BlackBuck is backed by the likes of Accel India, Quickroutes, and Peak XV Partners

Accel India is the biggest shareholder of the startup, with 17.07% stake. Flipkart’s subsidiary Quickroutes International holds 12.97% stake in the unicorn

The logistics startup’s IPO will comprise a fresh issue of shares worth INR 550 Cr and an OFS component of up to 2.16 Cr shares

Last week, logistics unicorn BlackBuck

According to the startup’s draft red herring prospectus (DRHP), its IPO will comprise a fresh issue of shares worth INR 550 Cr and an offer for sale (OFS) component of up to 2.16 Cr shares.

The Flipkart-backed startup aims to deploy INR 140 Cr from the IPO proceeds in its non-banking financial company (NBFC) subsidiary BlackBuck Finserv. However, the largest chunk of capital, INR 200 Cr, will be utilised for sales and marketing activities. Besides, the startup will also spend on product development and general corporate purposes.

Founded in 2015 by Rajesh Kumar Naidu Yabaji, Chanakya Hridaya and Ramasubramanian Balasubramaniam, BlackBuck operates an online B2B marketplace for inter-city full truck load (FTL) transportation. Its platform provides payment options, loads marketplace, and vehicle financing services to truck operators in the country.

It claims to be the largest online trucking platform in India, accounting for 27% market share of all truck operators.

The startup is backed by the likes of Accel India, Flipkart’s subsidiary Quickroutes, and Peak XV Partners.

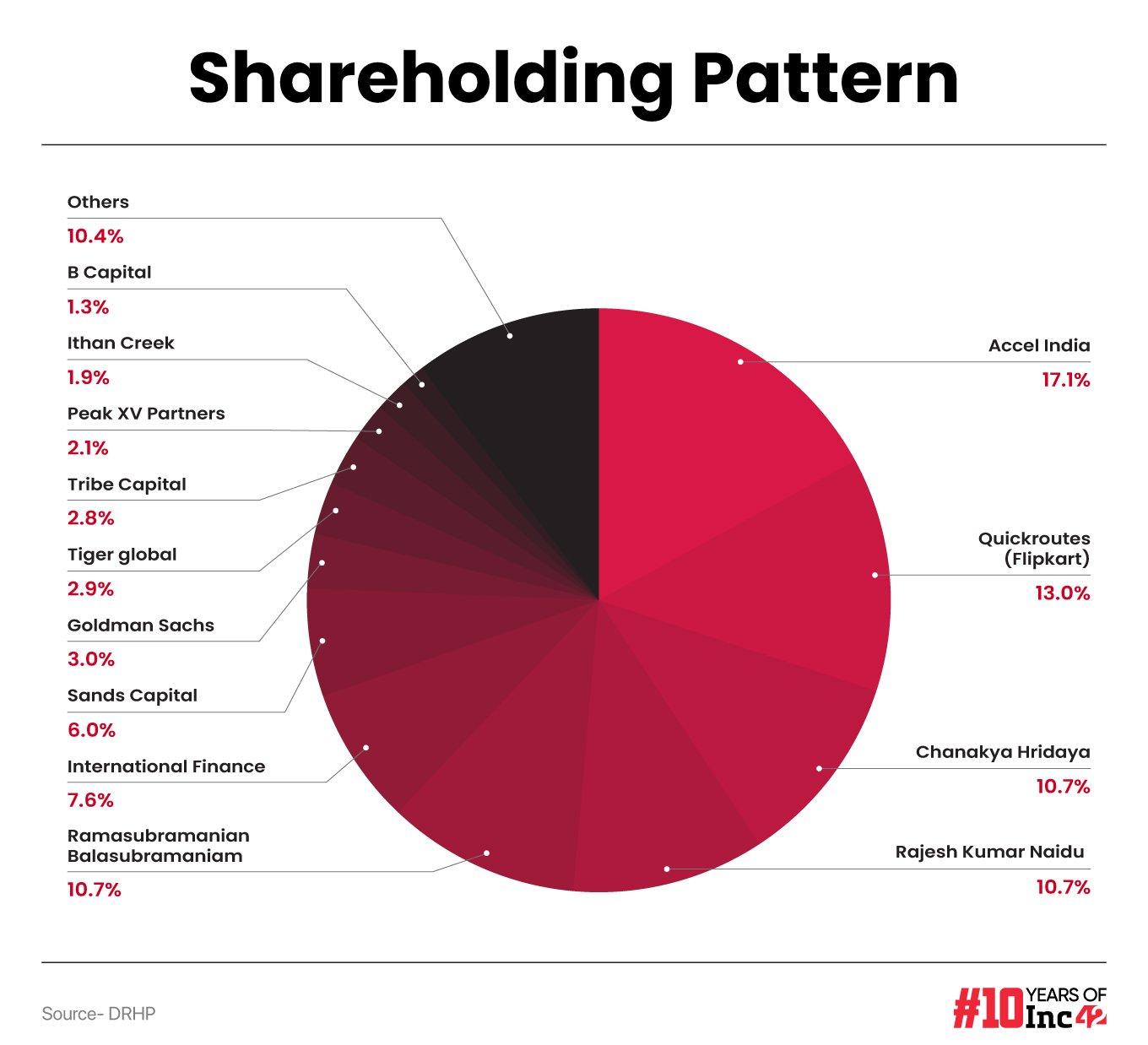

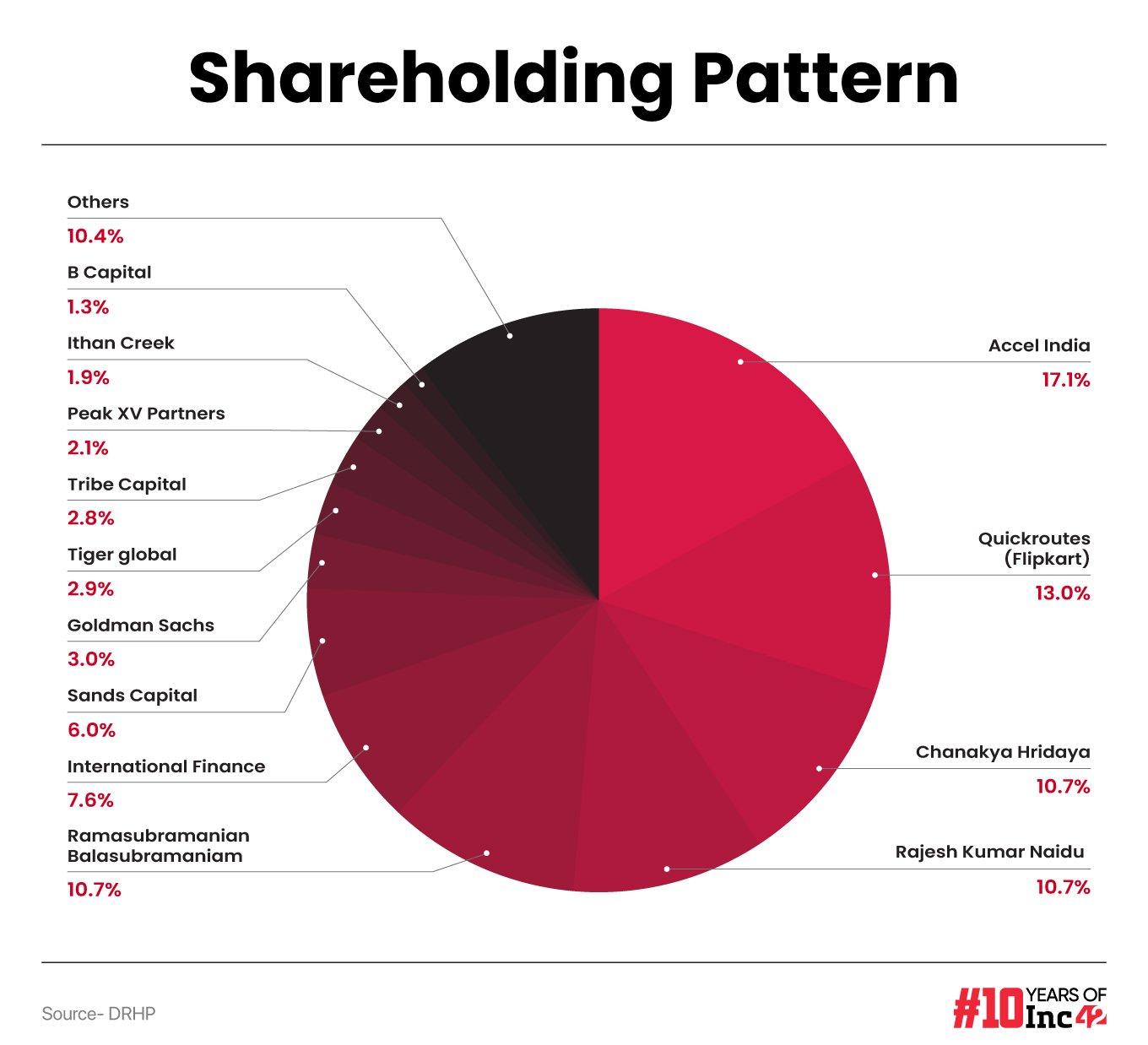

A Look At BlackBuck’s Cap Table

The company’s oldest backer, venture capital firm Accel India, is the leading stakeholder in the company. It holds a 17.07% stake, or 2.83 Cr shares, in the startup. Under its Accel India IV fund, the firm owns 14.06% stake in the company, while Accel Growth Fund V holds 3.01% stake.

The VC firm is the only shareholder with a stake in excess of 15%. It is pertinent to note that it co-led the startup’s $80 Mn Series D round in 2019.

The second largest stakeholder in the startup is Flipkart’s subsidiary Quickroutes International, which holds 12.97% stake. Flipkart first invested in the startup in 2015, when it participated in its $25 Mn Series B round.

The three founders come in next in terms of shareholding. While Hridaya owns 10.68% stake in Blackbuck, Yabaji and Balasubramaniam hold 10.67% stake each.

International Finance Corporation (IFC), Sands Capital, Goldman Sachs (GSAM Holdings), Tiger Global, Tribe Capital, Peak XV partners, and Cayman (Ithan Creek Master Investors) are the other prominent stakeholders in the company.

The Decision-Makers At BlackBuck

The three founders, Yabaji, Balasubramaniam, and Hridaya, are also the promoters of BlackBuck.

Out of the three, Yabaji is the chairman, managing director and CEO of Blackbuck. Balasubramaniam and Hridaya act as Head-New Initiatives and COO, respectively, besides being the executive directors of the startup.

BlackBuck’s board also has five non-executive independent directors. The list includes Jana Capital MD and CEO Rajamani Muthuchamy, Kinara Capital founder and CEO Hardika Shah, Spinny CEO Niraj Singh, Zomato chairman and independent director Kaushik Dutta, and Accel partner Anand Daniel.

The startup’s operations are driven by a team of 12 members, led by CEO Yabaji. Here are the brief profiles of the team.

Rajesh Kumar Naidu Yabaji – MD & CEO

After completing a four-year stint leading the technical function of ITC’s foods division business, the IIT Kharagpur graduate linked up with his two cofounders to set up BlackBuck in 2015.

Chanakya Hridaya – COO

Like Yabaji, Hridaya also completed his education from IIT Kharagpur. He has a bachelor’s degree in technology in mechanical engineering and a master’s degree in manufacturing science and engineering. Prior to starting BlackBuck, he worked as an assistant manager in the supply chain division of ITC for about two years.

Ramasubramaniam Balasubramaniam – Head of New Initiatives

Balasubramaniam holds a post graduate diploma in business management. He has about 27 years of experience. Besides BlackBuck, he is also associated with supply chain company Miebach Consulting India.

Satyakam G N – CFO

Chartered accountant Satyakam Naik joined the logistics major in 2018 as a business finance manager. He climbed the ranks to become the chief financial officer of the startup during his tenure. According to his LinkedIn profile, his current role encompasses managing all functions of finance, including accounting, business finance, and treasury. He has had prior stints in NTT Data Services and Tesco HSC.

Thejasvi Bhat – CTO

Bhat joined the startup in 2020 after nearly three engagements with Swiggy, where he led the foodtech major’s engineering function as well as growth and new initiatives. He also worked with HolidayIQ.com, snapThings, among others, during his near two-decade long career.

Manish Singh – Chief Product Officer

The IIT Kanpur graduate joined the startup in 2018 as its head of management after completing a near four-year stint with ride-hailing major Ola. He also worked with software giant Infosys and IDS Software in his two-decade long career. Besides, he cofounded two startups – Gazoi Store and CAT India Online.

Shilpi Pandey – Chief People Officer

The XLRI Jamshedpur alumnus joined the startup in 2016 and has been supervising the overall strategy formulation and management of BlackBuck’s human resources operations since then. She also worked in the people functions of Common Floor, Photon Interactive, and Aditya Birla’s Madura Fashion and Lifestyle in her 21-year-long HR career.

Supil Chachan – Business Head, Marketplace

Chachan currently serves as the vice president of freight marketplace for the startup, having joined BlackBuck in 2018. Earlier, the IIM Bangalore alumni worked with Jindal Stainless, Tata Power Solar Systems, Tata Administrative Services, among others.

Chandra Prakash – National Sales Head

Prakash joined the startup as a senior VP – national sales head, market channel, after a four-year stint with Ola as its VP. He has also worked with Airtel, Tata Teleservices, and HUL in his 23-year-long career.

Prakash Bajirao Mali – National Head-Vehicle Finance

Prior to joining BlackBuck in 2022, Mali worked with financial institutions like IndusInd Bank and Kotak Mahindra Bank Limited in the field of sales and business development in commercial vehicle loans.

Barun Pandey – Company Secretary and Legal Head

Pandey joined the company only last month as its company secretary and compliance officer. He is a company secretary from the Institute of Company Secretaries of India, and has over 8 years of work experience.