sanjeev Bikhchandani of Info Edge; Soumya Rajan, founder & CEO of Waterfield Advisors; Rajan Anandan, MD of Peak XV Partners & Surge, and Padmaja Ruparel of Indian Angel Network, among other prominent figures.

This year, we’re amplifying MoneyX to a whole new level, as we are bringing together 300+ investors under one roof, creating India’s largest investor and VC conclave.

Unleashing India’s Domestic Capital Potential

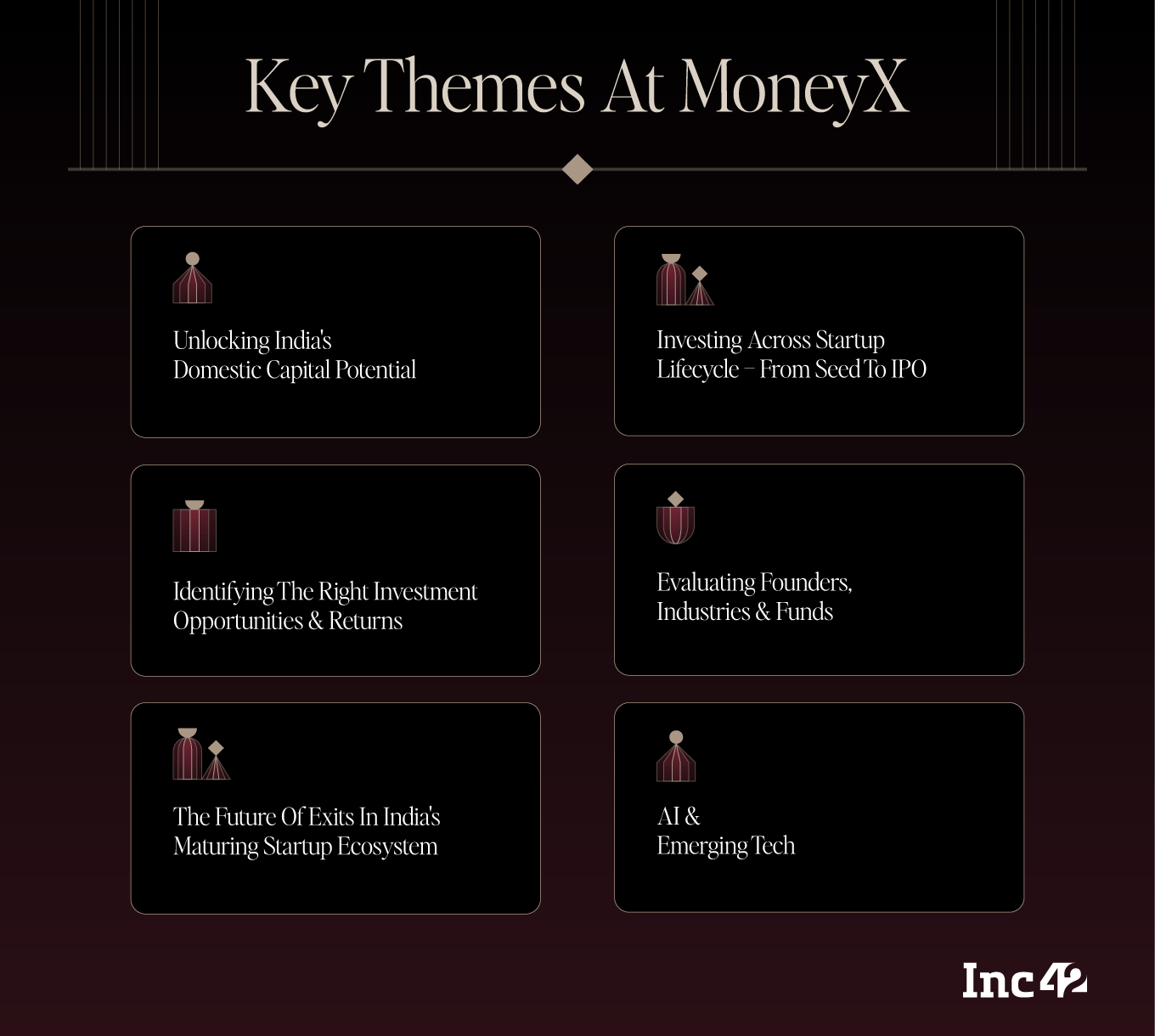

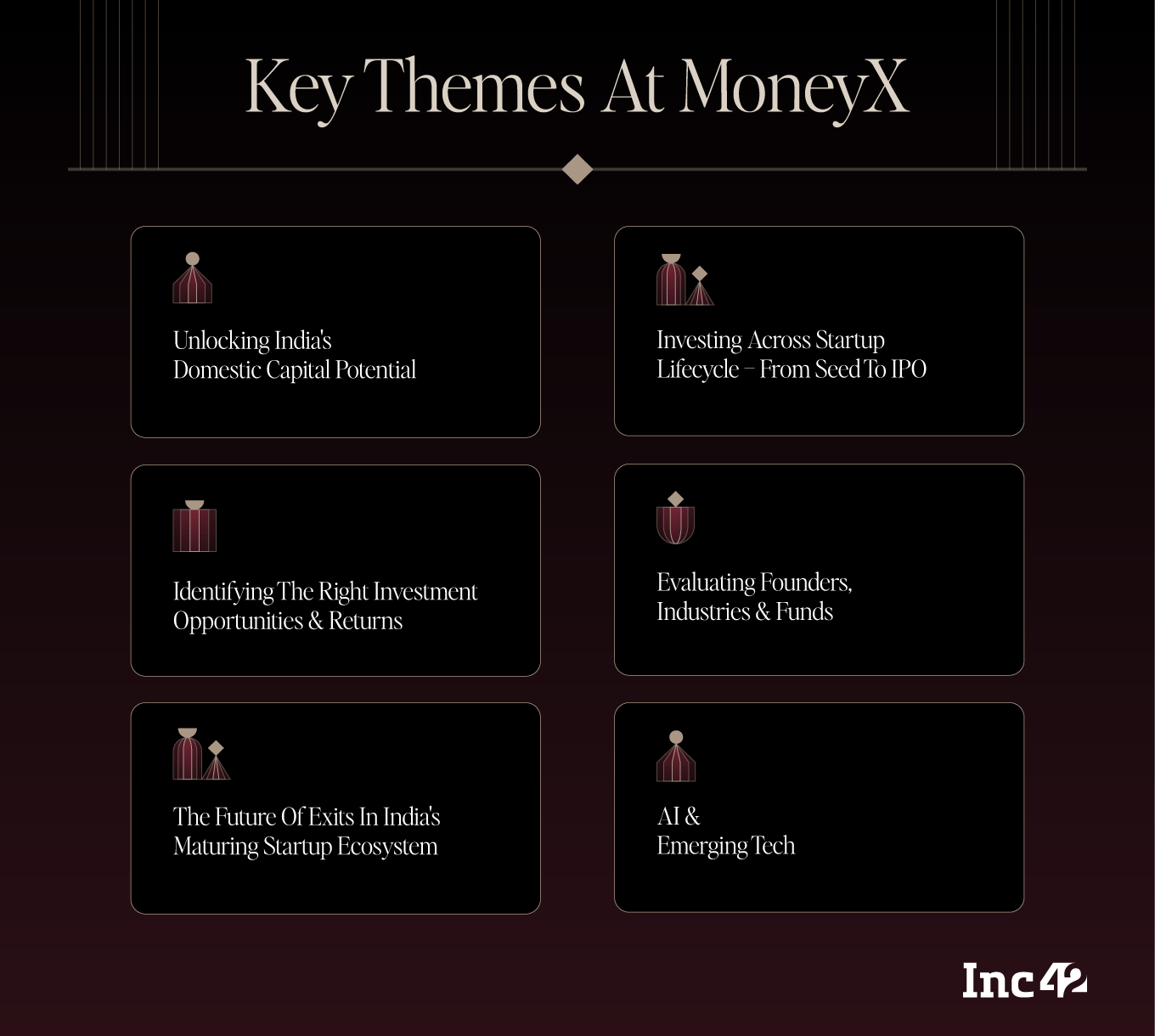

At MoneyX 2.0, we will explore strategies to mobilise domestic funds, addressing how Indian investors can bridge critical domestic capital gaps across the entire startup lifecycle — from seed funding to IPO. The speakers will shed light on how investors can identify the right investment opportunities and how to evaluate returns.

Speakers will also dive into how investors assess founders, industries and funds. The discussions will further highlight the evolving dynamics of VC in India, from the rise of micro VCs to family office involvement, and will examine emerging trends reshaping the landscape.

Attendees will also gain insights into the future of exits in a maturing startup ecosystem and how AI and emerging technologies are influencing investment strategies in high-growth sectors.

We’re calling on VCs, LPs, GPs, family offices, angel investors, PE fund managers and all investment leaders to join us in revolutionising India’s domestic investment scene. Mark your calendars for MoneyX 2.0 to engage with top-tier investors and uncover key investment trends that will shape the next wave of startup innovation. Watch this space for the agenda.