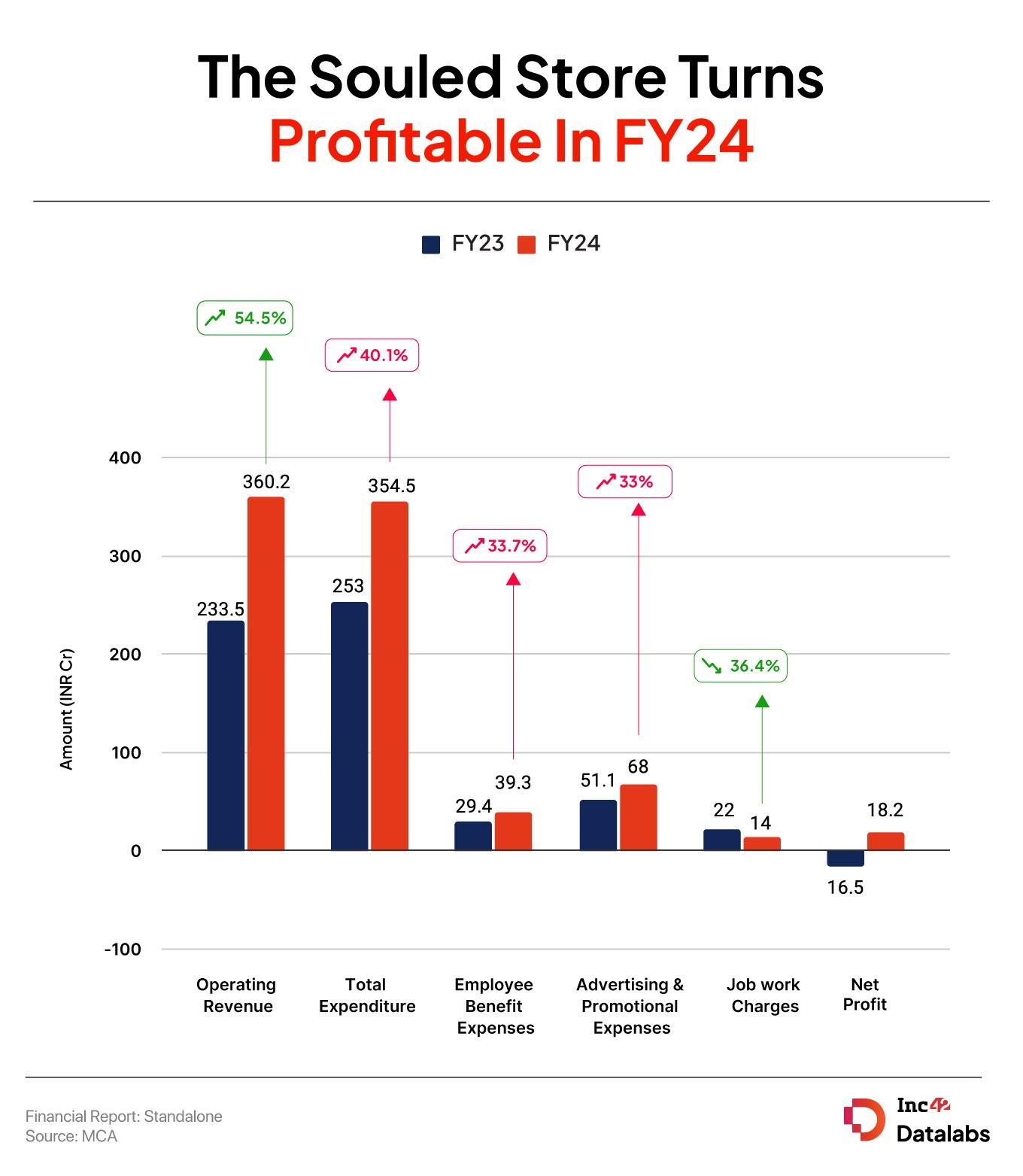

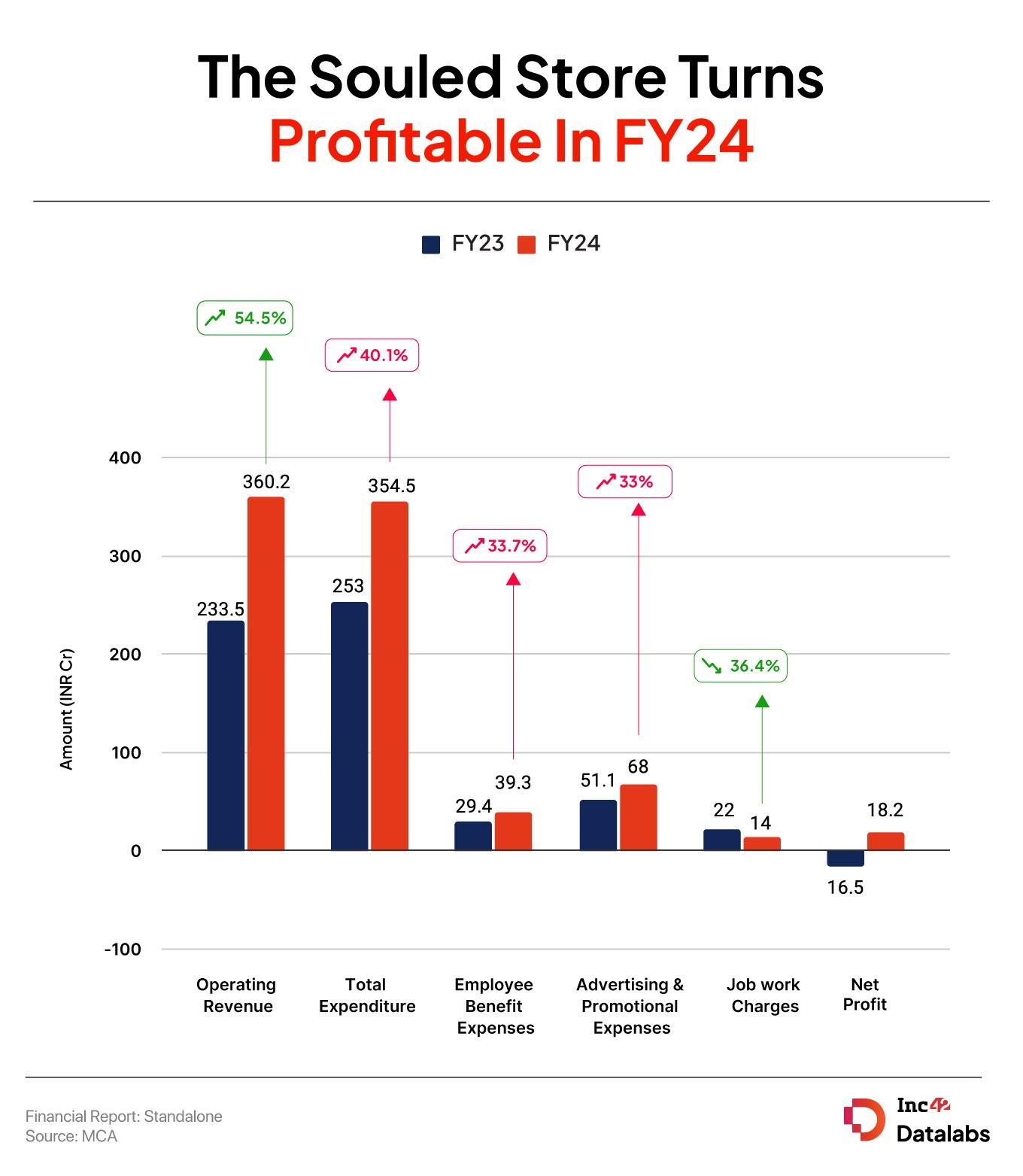

The Souled Store turned profitable in the financial year ended March 2024 (FY24) on the back of a strong growth in its top line and improvement in margins

Operating revenue surged 54.26% to INR 360.2 Cr from INR 233.5 Cr in FY23

The company’s total expenses grew 40.12% to INR 354.5 Cr from INR 253 Cr in FY23

D2C fashion startup The Souled Store

Operating revenue surged 54.26% to INR 360.2 Cr from INR 233.5 Cr in FY23. It earned INR 5.2 Cr from membership fees, while the rest of the revenue came from the sale of products.

Founded in 2013 by Vedang Patel, Rohin Samtaney, Aditya Sharma and Harsh Lal, The Souled Store started as a branded merchandise apparel brand and later morphed into its current D2C casual wear brand form.

It also sells products such as backpacks, sneakers, shoes and socks to customers ranging from kids to adults.

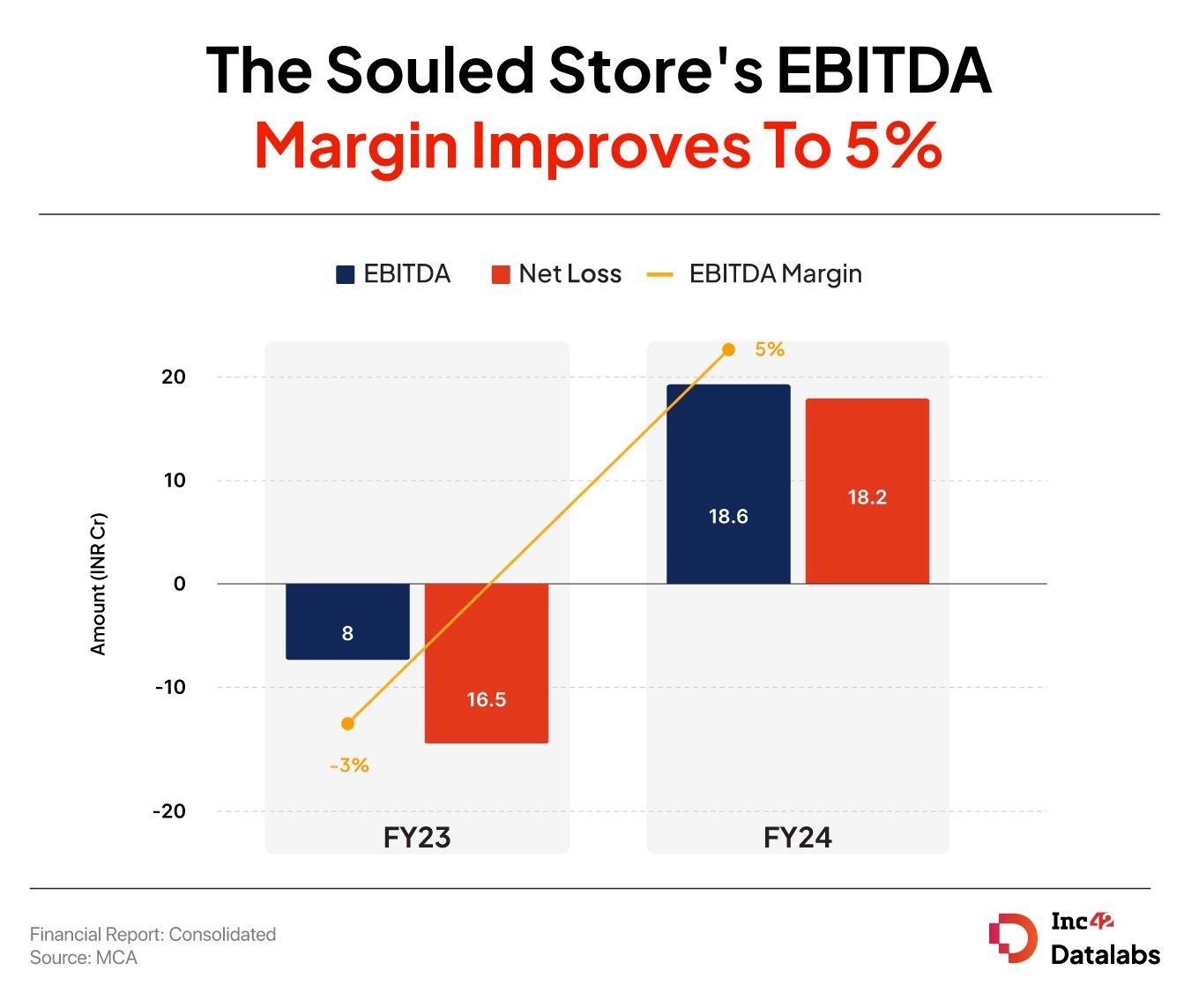

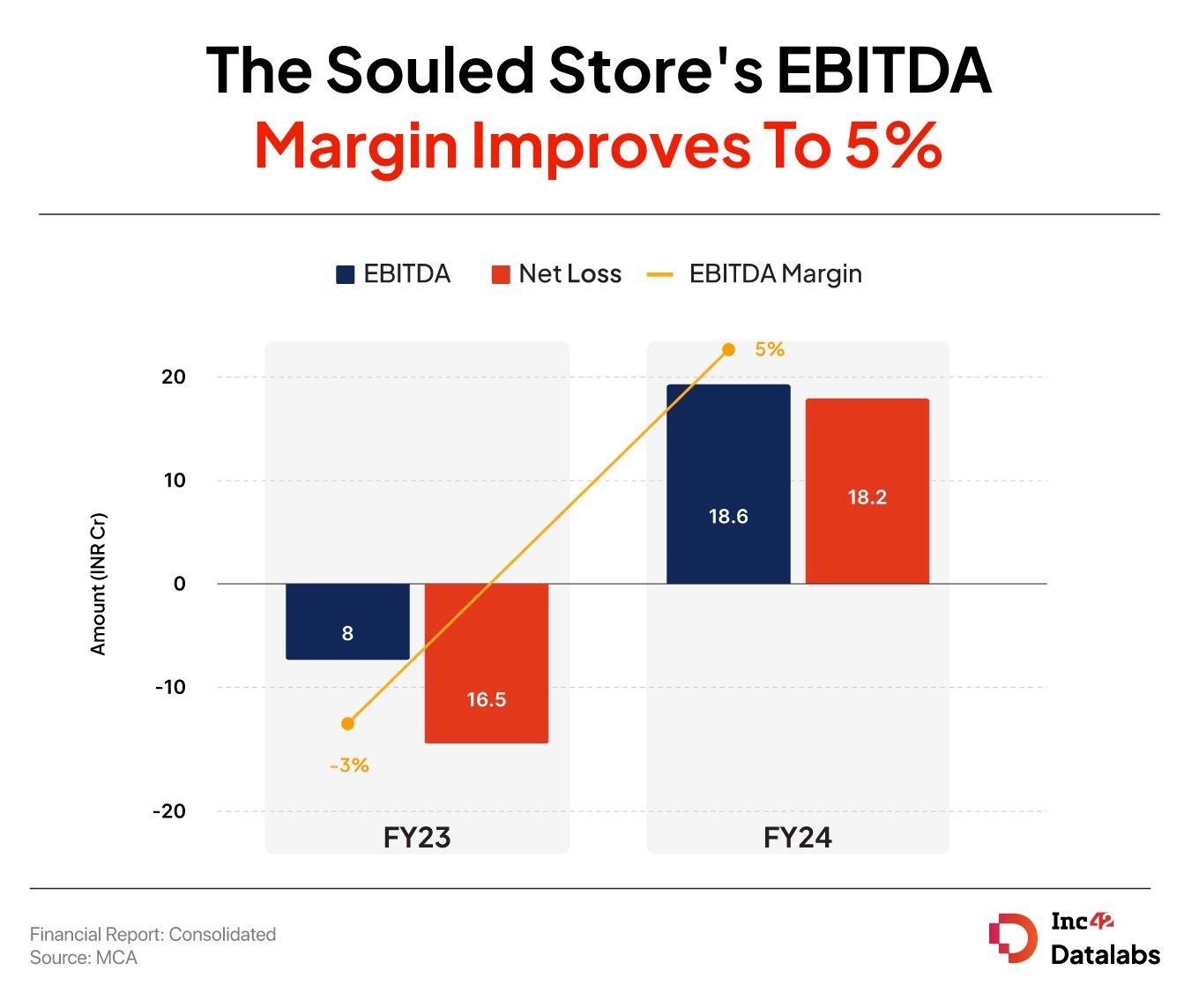

The startup reported an EBITDA profit of INR 18.6 Cr in FY24 as against an EBITDA loss of INR 8 Cr in the previous year. EBITDA margin improved to 5% from -3% in the previous year.

Its cash and cash equivalents stood at INR 14.4 Cr at the end of FY24 as against INR 114.1 Cr a year ago.

The Souled Store has raised a total funding of about $30 Mn to date. Most recently, it raised INR 135 Cr in 2023 in a strategic funding round led by Xponentia Capital. The round also saw participation from its existing investors Elevation Capital and RPSG Capital.

Tracking Down The Expenses

The Souled Store’s total expenses grew 40.12% to INR 354.5 Cr from INR 253 Cr in FY23.

Employee Benefit Expenses: The D2C fashion brand spent INR 39.3 Cr under this head, an increase of 33.67% from INR 29.4 Cr in FY23. This indicates that it increased its headcount during the year under review.

According to LinkedIn data, it has increased its headcount by 23% in the last 12 months.

Advertising & Promotional Expenses: The spending under the head rose 33.07% year-on-year to INR 68 Cr in FY24.

Royalty Expenses: The startup attracts the Gen Z crowd by offering limited edition/ exclusive merchandise in collaboration with international movies/ webseries brands like MCU, DCU, among others. For this, it pays royalty to the brands, which rose 13.5% to INR 13.4 Cr from INR 11.8 Cr in the previous fiscal year.

Job Work Charges: It spent INR 14 Cr under this head, a decline of 36.36% from INR 22 Cr in FY23.