SUMMARY

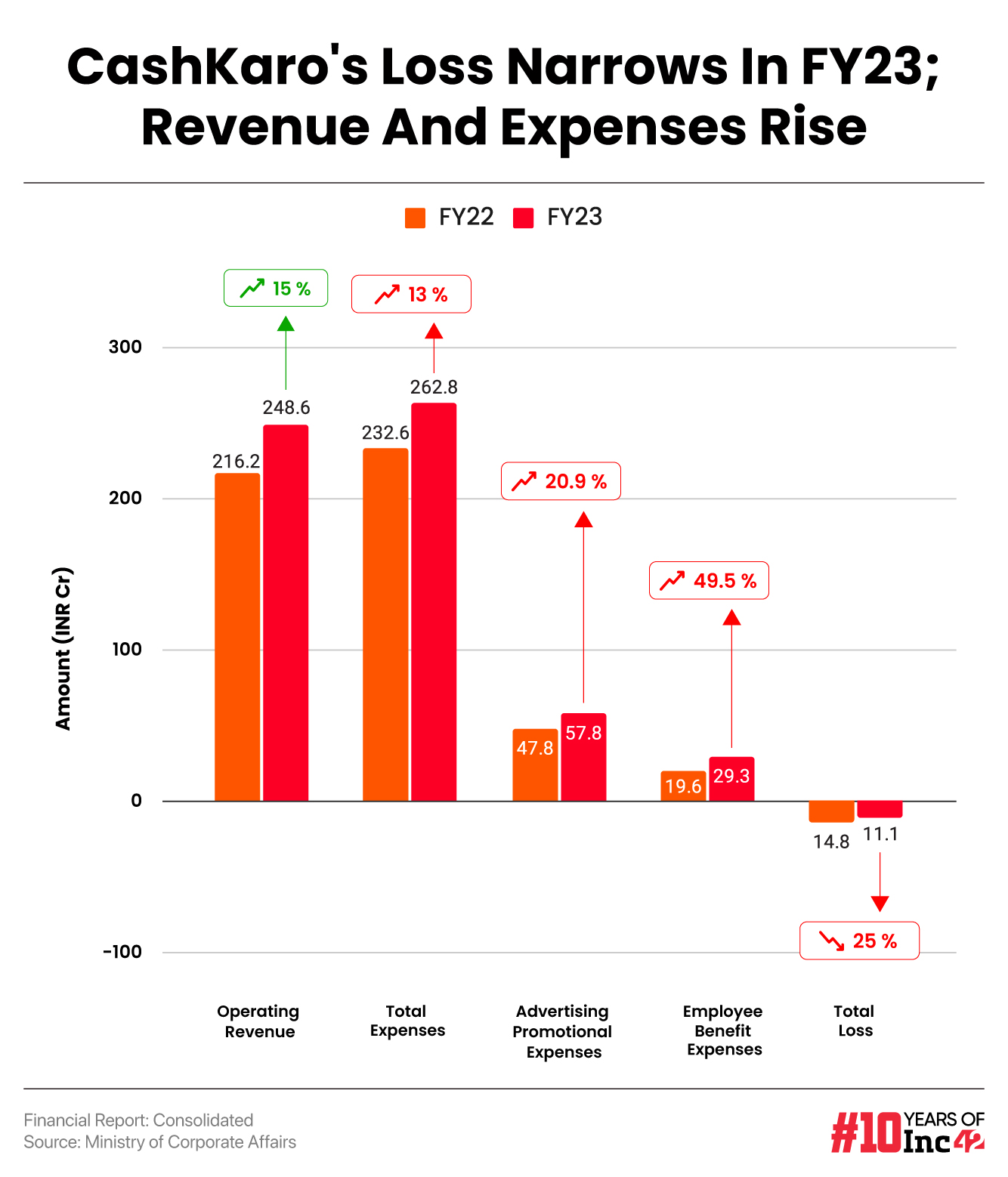

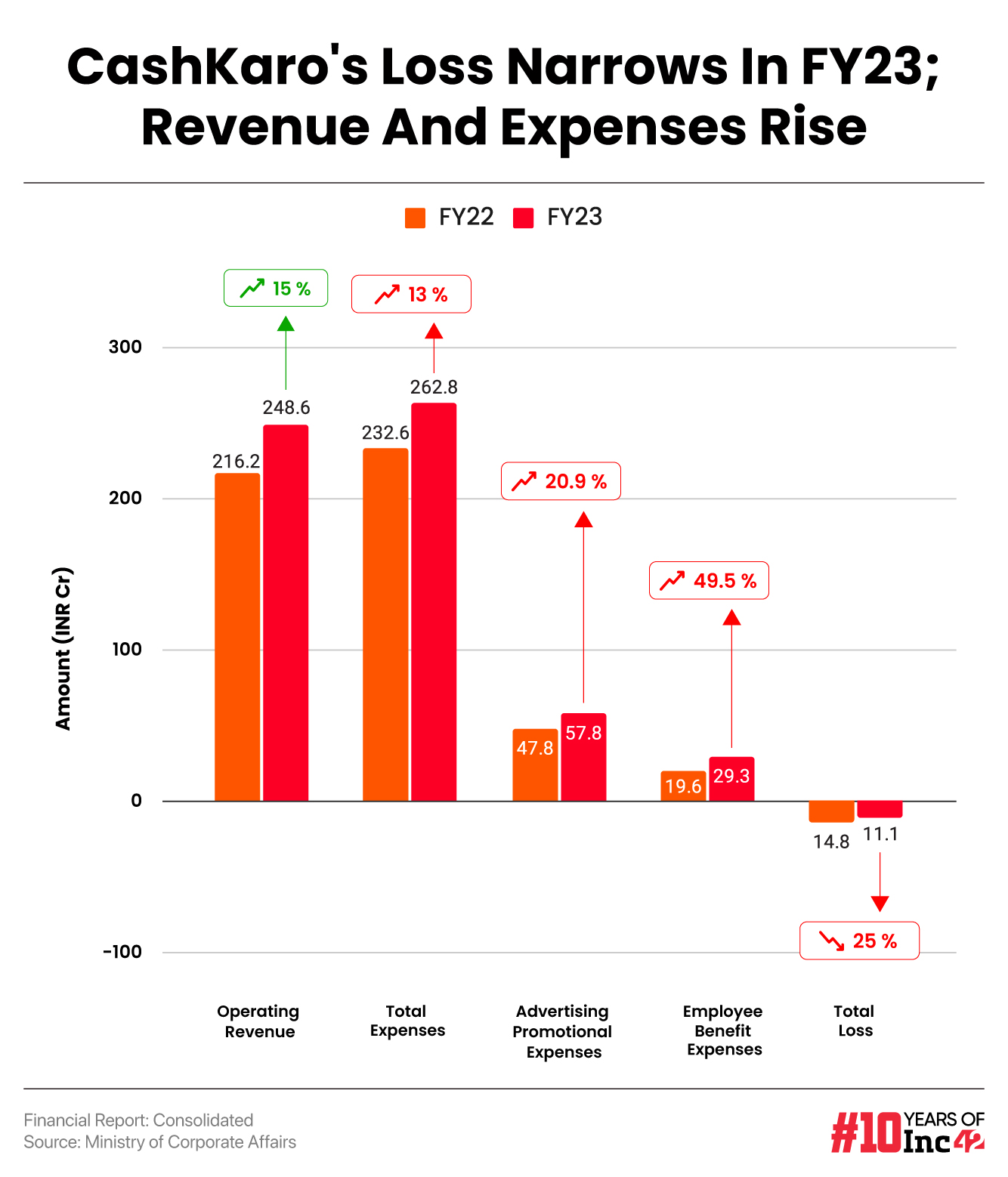

CashKaro’s operating revenue increased 15% YoY to INR 248.6 Cr in FY23 with the sale of e-vouchers becoming a new revenue stream

The startup’s total expenses increased 13% YoY to INR 262.8 Cr in FY23 with the addition of purchases of e-vouchers as a new expense head

Its spending on cashback comprised the biggest part of its expenses, which stood at INR 137 Cr in FY23

Coupons and cashback app CashKaro’s net loss narrowed 25% to INR 11.1 Cr in the financial year 2022-23 (FY23) from INR 14.8 Cr a fiscal ago, helped by the addition of a revenue head from the sale of e-vouchers.

Founded in 2013 by Rohan and Swati Bhargava, CashKaro offers coupons, price comparisons, and deals to consumers, allowing users to earn cashback and rewards for shopping online across over 1,500 ecommerce platforms, including Nykaa, Amazon, Flipkart, Tata1MG and Myntra.

Its two main operating revenue sources in FY23 were from platform services and the sale of e-vouchers. The startup’s operating revenue grew 15% to INR 248.6 Cr in the reported year from INR 216.2 Cr in FY22. In this, INR 230.6 Cr came from its platform services while INR 18 Cr was from the sale of e-vouchers. In FY22, CashKaro did not earn any revenue from the purchase of e-vouchers.

Including interest income, excess provisions written back, and other non-operating income, CashKaro’s total revenue stood at INR 251.7 Cr in FY23 as against INR 217.8 Cr in the prior year.

In FY23, CashKaro also raised INR 130 Cr ($15.69 Mn) in its Series C funding round to strengthen its B2C engagement model and scale business. The round was led by Affle Global.

CashKaro is also backed by the likes of Ratan Tata, Kalaari Capital, and Korea Investment Partners.

Zooming Into Expenses

In line with its growing business, the startup’s total expenses increased 13% to INR 262.8 Cr in FY23 from INR 232.6 Cr in the year before with the addition of purchases of stock-in-trade as a new expense head.

Purchases Of Stock-In-Trade: CashKaro’s spending for the purchase of e-vouchers stood at INR 17.9 Cr in the year under review, which was zero in FY22.

Employee Cost: The startup’s employee benefit expenses witnessed a sharp jump of almost 50% to INR 29.3 Cr in FY23 from INR 19.6 Cr in the year before. Of this, INR 26.2 Cr was spent towards salaries and wages, a jump of 46.5% year-on-year (YoY).

Advertising Promotional Expenses: CashKaro’s ad expenses increased about 21% to INR 57.8 Cr in FY23 from INR 47.8 Cr a year ago.

Cashback: The startup’s spending on cashback comprised the biggest part of its expenses, which stood at INR 137 Cr in FY23. However, it was a 2.4% YoY decline from INR 140.4 Cr spent in FY22.

As per CashKaro’s website, the startup crossed the 20 Mn users mark in 2023. It has also paid over INR 700 Cr in cashback so far.