SUMMARY

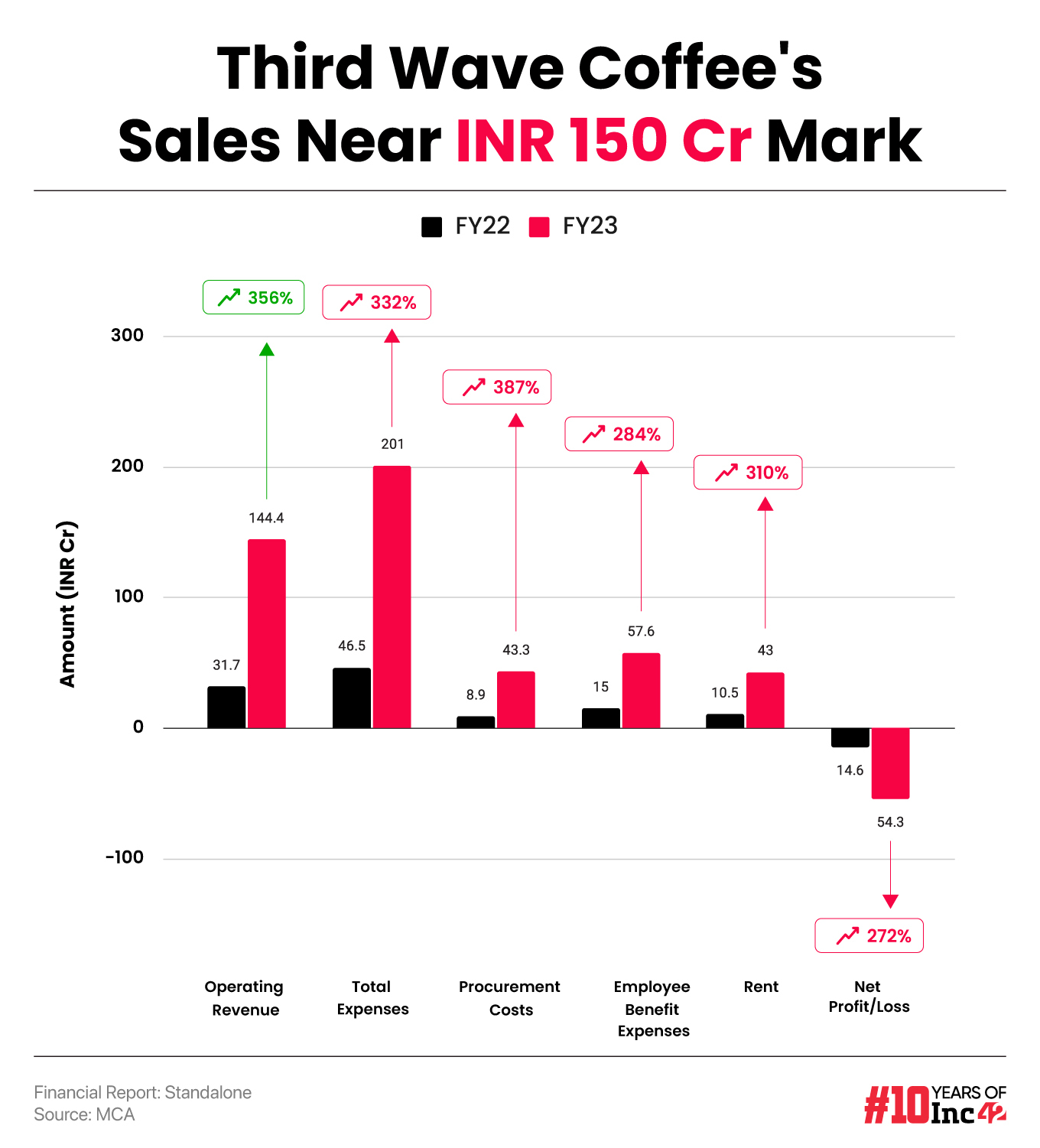

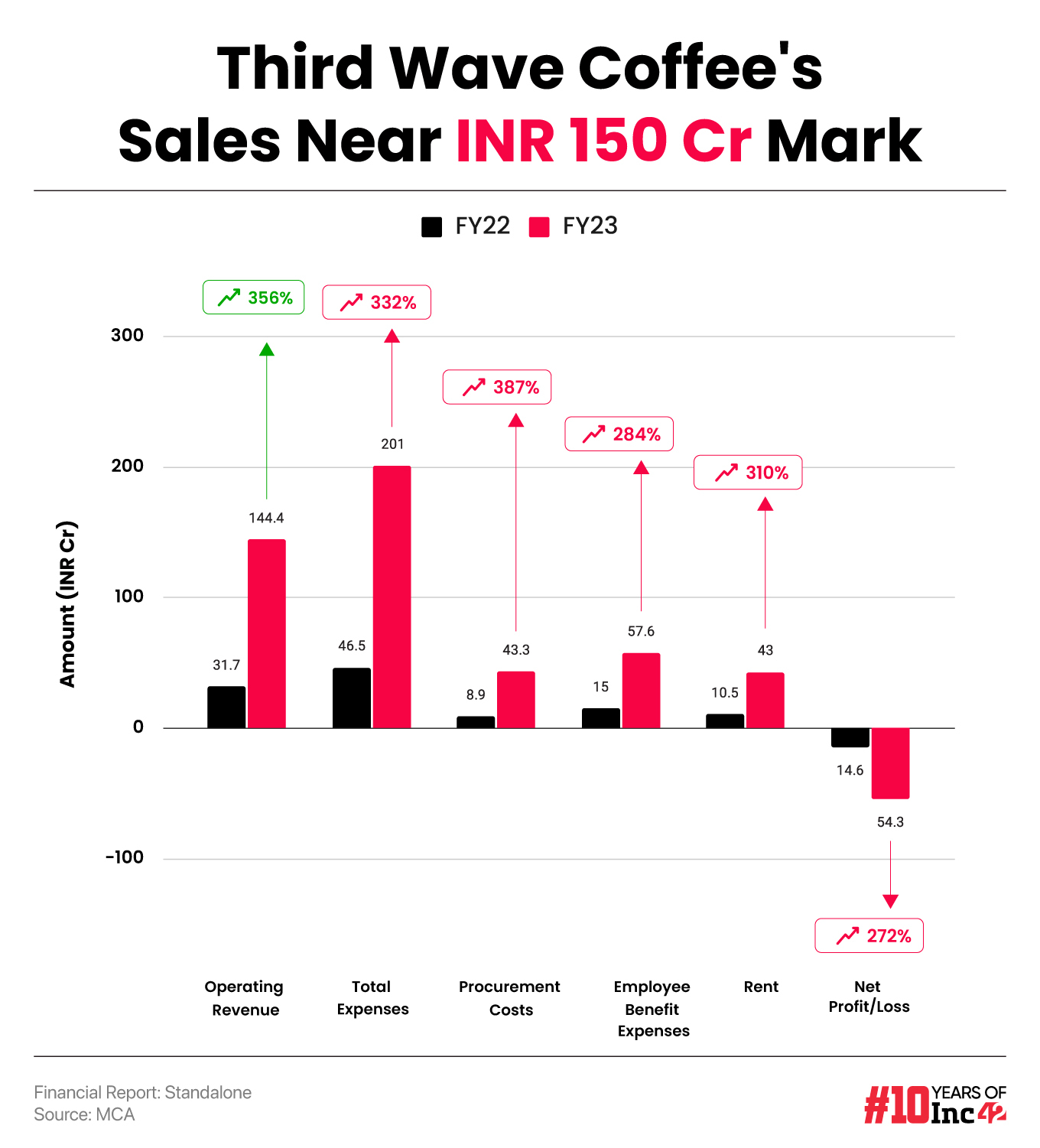

The QSR coffee chain had reported a net loss of INR 14.6 Cr in FY22

Third Wave Coffee’s sales surged 356% to INR 144.4 Cr in FY23 from INR 31.7 Cr in the previous fiscal year

EBITDA loss increased to INR 38.7 Cr in FY23 from 12 Cr in the previous fiscal year

Bengaluru-based QSR coffee chain Third Wave Coffee Roasters’ loss nearly quadrupled in the financial year ended March 31, 2023. The startup reported a net loss of INR 54.3 Cr in FY23, an increase of 272% from INR 14.6 Cr in the previous fiscal year.

Founded in 2017 by Ayush Bathwal, Anirudh Sharma and Sushant Goel, the startup currently operates over 100 stores across the country. It also sells coffee products through its own website and ecommerce marketplaces.

The startup’s loss increased despite its sales surging 356% to INR 144.4 Cr in FY23 from INR 31.7 Cr in the previous year. The increase in operating revenue can be attributed to the growth in the number of retail outlets operated by the startup.

Third Wave Coffee earns revenue by selling coffee and other food items either offline or online.

Including other income, the startup’s total revenue rose 351.8% to INR 144.6 Cr from INR 32 Cr in FY22.

Where Did Third Wave Coffee Spend?

The startup’s total expenditure zoomed 332% to INR 201 Cr in FY23 from INR 46.5 Cr in the previous fiscal year.

Procurement Cost: The startup’s procurement expenses zoomed 387% to INR 43.3 Cr from INR 8.9 Cr in FY22.

Employee Benefit Expenditure: Employee costs almost quadrupled to INR 57.6 Cr from INR 15 Cr in FY22. Employee benefit expenses primarily comprise wages, gratuity, and PF contributions. The rise in employee benefit expenses is in line with the startup opening more outlets in FY23.

Rent: The startup spent around INR 43 Cr on rent in FY23, a jump of 310% from INR 10.5 Cr in the previous fiscal year.

Third Wave Coffee’s EBITDA loss increased to INR 38.7 Cr in FY23 from 12 Cr in the previous fiscal year. EBITDA margin improved to -26.8% from -37.8% in FY22.

The startup last raised $35 Mn in its Series C funding round led by private equity firm Creaegis in September last year. The funding round also saw participation from existing investors, including WestBridge Capital and Udaan cofounder Sujeet Kumar.

The startup has raised $62 Mn in total funding till date and counts Nikhil Kamath and Ayyapan Rajgopal among its backers.

In December last year, Third Wave Coffee sacked around 10% of its workforce, or around 80 employees, in a restructuring exercise to “consolidate” its teams.

Third Wave Coffee competes against the likes of Slay Coffee, Blue Tokai, and StarBucks.