SUMMARY

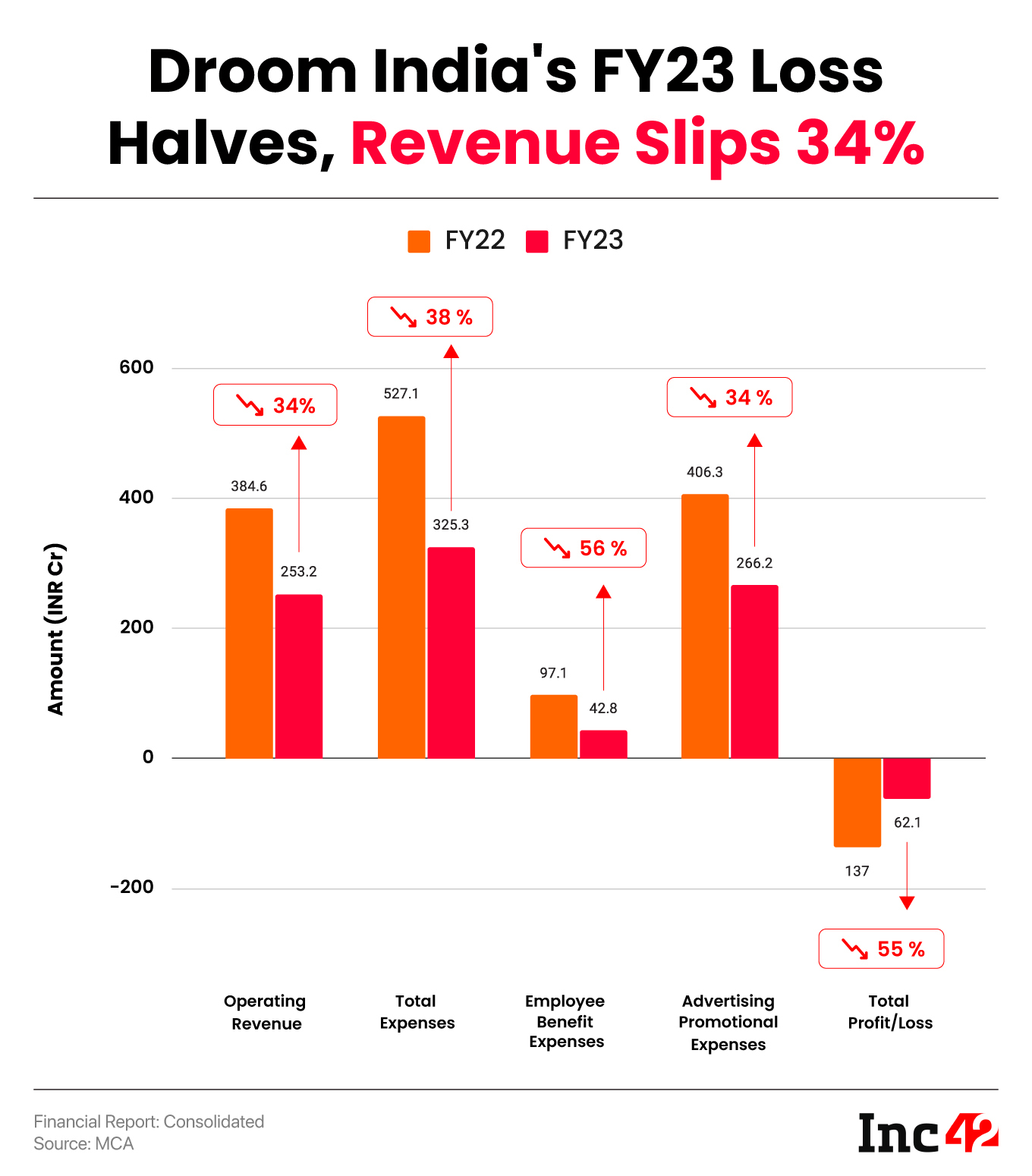

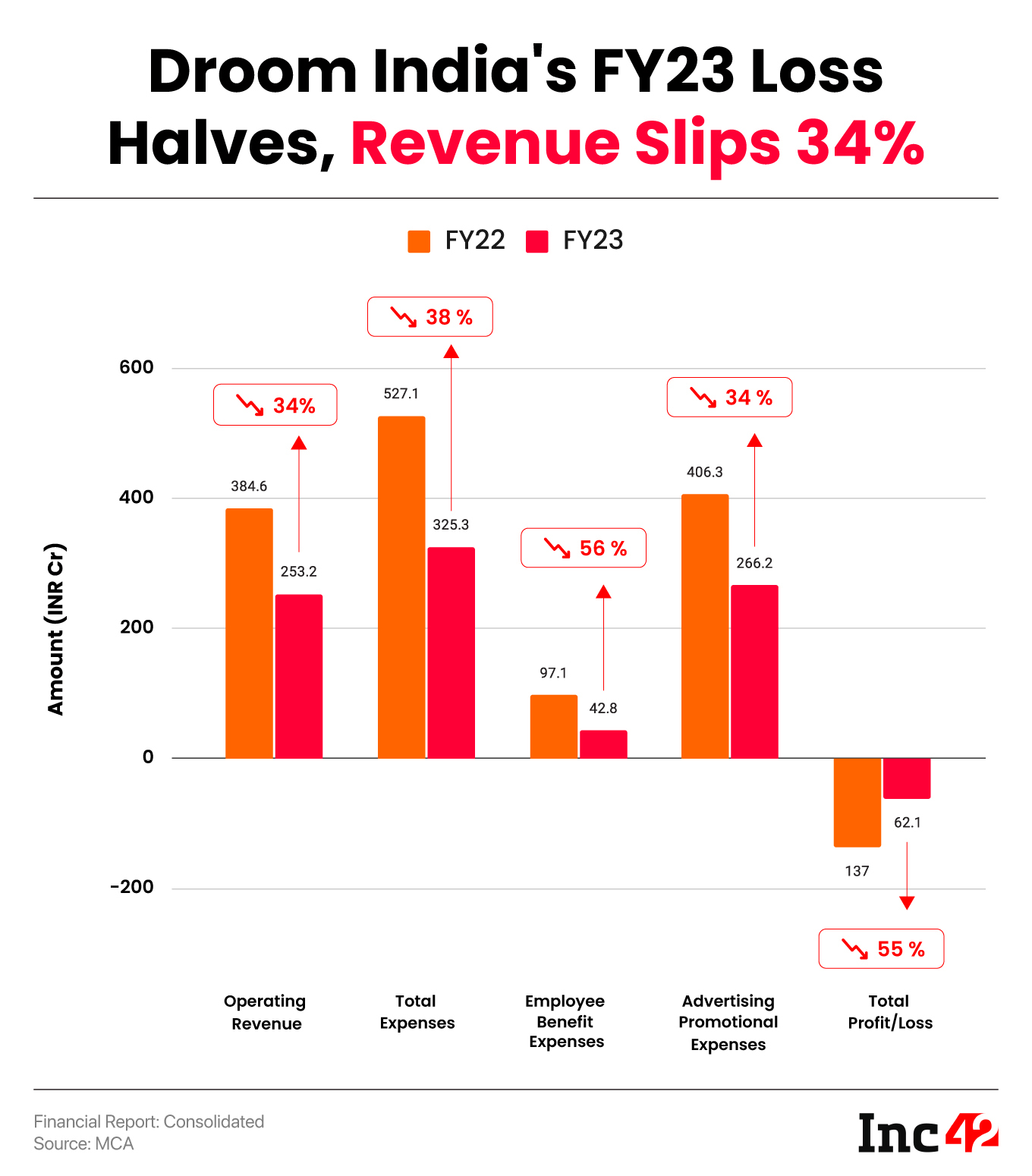

Droom managed to narrow its net loss by 55% to INR 62.1 Cr in FY23 from INR 137 Cr

The startup’s total expenditure decreased 38% to INR 325.3 Cr in FY23 from INR 527.1 Cr in the previous fiscal year.

Droom India reported an operating revenue of INR 253.2 Cr in FY23, a decline of 34% from INR 384.6 Cr

Car marketplace Droom’s India entity halved its loss in the financial year ended March 31, 2023. The startup managed to narrow its net loss by 55% to INR 62.1 Cr in FY23 from INR 137 Cr in the previous fiscal year.

However, its operating revenue also plunged during the year under review. Droom India reported an operating revenue of INR 253.2 Cr in FY23, a decline of 34% from INR 384.6 Cr in the previous fiscal year.

Founded in 2014 by Sandeep Aggarwal, Droom offers an ecommerce platform where it connects used car dealers with customers. The startup also provides financing through its tie-up with banks and NBFCs.

The startup primarily earns revenue from commission from buyers, income from seller subscriptions, and advertisement fees.

Including other income, the startup’s total revenue slipped 32.6% to INR 262.6 Cr in FY23 from INR 390.1 Cr in the previous fiscal year.

Where Did Droom India Spend?

The startup’s total expenditure decreased 38% to INR 325.3 Cr in FY23 from INR 527.1 Cr in the previous fiscal year.

Advertising Expenses: Advertising cost was the biggest expense for the marketplace. However, in a bid to reduce its expenditure, the startup cut its advertising cost by 34% to INR 266.2 Cr from INR 406 Cr in the previous fiscal year.

Employee Benefit Expenditure: Employee cost was the second biggest expenditure for Droom India. Similar to advertising expenses, the startup reduced its employee benefit expenditure by 56% to INR 42.8 Cr from INR 97.1 Cr in the previous fiscal year.

Droom was among the Indian startups that filed their draft red herring prospectus (DRHP) with the market regulator SEBI in 2021. The automobile marketplace intended to raise INR 3,000 Cr through its IPO. However, it shelved its IPO plans due to the economic slowdown and volatile market conditions. `

Droom entered the coveted unicorn club in 2021 after raising $200 Mn from investors such as 57 Stars and Seven Train Ventures.

The startup has raised over $300 Mn in funding till date. It competes against the likes of Spinny, Cars24, and CarTrade.