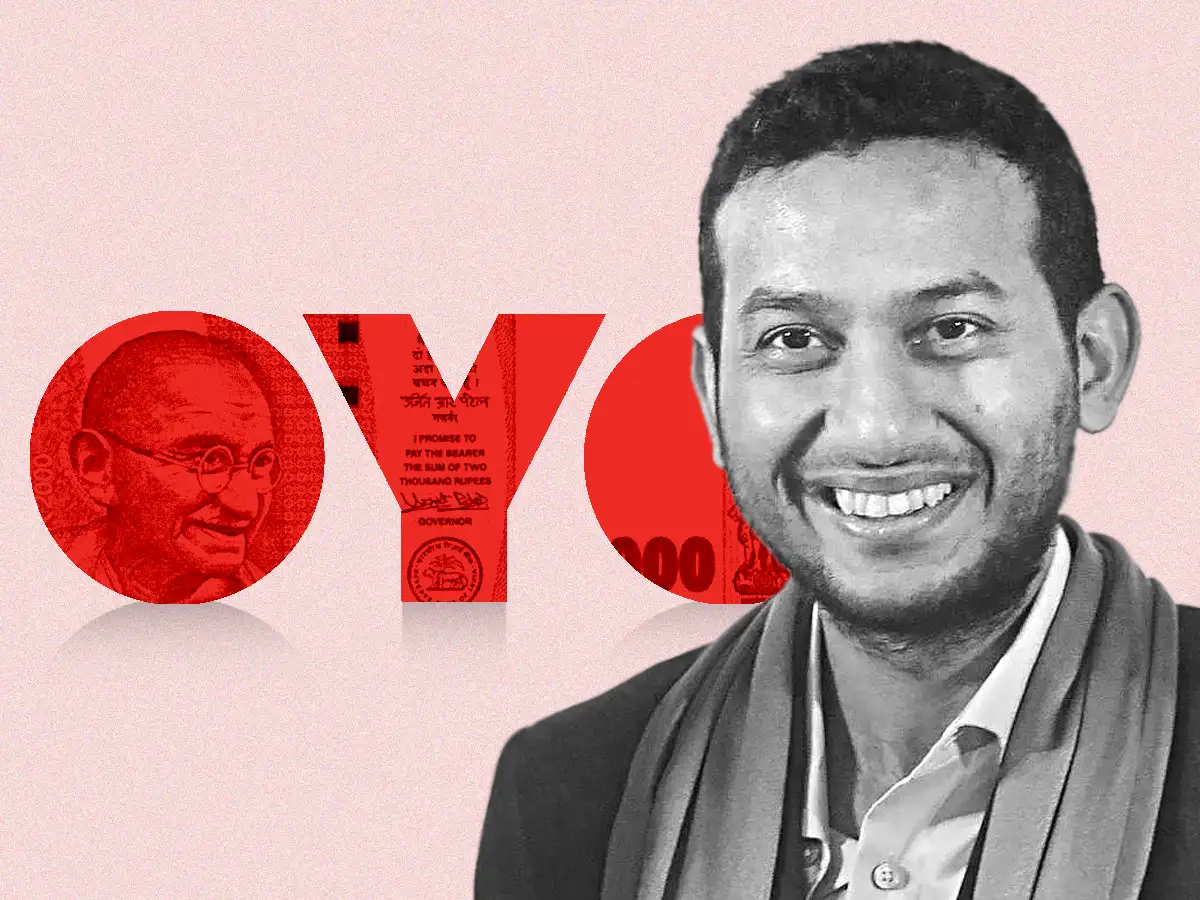

The demand was raised under Section 56(2)(viib) of the Income Tax Act on account of the addition to the income after the assessee had issued compulsorily convertible preference shares to its holding company Oravel Stays. This investment by Oravel, according to the department, into its Indian subsidiary was an income, thus taxable.

However, Oyo’s…