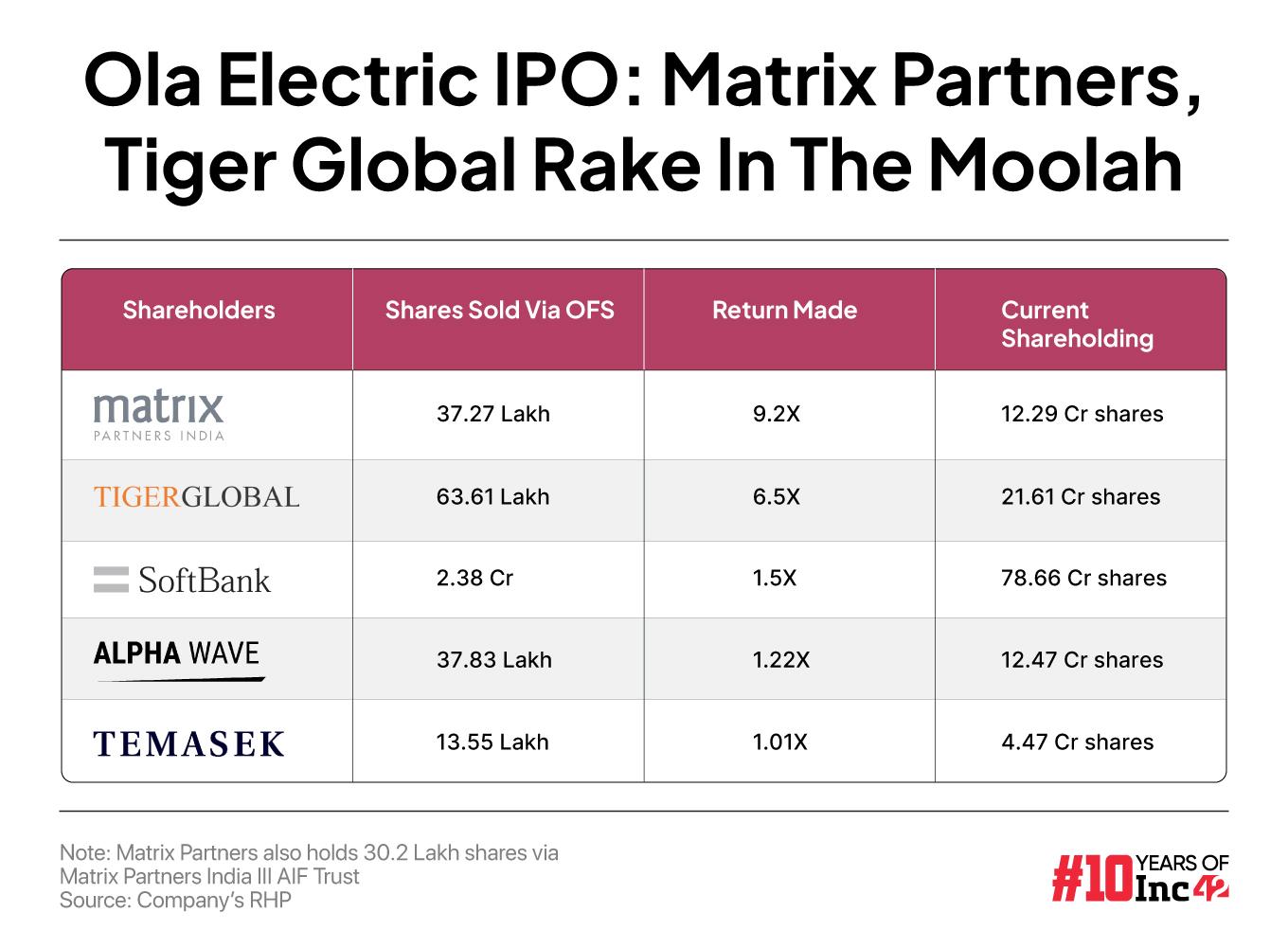

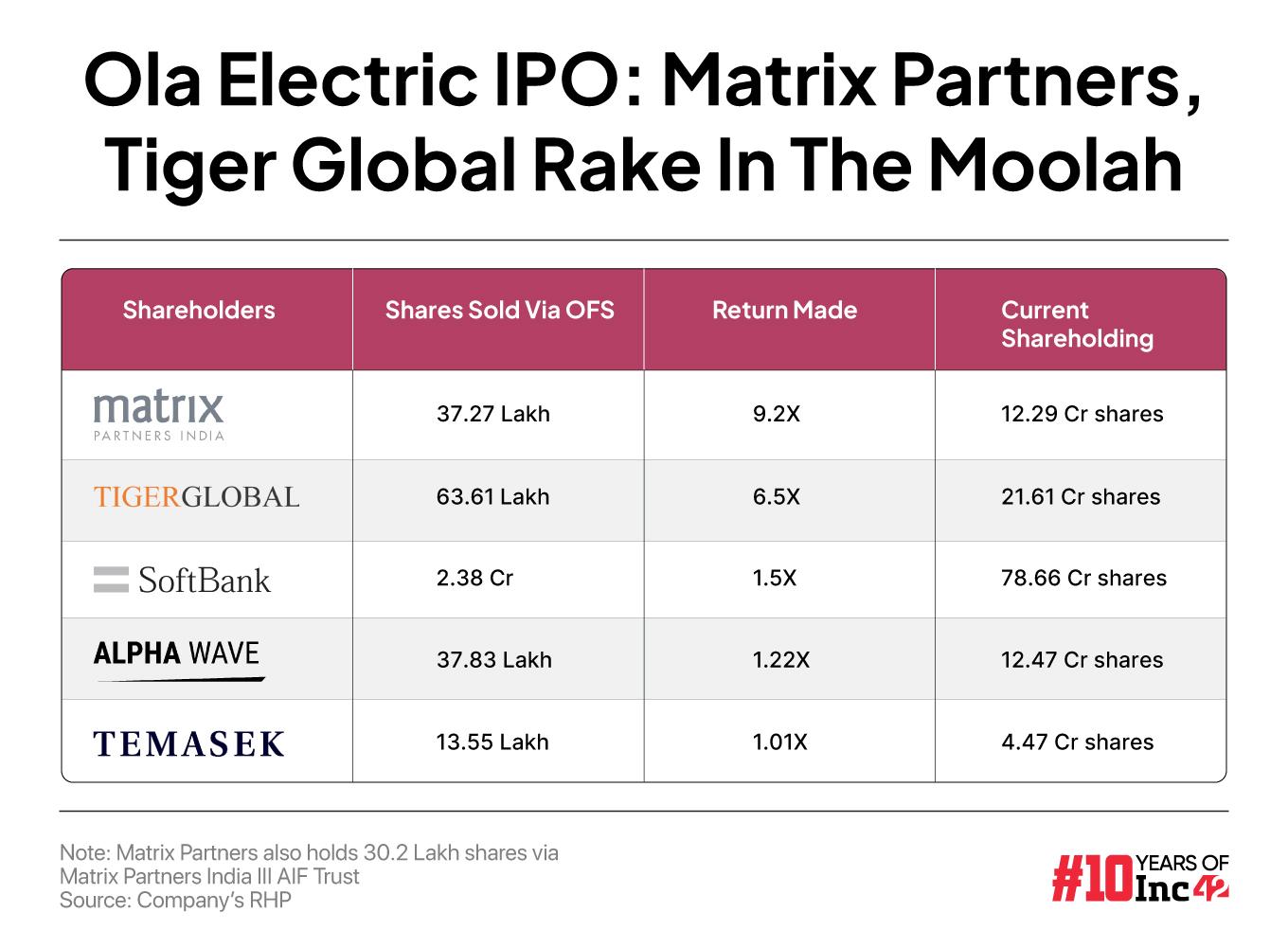

Matrix Partners India Investments III, LLC held 12.66 Cr shares in the company at an weighted average price of INR 8.22 per equity share. It is selling 37.27 Lakh shares worth around INR 28.33 Cr as part of OFS

Tiger Global, via its Internet Fund III Pte Ltd, is also selling almost 63.61 Lakh shares worth INR 48.34 Cr

Ahead of its listing, Ola Electric’s public issues received 4.27X subscriptions, lower that Street estimates, which suggests a flat or dicounted listing, as per an analyst

With the much-awaited public listing of two-wheeler EV major Ola Electric

Matrix Partners (rebranded as Z47) via Matrix Partners India Investments III, LLC held 12.66 Cr shares in the company at an weighted average price of INR 8.22 per equity share. As part of Ola Electric’s offer for sale (OFS) component during its initial public offering (IPO), the fund is selling 37.27 Lakh shares worth around INR 28.33 Cr. This would translate to a 9.2X return on its investment towards these shares.

It is pertinent to note that Matrix Partners also holds 30.2 Lakh shares of the EV startup via Matrix Partners India III AIF Trust.

Ola Electric’s IPO comprised a fresh issue of shares worth INR 5,500 Cr and an OFS component of 8.49 Cr shares. The company had set a price band of 72-76 per equity share.

At the upper end of the price band, the EV manufacturer will raise over INR 6,145.6 Cr in total.

As part of the OFS, Tiger Global, via its Internet Fund III Pte Ltd, is also selling almost 63.61 Lakh shares worth INR 48.34 Cr. The fund had invested around INR 7.44 Cr to buy these shares of Ola Electric, which would now give it a 6.5X return.

Matrix Partners and Tiger Global first co-led a $56 Mn (INR 400 Cr) round of the startup in 2019. Following this, it turned into a unicorn in the same year after raising $250 Mn in its Series B funding round from SoftBank.

Among the other selling shareholders in the IPO is Ola Electric founder and promoter Bhavish Aggarwal, who is expected to make INR 288.15 Cr by selling 3.79 Cr shares. Aggarwal will continue to hold 135.8 Cr equity shares of the company after the listing.

Prior to the offer, CEO and founder Aggarwal held a majority 36.94% stake in the startup.

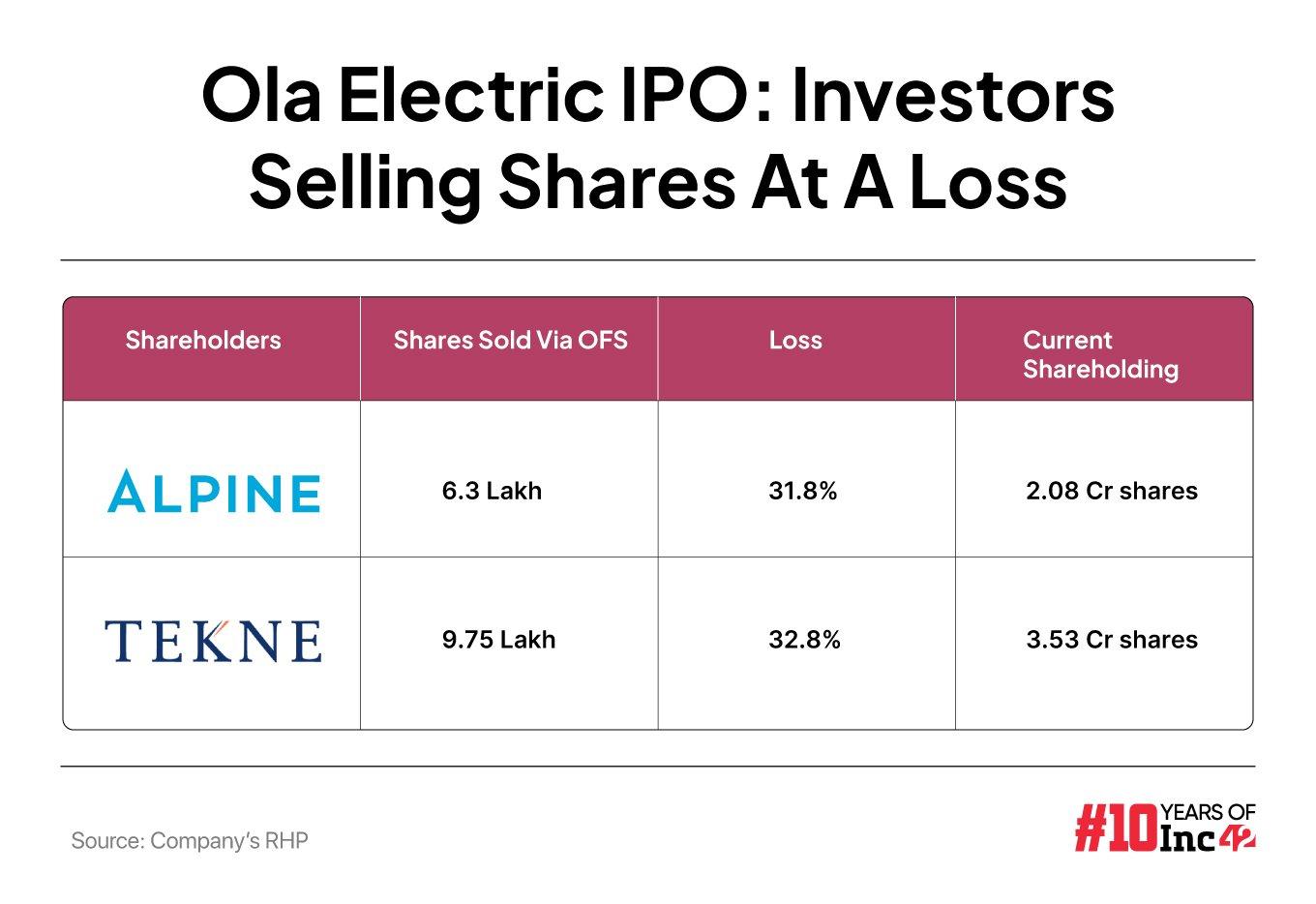

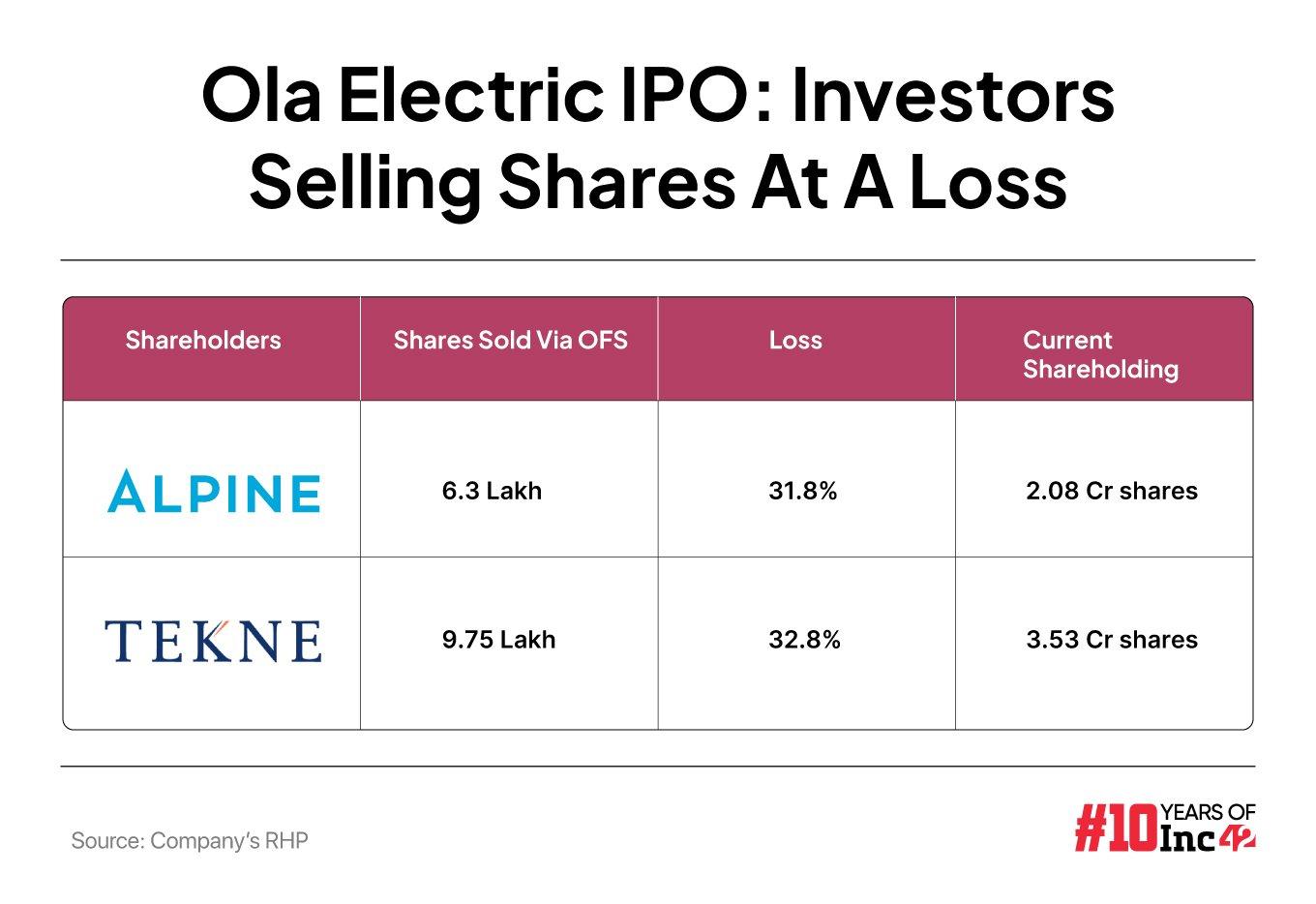

While some of the selling shareholders are making massive gains by offloading parts of their stakes in the startup, most are settling for minimal returns. Some investors are even set to make losses.

For instance, SoftBank via SVF II Ostrich (DE) LLC sold 2.38 Cr equity shares out of 81.04 Cr shares it held. The selling shares were worth about INR 181.31 Cr as against its investment of INR 122.55 Cr to acquire those shares, translating to a 1.5X return.

On the other hand, Alpha Wave Venture is set to make a 1.22X return on its investment by selling shares worth INR 28.75 Cr.

MacRitchie Investments (Temasek) and Ashna Advisors are set to make 1.01X and 1.07X returns, respectively, on their investments in Ola Electric.

Meanwhile, Tekne Private Ventures is set to make a 32.8% gain on its investment in the startup, while Alpine Opportunity Fund sold the shares at a 31.8% loss.

Tekne and Alpine had acquired shares of Ola Electric at an weighted average cost of INR 113.12 and INR 111.51, respectively. However, the upper limit of Ola Electric’s IPO was INR 76 apiece.

It is worth noting in this regard that Ola Electric is going public at a $4 Bn valuation, which is a sharp 25% discount to its $5.4 Bn valuation during its last funding round in September 2023.

Initially, as per multiple reports, the company was eyeing a valuation of around $10 Bn for its IPO, which analysts had deemed as unsustainable. The current valuation is also a sharp cut from the $7 Bn valuation Ola Electric was recently looking at.

While reports said that the company lowered its valuation following a pushback from its investors, founder Aggarwal said during its IPO conference last week that the startup decided to price the public issue “attractively” so that the country’s investor community can become a part of Ola Electric’s story, which has a large opportunity to grow.

A Quick Overview Of The IPO

Ola Electric’s public issue opened for retail subscription on August 2 and closed on August 6, witnessing a strong interest from qualified institutional buyers (QIBs).

The portion allotted to the QIBs was subscribed 5.31X, while retail investors’ quota was subscribed 3.92X. Non-institutional investors’ (NIIs) portion was subscribed 2.4X.

However, the total subscription of 4.27X was quite low compared to the IPO response received by other startups which listed recently on the exchanges. For instance, traveltech major ixigo’s public issue was oversubscribed 98.34X, coworking startup Awfis received 11.4X subscription, and insurtech unicorn Go Digit’s public issue was subscribed 9.6X.

Noting that the “much-hyped” IPO saw lower demand than the Street estimates, Prashanth Tapse, senior VP (research) at Mehta Equities, said there is a possibility that shares of Ola Electric list on the exchanges at the issue price or at a 5-10% discount.

“Discounted listing would be justified on the back of weak financials and risk of negative net cash flows in the past, and future negative cash flows. Allotted investors should understand the risk of negative net cash flows in the past and future negative cash flows, which could adversely impact its consolidated financial position post listing,” said Tapse.

“Considering all the factors, we advise only risk-taking investors to continue to hold with a minimum holding period of two-three years,” he added. “The long-term story is intact but we may see a lot of ups and downs in the short term.”

Despite the public market’s inhibition towards loss-making entities, Ola Electric is set to go public with heavy cash burn and hardly any clarity on its path to profitability. Multiple risks such as the changes in government’s subsidies, changes in consumer demand for its escooters, and its increasing investment continue to overhang.

Its net loss widened 7.6% year-on-year (YoY) to INR 1,584.4 Cr in FY24 while operating revenue jumped over 90% to INR 5,009.8 Cr.

InCred Equities recently said that it’s constructive on the IPO, however, quarterly volatility from policy and EV cell plant delay penalty risk would limit Ola Electric’s stock price gains.

Meanwhile, LKP Securities gave a ‘subscription’ rating for the public issue with a long-term perspective.