BlackRock and Fidelity’s spot Bitcoin ETFs have an advantage over Grayscale’s GBTC in two key liquidity metrics, according to a new report by JP Morgan shared with Decrypt.

Although outflows from spot Bitcoin ETFs, and in particular GBTC, have slowed over the past two weeks, JP Morgan’s analysts concluded that over time Grayscale’s fund will likely lose further funds to BlackRock and Fidelity’s ETFs, absent “meaningful cuts to fees” for GBTC.

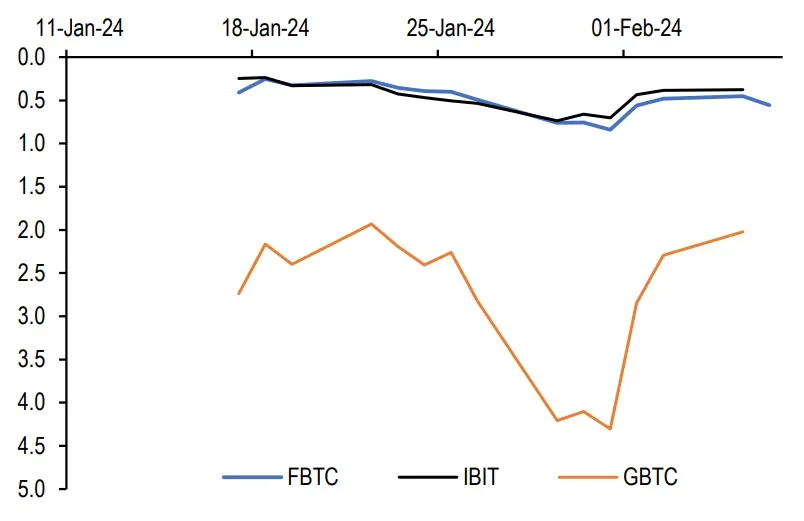

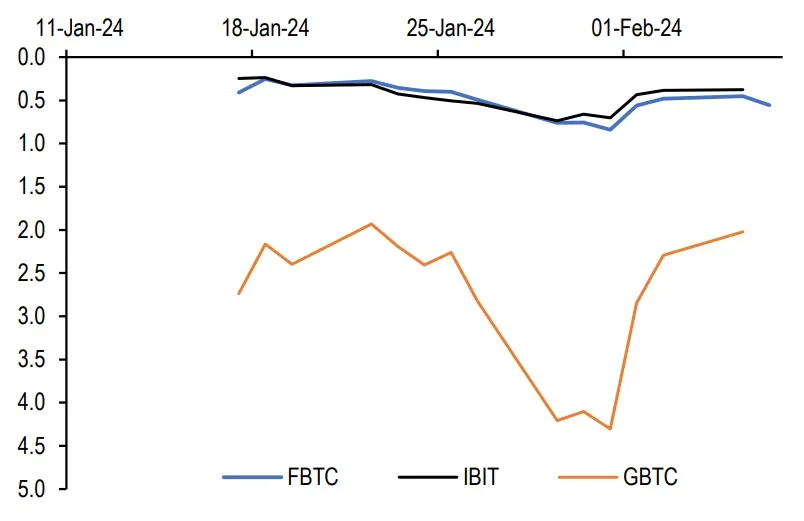

JP Morgan’s analysts attribute this to two key advantages for the Fidelity and BlackRock ETFs. The first is a proxy for market breadth based on the Hui-Heubel ratio, which is approximately four times lower for BlackRock and Fidelity’s ETFs than for GBTC, suggesting that they exhibit greater market breadth.

Generally speaking, market breadth is a measure used to gauge the overall direction of a market by comparing the number of companies whose stock prices are increasing to the number of companies whose stock prices are decreasing. It helps investors understand the extent of market movements and whether they are broadly supported by the performance of many companies or driven by just a few.

When it comes to ETFs, understanding the breadth of a market gives analysts a benchmark against when to emasure how well a fund tracks it.

The second is based on the average absolute deviation of each ETF’s closing prices from net asset value (NAV). Over the past week, the analysts noted, this metric indicated that the ETF price deviation from NAV of BlackRock and Fidelity’s spot Bitcoin ETFs approached that of the GLD Gold ETF. This, they suggest, implies “a significant improvement in liquidity, while the deviations for the GBTC ETF have remained higher implying lower liquidity.”

Grayscale’s GBTC has seen significant outflows since its conversion into a spot Bitcoin ETF, following the SEC’s landmark approval of multiple spot Bitcoin ETFs last month.

Prior to its conversion to an ETF, investors holding GBTC shares were locked in for at least six months before they could sell them. With its conversion to an ETF, those investors have been taking the opportunity to cash out, causing huge sell-offs as they exit their positions.

Those sell-offs have, in turn, caused the price of Bitcoin to slump in the weeks following the ETFs’ approval, though there are signs the market slump may be easing off, with Bitcoin trading back at levels approaching $45,000 in the last day.

Edited by Stacy Elliott.

Would-be entrepreneurs have an extra helping hand from Luxembourg’s Chamber of Commerce, which has published a new practical guide. ‘Developing your business: actions to take and mistakes to avoid’, was written to respond to the needs and answer the common questions of entrepreneurs. “Testimonials, practical tools, expert insights and presentations from key players in our ecosystem have been brought together to create a comprehensive toolkit that you can consult at any stage of your journey,” the introduction… Source link

B&H Photo is one of our favorite places to shop for camera gear. If you’re ever in New York, head to the store to check out the giant overhead conveyor belt system that brings your purchase from the upper floors to the registers downstairs (yes, seriously, here’s a video). Fortunately B&H Photo’s website is here for the rest of us with some good deals on photo gear we love. Save on the Latest Gear at B&H Photo B&H Photo has plenty of great deals, including Nikon’s brand-new Z6III full-frame… Source link

Long before Edgar Wright’s The Running Man hits theaters this week, the director of Shaun of the Dead and Hot Fuzz had been thinking about making it. He read the original 1982 novel by Stephen King (under his pseudonym Richard Bachman) as a boy and excitedly went to theaters in 1987 to see the film version, starring Arnold Schwarzenegger. Wright enjoyed the adaptation but was a little let down by just how different it was from the novel. Years later, after he’d become a successful… Source link

@2025 – All Right Reserved. Designed and Developed Startupnews