SUMMARY

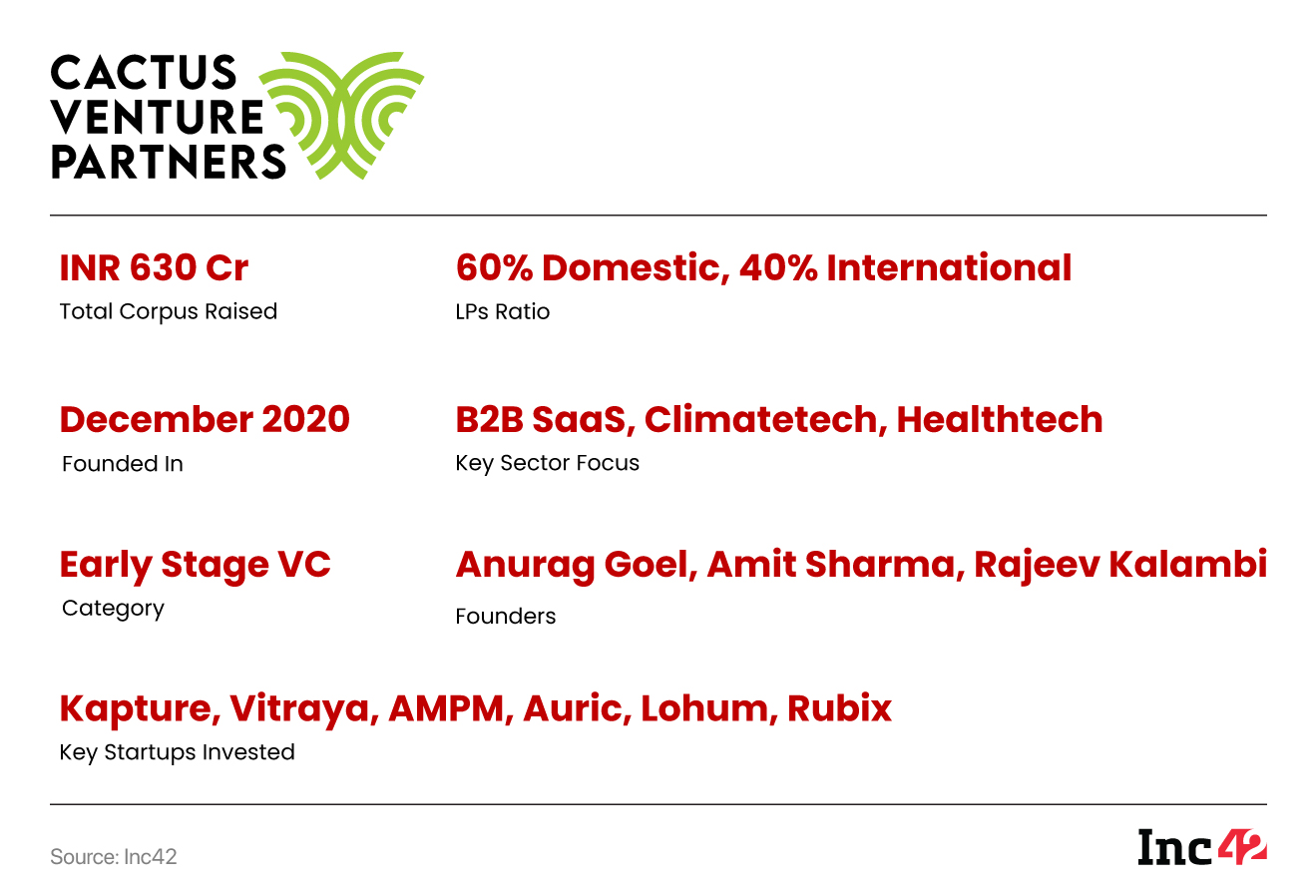

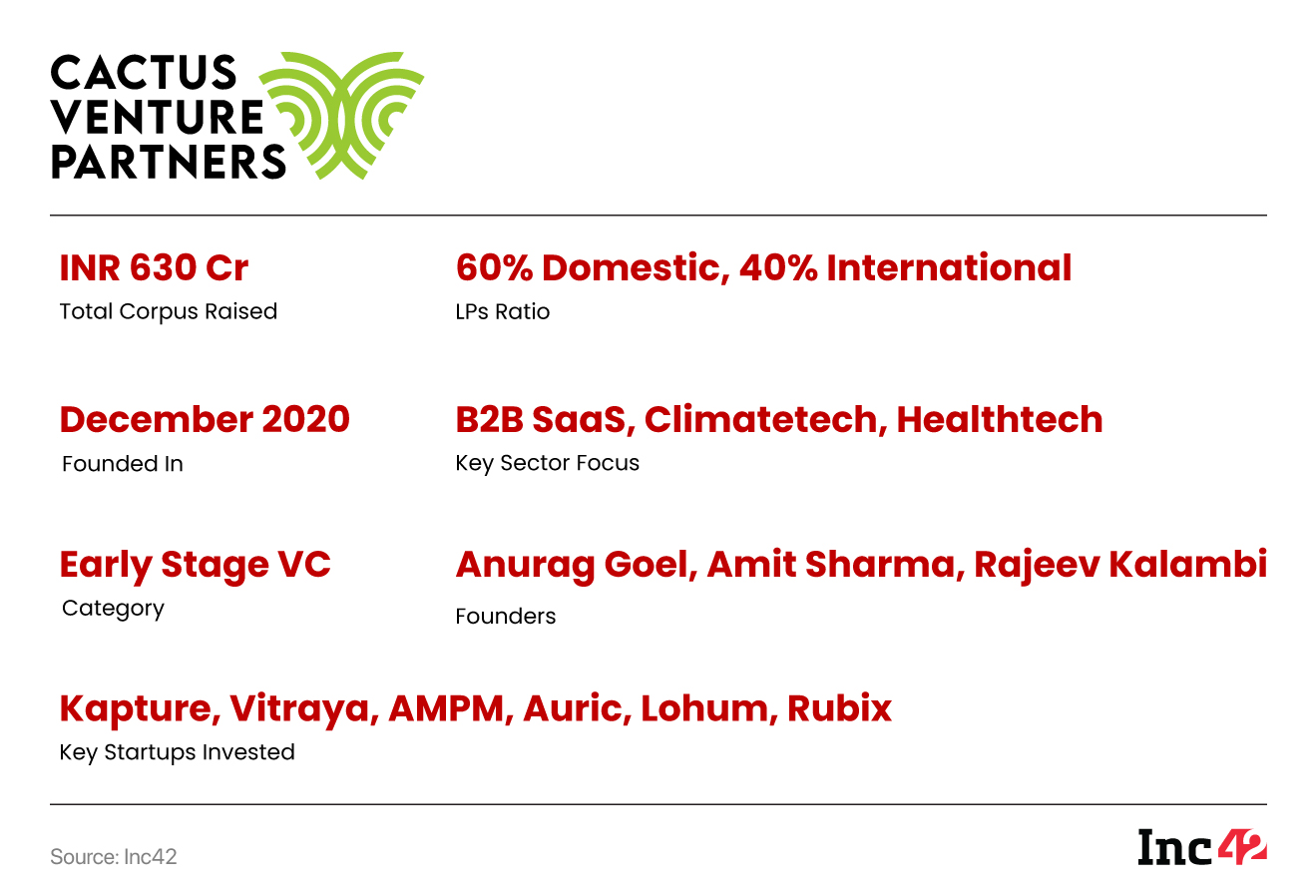

The early-stage fund has around 70 limited partners, of which 60% are from India and 40% are overseas partners

SIDBI, Self-Reliant India Fund (SRI Fund), and the UP Startup Fund have also backed Cactus Venture Partners’ maiden fund

The fund has already invested in six startups – Kapture, Vitraya, AMPM, Auric, Lohum and Rubix. Last year, it exited Rubix at an IRR of 48%

Mumbai-based Cactus Venture Partners has announced the final close of its maiden early-stage fund at INR 630 Cr ($75.8 Mn). The first close of the fund took place in August 2022.

The fund has around 70 limited partners (LPs), of which 60% are from India and 40% are overseas partners, predominantly from the US, Singapore, the EU, and the UK.

Leading Indian development financial institutions, such as SIDBI, Self-Reliant India Fund (SRI Fund), and the UP Startup Fund, have also backed the early-stage venture capital (VC) firm’s first fund.

Cactus Venture Partners has already invested in six startups – Kapture, Vitraya, AMPM, Auric, Lohum and Rubix – from the fund. It also got its first exit in March 2023 from Rubix at an IRR of 48%.

“We invest in startups with established product-market fit and founders with a growth mindset. We will do 8 to 10 more focussed, conviction-oriented investments in the next two years,” Cactus Venture Partners founder and general partner Rajeev Kalambi told Inc42.

The VC firm was launched in 2020 by Cactus Communications’ cofounder Anurag Goel, seasoned investor Amit Sharma, and former banker and PE investor Kalambi with a sponsor capital of $7 Mn-$8 Mn. The fund was looking to raise a total of INR 750 Cr with a green shoe option of INR 250 Cr.

However, the ongoing funding winter resulted in the VC firm closing its maiden fund below this target.

“We started raising funds in February 2022 and by the time in August we made our first close, the markets went completely dry. So, considering our first time raising a fund, and a completely new team coming together, we feel proud to gain LPs’ trust and achieve the set target, even though partially, in this difficult market,” said Sharma.

It is pertinent to note that the funding winter, which began in 2022, has wreaked havoc in the Indian startup ecosystem and resulted in shutdowns and layoffs. The overall Indian startup funding nosedived 60% to $10 Bn in 2023 from $25 Bn in 2022. The funds launched for startups also saw a decline of 69% to $5.6 Bn last year from $18 Bn in 2022.

The Growth Acceleration Playbook

As of now, the fund writes a first cheque of INR 20 Cr to INR 40 Cr to startups. It looks to invest in at least two rounds of funding of its portfolio startups which are performing well. The first 50% of investible capital is reserved for the first cheque.

Cactus Venture Partners invests based on its in-house investment thesis GAP – Growth Acceleration Playbook. Explaining this, Kalambi said the VC firm helps startups achieve their actual growth potential.

“We… act as the wind beneath the wings of star founders to help them in this journey with whatever resources and guidance they require to be able to take it from where they are today to five years later,” Sharma added.

Purpose-driven founders, businesses which have achieved critical mass in terms of revenues, stability, and recurrence of revenues are among the key factors that the VC firm considers while investing.

“This model has worked for us so far because we started investing in 2020 at the peak of euphoria and we are yet to have any write-offs. With that context, the strategy is working. And that is how we kind of try to invest in sustainable businesses rather than the market fads,” Sharma said.

Focus On B2B SaaS, Climate Tech & Healthtech

Cactus Venture Partners has a broad sector focus, with a primary interest in climate tech, healthtech, and B2B SaaS businesses. Within each sector, the fund has identified 5-10 key subsectors for investment.

For instance, within climate tech, the fund’s focus is on areas such as energy storage tech, battery recycling, sustainable agriculture, and waste management. In healthtech, the fund is focussed on differentiated business models which are leveraging technology to build phygital elements in areas such as wellness and preventive healthcare, insurance, primary care, and secondary chronic tertiary care.

According to Sharma, the aforementioned three sectors of primary interest offer a secular growth, which will allow the firm to plan for even two new funds with the same investment thesis in future.

Currently, Cactus Venture Partners has a team of 12 members spread across three offices in Gurugram, Bengaluru and Mumbai.