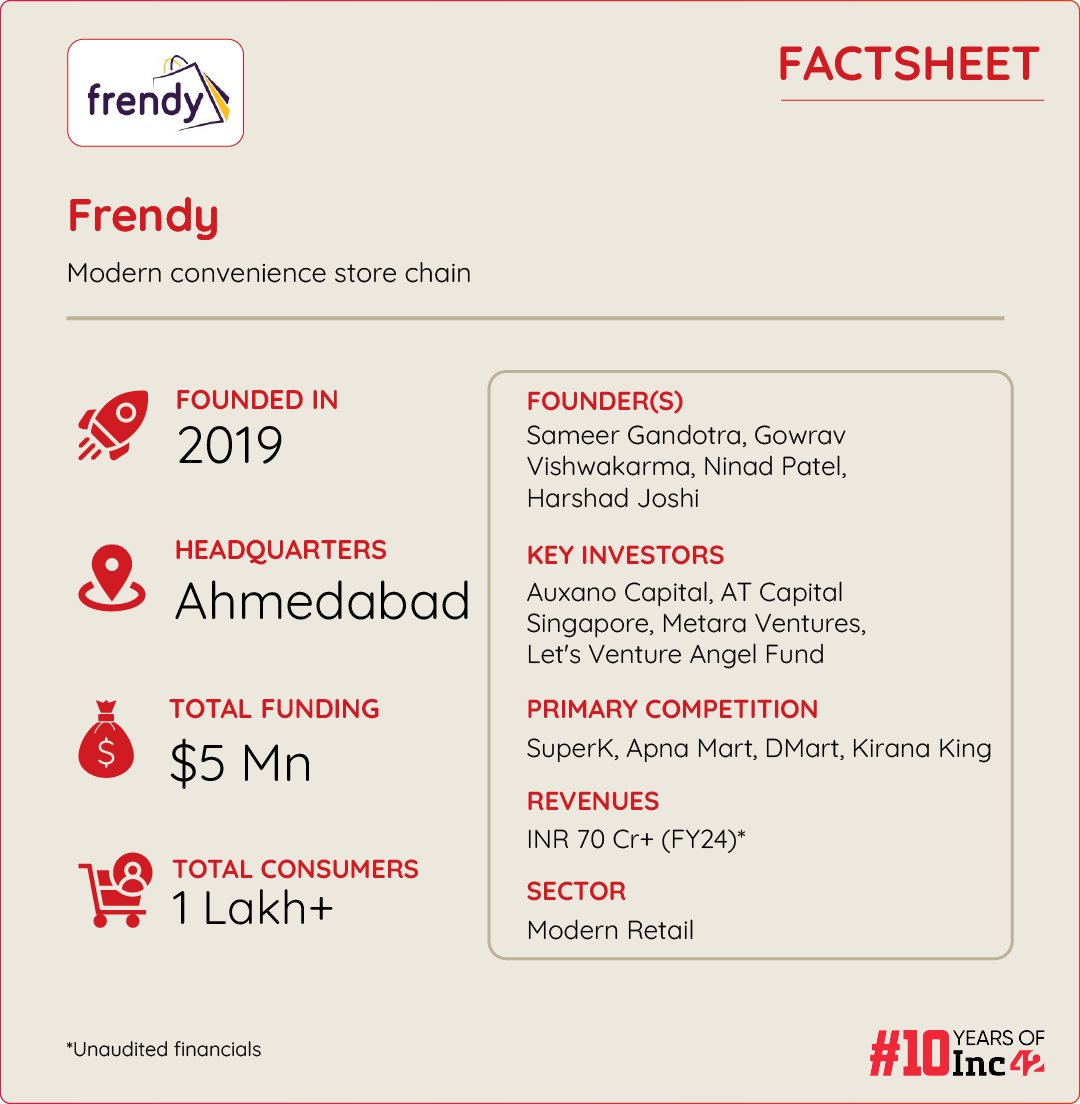

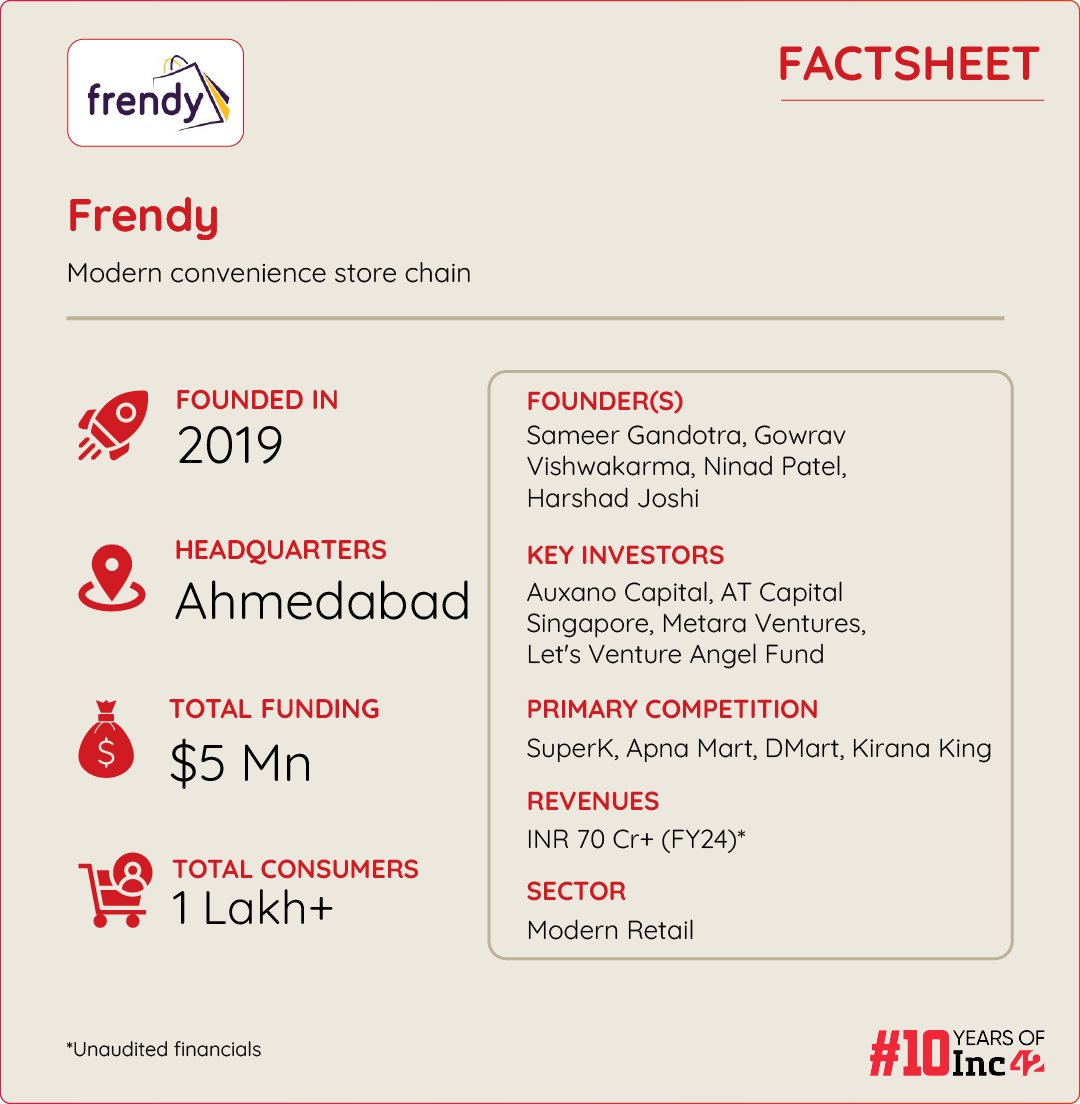

Incorporated in 2019 by serial entrepreneurs Sameer Gandotra, Gowrav Vishwakarma, Ninad Patel and Harshad Joshi, Frendy aims to enhance the shopping experience for customers living in lesser-known areas of India through its spacious stores and app

Currently, the startup operates 25 mini marts, which are present in small towns of Gujarat like Chitroda, Khodiyarnagar, Nikol, Gondal, etc. The founders keep on increasing the number of their mini marts every month

With its eyes on covering the 20,000 villages in India that comprise 60% of the rural population, the startup aims to gradually expand to larger towns and Tier III cities

The retail industry in India has witnessed a significant evolution, transitioning from small, independent shops to large stores, supermarkets, hypermarkets, and now ecommerce. This transition has taken place on the back of a dramatic change in the shopping habits of consumers.

Consequently, the retail landscape has seen a rise in tech-driven neighbourhood stores such as SuperK, Apna Mart, and Kirana King, especially after the pandemic. The most interesting, yet crucial, aspect of these players is that they are focussed on improving the shopping experience for customers living in the country’s rural areas.

Making waves in this competitive landscape is the D2C startup Frendy, which is bringing modern retail convenience to Tier III cities and beyond, with its eyes on markets where giants like Reliance and Tatas have yet to establish their presence.

Incorporated in 2019 by entrepreneurs Sameer Gandotra, Gowrav Vishwakarma, Ninad Patel and Harshad Joshi, Frendy aims to enhance the shopping experience for customers living in lesser-known areas of India through its spacious stores and app.

Interestingly, the founders of Frendy came up with the idea to launch Frendy when they noticed that hardly any retail player focussed exclusively on customers living in Tier III and beyond cities. However, what prompted them to execute their thesis was the strong aspirations of the people living in small towns and cities.

“While there was a lot of chatter about ecommerce in the country at the time, most people from the rural parts of the country were untouched by its magic. Trust and last-mile assistance were missing in ecommerce in rural areas, so we started researching and realised that purely digital solutions wouldn’t work because these consumers haven’t even seen a proper modern retail experience. So, we came up with a phygital (physical plus digital) model,” the cofounder said.

This led to the creation of the Ahmedabad-based Frendy. The startup currently operates as an omnichannel retail store network that sells grocery, cleaning, beauty and other household products under its private-label portfolio.

It also aims to disrupt the market by addressing the challenges faced by micro kirana stores, such as poor stocking, managing multiple SKUs, and maintaining discounted rates and profit margins. As per the founders, the brand has served approximately 1 Lakh+ households since its inception.

They added that the startup’s revenue doubled to INR 82 Cr in FY23 from INR 40 Cr in FY22. However, in FY24, it posted a revenue of INR 70 Cr (unaudited). Per the founders, the degrowth on the revenue front was the result of a strategic turnaround to reduce burn and enhance operational efficiency.

Nevertheless, the startup, since its inception, has garnered significant interest from Auxano Capital, AT Capital Singapore, Metara Ventures, Let’s Venture Angel Fund, Desai Ventures, Auxano Capital, Priya Joseph, Rohan Jain and Rishabh Jain of The Wellness Co., and Apurva Salarpuria family office, among others. It has raised a total of $5 Mn in its journey so far.

Frendy’s Permutations & Combinations

Speaking with Inc42, the cofounders said that much has gone into creating a robust customer base. Gandotra added that Frendy’s business model has undergone multiple iterations from time to time on the back of changing customer demands, market conditions and opportunities.

From September 2019 to February 2020, Gandotra added, they operated Frendy as a referral-based ecommerce platform, offering groceries and products under categories like fashion and accessories, home decor and kitchenware.

But when the Covid-19 pandemic brought the world to its knees, the founders shifted their focus from other categories to strengthen their grocery segment, all while boosting their last-mile delivery play.

In March 2022, they began focussing on micro kiranas as agents and by October 2023, they launched Frendy Marts, which function as both retail outlets and micro-warehouses.

Currently, the startup operates 25 mini marts (also known as Frendy Marts), which are present in small towns of Gujarat like Chitroda, Khodiyarnagar, Nikol, Gondal, etc. The founders said they keep on adding 3-5 new mini marts every month.

These mini marts serve as modern retail outlets for villages or towns with populations of 10,000 to 15,000 people. Frendy’s mini marts also serve as fulfilment centres or warehouses and a one-stop supply hub for micro kiranas. The startup has its central warehouse located in Ahmedabad.

“We initially launched with a wider assortment of around 10,000 SKUs, including fashion and accessories. Currently, our catalogue has been reduced to 5,000 SKUs as we focus mainly on groceries and have largely eliminated fashion items. Of these, 1,000 SKUs are available at the Mart, 1,000-1,500 at micro kiranas, and 4,000 at the central warehouse,” he added.

Although the business model has changed over the years, one thing that has remained constant for the cofounders is their commitment to technology.

Frendy’s Tech At Play

To facilitate hassle-free shopping, Frendy uses its in-house app, which has around 5,000 SKUs. This app allows micro kiranas to access a digital product catalogue, place orders, and receive deliveries from mini marts. Consumers can either order directly through this app or request the micro kirana owner to place an order on their behalf.

Further, its in-house digitised network includes WhatsApp-based merchandising and customer engagement tools. The customer app features interactive pricing, offers and discounts, trending products, and vernacular language support. In addition to this, its logistics app, integrated with Mart POS, facilitates demand forecasting, inventory management, and provides strong analytics and business insights.

Further, its CRM system includes a delivery app for order tracking and payments; a micro store/partner app with data dashboards, analytics, payments, and CRM functionalities, including ticketing and communication; and a Mart POS with easy operation, data analytics, ARS, AI-based merchandising, and payment processing. Additionally, it also has a warehouse management system to handle inventory, order management, accounting, and vendor interactions.

Currently, about 90% of its consumers make purchases in person at micro kiranas, while only 10% use the app.

The app is mainly used by partners and micro kiranas to manage orders. The platform allows users to check product availability and prices with ease.

Frendy’s Expansion Plans

Operating in Gujarat, the startup has plans to emerge as the next DMart. Interestingly, as per Gandotra, the country can easily accommodate another 20 DMarts.

With its eyes on covering the 20,000 villages in India that comprise 60% of the rural population, the startup eventually aims to expand to larger towns and Tier III cities.

“The initial focus is on acquiring the rural areas of Gujarat before expanding to other states in the coming years,” the cofounder added.

As per Gandotra, within Gujarat, there are about 1,100 towns, which provides the startup ample opportunities for the next two to three years.

“This regional focus will allow us achieve greater efficiency as we will be operating within the same state,” he said, adding that the brand is currently focussed on creating differentiation by providing a standardised and superior retail experience.

As per the founder, Frendy stores also offer amenities such as tea stalls and video game consoles for kids, making the shopping trip more enjoyable and convenient.

By FY25, the cofounders aim to establish 70-80 Frendy Marts. “Our primary focus is on solidifying the foundation of our business through these marts, which will then facilitate easier scaling.”

While the rural retail sector currently features only a few players like SuperK and ApnaMart with strategies similar to Frendy’s, it is only a matter of time before major retail giants such as Reliance enter these markets. With that said, it will be interesting to see how Frendy is able to solidify its rural game play before shedding some of its market share to other bigger rivals.

[Edited by Shishir Parasher]