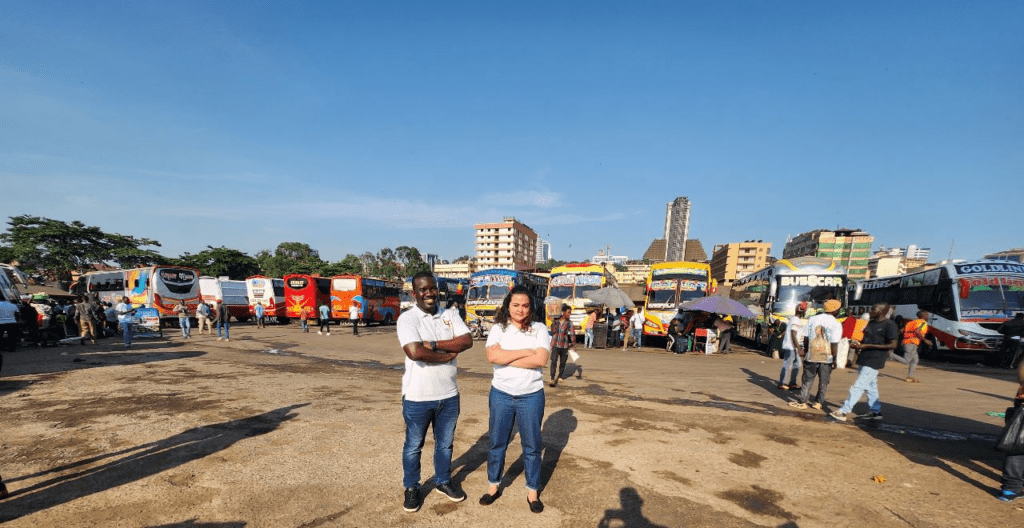

Kenya-based B2B2C mobility marketplace BuuPass has raised $1.30 million in a pre-seed round led by Founders Factory Africa. The round also saw participation from Google Black Founders Fund, Gullit VC, Five35 VC, Artha India Ventures, FrontEnd Ventures, Adaverse, Renew Capital, Changecom, XA Network, Ajim Capital, and Daba Finance. Funds raised will get used for expanding into East African markets with a special focus on Kenya and Uganda since the Company aims to increase its market share in these markets. This is the first institutional round raised by BuuPass, which previously received $1 million in grants from Bill Clinton-backed Hult Prize.

Sonia Kabra, Co-founder, and Co-CEO, BuuPass, says, “Coming from a small town in India, traveling to larger cities meant long queues and endless wait times for buses or trains. Witnessing the impact of online travel-booking platforms like redBus and IRCTC, I co-founded BuuPass to build the digital infrastructure for transport in Africa. With the support of our investors, we’re thrilled to scale our product and expand our reach, making transportation more seamless and accessible. This funding will enable us to expand our footprint in Kenya and Uganda. Our goal is to create a comprehensive continent-wide network of interconnected transport that make traveling hassle-free for all.”

Founded in 2016, BuuPass follows a B2B2C approach and provides fleet owners with a full-stack bus management system (‘BMS’) for managing their operations, inventory, and sales. The BMS also includes a point-of-sale solution to capture bookings and provides access to a parcel management module. BuuPass helps customers search, compare and book their tickets across different channels through their marketplace, like websites, apps, and USSD codes.

Anirudh A Damani, Director of Artha India Ventures, says, “The African continent is fast emerging as a startup innovation hotbed. The African ecosystem is churning out many unique investment opportunities that will disrupt the market across sectors. Artha India Ventures is taking an early bet to back potential category winners with immense promise. In that vein, BuuPass has taken the lead in building digital rails for Africa’s intercity transport infrastructure. Based on Artha’s success in navigating this digitization play in India, we are confident that BuuPass will grow rapidly into a market leader.”

BuuPass has over 1,200 vehicles registered on its platform from over 25 bus companies. Through its partnership with Safaricom (or M-Pesa), the Company is the sole technology provider for online railway ticket booking in Kenya and generated a GMV of $30 million in CY 2022. It currently processes ~12,000 transactions daily.

Wyclife Omondi, Co-Founder & Co-CEO, BuuPass, says, “Over 9 million travelers have saved time and money by buying their tickets from the comfort of their homes. Additionally, our bus operators have seen a significant decrease in cash leakages and increased revenue from online bookings. 80% of our clients come through referrals, demonstrating that our focus on customer satisfaction is yielding fruit. We can customize the technology for most businesses, give on-demand support, and provide USSD functionality.”

Mr. Akshay Grover, Group CEO of Cellulant and potential payments partner for BuuPass said, “At Cellulant, I have seen the importance of building digital infrastructure to empower and grow businesses. Therefore, the opportunity to invest in a company like BuuPass, which is digitizing the $40 billion intercity transport industry, was super exciting. Both Sonia and Wyclife are outstanding founders with an excellent track record of execution, and together, we can build strong partnerships within the African ecosystem. Further, I am delighted to partner with Artha in our second investment in Africa.”

About BuuPass

BuuPass is Kenya’s largest online bus, train, and flight ticketing platform that has transformed bus travel in the country by bringing ease and convenience to millions of Kenyan travelers. They work with the country’s leading bus, train, and flight operators to bring you the convenience of digital bookings.

About Artha India Ventures

Artha India Ventures (‘AIV’) is a distinguished family office founded in 2012, with a diverse investment portfolio encompassing renewables, leasing, and institutional funds. AIV manages over ₹800+ crores in third-party capital and has invested in 80+ high-performing startups across India, the USA, Israel, and Africa, including renowned companies such as OYO, Purplle, LeverageEdu, Tala, IconBuild, Rapido, Coutloot, Chai Break, Karza Technologies, Stay Vista, Mobilewalla, and Exotel. In addition, the AIV currently operates a 10+ MW renewable energy portfolio and leases more than 100 cars, demonstrating its dedication to sustainable growth and business development.

The AIV-promoted Artha Select Fund (‘ASF’) has recently gained recognition as a leading fund in Bain & Company’s / IVCA’s 2023 Report on the Indian Venture Capital ecosystem.