A U.S. bankruptcy judge has granted bankrupt crypto trading desk and lender Genesis permission to sell $1.6 billion worth of its Grayscale Bitcoin Trust (GBTC) shares, according to a court filing.

Along with the GBTC shares, Genesis will also be selling its shares in Grayscale Ethereum Trust (ETHE), and Grayscale Ethereum Classic Trust (ETCG) as part of the firm’s plan to repay its creditors.

The approval was made despite objections from Digital Currency Group, Genesis’ parent company, concerning the potential prematurity of the sale in relation to the overall bankruptcy plan. Earlier this morning DCG argued that the plan would wind up overpaying creditors.

In a court filing, DCG argued that the repayment plan “disproportionately favors a small controlling group of creditors over others,” and that “DCG cannot support such a plan, and the court should not approve it.”

The biggest issue? According to DCG, some of the creditors will receive far more than others since the prices of digital assets like Bitcoin (BTC) and Ethereum (ETH) have risen since Genesis went bust in January 2023.

But the judge wasn’t convinced.

Genesis aims to use the proceeds to repay customers and avoid monthly fees associated with its trust agreements. This development is just a part of Genesis’ broader liquidation plan, which includes settlements with regulatory bodies to prioritize customer repayments. A future court hearing will consider the approval of Genesis’ entire bankruptcy plan on February 26.

Genesis first ran into trouble in November 2022. It was already known the firm had made billions worth of loans to bankrupt hedge fund Three Arrows Capital. But when things started falling apart for Alameda Research and FTX, things got more dire for Genesis. The company filed for Chapter 11 bankruptcy protection in January 2023.

Meanwhile, the judge’s approval means that GBTC will experience more selling pressure after seeing a wave of it over the past month. After the U.S. Securities and Exchange Commission approved Grayscale to convert GBTC to a spot Bitcoin ETF, there were a few weeks of intense sell-the-news trading as investors liquidated their GBTC shares.

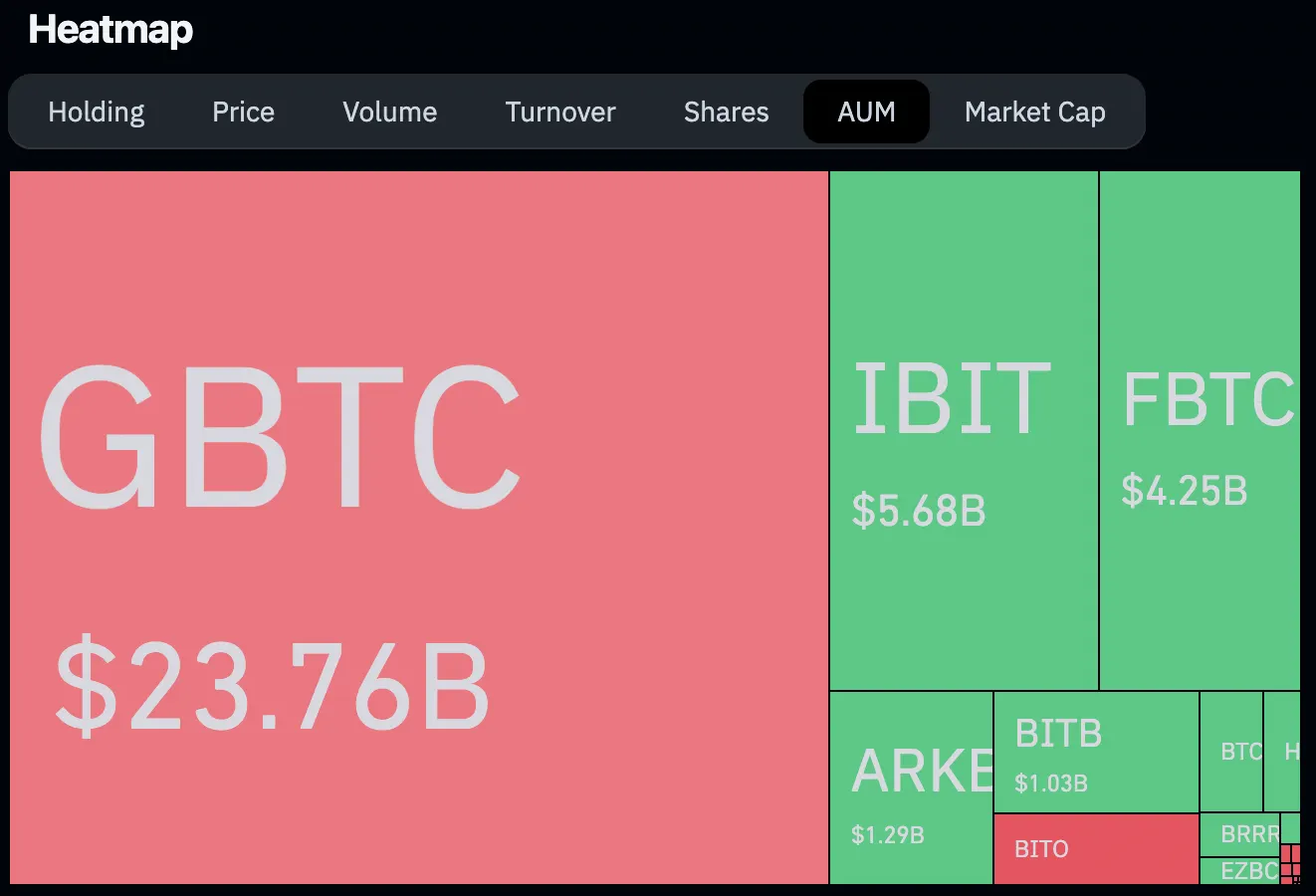

Keep in mind that even with the persistent outflows since GBTC was converted, the fund is far and away the dominant product in the space.

Its assets under management are about four times that of BlackRock’s iShares Bitcoin Trust (IBIT), which just this week cleared the $5 billion milestone. That metric is significant because it means IBIT has now doubled its fee from the initial 0.12% to 0.25%.