The HashKey Exchange’s trading system, HEX Engine, can handle up to 5,000 transactions per second.

Sarthak Luthra

Sarthak Luthra

Hey, there! I am the tech guy. I get things running around here and I post sometimes. ~ naam toh suna hi hoga, ab kaam bhi dekhlo :-)

Reliance Industries Ltd’s (RIL’s) financial services subsidiary Jio Financial Services (JFS) will explore new-age technologies such as blockchain-based platforms and Central Bank Digital Currency (CBDC) for its products.

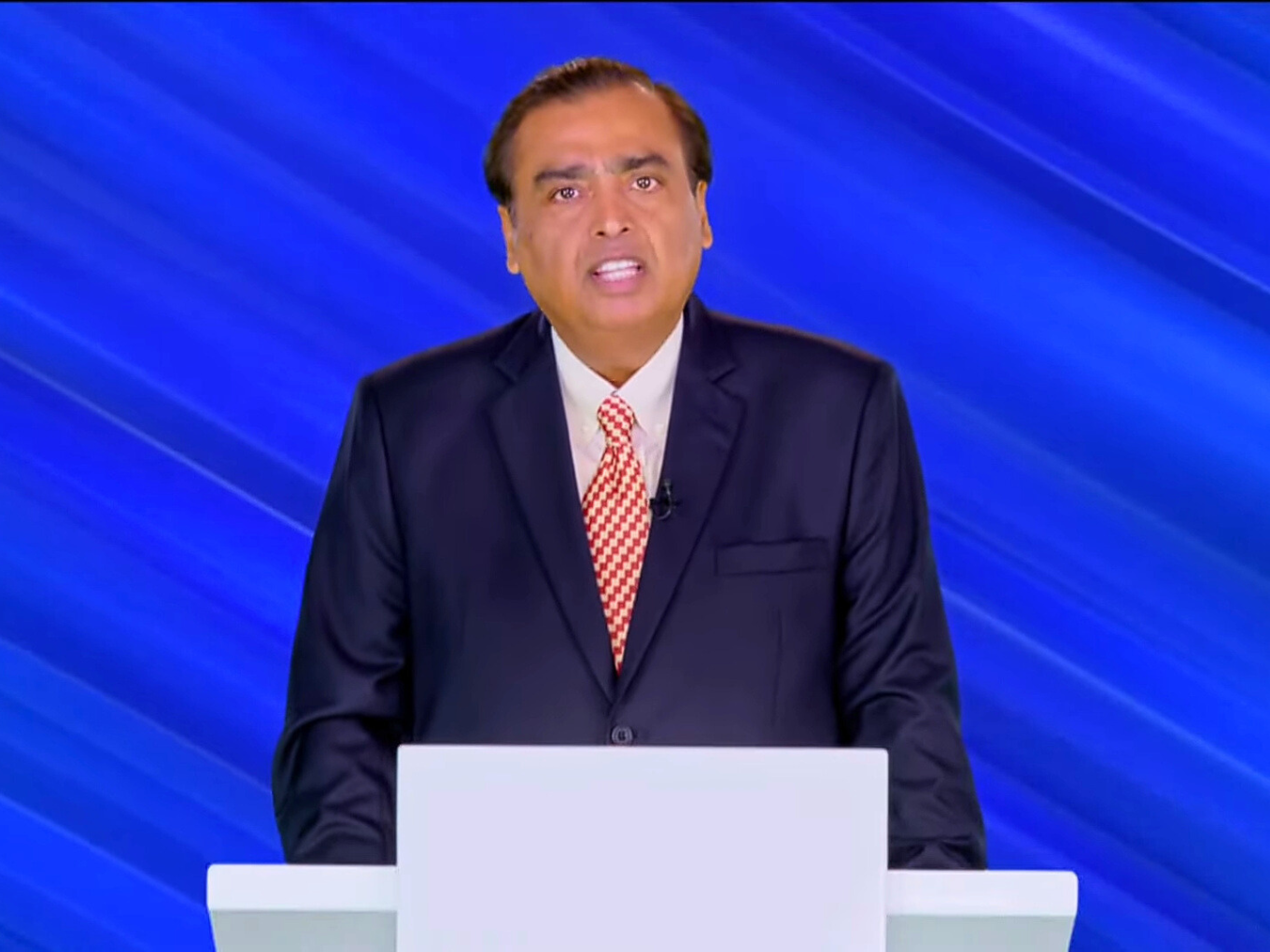

Speaking about the newly-listed subsidiary during RIL’s annual general meeting, chairman and managing director Mukesh Ambani said, “In payments, JFS will ensure ubiquitous offering for both consumers and merchants, further driving digital adoption. JFS products will explore path-breaking features such as # blockchain-based platforms and CBDC.”

Ambani said that the newly listed company will increase the penetration of financial services with a digital-first approach that simplifies products, reduces cost, and expands reach.

“For tens of thousands of SMEs, merchants, and self-employed entrepreneurs, ease of doing business must mean ease in borrowing, investments, and payment solutions. JFS plans to democratise financial services for 1.42 Bn Indians, giving them access to simple, affordable, innovative, and intuitive products and services,” the RIL CMD said.

Last year, RIL announced the demerger of its financial services business and the spin-off of Reliance Strategic Investments as Jio Financial Services. JFS listed on the bourses earlier this month.

It has already tied up with investment giant BlackRock to foray into the Indian asset management space. The two companies will own a 50% stake each in the newly formed digital-first entity, Jio BlackRock.

“BlackRock is the world’s largest asset management company, managing assets worth over $11 Tn with a stellar reputation and track record. The JV will synergise the respective strengths of JFS and BlackRock to deliver tech-enabled, affordable and innovative investment solution,” Ambani said.

JFS will have products in the payments and insurance segments in India besides being in the asset management business, Ambani added.

Shares of JFS ended Monday’s session 0.28% lower at INR 211.65 on the BSE.

The post Jio Financial Services To Explore Blockchain-Based Platforms, CBDC appeared first on Inc42 Media.

Jio Financial Services Set To Disrupt Insurance, Payments, And Asset Management Businesses In India

Reliance’s newest entity Jio Financial Services (JFS) will have products in the payments and insurance segments in India besides being in the asset management business, Reliance chairman Mukesh Ambani said during the 46th annual general meeting (AGM) of the company on Monday (August 28).

“In payments, JFS will consolidate its payment infrastructure with a ubiquitous offering for both consumers and merchants, further driving digital adoption,” said Ambani, adding that JFS products will not only compete with current industry benchmarks but also new-age features such as blockchain-based platforms and the central bank digital currency (CBDC).

Further, as speculated, JFS is set to enter the insurance market in India, offering general insurance, health insurance, and life insurance products. JFS is partnering with global players to deliver insurance products digitally.

As per recent report, the company is also planning to offer full-fledged insurance services starting 2024.

Ambani said today that financial services is a highly capital-intensive business and Reliance has capitalised JFS with a net worth of INR 1.20 Cr. In fact, Ambani claimed that JFS has become the world’s highest capitalised financial services platform at inception, which also sets the path for the company to achieve “tremendous” success.

“I have three reasons to be absolutely confident about JFS achieving tremendous success over the next few years. First, the digital-first architecture of JFS, will give it an unmatched head start to reach millions of Indians. Second, this is a highly capital-intensive business. Your company has provided JFS with a strong capital foundation to build a best-in-class trusted financial services enterprise and achieve rapid growth,” he said.

Besides, the company’s strong board led by KV Kamath would also help the company achieve greater heights, Ambani added.

JFS was demerged from RIL in July and listed at a slight discount earlier this month. With the deep-pocketed player set to enter the market of insurance and payments, competition for the new-age Indian players including Zerodha, Groww, Paytm, PhonePe, and PB Fintech increases considerably.

JFS has also tied up with the world’s largest asset manager BlackRock to take a bet on India’s $540 Bn mutual fund industry dominated by the likes of SBI, ICICI, and HDFC along with startups such as Zerodha, and Groww.

Following the announcements at the AGM, JFS shares ended Monday’s session marginally down at INR 211.65 on the BSE while RIL closed the session down 1.1% at 2442.55 on the exchange.

The post Jio Financial Services Set To Disrupt Insurance, Payments, And Asset Management Businesses In India appeared first on Inc42 Media.

Calling the launch of JioMart on WhatsApp a huge success, Reliance Retail executive director Isha Ambani said the ecommerce vertical has seen a 9X rise in customers since its launch on the Meta-owned messaging app.

“The launch of JioMart on WhatsApp has been a phenomenal success with 9X growth of JioMart customers on WhatsApp since launch in 2022,” Ambani said while addressing the shareholders at Reliance Industries Ltd’s (RIL’s) annual general meeting.

Last year, Reliance took its partnership with WhatsApp a notch higher to provide an end-to-end shopping experience for JioMart customers under which they can browse through JioMart’s entire grocery catalogue, add items to cart, and make the payment on WhatsApp itself.

Overall, the sales of digital and new commerce businesses surged in the financial year 2022-23 (FY23), reaching INR 50,000 Cr.

“Our digital and new commerce sales contributed ~ INR 50,000 cr, accounting for a fifth of revenues. We have invested over $10 Bn in the last two years, focusing on integration, growing in-house brands, and improving supply chain,” Ambani said.

She attributed the growth of the new commerce business to its omnichannel capabilities.

The company has built retail business on principle of ‘4 Cs’ – collaboration, consumer engagement, creativity, and care, Ambani said, adding that Reliance Retail has partnered with 30 lakh merchants to serve 98% of India’s PIN codes.

Reliance Retail owns brands such as JioMart, AJIO, Netmeds, and Trends, among others. Its consumer-facing retail businesses sell items ranging from footwear to electronics and from apparel to grocery.

In its grocery business, Reliance Retail sold over 18 Lakh metric tonnes of groceries during the year. It sold nearly 5 Lakh laptops and over 23 Lakh appliances and 50 Cr garments in the year.

“AJIO had yet another strong year, with its catalogue size crossing 13 lakh options,” Ambani added.

Reliance Retail’s net profit surged 18.8% year-on-year (YoY) to INR 2,448 Cr in Q1 FY24, compared to INR 2,061 Cr a year ago. Revenue from operations zoomed 20.5% YoY to INR 62,159 Cr in Q1 FY24 as against INR 51,582 Cr in Q1 FY23.

Qatar Investment Authority recently invested $1 Bn in Reliance Retail for an 1% equity stake, at a pre-money equity value of INR 8,28,000 Cr.

The post JioMart Customers Surge 9X Since Launch On WhatsApp In 2022: Isha Ambani appeared first on Inc42 Media.

Reliance Launches Jio True 5G Developer Platform & 5G Lab For Enterprises, Startups

Reliance Jio has introduced the Jio True 5G Developer Platform and Jio 5G Lab, enabling startups and enterprises to develop 5G use cases on Jio’s 5G network, edge computing and partner solutions.

“It will allow companies to activate network slices on demand, deploy applications on Jio’s multi-access edge compute locations and access a diverse ecosystem of partner applications on the platform,” said Akash Ambani, chairman of Reliance Jio, at the 46th Reliance Annual General Meeting (AGM).

The platform will also enable quick deployment of 5G edge compute solutions, enabling fast, autonomous decisions, immersive experiences and real-time edge AI, added Ambani.

Put simply, network slicing is making ‘slices’ of a 5G network to deploy certain use cases without the interference of other use cases. A 5G network can have any number of ‘slices’ to separate various applications. For instance, a network can have a separate ‘slice’ for low-latency applications such as streaming videos or playing online games, where user experience is paramount.

Enterprises can access advanced network slicing capabilities, which would enable them to independently establish and optimise network slices consistently. This should theoretically improve the network resource management for enterprises offering cloud-based solutions.

The platform also offers access to partner solutions, allowing enterprises and startups to deliver 5G use cases.

Network slicing also offers a high degree of security since no two slices interact with each other.

During the event, Ambani also announced the launch of Jio 5G Lab at Reliance Corporate Park in Navi Mumbai. The facility will enable partners and enterprise customers to develop, test and produce industry-specific solutions.

The post Reliance Launches Jio True 5G Developer Platform & 5G Lab For Enterprises, Startups appeared first on Inc42 Media.

Speaking at the 46th edition of the Reliance Annual General Meeting, group chairman Mukesh Ambani said that the company’s broadband internet service, JioFiber, has crossed 10 Mn subscriptions in India.

Ambani also announced the launch of a fixed wireless broadband (FWB) offering, the Jio AirFiber, set to launch on September 19. “Jio AirFiber uses our pan-India 5G network and advanced wireless technologies to bypass the need for last-mile fibre,” said Ambani.

With AirFiber, the company is looking to increase the broadband expansion rate from 15,000 daily additions to 1,50,000, a 10X jump.

For the uninitiated, fixed wireless broadband has been touted as one of the key use cases of 5G networks ever since 5G development started in the mid-2010s. Fixed wireless broadband enables a broadband experience on 5G without the need for last-mile fibre connectivity, making use of the high speeds and bandwidth that come with 5G networks.

Jio’s FWA launch follows rival Airtel, which launched a similar service earlier this month.

Elsewhere, Reliance Jio continued its dominance in the mobile broadband market, having crossed 450 Mn subscribers, as per the company.

The post JioFiber Crosses 10 Mn Subscribers, Jio AirFiber Launch On September 19 appeared first on Inc42 Media.

Following a notable 50% growth during FY22, Marico-owned Beardo decelerated during the previous fiscal year ending March 2023. However, the Ahmedabad-headquartered company slipped into losses in FY23 after registering a first-ever profit during FY22. Beardo’s revenue from operations increased 12.2% to Rs 106.6 crore in FY23, according to the annual report published by the holding …

Continue reading “Beardo crosses Rs 100 Cr revenue in FY23, slips into losses”

The post Beardo crosses Rs 100 Cr revenue in FY23, slips into losses appeared first on Entrackr.

In recent years, the healthcare industry has witnessed an explosion of startups promising innovative solutions to revolutionise patient care, improve accessibility, and reduce costs. However, amid the buzz and excitement, many of these ventures failed to achieve their goals.

The reasons behind the downfall of these healthcare startups are multifaceted, but a critical analysis reveals common mistakes that can serve as valuable lessons for entrepreneurs and investors alike.

Typical Mistakes Healthcare Startups Make

While technology has the potential to transform healthcare, some startups have fallen into the trap of developing solutions solely for the sake of innovation, rather than addressing the needs of patients, providers and payers.

Ignoring user-centric design principles and failing to conduct comprehensive market research often results in products and services that fail to gain traction or align with existing workflows, hindering adoption and scalability.

Healthcare startups also fail to comprehend the complexity of the industry and neglect establishing partnerships with established healthcare providers, regulatory bodies and medical professionals. Ignoring the valuable insights these stakeholders bring to the table often leads to a disconnect between the startup’s vision and the realities of healthcare delivery, resulting in unsustainable business models.

Further, many healthcare startups rely heavily on venture funding while innovating endlessly, without a clear path to profitability. Such startups struggle to identify and implement viable revenue models and are at a high risk of capitulating. Sustainable business models should consider factors such as reimbursement mechanisms, pricing structures and strategic partnerships to ensure long-term viability.

Healthcare is also a highly regulated industry and startups must navigate the complex legal frameworks to ensure compliance with privacy, security and data protection regulations. Neglecting these crucial aspects can lead to significant setbacks, loss of trust and even legal ramifications.

Further, ethical considerations, such as maintaining patient confidentiality, respecting consent and ensuring equitable access, must be ingrained in the startup’s core values.

Bouncing Back From Failure

The rise and fall of healthtech startups can be put down to any number of mistakes, but the lessons derived from these failures are invaluable. Entrepreneurs and investors must understand the intricacies of the healthcare industry, collaborate with established stakeholders and prioritise user needs and market research.

By doing so, they can foster a culture of innovation and build startups that truly transform healthcare, benefiting patients, providers, and the industry. The future of healthcare entrepreneurship depends on our ability to acknowledge past failures and embrace a more informed, collaborative and user-centric approach to building and scaling startups in the healthcare landscape.

The post The Rise And Fall Of Healthcare Startups: Learning From Mistakes appeared first on Inc42 Media.

Vivek Sinha, the chief operating officer (COO) of the edtech unicorn Unacademy, has resigned from his post.

He announced his departure via an X post on Saturday evening (August 26). “After three incredible years at Unacademy, I have decided to take the next step in my career. Grateful for the opportunities, friendships, and memories I have gained. Thank you for believing in me and constantly pushing me to operate at (the) peak of my abilities Gaurav Munjal,” said Sinha.

In response, Gaurav Munjal, Unacademy CEO, said, “Thank you @viveksinhaisb for being a part of Unacademy. You’re one of the most Relentless Leaders I have worked with. Best wishes for the future :)”

Sinha did not clarify what his next move would be.

An NIT Jamshedpur and ISB alumnus, Vivek Sinha joined Unacademy in August 2020 as the COO. In his role at the edtech unicorn, he managed the full-stack P&L of digital test prep, hybrid centres, K12 and jobs & skills verticals. According to his LinkedIn profile, Sinha was directly in charge of about 4,000 employees across functions such as growth, business, marketing, BD, sales, content, ops, CX, academics, CAPEX and real estate.

Previously, Sinha had worked at OYO and Mobikwik. At OYO, Sinha managed an SBU (separate business unit) for the startup’s joint venture with Softbank managing luxury hotels in the country. Sinha had also founded a construction-tech startup, Buildzar.com, in 2015. At the startup, the ex-Unacademy COO raised $4 Mn in Series A funding before exiting the startup in 2016.

The exit comes days after Unacademy hired Aakash Educational Institute’s Anurag Tiwari to lead its offline vertical, in what now appears to be a bid to redistribute some of the responsibilities the outgoing COO looked after. The edtech unicorn also elevated Graphy CEO Sumit Jain to the role of a partner.

Unacademy, which has undertaken multiple cost-cutting measures over the past few months, including firing thousands of staffers, also posted a cash flow positive month in June 2023, as announced by CEO Munjal on social media. The edtech unicorn is yet to file its financials for FY23, however, it posted a net loss of INR 2,848 Cr in FY22, up 85% year-on-year (YoY).

The post Unacademy COO Vivek Sinha Resigns After Three-Year Stint appeared first on Inc42 Media.

Peak XV Partners-backed edtech startup Cuemath has reportedly fired another 100 employees to bring down its costs.

“…unfortunately, our revenue and cost trajectories are still divergent from expectations, and our problems are compounded by the bad macro situation around capital availability, particularly for edtech,” Cuemath founder and CEO Manan Khurma told the employees in an email on Friday (August 25), as per a Moneycontrol report.

“This means that we will have to move to a leaner team structure, in which some roles will get redundant. That exercise is being carried out today,” the email reportedly read.

Inc42’s email to Cuemath did not immediately elicit a response till the time of publishing this article.

The development comes three months after the Bengaluru-based edtech startup fired around 100 employees in May this year, within a year of it raising a funding of $57 Mn.

After the May layoffs, Khurma had reportedly told the Cuemath employees saying there wouldn’t be any need for more layoffs.

“And at that point, I had full conviction in saying that. But clearly, I had underestimated the extent of the turnaround required to get the company into a healthy situation,” Khurma said in his latest mail.

“For what it’s worth, I and our leadership team worked very hard in the last few weeks to avoid this outcome. But we’ve come to the conclusion that we still have a long way to go and this action is inevitable,” he was quoted as saying.

In May, Khurma also returned as the full-time CEO of the company.

Founded in 2013 by Manan and Jagjit Khurma, Cuemath offers mathematics courses to K-12 students and is present in over 80 countries. The startup is backed by marquee investors like Google, Alpha Wave Incubation, and Lightrock India.

Cuemath’s standalone net loss widened 65.7% year-on-year (YoY) to INR 216.6 Cr in FY22, while its operating revenue jumped 64% to INR 148 Cr. Employee benefit expenses accounted for almost 34% of its total expenses of INR 369.6 Cr in the year.

Cuemath is yet to file its FY23 financial statements.

The edtech sector is one of the worst hit due to the ongoing funding winter. Since 2022, at least 22 edtech startups in the country, including five of the seven edtech unicorns, have fired 9,871 employees, as per Inc42’s layoff tracker.

Many Indian edtech startups have also been involved in controversies. While BYJU’S is in the line of fire for a range of issues, including corporate governance and delay in filing financial statements, last week Inc42 exclusively reported about various allegations levelled by students against Skill-Lync.

The post Edtech Startup Cuemath Fires Another 100 Employees To Cut Costs appeared first on Inc42 Media.