Recent acquisitions are paving the way for the company to IPO in 2025.

Sarthak Luthra

Sarthak Luthra

Hey, there! I am the tech guy. I get things running around here and I post sometimes. ~ naam toh suna hi hoga, ab kaam bhi dekhlo :-)

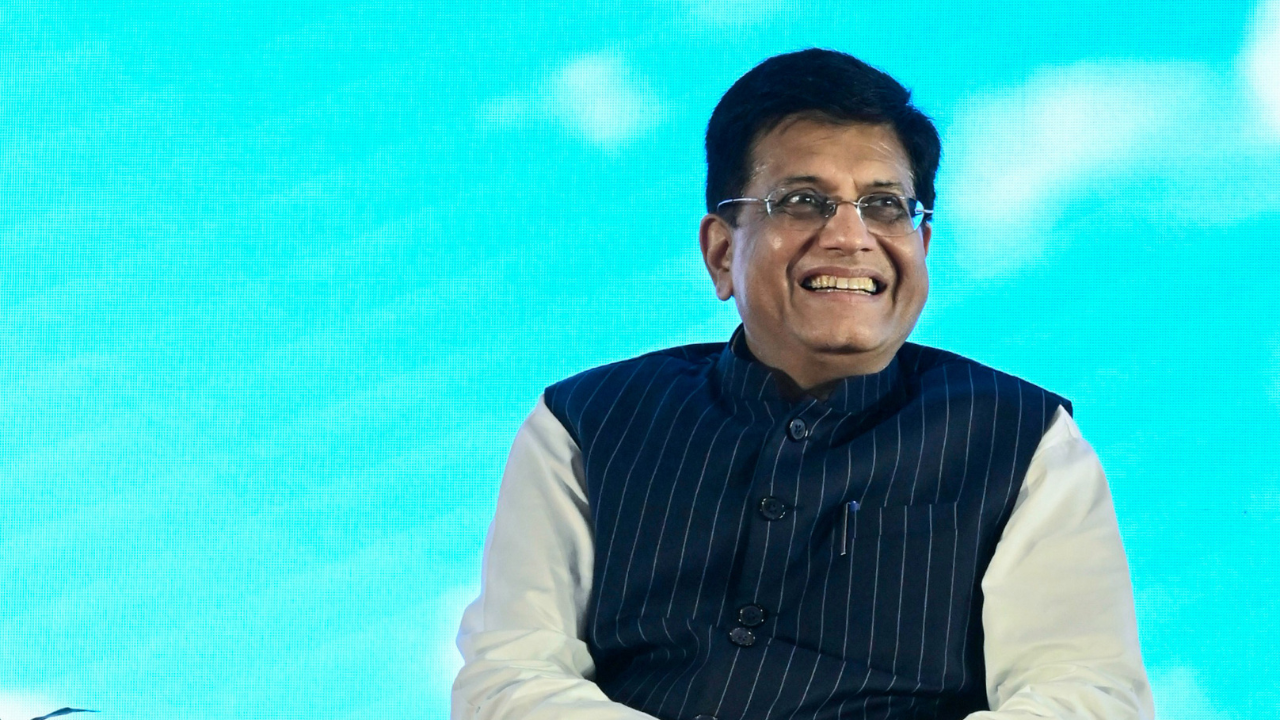

Even before it forays into India with its electric cars, American electric vehicle giant Tesla has begun heavy component sourcing from the country. It is expected to ship parts worth $1.7-1.9 billion this year from India. Commerce and industry minister Piyush Goyal said while the company finalises its launch plans for the market, it is already sourcing significantly from India, indicating the robustness of the manufacturing processes and quality of production.

Apple’s iPhone 15 will cost much more in India than in the US and Dubai, despite the company manufacturing them in the country. With the company going aggressive in India on iPhone production, buyers had expected prices in the domestic market to come down, but that has not happened.

Kae Capital Closes Its Winners Fund II At $50 Mn To Invest In Portfolio Startups

Early stage venture capital firm Kae Capital has closed its Winners Fund II (KWF II) by raising $50 Mn (INR 410 Cr) to co-invest in its portfolio startups in their growth stage funding rounds.

Investors including Velo Partners, VM Thapar Family Office, KKR cofounder and co-executive chairman Henry Kravis, 360 ONE, HealthKart founder Sameer Maheshwari, Max Healthcare founder Abhay Soi, DSP Group founder Hemendra Kothari, and Tata 1mg’s Prashant Tandon and Tanmay Saksena infused capital in the fund, the firm said in a statement.

“We have launched this fund in order to continue backing our best founders, alongside other successful founders in the ecosystem, who are not yet a part of the Kae family,” said Sasha Mirchandani, partner at Kae Capital, announcing the closure of KWF II.

Like all its previous funds, KWF II was also oversubscribed, the VC firm said.

Kae Capital has been investing in Indian startups for over a decade now. It is a sector-agnostic fund that invests in pre-Seed to pre-Series A rounds with initial cheque sizes typically ranging between $1 Mn-$3 Mn.

The VC firm said that KWF II would also provide a similar ticket size but with an upward limit of $4 Mn. It’s a sector-agnostic fund.

KWF II, unlike Kae Capital’s regular funds, will invest in startups of its previous funds. Hence, with this fund, the VC firm won’t lead any rounds but rather co-invest with other growth-stage funds in Series B, C, and D rounds, the statement added.

In addition to its own portfolio, Kae Capital would also invest in other market-leading companies with KWF II, it said. The fund has already invested in HealthKart, Wysa, Brightchamps, and Disprz.

Through KWF II, the VC firm aims to invest in 20 companies.

Kae Capital, launched in 2012, has invested in 81 startups in total, including Porter, Zetwerk, Nazara, and Tata 1mg, among others.

Its portfolio enterprise valuation stands at $8.76 Bn. Kae Capital has also made 14 exits.

In November last year, Kae Capital announced the final close of its third fund at INR 767 Cr.

The announcement comes at a time when the startup ecosystem has witnessed the launch and closure of several funds over the last few months.

Earlier this week, private equity firm Xponentia Capital announced the final close of its Xponentia Opportunities Fund II after it raised INR 1,000 Cr from investors. Early stage VC Vertex Ventures Southeast Asia and India also raised $541 Mn for its fifth fund.

Prior to that, Pentathlon Ventures announced the launch of its second fund, while Unicorn India Ventures announced the first close of its INR 1,000 Cr fund III.

Recently, gradCapital launched its $6 Mn second fund to invest in student startups.

As per Inc42 analysis, VC, angel, and PE investors have announced 52 funds worth over $3.8 Bn till August to support Indian startups at various stages despite the funding winter.

The post Kae Capital Closes Its Winners Fund II At $50 Mn To Invest In Portfolio Startups appeared first on Inc42 Media.

Update everything: Chrome, Firefox, Brave, and Edge just patched a big flaw

Photo by Amelia Holowaty Krales / The Verge

Google, Mozilla, Microsoft, and Brave have each issued critical security patches, reports Stack Diary. The patches address a vulnerability that an attacker could use to gain access to or run malicious code on your computer, and the companies acknowledge it’s been actively exploited in the wild. NIST classifies the vulnerability as severe. Other companies’ applications are affected — the vulnerability is linked to code used to render WebP images, which are widely used.

The software version numbers containing the fix are below.

Google: Chrome version 116.0.5846.187 (Mac / Linux); Chrome version 116.0.5845.187/.188 (Windows)

Mozilla: Firefox 117.0.1; Firefox ESR 102.15.1; Firefox ESR 115.2.1; Thunderbird 102.15.1; Thunderbird 115.2.2

Microsoft: Edge version 116.0.1938.81

Brave: Brave Browser version 1.57.64

Stack Diary mentioned that Electron-based apps like encrypted-messaging app Signal and Bandisoft’s Honeyview have also released patches for the issue. Other apps, like Affinity, Gimp, LibreOffice, Telegram, many Android applications, and “cross-platform apps built with Flutter” are likewise affected, according to the site.

Apple also released a security patch this week for what appears to be the same issue, though it references a different issue number on the NIST site.

US industrial conglomerate 3M on Wednesday warned of “a slow growth environment” next year and highlighted weakness in its electronics and consumer segments in the current and next quarters. The warning by the conglomerate comes months after it elevated its annual profit forecast in July. 3M, which manufactures electronic displays for smartphones and tablets, has been registering a considerable decline in US retailers’ inventories

Mitgo’s Publisher Investments offers MENA publishers $50,000-$500,000 to scale-up and grow

Global tech company Mitgo has announced the launch of its Publisher Investments program, an innovative alternative finance service providing investment opportunities with a clear focus on the MENA market. Offering flexible terms, with or without equity, loans or credit and with an initial investment capital of $20 million USD, the program will continually expand as new applications are received.

Aimed primarily at projects working in the FinTech, smart shopping, gig economy, generative AI, HRtech, MarTech, Influencer and no-ads sectors, the program intends to help publishers solve one of the biggest issues they face: finance gaps and cash flow problems that stand in the way of growth.

Publishers applicable for investment could be an individual, platform or organisation. What’s important is that they have their own audience or access to one through traffic acquisition (e.g. contextual advertising), to which they promote advertisers’ goods or services and generate sales or lead actions for them. This may include publisher types like cashback services, browser extensions, content platforms, influencers and many others.

Applicants must also currently – or plan to through investment – earn more than 50% of their revenue from “cost per lead”, “cost per click”, “cost per sale” and other performance-based models. They should either already be working with Mitgo businesses Admitad and Takeads or with other affiliate networks or must be willing to provide statistics that demonstrate their project’s readiness to earn on the above models.

Successful candidates will be eligible to receive between $50,000 and $500,000 USD, funds which they can use to nurture their businesses, scale-up and grow. They will also gain access to personal strategic managers who will help them leverage the entire Mitgo ecosystem to their benefit.

MENA will be a key focus region for Publisher Investments, and Mitgo expects at least 10% of all investments to be made in local projects.

The creation of an investment service to aid publishers in bridging finance gaps seemed a natural step forward for Mitgo CEO Alexander Bachmann, someone whose career started as a publisher himself, more than 15 years ago.

“Their success is our success, which is why we’ll not only provide financial support, but also allocate time and resources into mentoring and coaching, as well as giving access to an extensive network of digital advertising contacts.” – Alexander Bachmann, CEO & Founder, Mitgo

The company has a long and successful history in investing, having already closed more than 30 investments, including projects such as Fairsavings ($500k+ invested) and Letyshops ($3 million+ invested).

Since the launch of Publisher Investments in June, Mitgo has already received 100+ applications, and actively invites MENA publishers to submit proposals for their projects.