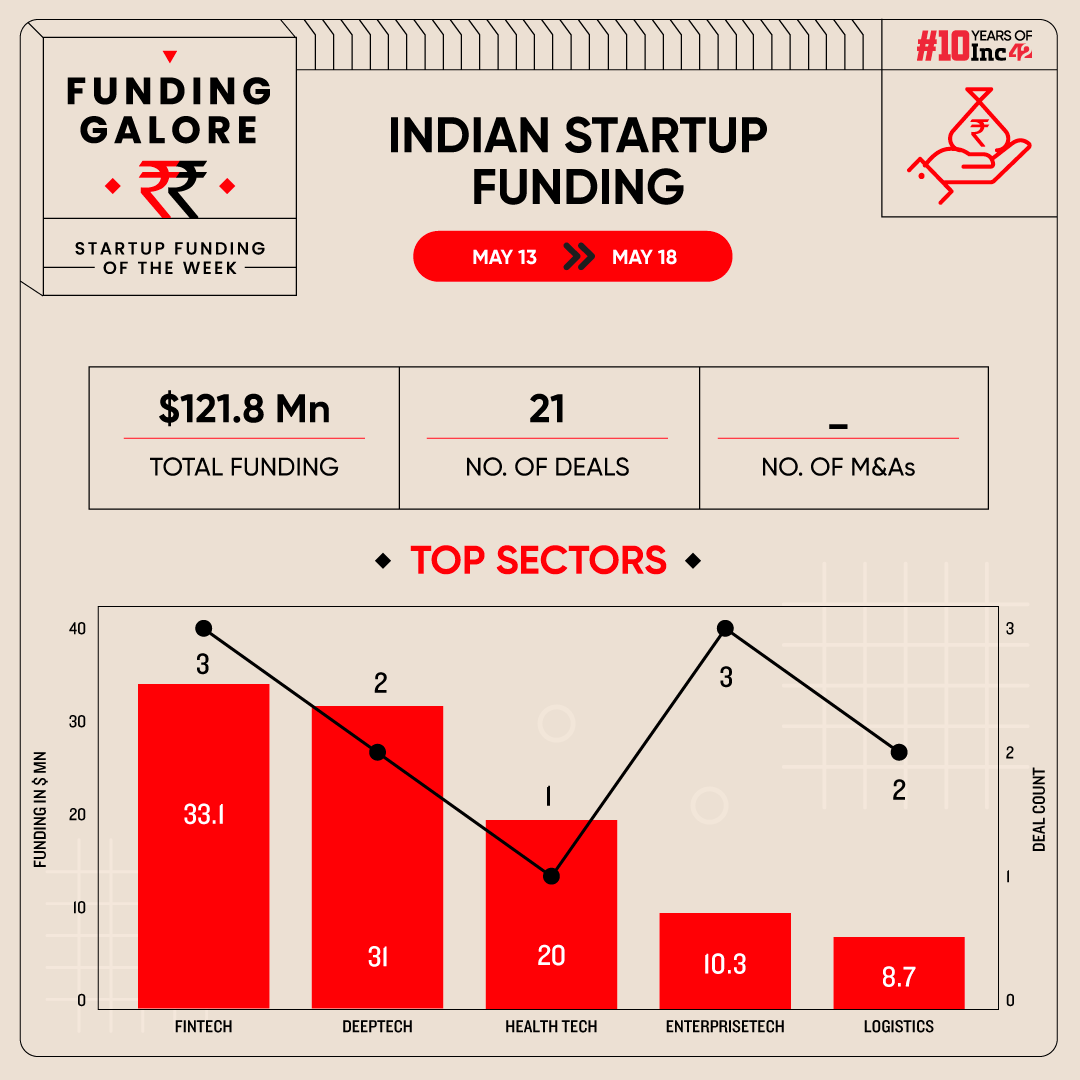

Indian startups cumulatively raised $121.8 Mn across 21 deals between May 13 and 18, down 45% from last week

Fintech regained its dominance in weekly funding trends, with startups in the sector raising $33.1 Mn across three deals

Seed funding continued to tumble down this week as well, with startups at this stage securing $3.5 Mn this week

Funding activity in the world’s third largest startup ecosystem saw a decline for the second consecutive week in May. Indian startups raised $121.8 Mn across 21 deals between May 13 and 18, a 45% decline from last week’s $220.2 Mn raised across the same number of deals.

Funding Galore: Indian Startup Funding Of The Week [May 13 – May 18]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 17 May 2024 | Propelld | Fintech | Lendingtech | B2C | $25 Mn | Debt | Credit Saison India, AU Small Finance Bank, InCred Financial Services, Northern Arc Capital | – |

| 15 May 2024 | RED.Health | Healthtech | Healthcare Services | B2C-B2B | $20 Mn | Series B | Jungle Ventures,HealthQuad, HealthX, Alteria Capital | Jungle Ventures |

| 13 May 2024 | Dhaksha Unmanned Systems | Deeptech | Dronetech | B2B-B2C | $18 Mn | – | Coromandel International Limited | Coromandel International Limited |

| 14 May 2024 | Niqo Robotics | Deeptech | IoT & Hardware | B2B | $13 Mn | Series B | Bidra Innovation Ventures, Fulcrum Global Capital, Omnivore | Bidra Innovation Ventures |

| 14 May 2024 | Rupeek | Fintech | Lendingtech | B2C | $6.1 Mn | – | One Large Value Fund, BlackSoil | – |

| 14 May 2024 | Celcius | Logistics | Supply Chain | B2B | $4.7 Mn | pre-Series B | IvyCap Ventures, Mumbai Angels, Caret Capital | IvyCap Ventures |

| 16 May 2024 | SolarSquare | Cleantech | SolarTech | B2B-B2C | $4.2 Mn | – | Zerodha Technology, Abhijeet Pai, Gruhas Proptech, Lowercarbon Capital, Good Capital | – |

| 16 May 2024 | Matel | Cleantech | Electric Vehical | B2B | $4 Mn | Series A | Transition VC, Gruhas, Haresh Abichandani | Transition VC |

| 17 May 2024 | 3SC | Logistics | Supply Chain | B2B | $4 Mn | – | GEF Capital | GEF Capital |

| 14 May 2024 | Highperforrmr.AI | Enterprisetech | Horizontal SaaS | B2B | $3.5 Mn | Seed | Venture Highway, The Neon Fund, DeVC | Venture Highway |

| 17 May 2024 | OTPless | Enterprisetech | Horizontal SaaS | B2B-B2C | $3.5 Mn | Pre-Series A | SIDBI, Venture Highway, FJ Labs, Piper Serica | SIDBI |

| 15 May 2024 | Stupa Sports Analytics | Enterprisetech | Horizontal SaaS | B2B | $3.3 Mn | pre-Series A | Centre Court Capital, PeerCapital | Centre Court Capital, PeerCapital |

| 15 May 2024 | DrinkPrime | Ecommerce | D2C | B2C | $3 Mn | – | SIDBI Venture Capital | SIDBI Venture Capital |

| 16 May 2024 | InstaAstro | Consumer Services | Hyperlocal Serives | B2C | $2.3 Mn | Pre-Series A | Artha Venture Fund, LogX Ventures, Singularity Ventures, InfraRed Capital Partners, Blume Founders Fund, Aloke Bajpai | Artha Venture Fund |

| 14 May 2024 | BimaPay | Fintech | Lendingtech | B2C | $2 Mn | – | LC Nueva Investment Partners | LC Nueva Investment Partners |

| 16 May 2024 | Gramophone | Agritech | Farm Advisory | B2C | $1.8 Mn | – | Info Edge | Info Edge |

| 16 May 2024 | The Betal Leaf | Ecommerce | D2C | B2C | $1.2 Mn | – | Inflection Point Ventures and Venture Catalysts | Inflection Point Ventures and Venture Catalysts |

| 15 May 2024 | Infurnia | Real Estate Tech | Real Estate Services | B2B-B2C | $1.2 Mn | – | Yogesh Chaudhary, Coast to Coast, Greenply, Ozone | Yogesh Chaudhary |

| 13 May 2024 | BEYOBO | Ecommerce | B2B Ecommerce | B2B | $802K | pre-Series A | Indian Angel Network, International Startup Foundation, SAN Angels | Indian Angel Network |

| 16 May 2024 | Stylework | Real Estate Tech | Shared Spaces | B2C | $120K | Series A2 | BizDateUp Technologies | BizDateUp Technologies |

| 15 May 2024 | Sprect | Consumer Services | Hyperlocal Serives | B2C | $60K | Siddarth Shetty | Siddarth Shetty | |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- The week’s biggest cheque was secured by fintech startup Propelld. Buoyed by its $25 Mn fundraise, fintech dominated the funding trend at a sectoral level. Startups in the space raised $33.1 Mn across three deals, the highest number of deals secured at a sectoral level.

- Gruhas Proptech and Venture Highway were the most active investors this week, backing twp startups each.

- Seed funding continued to tumble down this week as well, with startups at this stage securing $3.5 Mn. This was a 58% decline from last week’s $8.4 Mn.

Updates On Indian Startup IPOs

- Making a bumper debut on the bourses, shares of B2B travel portal TBO Tek listed at INR 1,426 on the NSE on Wednesday, a 55% premium over its issue price of INR 920. Similarly, the company listed at INR 1,380 on the BSE at a premium of 50%.

- D2C meat delivery startup Zappfresh has set the ball rolling for its initial public offering (IPO). The Delhi NCR-based company transformed itself into a public company this week, marking its first major milestone in preparation for its public offering.

- Insurtech unicorn Digit’s public issue received 50.76 Cr bids against 5.28 Cr shares on offer, resulting in a 9.6X subscription. Its IPO comprises a fresh issue of shares worth INR 1,125 Cr and an offer for sale (OFS) element of 5.47 Cr shares.

- Global retail giant Walmart is currently exploring the “right time” for the ecommerce giant Flipkart’s IPO. Walmart International president and CEO Kath McLay said that the IPO plans stem from Flipkart’s growth trajectory as the company has been EBITDA positive for the last two quarters.

Other Major Developments Of The Week

- US-based ecommerce giant Amazon has invested $199 Mn in its Indian Arm. Its local subsidiary, Amazon Seller Services Pvt Ltd, has allotted 160 Cr equity shares to at least two overseas entities.

- Early stage venture capitalist fund 9Unicorns has rebranded itself to 100Unicorns and launched its second fund that will have a corpus of $200 Mn and a green shoe option of $100 Mn. The fund will invest in 200 early stage startups.

- Battery-swapping startup Battery Smart is raising $45 Mn as part of a Series B round, which will see participation from Acacia Inclusion, Japan’s MUFG Bank, Blume Ventures, among others.

- Global investment firm KKR is looking to divest a 10% stake in NBFC startup InCred to Japan’s Mizuho Financial Group. The deal is expected to peg the fintech startup’s valuation 30-40% higher than its last valuation of $1.2 Bn.

- Enterprise tech startup Orbod is selling its AI platform focussed on the banking, financial services and insurance (BFSI) sector, SuperScan, to listed fintech company Niyogin Fintech Ltd. Niyogin’s board has approved signing definitive agreements to acquire SuperScan.

- London-based private equity firm Apax Partners is mulling investments in Indian pharmaceuticals, consumer, and consumer derivative markets. The firm has deployed a India-focused team to scout buyout opportunities and is also working on multiple deals at different stages across sectors.

- After launching an INR 200 Cr Category I Alternative Investment Fund, angel investing platform BizDateUp Technologies bought a 20% stake in waste management startup Duro Green for an undisclosed amount.

- With an eye on beefing up its AI investments in India, Japanese conglomerate SoftBank is now mulling investing in Indian data centre and industrial robotics companies.