SUMMARY

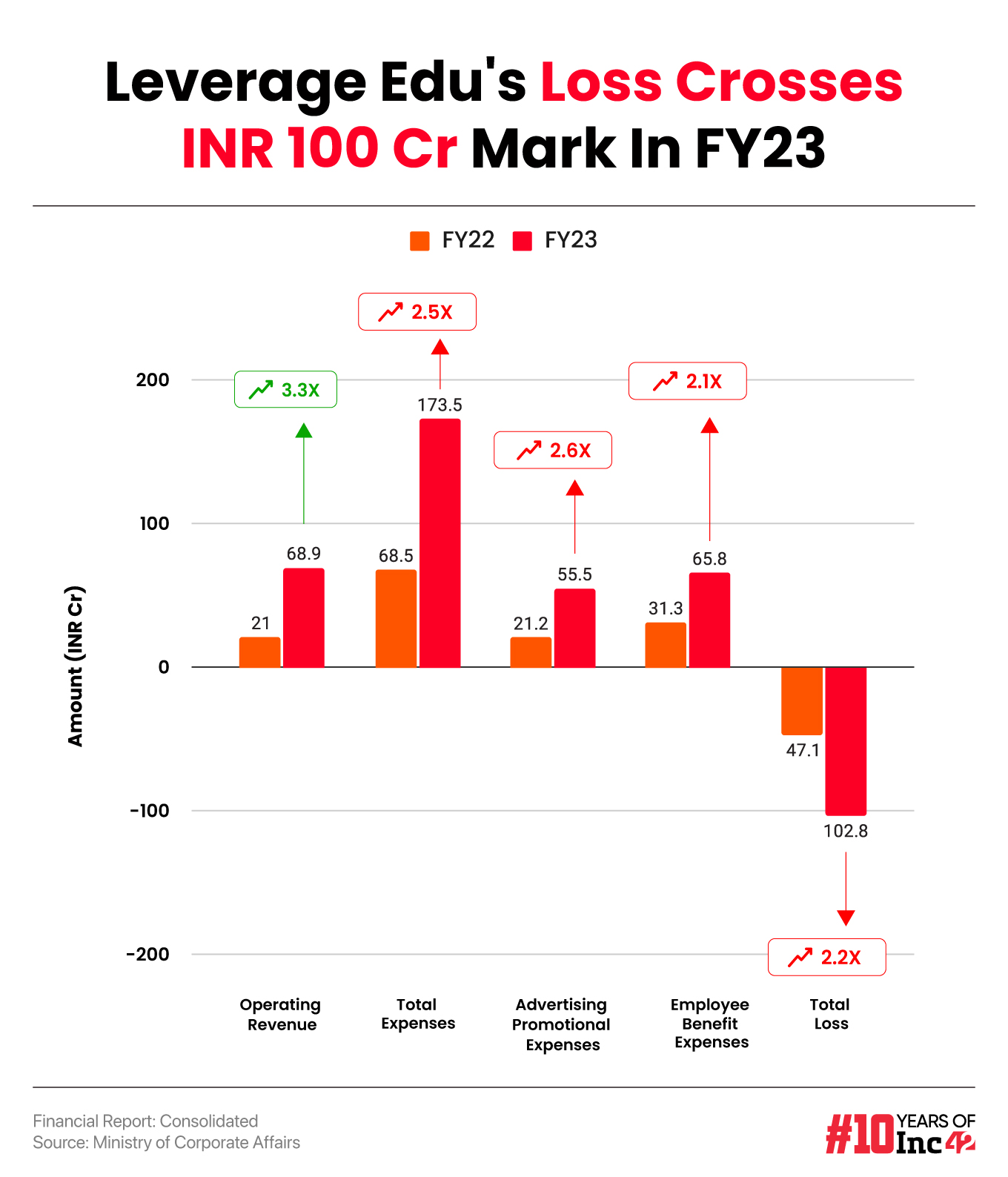

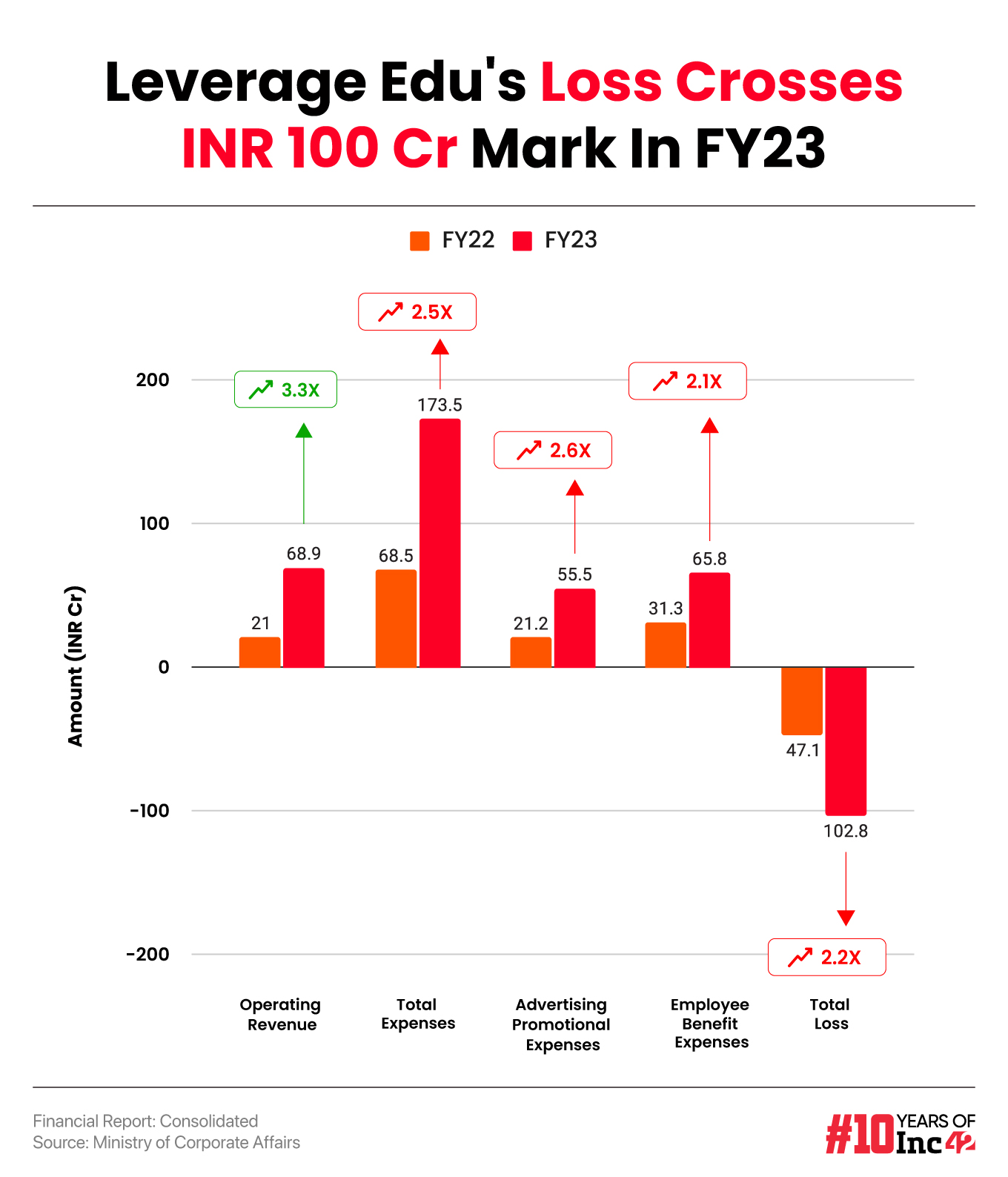

Leverage Edu’s operating revenue jumped 3.3X to INR 68.9 Cr in FY23 from INR 21 Cr in the previous fiscal year

In line with the rise in business, total expenses jumped 153% to INR 173.5 Cr from INR 68.5 Cr in FY22

Leverage Edu founder and CEO Akshay Chaturvedi highlighted that the startup’s strategic focus was on long-term investments in 2022

Study abroad startup Leverage Edu’s loss widened 118% to INR 102.8 Cr in the financial year 2022-23 (FY23) from INR 47.1 Cr in the previous fiscal year, as its expenses shot up in line with its growing business.

The startup’s operating revenue jumped 3.3X to INR 68.9 Cr in FY23 from INR 21 Cr in the previous fiscal year.

Founded in 2017, Leverage Edu is a study abroad platform that helps students apply to foreign universities. It offers courses across three apps – Study Abroad With Leverage Edu, LeverageIELTS, and the recently launched LeverageTOEFL.

The startup’s total revenue, including other income, stood at INR 70.8 Cr in FY23 as against INR 21.4 Cr in the previous fiscal year.

In a post on X, Leverage Edu founder and CEO Akshay Chaturvedi highlighted that the startup’s strategic focus was on long-term investments in 2022. This included bolstering content, community, and student-first acquisition products such as AI Course Finder and UniConnect, which were expected to yield results over time.

Additionally, the startup initiated its first investments in the brand through the rollout of the Ayushi Campaign during the year under review, while also increasing the spending on paid marketing to drive momentum. Moreover, efforts were directed towards building a larger team capable of handling subsequent operations, with a significant emphasis on training to ensure better output, he added.

In 2023, there was significant brand growth for the edtech startup, with double-digit referrals fueled by previous momentum. Direct-to-student products, particularly in the UK corridor, led to over two-thirds of acquisitions with zero customer acquisition costs, the cofounder said.

“Conscious focus on high student NPS, high employee retention resulted in higher referrals and more-targeted/optimised marketing (lowering effective CAC), and significant improvement in conversions,” he said.

Zooming Into Expenses

The startup’s total expenses zoomed 153% to INR 173.5 Cr in the reported fiscal from INR 68.5 Cr in FY22.

Other expenses, which included rent, subscription membership fees, and IT expenses, accounted for the highest chunk of expenditure at INR 101.3 Cr during the year under review.

Advertising Promotional Expenses: The edtech startup spent INR 55.5 Cr on advertising and promotion in FY23 as against INR 21.2 Cr in FY22.

Employee Benefit Expenses: Leverage Edu’s employee costs witnessed a 110% rise to INR 65.8 Cr in FY23 from INR 31.3 Cr in the previous fiscal year.

In September last year, Leverage Edu raised an undisclosed amount of funding from the Thailand-based family office of Aloke and Suchitra Lohia to expand its footprint in the Southeast Asian market, especially Thailand.

This came barely two months after the startup raised $40 Mn as part of its Series C funding round led by language testing conglomerate ETS.

Leverage Edu also counts the likes of Blume Ventures and DSG Consumer Partners among its backers.