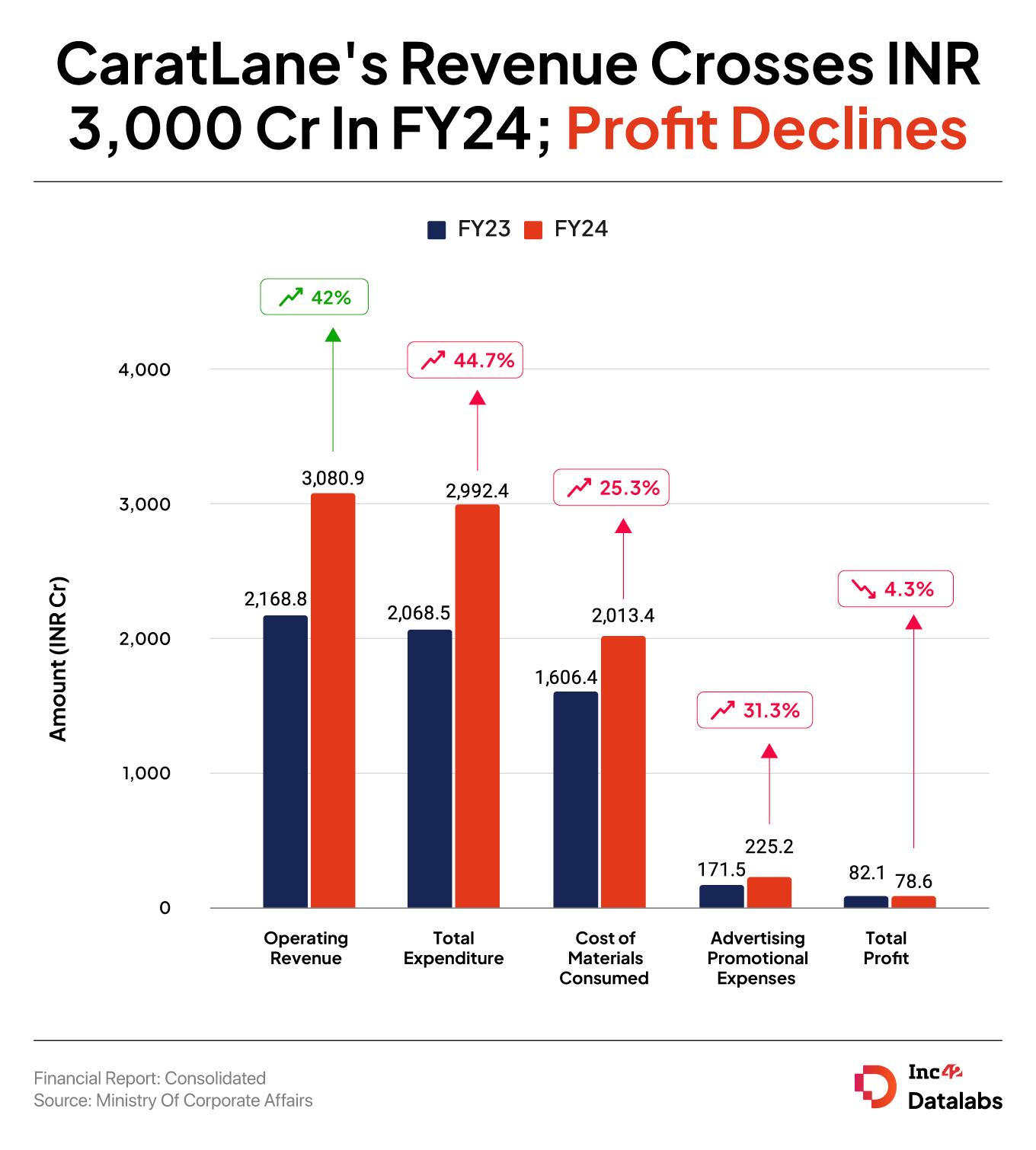

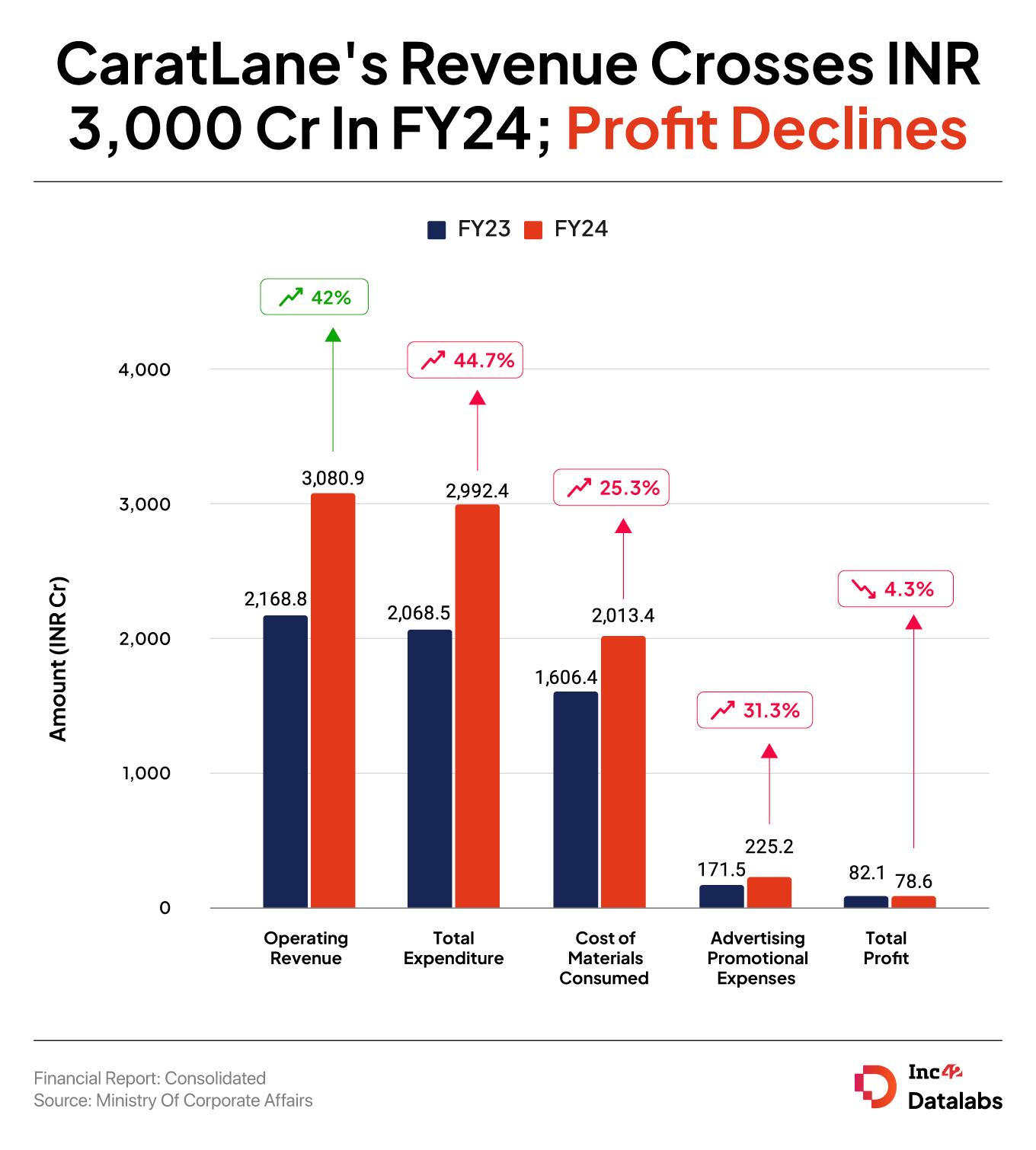

CaratLane’s operating revenue rose 41% to INR 3,080 Cr in FY24 from INR 2,168 Cr in the previous fiscal year

However, bottom line took a hit on rise in advertising expenses and “miscellaneous” expenses

The Titan-owned company’s total expenditure in FY24 jumped over 44% to INR 2,992 Cr from INR 2,068 Cr in FY23

Tata-owned omnichannel jewellery startup CaratLane’s operating revenue crossed the INR 3,000 Cr mark in the fiscal year 2023-24 (FY24). Its revenue from operations rose 41% to INR 3,080 Cr during the year from INR 2,168 Cr in FY23.

Founded in 2008 by Mithun Sacheti and Srinivasa Gopalan, Caratlane

Including other income, its total revenue rose nearly 42% year-on-year (YoY) to INR 3,106 Cr in the fiscal year ended March 2024.

However, its net profit declined nearly 5% to INR 78.59 Cr in FY24 from INR 82.08 Cr in the previous fiscal year due to rise in advertising and “miscellaneous” expenses during the year under review.

It is pertinent to note that CaratLane turned into a wholly-owned subsidiary of Tata-owned Titan in FY24. Titan acquired an additional 27.18% stake in CaratLane for INR 4,621 Cr at nearly INR 17,000 Cr valuation in August 2023, increasing its stake in the startup to over 99%.

Later, Titan bought the remaining 0.36% stake in CaratLane for INR 60.08 Cr in February 2024.

As per Titan’s financial results, CaratLane reported a total income of INR 754 Cr in Q1 FY25, which was an increase of 18% from INR 639 Cr in the year-ago period.

Zooming Into CaratLane’s Expenses

CaratLane’s total expenditure in FY24 zoomed over 44% to nearly INR 2,992 Cr in FY24 from INR 2,068 Cr in FY23.

Cost Of Materials Consumed: The expenditure under this head jumped 25% to INR 2,013.45 Cr in the fiscal year ended March 2024 from INR 1,606.42 Cr in FY23.

Purchases Of Stock-In-Trade: CaratLane saw its expenditures related to purchase of stock-in trade jump 46.8% to INR 243.59 Cr in FY24 from INR 165.93 Cr in the previous fiscal year.

Employee Benefit Expense: Employee costs jumped over 25% to INR 170.35 Cr during the year under review from INR 135.43 Cr in FY23.

Other Expenses: Expenditure under this head rose 32% YoY to INR 579.75 Cr during the fiscal year ended March 2024. It included advertisement and promotional expenses, legal professional charges, miscellaneous expenditures, among others.

- Advertisement & Promotional Expenses: CaratLane’s spending on advertising and marketing expenses zoomed 31% to INR 225.2 Cr in FY24 from INR 171.54 Cr in the previous fiscal year.

- Legal Professional Costs: Expenditure under this head rose to INR 39.34 Cr from INR 36.41 Cr in FY23.

- Miscellaneous Expenses: The cost under this head surged 42% to INR 239.86 Cr during the year under review from INR 168.62 in the fiscal year ended March 2023. However, the company did not give a breakdown of these expenses.

CaratLane competes against the likes of legacy giants such as Kalyan Jewellers and Malabar Gold, as well as new-age brands such as BlueStone and GIVA. Just days ago, Bluestone raised INR 900 Cr as part of its pre-IPO round that saw participation from Peak XV Partners, Prosus, Steadview Capital, Think Investments and Pratithi Investments through a primary and secondary share sale.