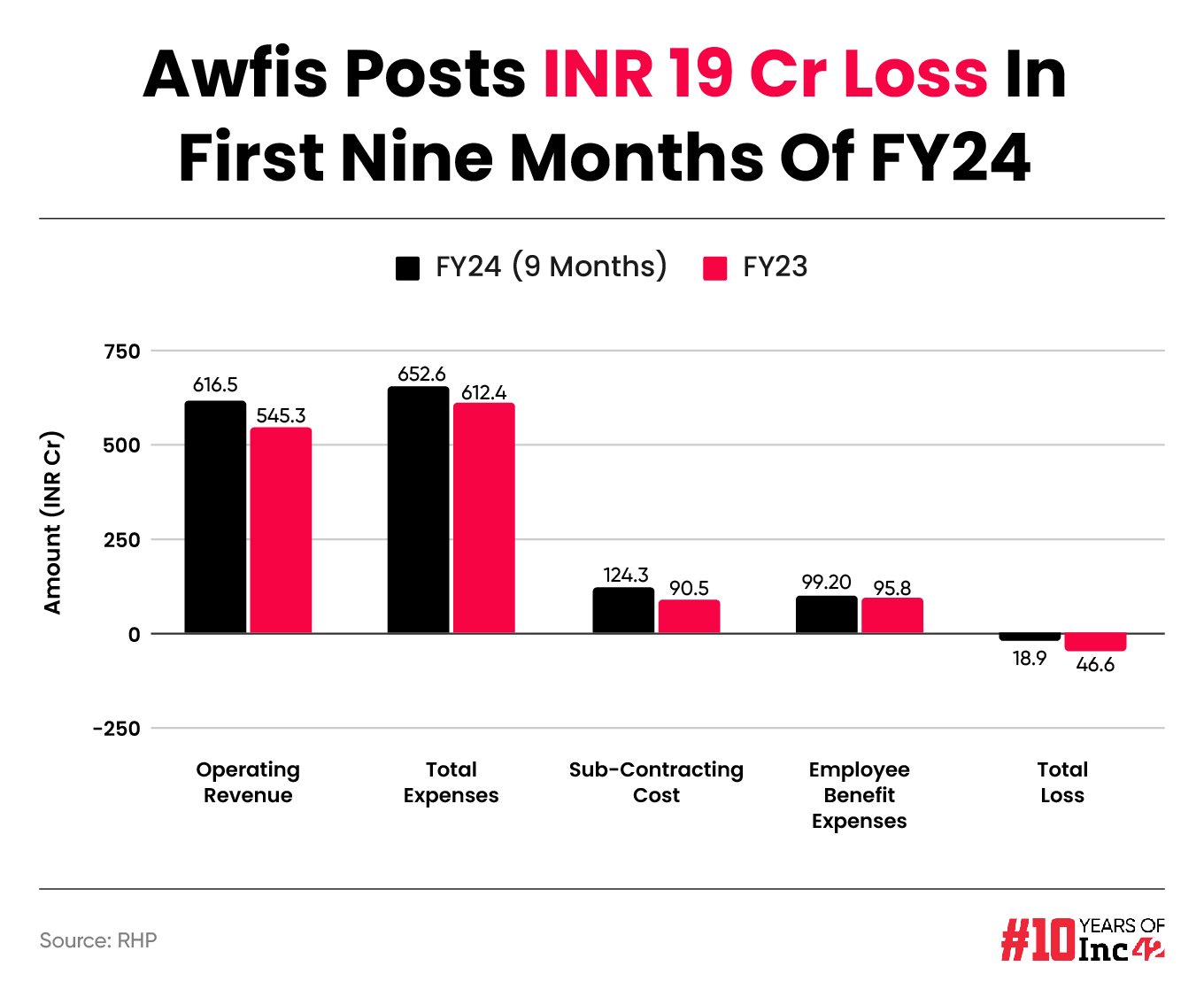

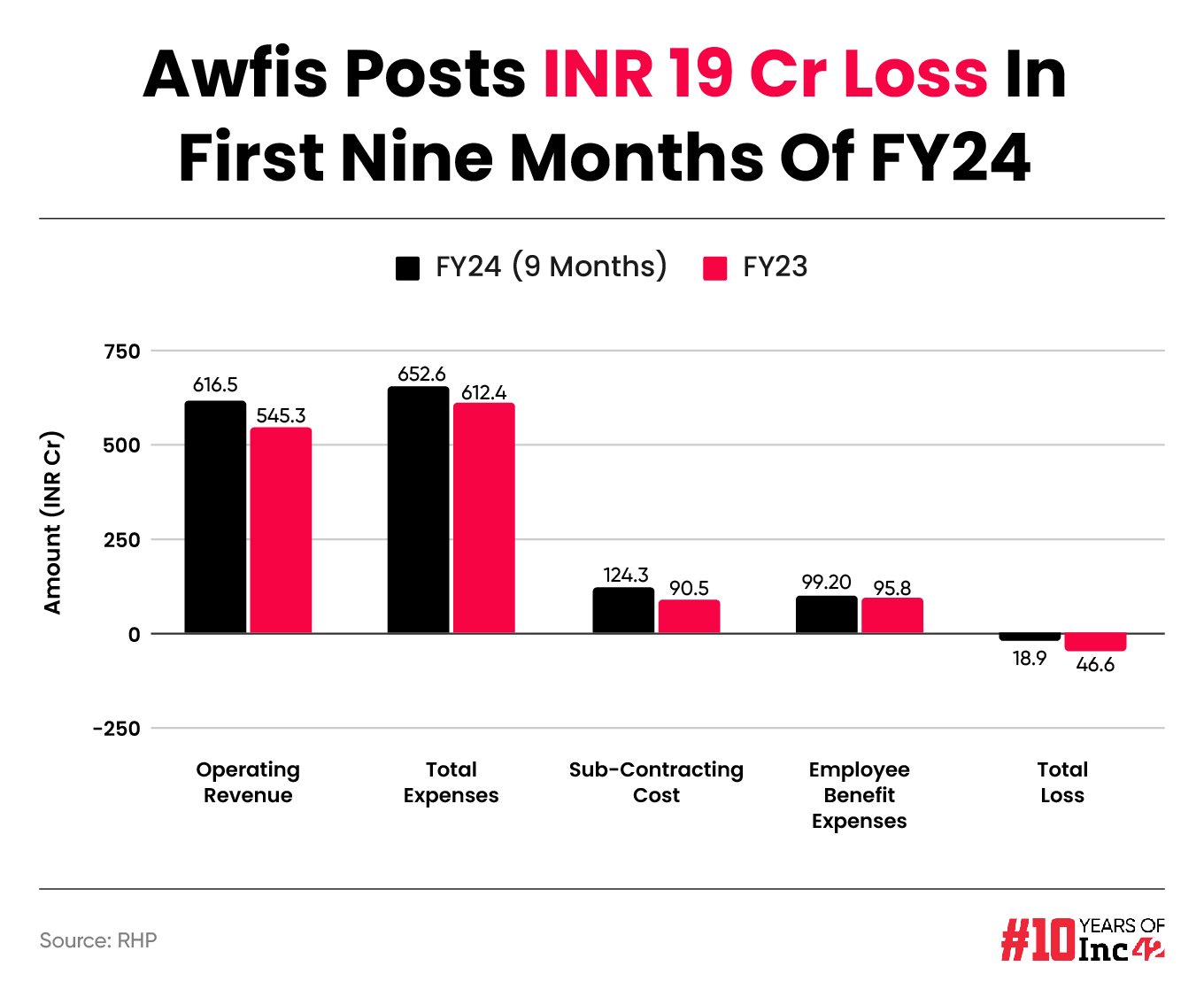

At INR 616.5 Cr, Awfis’ operating revenue crossed the FY23 number of INR 545.3 Cr within the first three quarters of FY24

The startup turned EBITDA profitable in 2021. In the nine months of FY24, its EBITDA stood at INR 195.5 Cr

Ahead of Awfis’ INR 599 Cr IPO opening next week, its chairman and MD Amit Ramani told Inc42 that Tier 2 cities would be one of the key expansion areas for the company going forward

Coworking startup awfis

It is pertinent to mention that Awfis narrowed its net loss by a little over 18% to INR 46.6 Cr in FY23 from INR 57.1 Cr in FY22, helped by a remarkable growth in business as the demand for flexible office spaces increased. In FY23, Awfis’ operating revenue saw a 112% jump year-on-year (YoY) to INR 545.3 Cr.

Meanwhile, operating revenue crossed the FY23 number within the first three quarters of FY24. Awfis’ revenue from operations stood at INR 616.5 Cr in the first nine months of FY24.

In that, the startup’s revenue from coworking space on rent and allied services (including services like food and beverage, IT services, and meeting room) stood at INR 451.1 Cr, accounting for around 73.2% of the operating revenue in the first nine months of FY24. On the other hand, construction and fit-out projects, called Awfis Transform, contributed INR 147.3 Cr (about 24%) to the revenue.

The company also earned around 3% of its revenue from its facility management services called Awfis Care and other services, including income from the sale of furniture and work-from-home solutions.

Founded in 2015 by Amit Ramani, Awfis has evolved over the years from being a coworking network to a tech-enabled workspace solutions platform, catering to enterprises, freelancers, startups, and SMEs.

In an interaction with Inc42 ahead of its IPO launch, Awfis chairman and MD Amit Ramani said that around 65% of the firm’s business comes from corporates, 22-23% from SMEs and mid-corporates, and about 10% from startups.

He said that Bengaluru and Mumbai are the top two cities in terms of revenue contribution for the company, followed by Hyderabad, Pune, and Delhi NCR. Meanwhile, about 10% of Awfis’ business comes from the Tier 2 cities.

It is pertinent to note that the startup aims to use a significant portion of the net proceeds from the IPO – INR 42 Cr – for funding its capital expenditure towards establishment of new centres.

Awfis currently has presence in 16 cities and is looking to enter three more cities – Lucknow, Guwahati, and Vijayawada – in 2024.

“In terms of Tier 2, the customer mix is quite interesting… There also a large portion is coming from larger enterprises, corporates, and obviously, SMEs. We are also seeing that a lot of large IT companies are clearly adopting a Tier II strategy where they are testing the market and once they get some traction, they are expanding very aggressively,” said Ramani.

While Tier 1 continues to be the main focus for Awfis now, Ramani believes that Tier 2 cities would ultimately be one of the key expansion areas for the company going forward.

In the nine months ended December 31, 2023, Awfis’ total revenue stood at INR 633.4 Cr.

Awfis turned EBITDA profitable in 2021. In the nine months of FY24, its EBITDA stood at INR 195.5 Cr.

Though the company continues to post losses at a net level, Ramani said that investors are optimistic given Awfis’ EBIT and cash flow figures.

“EBIT is what makes the big difference here and we did almost INR 67 Cr in EBIT in FY24 till December quarter. At the end of the day, in our case, depreciation is a large number because of the assets. So, from that standpoint, investors are seeing that our cash flow is not a challenge and at the EBITDA level, we are generating enough and more cash,” Ramani explained.

“It is very clear that the cash flow is there to sustain our growth and expansion potential,” he said.

Zooming Into Expenses

Awfis spent INR 652.6 Cr till the December quarter in FY24, with depreciation and amortisation expenses alone contributing over 22% to the total expense.

The startup had reported an over 82% YoY jump in its total expenses in FY23 to INR 612.4 Cr.

Depreciation & Amortisation Cost: The startup’s spending in this bucket stood at INR 145.3 Cr in the nine months of FY24 as against INR 150 Cr in FY23.

Sub-Contracting cost: Its expense in this bucket stood at INR 124.3 Cr in the nine-month period, growing from INR 90.5 Cr in the entire FY23.

Employee Cost: Awfis spent INR 99.2 Cr on employee benefits expenses in the first nine months of FY24.

In FY23, the startup spent INR 95.8 Cr in total in this bucket.

Marketing & Sales Cost: The startup spent INR 2.1 Cr on marketing and promotional expenses in the nine-month period under review. In FY23, the spending stood at INR 2.6 Cr.

Its advertising and sales promotion expenses include digital marketing expenses, broker meetings, client get-togethers, and allied costs.

A Quick Review Of The Upcoming IPO

Awfis’ IPO is set to open next week on May 22 and close on May 27. The startup will allocate shares to anchor investors a day prior, on May 21.

The startup has set a price band of INR 364-INR 383 for the IPO, which comprises a fresh issue of shares worth INR 128 Cr and an offer for sale (OFS) component of up to 1.23 Cr shares.

The startup is looking to raise INR 599 Cr at the upper end of the price band via the public issue.

Peak XV Partners, Bisque Limited, and Link Investment Trust are the investors who will offload parts of their stakes in the startup via the IPO.

Despite operating in a competitive market, Awfis is bullish about its managed aggregation strategy in the coworking space.

Besides, Ramani said that the startup’s strong network mix and ability to provide all types of services possible in the coworking space are among the key factors that would help in its long-term success in the coming days.