The report found talent pool costs are 25-30% lower than those in mature hubs, with 50% cost savings in real estate rentals compared with mature hubs. This economic advantage also makes these cities an attractive choice for growth with lower investments demonstrated by over 140 Global Capability Centres (GCCs) located in these places.

Sarthak Luthra

Sarthak Luthra

Hey, there! I am the tech guy. I get things running around here and I post sometimes. ~ naam toh suna hi hoga, ab kaam bhi dekhlo :-)

Illustration by Alex Castro / The Verge

Verizon is making it easier to block pesky spam texts sent by random email addresses. If you find yourself overloaded with these messages, you can now text “Off” to 4040 to stop receiving texts from emails altogether.

While Verizon previously let you turn email-to-text off through your My Verizon account, this new feature lets you switch off email-to-text messages directly from your phone. It’s worth noting that when you turn email-to-text off, you won’t receive any emails to your phone number — so you might not want to turn it off if you often receive legitimate messages from emails.

If you want to start receiving text messages from email addresses again, you can text “On” to 4040. You can also check whether or not you’ve enabled email-to-text by sending “Status” to 4040.

This new shortcut builds upon some of the existing protections provided by Verizon, which includes a call filter that alerts you to potential spam. You can also report spam texts by forwarding them to 7726 or by reporting them directly in your texting app.

Entrepreneur Supam Maheshwari, recognized for establishing the online platform catering to newborns, parenting, and children’s products, FirstCry, has reportedly come under scrutiny for alleged tax evasion. Maheshwari is also the brains behind Globalbees Brands and Xpressbees, both of which have achieved unicorn status.

Notice Sent by Tax Department to FirstCry Founder

Reports indicate that the Indian tax department has initiated an investigation into potential tax evasion by Supam Maheshwari. Sources reveal that notices have been dispatched to Maheshwari, inquiring into the reasons behind his purported failure to pay over $50 million in taxes linked to equity transactions conducted through FirstCry.

Wider Implications: Investors Also Probed

The tax inquiry isn’t limited to Maheshwari alone. At least six investors affiliated with FirstCry, including ChrysCapital Management Co, a private equity firm, and the family office of Sunil Bharti Mittal, have reportedly been contacted by tax authorities for clarifications concerning this matter.

Efforts to Resolve the Matter

According to insiders familiar with the situation, Maheshwari is actively engaging with the tax department to reach a resolution regarding the ongoing investigation. However, he has yet to provide an official statement addressing the matter.

Business Evolution: From Losses to Profit in FristCry

After a period of operating at a loss, FirstCry marked a significant turning point. By achieving profitability in the fiscal year ending on March 31, 2021. The company reportedly aspires to enter the market with an initial public offering (IPO) after achieving operational profitability.

Scope and Presence

Based in Pune, FirstCry operates warehouses across India to fulfill orders. Its reach extends beyond India, encompassing a presence in the UAE as well. The company’s product range caters to babies and children, encompassing essentials such as diapers, baby food, infant accessories. As well as items like strollers, high chairs, nursery furniture, clothing, footwear, toys, and school-related products.

Conclusion

The allegations of tax irregularities against Supam Maheshwari, a prominent figure in the Indian entrepreneurial landscape. Highlights the importance of regulatory compliance and financial transparency in the business world. As investigations unfold, the outcome could potentially impact the trajectory of FirstCry and its associated ventures.

Illustration by Samar Haddad / The Verge

Over the last few months, Elon Musk’s X, which was formerly known as Twitter, has been a bubbling cauldron of strange advertising decisions, continuous upheavals, and weird overflows of testosterone.

Not that Twitter has ever been calm waters. Before Musk, Twitter was the social media world’s most reliable double-edged sword. One minute, you were retweeting a funny meme account and enjoying some wholesome discussion about your current TV binge fixation, and the next, you were being buried by a harassment campaign or finding your day ruined by a thread that makes you want to throw your laptop through the window.

Either way, if you’re now on X or were ever on Twitter, it’s a good idea to take precautions with your posting history since, even if you’ve moved on to one or more other social networks, it’s possible that somebody will unearth one of your old tweets and create a firestorm without you even being aware it’s happening. (And while it’s not necessarily bad to be able to ignore something like that, it’s probably a good idea to know when it’s erupting.)

So, regardless of whether you’ve cut Twitter out of your life, the best protection you can provide yourself is the deletion of your Twitter history. Here’s where to start if you’re interested in nuking your timeline and keeping future tweets from falling into the internet’s vindictive void of posterity.

Step one: archive your tweets

Before you settle on a method to wipe your Twitter history, it’s recommended that you archive your tweets first. To begin with, that means you can just hold on to the folder in the event you ever want to casually scroll back to that three-month period when you first signed up for Twitter and all you could think to tweet about was breakfast and the weather and earnest hashtag use.

But the main reason that you want to archive your tweets is that, if you have more than 3,200 tweets, you won’t be able to remove them without an archive. How come? Because individuals can only delete individual posts, and if you use a third-party app, Twitter will only allow it to delete the most recent 3,200 tweets. To get around that limitation, most deletion apps use your archive (or tell you how to use your archive) to identify all the older tweets you’ve amassed so they can get rid of them.

To access your archive:

Go to your Twitter account and, in the left-hand column, click on More > Settings and Support > Settings and Privacy.

Under the Your Account column, click on Download an archive of your data. It can take a day or more until you get your data, so if you think you may be in a hurry to delete your Twitter data, plan ahead.

It’s not hard to get an archive of your data.

Eventually, you’ll get an email from Twitter inviting you to download your archive. It will arrive in a ZIP file, which contains a folder in which you’ll find an HTML file. Clicking on that will open a webpage in your browser window for scrolling through your entire Twitter history, together with a list of JavaScript data files.

Step two: delete single tweets

If you only have a few older tweets that you want to get rid of — because you find them embarrassing, have changed your mind, or don’t want your new employer tripping over them — you can delete them one at a time.

Go to your Profile page.

Find the tweet that you want to delete, and click the three dots to the right of the post.

Click on Delete.

A pop-up will ask if you’re sure. If you are, click on Delete.

Deleting a single tweet is not a problem. It’s deleting them in bulk that can be problematic.

Step three: pick a service

There are many services out there designed to help you manage your Twitter history and wipe it clean. Some are free, and some charge a subscription fee. None can immediately delete more than your most recent 3,200 tweets. (This is a function of Twitter’s API.) However, most of the apps have found a way of getting around it by helping you download your archive (see step one above) and then using the archive to, in essence, delete a specified range of tweets that were created before those 3,200.

And even if you’ve used one of these to delete all your past tweets, it’s a good idea to go back and check. There have been reports, including from Verge staffers, that “deleted” posts have mysteriously reappeared.

Current apps include:

TweetDelete, one of the best known, is a web tool that lets you both delete your Twitter history and set a timer for the deletion of future tweets. The free version only deletes those most recent 3,200 tweets. The company does offer three paid plans: a Starter plan for $5.99 a month or $35 a year that will delete up to 500 tweets a month; a Pro plan that, for $6.49 a month or $40 a year, will delete up to 3,200 tweets a month; or the Premium plan for $6.99 a month or $44 a year that attempts to get around the 3,200-tweet limitation by uploading your Twitter data file and then letting you delete a range of specific tweets. According to TweetDelete’s privacy policy, the data files are automatically removed after three days; there is also a button on the page that, according to TweetDelete, will delete your account and all associated stored data.

TweetEraser is owned by the same company — TD Social LLC — that owns TweetDelete. So, not surprisingly, it is similar and offers similar features. In fact, its list of premium features is almost identical to that of TweetDelete, and its prices are exactly the same except that, instead of a Starter plan, Pro plan, and Premium plan, TweetEraser offers a Beginner plan, Advanced plan, and Expert plan. The only differences are that TweetEraser does not offer a free version, and it claims “extra fast” deletion in the Advanced plan and “super fast” deletion in the Expert plan. We’ve contacted TweetEraser for information about how you can delete your data from the service if you wish.

TweetDeleter will also delete your older tweets using the same strategy as the previous two apps: by using your Twitter archive to find and delete those posts. If you only want to delete certain tweets, you can find them using keywords or whether they’re attached to media. TweetDeleter offers a Standard plan that lets you delete up to 100 tweets per month for $7.99 a month or $47.88 a year; the Advanced plan deletes up to 3,000 posts and 3,000 likes for $9.99 a month or $59.88 a year, and the Unlimited plan lets you delete an unlimited number of tweets and likes (including all at once) for $11.99 a month or $71.88 a year. According to the company, uploaded archive files are permanently deleted from their servers, uploaded tweets are retained until manually deleted, and the data of users who leave the service is deleted after two months.

Redact is a downloadable app for macOS, Windows, and Linux that deletes posts from an impressively wide variety of services. The free version deletes unlimited posts on Reddit and Twitter and 30 days’ worth of posts from Facebook and Discord. For $84 annually, you can delete an unlimited number of posts from all of those services; remove posts from, according to Redact, over 40 services in total; schedule bulk deletions; and enjoy beta access to new features, among other features. Its privacy policy states that all user data will be deleted upon request.

Update August 29th, 2023, 8:23AM ET: This article was originally published on July 26th, 2018. It has been updated to reflect recent changes to Twitter / X and tweet-deleting services and to add information about the privacy policies of these services.

Amazon India, a prominent e-commerce player, has taken significant steps towards sustainability by integrating over 6,000 electric vehicles (EVs) into its nationwide delivery network across more than 400 cities. The company has expressed its intent to further escalate this number to 10,000 EVs within the next four years.

Commitment to Sustainability and Collaboration

Amazon India is lauding its progress towards the ambitious goal of deploying 10,000 EVs by 2025. This move reflects the company’s resolute dedication to reducing the carbon footprint of its extensive transportation operations. Abhinav Singh, Vice President of Operations at Amazon India, emphasized this commitment.

The e-commerce giant has been actively fostering partnerships and collaborations with various stakeholders. This comprehensive approach encompasses EV manufacturers, charging infrastructure providers, and financial institutions. Among the notable collaborators are industry leaders like Mahindra Electric, Tata Motors, TVS, and Sun Mobility.

Focus on Decarbonizing Transportation

Notably, Amazon India’s environmental focus extends to its middle-mile and last-mile trucking operations. The company is diligently working on pilot programs for scalable carbon reduction technologies. Additionally, it is establishing strategic alliances with energy infrastructure companies and financial entities. These partnerships are aimed at creating holistic solutions for transporters contemplating the transition to electric trucks.

Aligned with Government Initiatives

Amazon’s initiatives align with the Indian government’s push for widespread EV adoption to mitigate the nation’s carbon emissions. The government has been actively advocating for the incorporation of EVs into various sectors.

Widespread Impact on ESG Initiatives

The global shift towards Environmental, Social, and Governance (ESG) considerations has motivated companies worldwide to increase their adoption of EVs. This push toward sustainability is notably visible among major Indian startups, including Flipkart, Zomato, and Swiggy, which have partnered with EV manufacturers to expedite the integration of EVs into their logistics fleets.

Rivalry and Industry Buzz

Amazon’s competitor, Flipkart, has announced its own ambitions in this space, with plans to introduce 25,000 EVs into its fleet by 2030. This rivalry underscores the competitive landscape as both companies vie to lead in sustainable transportation practices.

Moreover, Swiggy, a major player in the food delivery sector, has collaborated with Taiwanese battery-swapping solutions provider Gogoro to promote the use of electric smartscooters for last-mile deliveries across India.

Amazon India’s journey to expand its EV fleet emerges as a key contributor to the ongoing transformation of India’s transportation sector, aligning with global trends towards greener and more sustainable practices.

In an unfolding chapter of layoffs within the Indian startup landscape, CoinSwitch, a crypto exchange backed by Tiger Global, has undertaken a restructuring effort that resulted in the termination of 44 employees.

Restructuring Measures Impacting Workforce

According to CoinSwitch’s LinkedIn profile, the startup currently employs 519 individuals. This implies that around 8% of its workforce has been affected by the recent layoffs.

Customer Support Team Takes the Hit

A spokesperson from CoinSwitch confirmed the layoffs, noting that the customer support team bore the brunt of the restructuring. The affected employees reportedly chose to leave their roles voluntarily.

The spokesperson stated, “We continuously evaluate our business to stay competitive, prioritising innovation, value, and service for our customers. To that end, we right-sized our customer support team to align with the present volume of customer queries on our platform. This impacted the roles of 44 members of our customer support team, who voluntarily resigned from their roles after a detailed discussion with their managers earlier this month.”

Operations Department Also Impacted

However, reports from sources including Moneycontrol indicate that the layoffs extended beyond the customer support division. Positions across various roles within the operations department were also affected, with roles such as team leads, agents, support staff, senior managers, and quality analysts impacted.

Company Clarifies Organizational Structure

CoinSwitch responded to these reports by clarifying their organizational structure. The company highlighted their flat hierarchy, with the Head of Customer Support directly reporting to the COO. Additionally, they stressed that the Customer Support team also serves as the Customer Operations team, eliminating the need for a separate operations team.

Recent Hiring and Funding Status

Despite the layoffs, an insider source revealed that CoinSwitch had hired 60 new employees since April and was actively recruiting for various positions. The source also claimed that the company had a funding runway of five years.

Background and Challenges in the Crypto Industry

CoinSwitch, founded in 2017, has garnered over $300 million in funding from investors such as Andreessen Horowitz (a16z), Tiger Global, and Sequoia Capital India. Regulatory challenges, particularly heavy taxation measures and government raids on crypto exchanges, have cast a shadow over the industry. These challenges, combined with the broader bear market, have led to downturns in the fortunes of several crypto startups.

Broader Industry Impact

The crypto industry as a whole has faced significant hurdles, including regulatory uncertainty, taxation concerns, and economic shifts. Notably, the recent struggles of FTX, a major crypto player, have raised questions about the industry’s stability.

Larger Ecosystem Impact

Within India, the crypto ecosystem has seen notable players shut down operations, including Pillow, Flint Money, and WeTrade. Regulatory and tax-related issues have also resulted in workforce reductions, exemplified by CoinDCX’s decision to cut 12% of its staff.

The broader challenges faced by the cryptocurrency sector, both globally and in India, continue to shape the operational landscape of companies like CoinSwitch.

Reliance’s ambitious Jio Financial Services (JFS) plans have been unveiled, sending ripples through India’s fintech scene. From payments to insurance and investments, JFS is poised to reshape these sectors and emerge as a formidable competitor to both startups and established BFSI players.

Initial Challenges and Market Reception of Jio financial services

Jio Financial Services recently went public after being demerged from Reliance Industries (RIL). However, its stock faced a rocky start, with several sessions of trading hitting lower circuits. Despite these initial hiccups, JFS claims to be the world’s highest-capitalized financial services platform at inception, underscoring its potential impact.

A Competitive Advantage with Reliance Ecosystem

JFS can leverage Reliance’s robust ecosystem, including the over 439 million Jio subscribers and nearly 250 million registered customers of Reliance Retail. This user base provides a solid foundation for JFS’s expansion.

Impact on Fintech Startups

JFS’s entry poses a challenge for India’s fintech startups, which have previously leveraged Reliance Jio’s services for growth. Now, these startups must not only address revenue concerns but also contend with JFS, which benefits from Reliance’s technological prowess, expansive retail network, and market reach.

Disruption in Asset Management Space

The joint venture between JFS and BlackRock aims to disrupt India’s $540 billion mutual fund industry. This move could impact startups like Zerodha, Paytm Money, INDMoney, and Groww, especially those lacking an Asset Management Company (AMC) license.

Jio financial services Payments Ambitions

JFS plans to offer payments services for consumers and merchants, with a focus on blockchain solutions for security and Central Bank Digital Currency (CBDC) services. This thrust into the payments domain puts JFS. In direct competition with established players like PhonePe, Paytm, Google Pay, and more.

Jio financial services Current Payments Landscape

While Jio launched UPI services in 2020, its market share remains modest compared to major UPI players. JFS is expected to launch a dedicated app for its payments services to increase its market presence.

Insurance Sector Ambitions

JFS will enter the insurance market, offering products in general insurance, health insurance, and life insurance in partnership with global players. This foray could challenge both traditional insurers like LIC, HDFC, and ICICI. And digital-first startups like Go Digit, Acko, and InsuranceDekho.

Also Read: Amazon India Aims to Expand Electric Delivery Fleet to 10,000 EVs by 2025

Fintech Lending and Scaling Strategies

Consumer durable lending, merchant lending, and buy-now-pay-later (BNPL) are areas of focus for JFS. While it may take time to scale its lending operations, JFS’s entry could provide a significant opportunity. Especially for underserved retailers and vendors.

Possible M&A Strategy

Reliance’s history suggests that JFS might pursue both organic and inorganic growth strategies. The conglomerate’s deep pockets could allow it to acquire struggling startups in the fintech space.

As Reliance’s JFS emerges as a multi-faceted player in the fintech landscape, it sets the stage for transformation. Across various sectors and intensifies competition among existing players and startups alike.

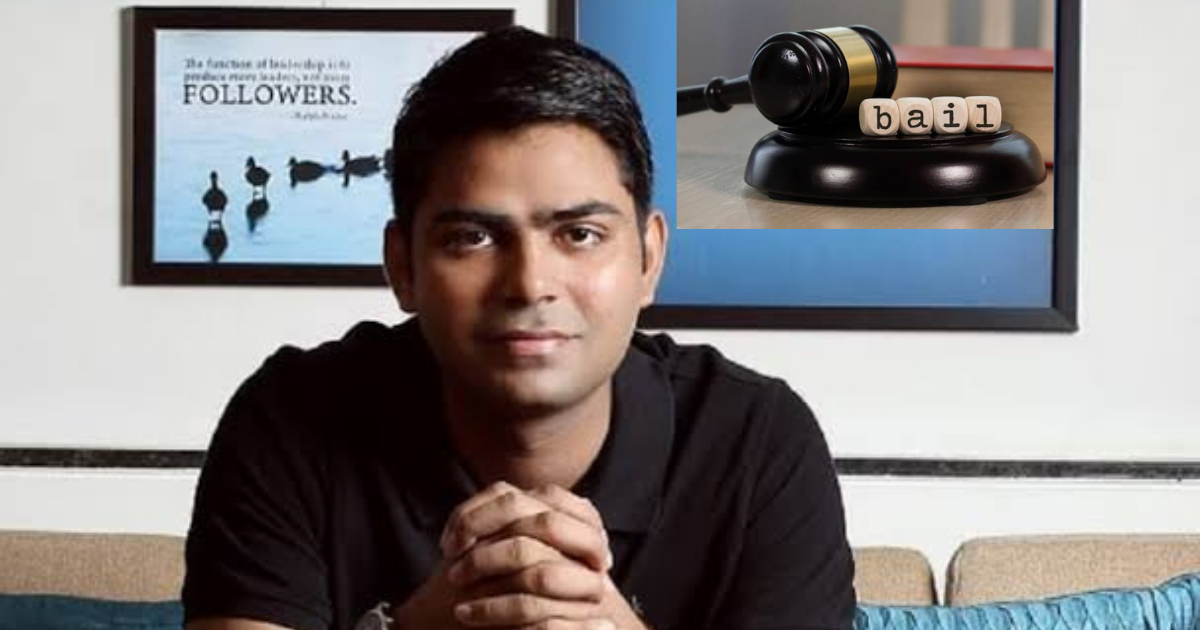

Rahul Yadav, Sanjay Saini of 4B Networks file an anticipatory bail application

Amidst a series of legal tussles, Rahul Yadav, co-founder of 4B Networks, and Sanjay Saini, a founding member, have approached a Mumbai Court to secure anticipatory bail, aiming to shield themselves from ongoing legal challenges.

Seeking Bail Amidst Allegations in 4B Networks

As reported by CNBC-TV18, Yadav and Saini have filed for bail in connection with a First Information Report (FIR) lodged by Vikas Nowal, co-founder and country head of Interspace Communications. The FIR alleges fraud and deceit by Yadav, implicating the Economic Offences Wing (EOW).

Anticipatory Bail Challenged

Reportedly, Mumbai police are set to oppose the anticipatory bail application made by the duo, adding an additional layer of complexity to the situation.

Under Scrutiny in 4B Networks

The duo has been under agency questioning for several days. During this inquiry, both Yadav and Saini have assured the agency that they intend to settle the money owed to Interspace. However, they have refrained from providing a reason for the initial payment default.

The Allegations

Earlier this month, Nowal filed an FIR with the EOW, invoking sections 406, 409, 420, and 34 of the Indian Penal Code. The allegations revolve around criminal breach of trust and fraud amounting to INR 10 crore. The dispute centers on the advertising agency Interspace Communications, which Broker Network enlisted for outdoor ad campaigns in February 2022.

Disputed Transactions

According to the FIR, Interspace set up 83 ad hoardings in Pune between April and August 2022. Nowal accuses Broker Network of defrauding Interspace and failing to make the INR 10 crore payment for the ad activity conducted in 2022.

Parallel Legal Matters

This development coincides with another legal incident. While hearing an arbitration case filed by Innov8, a coworking space provider, the Delhi High Court observed that 4B Networks had forfeited its right to respond due to a failure to address non-payment of INR 1.08 crore in rent to Innov8.

Investor Controversy in 4B Networks

Furthermore, Broker Network is entangled in an arbitration proceeding with investor InfoEdge. InfoEdge had invested INR 288 crore in the startup led by Rahul Yadav but had to devalue its investment due to allegations of financial misconduct.

Also Read: Amazon India Aims to Expand Electric Delivery Fleet to 10,000 EVs by 2025

Refusal to Disclose Information

Rahul Yadav’s reluctance to divulge financial transaction details during a forensic audit prompted by InfoEdge led to escalated arbitration proceedings.

Looking Forward

InfoEdge has taken the matter to the Delhi High Court against Yadav and Pratik Choudhary, another party to the shareholders’ agreement of 4B Networks. The High Court directed Yadav and Choudhary not to sell, transfer, or dispose of any assets or properties of 4B Networks and to preserve all records and information.

Three top executives from BYJU’S, including chief business officer Prathyusha Agarwal, have stepped down, marking the latest in a series of senior management departures from the edtech company.

Himanshu Bajaj, business head of BYJU’S Tuition Centers and Mukut Deepak, business head for Class 4 to 10, have also quit the edtech unicorn.

Agarwal joined the edtech giant in February 2022 from Zee Entertainment, where she was the chief consumer and data officer. Deepak was with the edtech for almost two years, having joined from Tata Play, while Bajaj joined BYJU’S in November 2021 to head BYJU’S Tuition Centers (BTC) from management consulting company Kearney.

BYJU’S spokesperson confirmed the development and attributed these resignations to organisational restructuring.

“As BYJU’S continues to chart its path to profitability and sustainable growth, we have undertaken a restructuring of businesses and verticals including the consolidation of four verticals into two key verticals – K-10 and Exam Prep,” the spokesperson said.

According to a Moneycontrol report, the edtech giant has scaled down the kindergarten to class 3 business, which was being headed by Agarwal from the business side.

“At present, two very seasoned and senior leaders lead both verticals – Ramesh Karra leads the K-10 vertical while Jitesh Shah leads the exam prep business. And as a part of this reorganisation of businesses, Mukut Deepak, Prathyusha Agarwal and Himanshu Bajaj will be moving on,” the spokesperson added.

The senior level exits come days after BYJU’S SVP for international business, Cherian Thomas, also quit. Thomas was considered one of the key members of the edtech unicorn’s American business and spearheaded Osmo, a US-based gaming-focused edtech startup acquired for $120 Mn in 2019.

Besides senior level exists, BYJU’S is also facing multiple operational issues, including delays in filing financials, resignations of board members, legal tussles with lenders and delays in raising fresh funding. However, the edtech giant has recently set up a board advisory council and roped in industry veterans like TV Mohandas Pai and Rajnish Kumar as advisors. It also appointed Richard Lobo as its human resources head earlier this month.

Since last year, BYJU’S and its group companies have let go of over 4,000 employees. The company also gave up its largest office space in Bengaluru to save operational costs.

Running behind the timelines, the edtech unicorn filed its financial statements for FY21 after an 18-month delay in September 2022, reporting INR 4,588 Cr in losses. Recently, BYJU’S assured investors that the company would file FY22 financials by September and statements for FY23 by the end of this year.

The post BYJU’S CBO, Two Other Senior Execs Resign Amid Restructuring appeared first on Inc42 Media.