SUMMARY

FirstCry-parent BrainBees Solutions has refiled its Draft Red Herring Prospectus with SEBI for IPO with updated financials after the markets regulator pressed for the inclusion of detailed key performance indicators (KPIs)

The Pune-based startup clocked sales of INR 4,814 Cr and reported a loss of INR 278.2 Cr in the first nine months of the fiscal year ended March 2024 (FY24)

Of the INR 18,160 Cr that FirstCry plans to raise through the fresh issue, the company will invest INR 140.7 Cr for setting up new modern stores under the BabyHug brand name and establishing warehouses in India

BrainBees Solutions Ltd, the parent of kids-focussed omnichannel retailer firstcry

As per the DRHP, the startup’s initial public offering (IPO) will comprise a fresh issue of shares worth INR 1,816 Cr and an offer for sale (OFS) component of 5.4 Cr equity shares.

The startup refiled the DRHP after markets regulator SEBI raised questions over the key metrics disclosed by it in its earlier DRHP, filed in December last year.

Japanese tech investor SoftBank, US-based private equity firm TPG, NewQuest, Mahindra & Mahindra Ltd are among the investors who will offload the shares via the OFS, as per the latest DRHP.

Of the INR 1,816 Cr that FirstCry plans to raise through the fresh issue, the company will invest INR 140.7 Cr for setting up new modern stores under the BabyHug brand name and establishing warehouses in India.

Out of the net proceeds, FirstCry will spend INR 116.5 Cr towards expenditure for lease payments of its existing modern stores in the country.

The Pune-based company also intends to use INR 388.2 Cr from the fresh proceeds towards funding organic growth opportunities, through investment in subsidiary Digital India.

Of these, INR 222.2 Cr has been earmarked for setting up new modern stores under the FirstCry brand and other home brands of the company, while INR 166 Cr will be used to lease payments for existing identified modern stores owned and controlled by Digital Age in India.

The kids-focused retailer will spend INR 155.6 Cr towards expansion in overseas markets.

Kotak Mahindra Capital, Morgan Stanley India, BofA Securities India, JM Financial are among the book running lead managers to the issue.

Notably, FirstCry clocked sales of INR 4,814 Cr and reported a loss of INR 278.2 Cr in the first nine months of the fiscal year ended March 2024 (FY24).

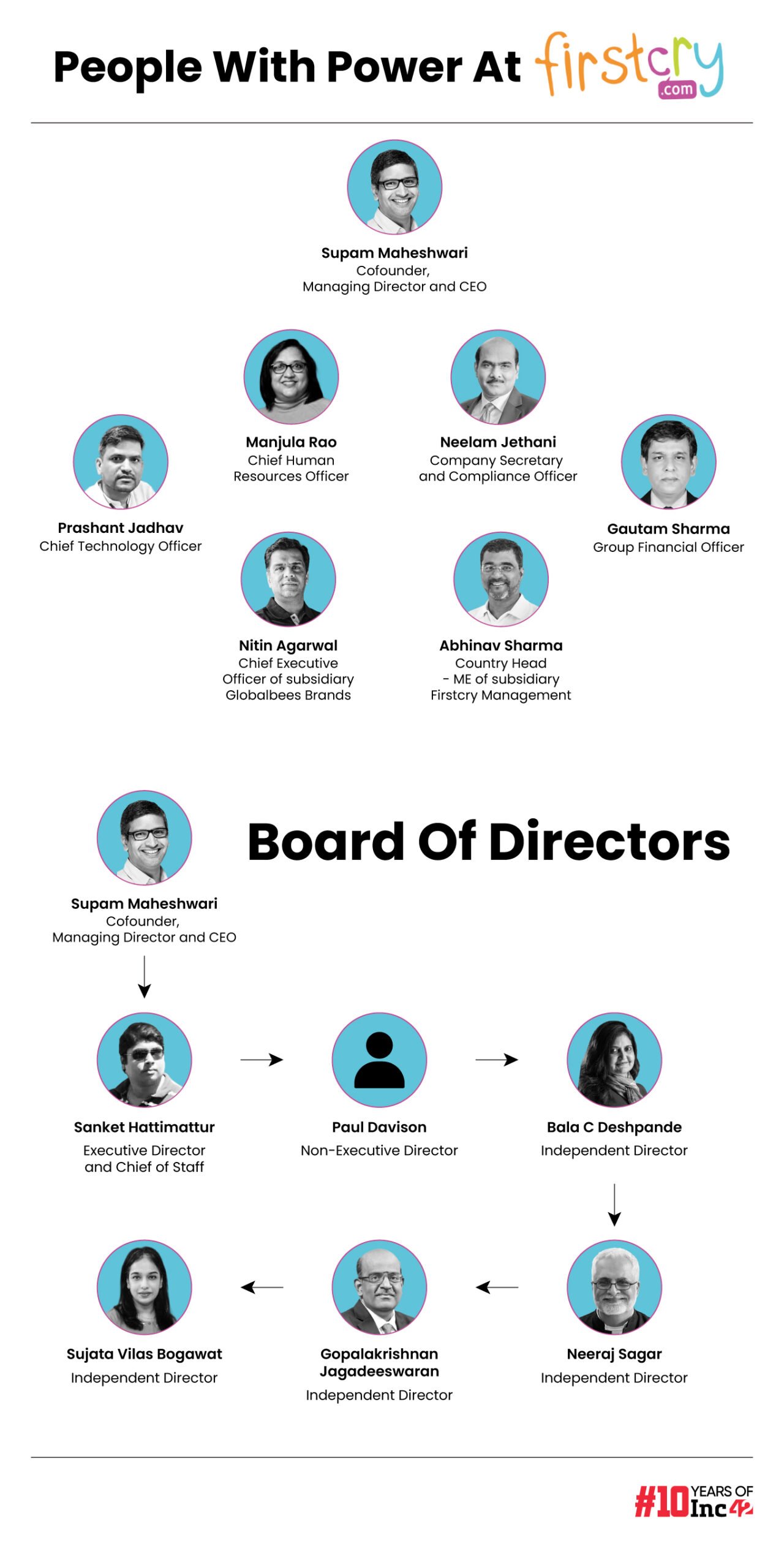

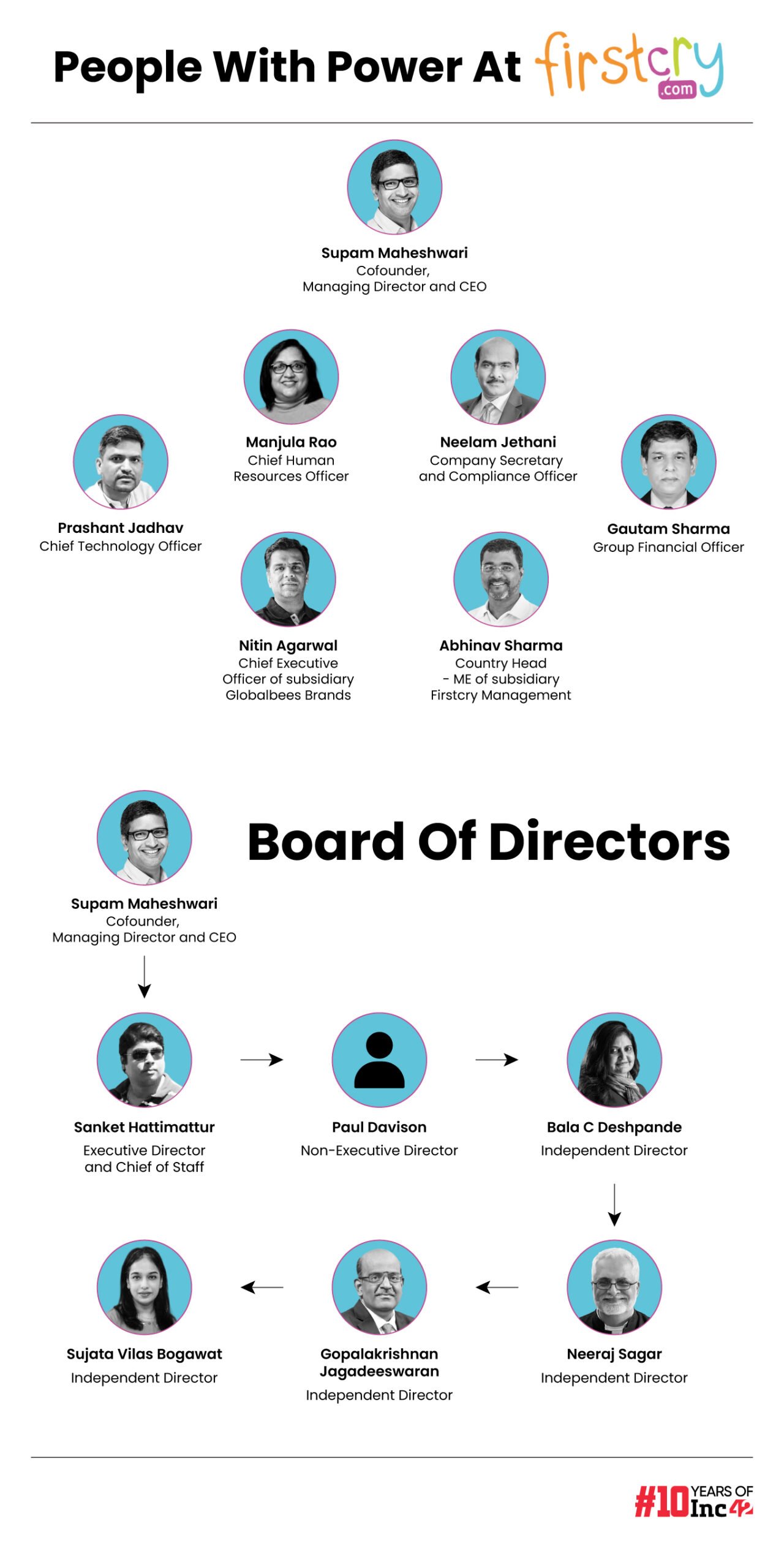

Let’s take a look at the key managerial personnel and senior management leading FirstCry as it nears Dalal Street debut.

Supam Maheshwari — Cofounder, Managing Director and Chief Executive Officer

An IIM-Ahmedabad alumnus and Delhi College of Engineering (Mechanical) graduate, Supam Maheshwari owns a 5.94% stake in Firstcry.

Maheshwari was paid a total remuneration of INR 77.5 Cr for the first nine months ended December 31, 2023. Further he received a sitting fee of INR 3.67 Cr in the fiscal year ended March 2024 (FY24).

Maheshwari has been on FirstCry’s board since its inception and has previously held positions at Firmroots, Globalbees Brands, Intellibees, and FirstCry DWC among others. His entrepreneurial journey began when he co-founded Brainsiva Technologies with Amitava Saha.

Gautam Sharma — Group Chief Financial Officer

Gautam Sharma, the Group Financial Officer at FirstCry, received a total compensation package of INR 1.64 Cr in FY24. A graduate of Gujarati Commerce College, Indore, Sharma is also an associate member of the Institute of Chartered Accountants of India and a fellow member with the Institute of Company Secretaries of India.

In 2024, Sharma bagged the Best CFO E-Commerce award from Biz Integration and Best CFO of the Year – Large Enterprises from the Economic Times. Prior to joining FirstCry, Sharma has worked with companies such as Birla Ericsson Optical and Reliance Industries among others.

Prashant Jadhav — Cofounder, and Chief Technology Officer

FirstCry chief technology officer Prashant Jadhav owns a 1.44% stake and is responsible for the IT function in the company. He earned a bachelor’s degree in Arts (Politics) from Shivaji University, Kolhapur and took home an annual remuneration of INR 1.9 Cr in FY24.

Before joining FirstCry, Jadhav worked with Brainvisa Technologies, an e-learning platform cofounded by Maheshwari.

Manjula Rao — Chief Human Resources Officer

Manjula Rao, chief human resources officer at FirstCry, heads the HR function in the company. Rao received a remuneration of INR 69.3 Lakh in FY24.

Rao pursued her bachelor’s degree in commerce from University of Pune and then earned master’s degree in personnel management from the institution. Prior to joining FirstCry, Rao has worked with firms like Project Concern International, Population Services International and Saertex India Private Limited

Abhinav Sharma — Country Head, Middle East – FirstCry Management

Abhinav Sharma is the head of the company’s business in the Middle East and is responsible for international expansion in the region. A mechanical engineering graduate of Maharashtra Institute of Technology, Sharma has also pursued a master’s degree of science in industrial engineering from the University of Texas.

Before joining FirstCry, Sharma worked with Fossil Inc and Flipkart India and has also served as a General Manager at FirstCry Trading. His aggregate compensation in FY24 stood at INR 2 Cr.

Nitin Agarwal — Chief Executive Officer – Globalbees Brands

An alumnus of IIT Delhi, Nitin Agarwal serves as the chief executive officer of Globalbees Brands, a subsidiary of FirstCry. Agarwal received a total compensation of INR 99.7 Lakh in FY24 and was previously associated with Wecash India Private Limited and Edelweiss Financial Services Limited.

Neelam Jethani — Company Secretary & Compliance Officer

Neelam Jethani is responsible for setting up the compliance framework at FirstCry to ensure the company is in compliance with regulatory and legal requirements. In FY24, Jethani received a remuneration of INR 24.7 Lakh in FY24.

Jethani holds a bachelor’s degree in law from Savitribai Phule, Pune University and is also an associate of the Institute of Company Secretaries of India. Prior to joining FirstCry, Jethani has held positions at firms such as Schaeffler India Limited, Persistent Systems Limited and KPIT Technologies Limited.