Kyle Wiggers

Leanne Sherred, a pediatric speech therapist, has long encountered challenges putting caregiver-led therapy into practice in traditional care settings.

Research suggests that caregiver-led speech therapy, which involves training the caregivers of patients in skill-building therapeutic techniques to use at home, can be highly effective. But as Sherred observed in the course of her practice, therapists often have limited access to caregivers and face serious educational and tech roadblocks.

In 2020, around the start of the pandemic, Sherred saw an opportunity to attempt a new, tech-forward speech therapy care model, one that put caregivers “at the center of care” (in her words). She teamed up with Nick Barbara (Sherred’s spouse), Spencer Magloff and Ryan Hinojosa to found Expressable, a platform that offers one-on-one virtual sessions with speech language pathologists.

“Layered on top of Expressable’s synchronous care is a platform that includes multimedia home programming, interactive weekly practice activities, therapist SMS support and more,” Magloff, Expressable’s chief marketing officer, told TechCrunch in an interview. “With Expressable, speech therapy isn’t limited to one to two times per week, void of caregiver participation.”

Expressable is covered by some insurance plans (including Medicaid) but also offers private pay rates and accepts HSAs and FSAs. It matches patients with speech therapists who might be able to meet their needs and fit their schedules. The matched therapist develops a treatment plan and then regularly meets with the patient and/or their caregiver for online sessions.

Some aspects of the plan are designed to be done on the patient’s own time, through Exressable’s self-service platform. Patients and caregivers can track progress week-to-week toward goals and milestones in their individualized plans.

Expressable, which caters to both adult and child patients with conditions ranging from language disorders to speech delays, aphasia, stuttering and autism spectrum disorder, differentiated itself early from many other telehealth startups by hiring its health specialists as W2 employees as opposed to contractors. While this increased Expressable’s medical licensing burden, it positioned the company well to handle challenging speech cases, Magloff says, which often require intensive, years-long treatment plans.

“With Expressable, parents and caregivers become active members of their patient’s care team, extending care into the home and throughout the entire therapeutic progress for faster outcomes,” Magloff said.

The digital and telehealth sector enjoyed liberal access to capital in the height of the pandemic but has cooled noticeably. But Expressable is bucking the trend, earlier this week closing a $26 million Series B round led by HarbourVest Partners with participation from Digitalis Ventures, F-Prime Capital and Lerer Hippeau.

With $50 million in the bank, Expressable plans to make improvements to its care delivery model and core tech, expand its payer relationships and grow its network of therapists as well as its operational team. The company’s also experimenting with various forms of AI, Magloff says.

“There are a number of relevant AI use cases we’re currently exploring or adapting to improve the client experience,” he added. “These could help catalog common speech errors, reduce administrative burdens on clinicians and improve operational efficiency.”

Lumos helps companies manage their employees’ identities — and access

Andrej Safundzic, Alan Flores Lopez and Leo Mehr met in a class at Stanford focusing on ethics, public policy and technological change. Safundzic — speaking to TechCrunch — says that the class drove home the point that few people, particularly in the corporate sector, have control over their online identities.

“The future of software is in automating manual workflows fully end-to-end,” Safundzic said. “Authorization decisions are probably one of the first workflows that make sense for this, since they’re a very straightforward — but also highly frequent — need with real business impact.”

It’s this seed of an idea that led Safundzic, Lopez and Mehr to brainstorm ways to better manage digital corporate identities. Their efforts culminated in Lumos, a platform that helps companies manage app access permissions across on-premises and cloud environments.

Lumos, which can be accessed via a command line or the web, helps to orchestrate tasks like audits of which users have access to which apps and systems within a corporate environment. Beyond this, Lumos can estimate and recommend ways to reduce spend on software licenses by tracking usage and integrating expenses data. And — leveraging AI — Lumos can convert support tickets into workflows and analyze employee data to suggest modifications to staff access credentials.

Lumos’ tools come especially in handy for businesses with lots of apps to wrangle, Safundzic says — which surveys would suggest is most businesses. Per BetterCloud, companies were using an average of 130 apps as of 2023, up 18% from the year prior.

“Now that people are starting to invest again, our features around employee onboarding and ticket automation are gaining traction because IT leaders want to enable their workforce to achieve more,” Safundzic said. “The future of access management is IT and identity access management becoming more of a strategic function that tunes and releases AI agents that automate repetitive tasks in different areas.”

With claims of 9x revenue growth since May 2022 and a customer base that includes Roku, MongoDB and Chegg, it’s not surprising that some VCs are throwing their weight behind Lumos. This week, the startup closed a $35 million Series B tranche led by Scale Venture Partners with participation from a16z, Harpoon Ventures, Neo and others.

With a total of over $65 million in the bank, Lumos is well-positioned to head off the many, many rivals in the access and identity management identity markets, Safundzic says.

“Building a generalizable core infrastructure makes it possible to mature our products way faster than normal,” Safundzic said. “Because of that, Lumos has been able to grow faster than competitive point solutions because we serve multiple pain points for customers, which made us show up in many different requests for proposals. For any company building an end-to-end platform, you’ll have a lot of competitors due to the large product surface.”

Lumos, which is based in San Francisco, plans to grow its workforce from 95 people to ~150 by the end of the year.

Sigma is building a suite of collaborative data analytics tools

In 2014, Jason Frantz and Rob Woollen co-founded Sigma Computing, a platform that overlays data stored in data platforms such as Snowflake and Google BigQuery with a spreadsheet-like interface for data visualization and analytics. With Sigma, the two former software engineers sought to tackle what they perceived as the intractable data challenges faced by large corporations: unwieldy tooling and difficult-to-manage data stores.

In a 2023 survey from Oracle, the majority of business leaders said that they don’t believe their employer’s current approach to data and analytics is addressing their needs. Seventy-seven percent said that the dashboards and charts they get aren’t germane to decisions they need to make, and 72% admit the sheer volume of data — and their lack of trust in that data — has at times stopped them from making decisions altogether.

“After recognizing the huge advances in cloud data infrastructure during the past decade, Jason and Rob identified a gap in the market,” Sigma Computing CEO Mike Palmer told TechCrunch in an interview. “Sigma is building a data workspace for everyone — where teams can analyze data in spreadsheets, build business intelligence in the form of dashboards and reports and create data workflows and applications where data never leaves a company’s data warehouse.”

Out of the gate (in 2014), Sigma only offered a set of basic business intelligence and analytics tools to connect to a customer’s outside databases. But the firm — which Frantz and Woollen founded while entrepreneurs in residence at Sutton Hill Ventures, Woollen having come from Salesforce’s Work.com org — quickly grew from there.

Today, Sigma’s product suite consists of tools that let users analyze data “in-place” in databases containing up to billions of records. Customers can tap the platform to build dashboards, reports, workflows and apps without data leaving its source.

“We champion what we call ‘massive multiplayer business intelligence,’ a dynamic environment where professionals, regardless of their technical expertise, come together to leverage their distinct skills, all in real time, all within the same platform,” Palmer said.

The go-to-market strategy has turned out to be a winning one.

According to Palmer, Sigma’s revenue has grown 100% year-over-year for four straight years on the back of a ~1,000-company customer base. Those figures have investors pleased. On Thursday, Sigma closed a $200 million Series D funding round co-led by Avenir Growth Capital and Spark Capital that values the company at $1.5 billion, up 60% from its valuation in 2021 (when it raised $300 million).

Palmer believes the key to Sigma’s success in the face of stiff competition like Tableau and Microsoft’s Power BI has been a continued focus on creating data analytics tools with a low barrier to entry.

“Existing business intelligence platforms were primarily designed for ‘super-analysts’ — individuals who work within lines of business and grasp the intricacies of enterprise-scale data manipulation,” Palmer said. “For most people, business intelligence was — and remains — a significant hurdle. Jason and Rob believed there was a giant market of smart people that have either been ignored by more technical tools or have been given simple tools that only allow them to ask simple questions.”

It probably doesn’t hurt that the market for business intelligence and analytics tools is huge — and growing at a very healthy pace. According to Precedence Research, a market research firm, the business intelligence sector alone will climb from $27.24 billion in 2022 to 54.9 billion by 2023.

With Sigma’s massive war chest — $581 million in venture capital — and a staff of around 450, the company plans grow its operations in the U.S. and internationally and invest in AI, specifically integrations with generative AI platforms like OpenAI’s to let users ask questions about their company’s data.

“We believe, due to data volumes, speed of change and governance, plus security requirements, that data will increasingly be centralized in systems like Databricks and Snowflake,” Palmer said. “For competitive enterprises to work synchronously and at high velocity, you need to provide your employees with raw, live data and the tools to build and communicate together. And they need a platform that enables them to access that data with whatever skills they have.”

Snowflake Ventures, Sutter Hill Ventures, D1 Ventures, Xn Ventures and Altimeter Capital also participated in Sigma’s Series D.

Retell AI lets companies build ‘voice agents’ to answer phone calls

Call centers are embracing automation. There’s debate as to whether that’s a good thing, but it’s happening — and quite possibly accelerating.

According to research firm TechSci Research, the global market for contact center AI could grow to nearly $3 billion in 2028, from $2.4 billion in 2022. Meanwhile, a recent survey found that around half of contact centers plan to adopt some form of AI in the next year.

The motivation is rather obvious: Call centers are looking to reduce costs while scaling up their operations.

“Companies with heavy call center operations, looking to scale quickly without the constraints of human contact center agents, are highly receptive to adopting effective AI voice agent solutions,” entrepreneur Evie Wang told TechCrunch. “This approach not only reduces their overall costs but also decreases wait times.”

Wang is one of the co-founders of Retell AI, which provides a platform companies can use to create AI-powered “voice agents” that answer customer phone calls and perform basic tasks such as scheduling appointments. Retell’s agents are powered by a combination of large language models (LLMs) fine-tuned for customer service use cases and a speech model that gives voice to text generated by the LLMs.

Retell’s customers include some contact center operators but also small- and medium-sized businesses that regularly deal with high call volumes, like telehealth company Ro. They can build voice agents using the platform’s low-code tooling, or they can upload a custom LLM (e.g. an open model like Meta’s Llama 3) to further tailor the experience.

“We invest a lot in the voice conversation experience, as we see that as the most critical aspect of the AI voice agent experience,” Wang said. “We don’t view AI voice agents as mere toys that one can create with a few lines of prompts, but rather as tools that can offer substantial value to businesses and replace complex workflows.”

Retell worked well enough in my brief testing, at least on the call-facing side.

I arranged a call with a Retell bot using the demo form on Retell’s website. The bot walked me through the process of scheduling a hypothetical dentist’s appointment, asking questions like my preferred date and time, phone number and so on.

I can’t say the bot’s synthetic voice was the best I’ve heard in terms of realism — certainly not on par with Eleven Labs or OpenAI’s text-to-speech API. Wang, in Retell’s defense, said that the team’s been mostly focused on reducing latency and handling edge cases, like interruptions that might occur in a conversation.

The latency is low: In my test, the bot responded pretty much without hesitation to my answers and follow-up questions. And it stuck to its script. Try as I might, I couldn’t confuse it or prompt it to behave in a way it shouldn’t. (When I asked the bot about my dental records, it insisted that I speak with the office manager.)

So are platforms like Retell the future of call centers?

Maybe. For basic tasks like appointment scheduling, automation makes a lot of sense, which is probably why both startups and big tech firms alike offer solutions that compete head-on with Retell’s. (See Parloa, PolyAI, Google Cloud’s Contact Center AI, etc.)

It’s low-hanging — and seemingly revenue-generating — fruit. Retell claims to have hundreds of customers, all of which are paying per minute of voice agent conversation. Retell has raised a total of $4.53 million in capital to date, courtesy of backers including Y Combinator (where the company was incubated).

But the jury’s out on more-complicated queries, particularly given LLMs’ tendency to make up facts and go off the rails even with safeguards in place.

As Retell’s ambitions grow, I’m curious to see how the company navigates the many well-established technical challenges in the space. Wang, at least, seems confident in Retell’s approach.

“With the advent of LLMs and recent breakthroughs in speech synthesis, conversational AI is getting good enough to create really exciting use cases,” Wang said. “For example, with sub-one-second latency and the ability to interrupt the AI, we’ve observed users speaking in fuller sentences and conversing as they would with another person. We’re trying to make it easy for developers to build, test, deploy and monitor AI voice agents, ultimately to help them achieve production readiness.”

Legion’s founder aims to close the gap between what employers and workers need

While taking a long road trip across the U.S. years ago, Sanish Mondkar realized that there were stark, problematic disconnects between employers and the staff they employ.

To critics of late-stage capitalism, that might sound like an obvious observation. But Mondkar, who has a master’s in computer science from Cornell, says that seeing the issues up close made all the difference.

“Traveling from town to town, I couldn’t help but notice the perpetual ‘for hire’ signs plastering the windows of countless labor-intensive businesses such as retailers and restaurants,” he said. “Simultaneously, I saw employees frequently changing jobs, yet struggling to make a living wage. This disparity between employers’ needs and workers’ realities struck a chord with me.”

Inspired by this experience, as well as stints at Ariba as EVP and chief product officer at SAP, Mondkar set out to build a startup that helps companies manage their workforces — particularly contract and gig workforces. His venture, Legion, today announced it raised $50 million in funding led by Riverwood Capital with participation from Norwest, Stripes, Webb Investment Network and XYZ.

“My objective was to rebuild the enterprise category of workforce management in order to maximize labor efficiency for the businesses and deliver value to the workers simultaneously,” Mondkar said. “I wanted to differentiate the company itself with a focus on intelligent automation of WFM and the employee value proposition.”

Legion is designed to support customers — employers like Cinemark, Dollar General, Five Below and Panda Express — in managing their hourly staff by automating certain decisions, like how much labor to deploy where and when to schedule workers. Taking into account demand forecasting, labor optimization and the preferences of employees, Legion’s platform generates work schedules.

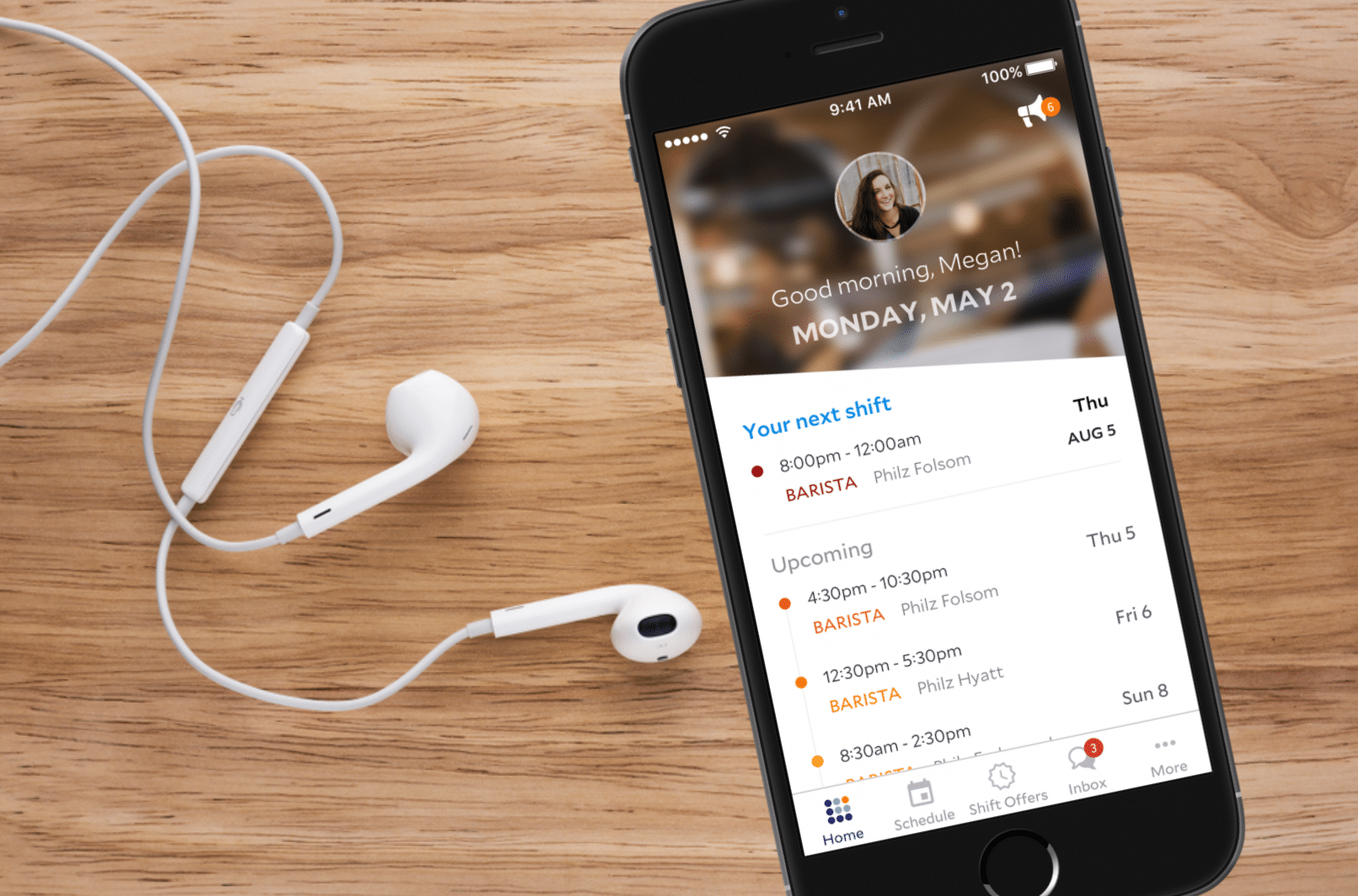

Employees whose companies are on Legion can use its mobile app to request how they want to work and set their preferred hours. Legion’s algorithm then tries to match the preferences of workers with the needs of the business.

Legion also incorporates performance management tools and a rewards program of sorts.

“We use algorithms trained on a blend of customer data and third-party data, which Legion aggregates from its partners,” Mondkar said. “This integration allows for forecasts for planning and resource allocation.”

In addition to the base scheduling features, Legion — very on trend — is leaning into generative AI with a tool called Copilot (not to be confused with Microsoft Copilot). Copilot answers questions about work informed by an organization’s employee handbook, labor standards and training content. In the coming months, Copilot will gain the ability to summarize work schedules and fulfill requests to add or delete shifts or change staffer assignments.

“In order to attract and retain staff, companies employing hourly labor must emulate gig-like flexibility,” Mondkar said. “Legion provides this with the intelligent automation of scheduling. Managers can match staff to projected demand, closing the gap between the needs of employees and the needs of the business.”

That’s all well and fine, but two concerning things stand out to me about Legion: its privacy policy and earned wage access (EWA) program.

Legion says it stores customer data for seven years by default — a long time by any measure. More concerningly, the data includes personally identifiable information like workers’ first and last names, email and home addresses, ages, photos and work preferences. Big yikes.

Legion says the data is necessary to “facilitate scheduling in compliance with labor regulations,” and that users can request that their data be deleted at any time. But I question the ease of the deletion process — and just how transparent Legion is about its data retention policies to customers.

My other gripe with Legion is InstantPay, Legion’s EWA program, which lets employees access a portion of their earned wages ahead of their scheduled paydays. Legion charges workers $2.99 for instant earned wage transfers, while next-day transfers are free — that might not sound like very much, but it can add up for a low-income worker. Legion pitches this as a benefit for hourly workers that gives them “greater flexibility” and “control” over their finances, as well as a business retention tool. But EWA programs are under scrutiny from policymakers, consumer rights advocates and employers. Legion’s mobile app.

Some consumer groups argue that EWA programs should be classified as loans under the U.S. Truth in Lending Act, which provides protections such as requiring lenders to give advance notice before increasing certain charges. These groups say EWA programs can force users into overdraft while effectively levying interest through fees.

In addition, it’s not clear whether EWA programs are a net win for employers. Walmart recently tried to combat attrition by giving hourly staff access to wages early. Instead, it found that employees using EWA tended to quit faster.

Setting aside my niggles with Legion, the company appears to be growing robustly despite competition from companies like Ceridian’s Dayforce, Quinyx, and UKG, with revenue and bookings climbing 55% and 125%, respectively, in the past year. That’s all the more impressive considering that funding for HR tech startups fell to a three-year low last year — $3.3 billion, down from $10.5 billion in 2021 — after a flurry of interests from VCs.

Legion, which makes money by charging subscriptions calculated by the number of hourly workers a company employs, plans to put its recently-raised capital toward growing its 200-staffer workforce with a focus on expanding R&D and customer-facing teams and launching go-to-market efforts in Europe.

To date, Legion’s raised $145 million.

“Legion will use our funds to fuel continued innovations in workforce management, including deep investments in R&D,” Mondkar said. “Legion has been relatively insulated from the broader tech slowdown, thanks to our focus on labor-intensive industries. This strategic alignment positions us well to navigate any potential economic headwinds effectively.”

Citigroup’s VC arm invests in API security startup Traceable

In 2017, Jyoti Bansal co-founded San Francisco-based security company Traceable alongside Sanjay Nagaraj, a former investor. With Traceable, Bansal — who previously co-launched app performance management startup AppDynamics, acquired by Cisco in 2017 — sought to build a platform to protect customers’ APIs from cyberattacks.

Attacks on APIs — the sets of protocols that establish how platforms, apps and services communicate — are on the rise. API attacks affected nearly one quarter of organizations every week in the first month of 2024, a 20% increase from the same period a year ago, according to cybersecurity firm Check Point.

API attacks take many forms, including attempting to make an API unavailable by overwhelming it with traffic, bypassing authentication methods, and exposing sensitive data transferred via a vendor’s APIs.

“There’s a lack of recognition of the criticality of API security,” Bansal told TechCrunch in an interview, “as well as ignorance of the ever-growing attack surface in APIs and a resistance to embrace API security due to entrenched investments in security solutions that don’t address the API security problem directly.”

To Bansal’s point, more and more businesses are tapping APIs in part thanks to the generative AI boom, but in the process unwittingly exposing themselves to attacks. Per one recent study, the number of APIs used by companies increased by over 200% between July 2022 and July 2023. Gartner, meanwhile, predicts that more than 80% of enterprises will have used generative AI APIs or deployed generative AI-enabled apps by 2026.

What Traceable does to try to shield these APIs is applies AI to analyze usage data to learn normal API behavior and spot activity that deviates from the baseline. Traceable’s software, which runs on-premises or in a fully managed cloud, can discover and catalog existing and new APIs including undocumented and “orphaned” (i.e. deprecated) APIs in real time, according to Bansal.

Image Credits: Traceable

“In order to detect modern threat scenarios, Traceable trained in-house models by fine-tuning open source large language base models with labeled attack data,” Bansal explained. “Our platform provides tools for API discovery, testing, protection and threat hunting workflows for IT teams.”

The API security solutions market is quickly becoming crowded, with vendors such as Noname Security, 42Crunch, Vorlon, Salt Security, Cequence, Ghost Security, Pynt, Akamai, Escape and F5 all vying for customers. According to Research and Markets, the segment could grow at a compound annual growth rate of 31.5% from 2023 to 2030, buoyed by the increasing threats in cybersecurity and the demand for more secure APIs.

But Bansal claims that Traceable is holding its own, analyzing around 500 billion API calls a month for ~50 customers and projecting revenue to double this year. Most of Traceable’s clients are in the enterprise, but Bansal says the company’s investigating piloting with governments.

“Traceable is building a long-term sustainable company, which from a financial perspective means that we have a very healthy margin profile that continues to improve as our revenue grows,” he said. “We’re not profitable today by choice, as we’re investing into the business responsibly … Our focus is on strategic investments maximizing return, not simply spending.”

To that end, Traceable today announced that it raised $30 million in a strategic investment from a group of backers that included Citi Ventures (Citigroup’s corporate venture arm) IVP, Geodesic Capital, Sorenson Capital and Unusual Ventures. Valuing Traceable at $500 million post-money and bringing Traceable’s total raised to $110 million, the new cash will be put toward product development, scaling up Traceable’s platform and customer engineering teams and building out the company’s partnership program, Bansal said.

Traceable has ~180 staffers currently. Bansal expects headcount to reach 230 by year-end 2024, as the the bulk of the new investment goes to hiring.

“Traceable wasn’t fundraising, as we still had substantial cash runway prior to this investment,” Bansal said, adding that Traceable secured a “sizeable” line of credit in addition to the new funds, “but we received significant inbound demand from investors. With the combination of the strategic alignment with Citi Ventures and the attractive terms of the investment, we decided to take a smaller investment now to accelerate our product and go-to-market initiatives before thinking about a more substantial fundraise.”

The OpenAI Startup Fund, a venture fund related to — but technically separate from — OpenAI that invests in early-stage, typically AI-related companies across education, law and the sciences, has quietly closed a $15 million tranche.

According to a filing with the U.S. Securities and Exchange Commission, two unnamed investors contributed the $15 million in new cash on or around April 19. The paperwork was submitted on April 25, and mentions Ian Hathaway, the OpenAI Startup Fund’s manager and sole partner.

The capital was transferred to a legal entity called a special purpose vehicle, or SPV, associated with the OpenAI Startup Fund: OpenAI Startup Fund SPV II, L.P.

SPVs allow multiple investors to pool their resources and make an investment in a single company or fund. In the VC sector, they’re sometimes used to invest in startups that don’t fit a fund’s strategy or that fall outside a fund’s terms. SPVs can also be marketed to a wider range of non-institutional investors.

It’s the second such time the OpenAI Startup Fund has raised capital through an SPV — the first time being in February for a $10 million tranche.

The OpenAI Startup Fund, whose portfolio companies include legal tech startup Harvey, Ambiance Healthcare and humanoid robotics firm Figure AI, came under scrutiny last year after it was revealed that OpenAI CEO Sam Altman had long legally controlled the fund. While marketed like a standard corporate venture arm, Altman raised capital for the OpenAI Startup Fund from outside limited partners, including Microsoft (a close OpenAI partner and investor), and had the final say in the fund’s investments.

Neither OpenAI nor Altman had — or have — a financial interest in the OpenAI Startup Fund. But critics nonetheless argued that Altman’s ownership amounted to a conflict of interest; OpenAI claimed that the general partner structure was intended to be “temporary.”

In April, Altman transferred formal control of the OpenAI Startup Fund to Hathaway, previously an investor with VC firm Haystack, who’d played a key role in managing the Startup Fund since 2021.

As of last year, the OpenAI Startup Fund — whose ventures also include an incubator program called Converge — had $175 million in commitments and held $325 million in gross net asset value. It’s backed well over a dozen startups including Descript, a collaborative multimedia editing platform valued at $553 million last year; language learning app Speak; AI-powered note-taking app Mem; and IDE platform Anysphere.

OpenAI hadn’t responded to TechCrunch’s request for comment as of publication time. We’ll update this post if we hear back.

Eric Schmidt-backed Augment, a GitHub Copilot rival, launches out of stealth with $252M

AI is supercharging coding — and developers are embracing it.

In a recent StackOverflow poll, 44% of software engineers said that they use AI tools as part of their development processes now and 26% plan to soon. Gartner estimates that over half of organizations are currently piloting or have already deployed AI-driven coding assistants, and that 75% of developers will use coding assistants in some form by 2028.

Ex-Microsoft software developer Igor Ostrovsky believes that soon, there won’t be a developer who doesn’t use AI in their workflows. “Software engineering remains a difficult and all-too-often tedious and frustrating job, particularly at scale,” he told TechCrunch. “AI can improve software quality, team productivity and help restore the joy of programming.”

So Ostrovsky decided to build the AI-powered coding platform that he himself would want to use.

That platform is Augment, and on Wednesday it emerged from stealth with $252 million in funding at a near-unicorn ($977 million) post-money valuation. With investments from former Google CEO Eric Schmidt and VCs including Index Ventures, Sutter Hill Ventures, Lightspeed Venture Partners, Innovation Endeavors and Meritech Capital, Augment aims to shake up the still-nascent market for generative AI coding technologies.

“Most companies are dissatisfied with the programs they produce and consume; software is too often fragile, complex and expensive to maintain with development teams bogged down with long backlogs for feature requests, bug fixes, security patches, integration requests, migrations and upgrades,” Ostrovsky said. “Augment has both the best team and recipe for empowering programmers and their organizations to deliver high-quality software quicker.”

Ostrovsky spent nearly seven years at Microsoft before joining Pure Storage, a startup developing flash data storage hardware and software products, as a founding engineer. While at Microsoft, Ostrovsky worked on components of Midori, a next-generation operating system the company never released but whose concepts have made their way into other Microsoft projects over the last decade.

In 2022, Ostrovsky and Guy Gur-Ari, previously an AI research scientist at Google, teamed up to create Augment’s MVP. To fill out the startup’s executive ranks, Ostrovsky and Gur-Ari brought on Scott Dietzen, ex-CEO of Pure Storage, and Dion Almaer, formerly a Google engineering director and a VP of engineering at Shopify.

Augment remains a strangely hush-hush operation.

In our conversation, Ostrovsky wasn’t willing to say much about the user experience or even the generative AI models driving Augment’s features (whatever they may be) — save that Augment is using fine-tuned “industry leading” open models of some sort.

He did say how Augment plans to make money: standard software-as-a-service subscriptions. Pricing and other details will be revealed later this year, Ostrovsky added, closer to Augment’s planned GA release.

“Our funding provides many years of runway to continue to build what we believe to be the best team in enterprise AI,” he said. “We’re accelerating product development and building out Augment’s product, engineering and go-to-market functions as the company gears up for rapid growth.”

Rapid growth is perhaps the best shot Augment has at making waves in an increasingly cutthroat industry.

Practically every tech giant offers its own version of an AI coding assistant. Microsoft has GitHub Copilot, which is by far the firmest entrenched with over 1.3 million paying individual and 50,000 enterprise customers as of February. Amazon has AWS’ CodeWhisperer. And Google has Gemini Code Assist, recently rebranded from Duet AI for Developers.

Elsewhere, there’s a torrent of coding assistant startups — Magic, Tabnine, Codegen, Refact, TabbyML, Sweep, Laredo and Cognition (which reportedly just raised $175 million) to name a few. Harness and JetBrains, which developed the Kotlin programming language, recently released their own. So did Sentry (albeit with more of a cybersecurity bent).

Can they all — plus Augment now — do business harmoniously together? It seems unlikely. Eye-watering compute costs alone make the AI coding assistant business a challenging one to maintain. Overruns related to training and serving models forced generative AI coding startup Kite to shut down in December 2022. Even Copilot loses money — to the tune of ~$20 a month to ~$80 a month per user, according to The Wall Street Journal.

Ostrovsky implies that there’s momentum behind Augment already — he claims that “hundreds” of software developers across “dozens” of companies including payment startup Keeta (which is also Eric Schmidt-backed) are using Augment in early access. But will the uptake sustain? That’s the million-dollar question, indeed.

I also wonder if Augment has made any steps toward solving the technical setbacks plaguing code-generating AI, particularly around vulnerabilities.

An analysis by GitClear, the developer of the code analytics tool of the same name, found that coding assistants are resulting in more mistaken code being pushed to codebases, creating headaches for software maintainers. Security researchers have warned that generative coding tools tools can amplify existing bugs and exploits in projects. And Stanford researchers have found that developers who accept code recommendations from AI assistants tend to produce less secure code.

Then there’s copyright to worry about.

Augment’s models were undoubtedly trained on publicly available data, like all generative AI models — some of which may’ve been copyrighted or under a restrictive license. Some vendors have argued that fair use doctrine shields them from copyright claims while at the same time rolling out tools to mitigate potential infringement. But that hasn’t stopped coders from filing class action lawsuits over what they allege are open licensing and IP violations.

To all this, Ostrovsky says: “Current AI coding assistants don’t adequately understand the programmer’s intent, improve software quality nor facilitate team productivity, and they don’t properly protect intellectual property. Augment’s engineering team boasts deep AI and systems expertise. We’re poised to bring AI coding assistance innovations to developers and software teams.”

Augment, which is based in Palo Alto, has ~50 employees at present; Ostrovsky expects that number to double by the end of the year.

Nvidia is acquiring Run:ai, a startup that makes it easier for developers and operations teams to manage and optimize their AI infrastructure, for an undisclosed sum.

Ctech reported earlier this morning the companies were in “advanced negotiations” that could see Nvidia pay upwards of $1 billion for Run:ai. Evidently, those negotiations went well.

Nvidia says that it’ll continue to offer Run:ai’s products “under the same business model” for the immediate future, and invest in Run:ai’s product roadmap as part of Nvidia’s DGX Cloud AI platform.

“Run:ai has been a close collaborator with Nvidia since 2020 and we share a passion for helping our customers make the most of their infrastructure,” Omri Geller, Run:ai’s co-founder and CEO, said in a statement. “We’re thrilled to join Nvidia and look forward to continuing our journey together.”