Ather Energy

For years, Ather Energy founders Tarun Mehta and Swapnil Jain have stuck to the strategy of building slowly and steadily, with a focus on service, quality and infrastructure rather than market share. None of that ‘move fast and break things’.

That could very well change under the spotlight of being a publicly listed company, with Ather Energy looking to raise INR 3,100 Cr from the public markets.

As it prepares to join Ola Electric on the stock market, Ather Energy will perhaps have to become a little more like the competition, and less like itself.

And at the same time, it has to address some key gaps in its portfolio relative to the competition. Before we see exactly what, here’s a look at some of the top stories from our newsroom this week:

- Indian Tech In 2025: Our tech and startup predictions for 2025 — from the state of IPOs, to what will happen after the quick commerce boom and how the GenAI revolution will shape up in 2025

- Best Of 30 Startups: The 54th cohort of Inc42’s 30 Startups To Watch brings crème de la crème of the 300 startups featured in 10 editions over 2024. Here’s our best-of list to wrap up the year gone by

- Reliance Bails On Dunzo: Reliance Retail, the largest shareholder in Dunzo, has written off its $200 Mn investment in the company, even as founder and CEO Kabeer Biswas is in talks with buyers for a distress sale

Ather Energy Vs Ola Electric And The Rest

The first thing Ather Energy needs to address is its relatively poor market share growth in the past year, even as EV sales have doubled between 2022 and 2024.

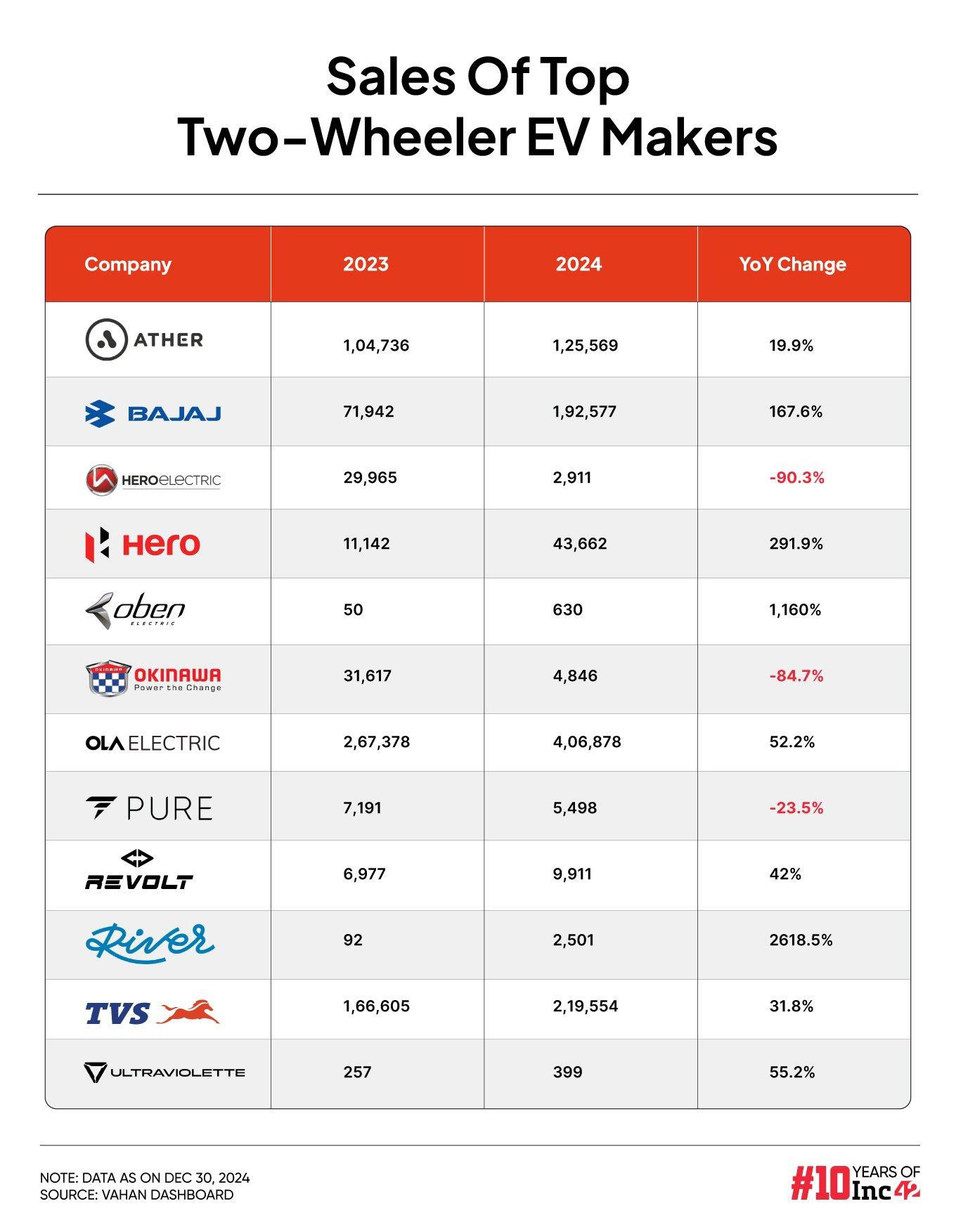

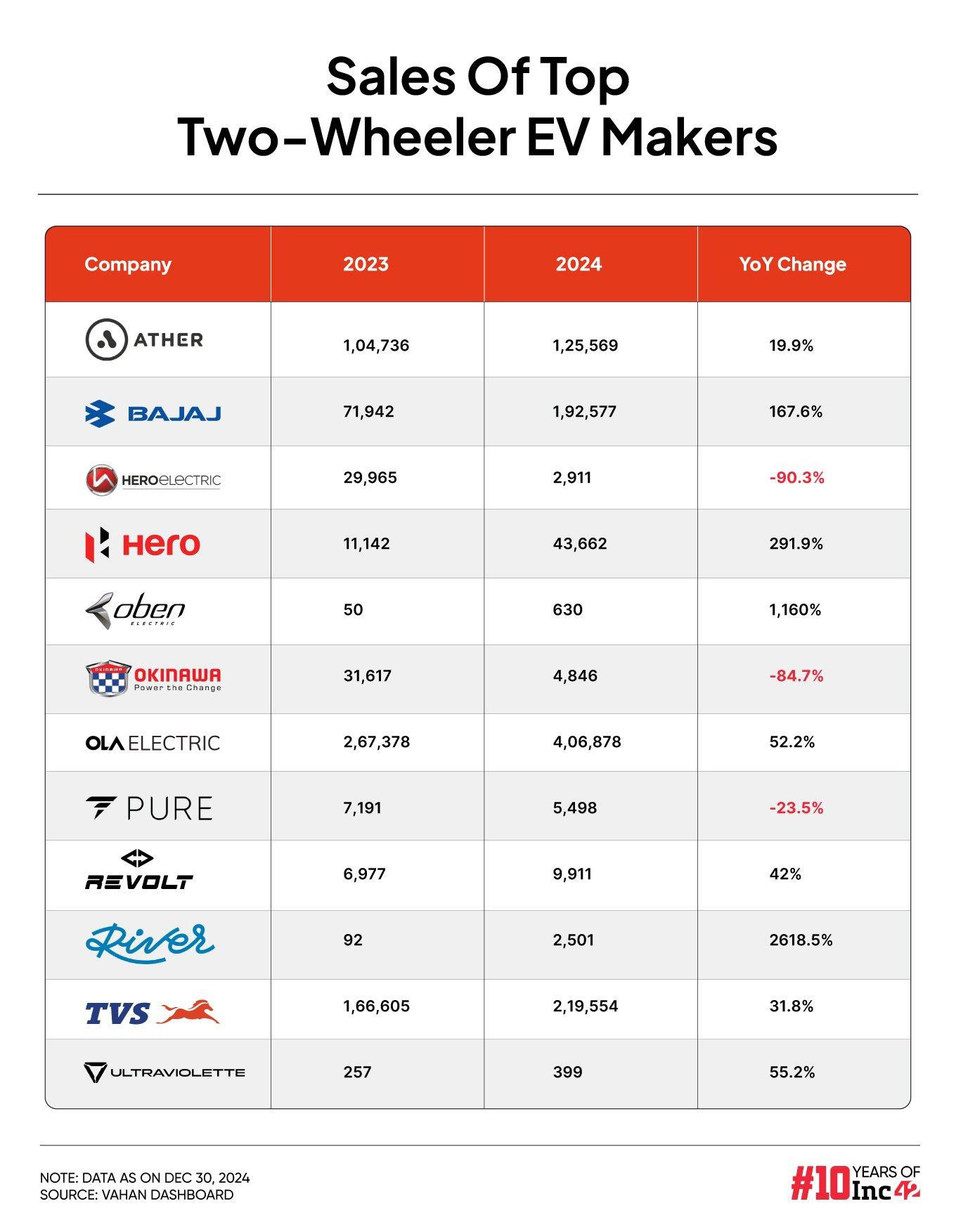

While the overall EV two-wheeler registrations surged 33% YoY in 2024, Ather’s sales grew only by 20%. In contrast, Ola Electric saw a 52% growth, while Bajaj and Hero had the biggest jump among the leading players.

Obviously, a lot of the attention in 2024 was on Ola Electric, as it became the first Indian EV maker to go public. The company also retained the top spot in the electric two-wheeler market. Ola Electric sold 4.1 Lakh units in 2024, accounting for more than 35% of the market share, compared to Ather Energy’s 1.25 Lakh units and 11% market share.

Competition was intense in 2024 for Ola Electric, as the likes of Bajaj and TVS overtook the Bhavish Aggarwal-led company at the end of the year. Whether this indicates a big inflection point for the two legacy manufacturers remains to be seen, but Ather Energy will equally feel the pain.

As it stands though, the 2024 performance does not make for good reading for Ather. And that’s also why there may be some uncertainty around investing in the Ather Energy IPO.

In fact, one might say that Ather’s focus on scaling up the service and infrastructure before sales might backfire in this competitive landscape.

Unlike Ola Electric, it does not have the critical mass of users to upsell or cross-sell services, and having more vehicles on the road will also help Ola Electric generate organic buzz.

This is evident in Aggarwal and Ola Electric’s focus since going public. The company has looked to sacrifice some of the market share in favour of building up the service and infrastructure network that many feel is critical for sustainable growth in the automotive sector.

Can Ather Step On The Pedal?

Ather Energy has not relied on marketing dollars to grow, but soon after the IPO one may see a different avatar – one that looks to press home the advantage of its slow-and-steady approach while aggressively going after market share.

Ather Energy is left with few choices but to chase sales growth aggressively, as it will need to recoup its capital expenditure since inception to unlock profitability.

The company plans to use INR 750 Cr, or 25% of the fresh issue portion of the INR 3,100 Cr IPO, for research and development (R&D). Moreover, capital expenditure for setting up a new plant in Maharashtra will be allocated INR 927 Cr. This should more than double the company’s annual manufacturing capacity to 900,000 units.

To put things in perspective, Ather sold just over 125,000 units in 2024. Even its current capacity of 400,000 units leaves it with some headroom.

Investors and shareholders would expect to see the monthly sales average grow by two or three times the 2024 monthly sales numbers, which will start delivering the returns on the capital expenditure.

The fact that Ather Energy does not have a battery cell manufacturing plant like Ola Electric is also a disadvantage for the former. Ather signed a partnership deal with battery maker Amara Raja in 2024, but it perhaps needs to improve its battery technology capabilities in the medium term. The R&D spending would definitely help in that regard.

Besides this, Ather does have the advantage of an interoperable fast-charging network in partnership with Hero MotoCorp, which competes with Ather Energy, but is also a promoter in the company.

The network allows Ather to have better unit economics for the battery charging infrastructure compared to the likes of Ola Electric. But Ather has not been able to grow its market share to truly take advantage of this partnership.

What Ather Is Missing

But there are other areas that Ather has to address. The company is betting big on the consumer opportunity, but the B2B opportunity cannot be ignored.

Meanwhile, low-speed electric scooters are seeing a surge in adoption due to the quick commerce boom. Companies such as AlphaVector have stepped into the low-speed segment, targeting consumers, while the likes of Zypp, Okaya, Hero Electric have looked to tap the B2B opportunity.

The expansion of delivery platforms outside the metros means there is increasing infrastructure development in Tier II, III, and IV cities, particularly for two-wheeler charging. This is a market that startups and new-age listed companies will look to target.

Ola Electric has already made its intentions clear with the launch of ‘Gig’ scooters. New product launches are expected to continue this year as companies look to increase their market share.

While the demand for Ola Electric’s electric motorbikes and new gig economy scooters will be keenly watched, the impact of Honda’s entry into the two-wheeler EV space on the market will also need to be seen.

Ather Energy is entering 2025 with a new version of its 450X electric scooter with a number of upgrades, but nothing that will change the competitive dynamics. Besides this model, it also has the Rizta lineup of scooters targeting families.

However, Ather does not yet have plans for electric scooters in the commercial category. This could be a major gap for the company and something investors would definitely want to see.

One cannot help but get a feeling that Ather Energy needs to do what it has been uncomfortable with for so long. The company has shied away from big campaigns and marketing spends. This has to change if it is to compete effectively with brands like Hero, Bajaj, TVS and Ola Electric and other emerging new-age startups, and soon the likes of Honda and Suzuki.

Can Ather Energy step out of its comfort zone as it stands on the cusp of its IPO?

Sunday Roundup: Tech Stocks, Startup Funding & More

- Funding Crystal Ball: Inc42’s annual funding report projects that compared to 2024, the total funding amount and deal count are likely to increase by 25% and 29% respectively, with Indian startups set to raise $15 Bn in 2025

- Women-Led Startups On The Up: By the end of 2024, women-led startups had raised more than $930 Mn, nearly double of what was recorded in 2023. What explains this sudden boom?

- PB Fintech’s New High: Shares of insurance major Policybazaar’s parent PB Fintech hit a fresh all-time high this past Friday, after the company ventured into the healthcare segment

- Bleak For Brokers: Zerodha CEO Nithin Kamath has predicted a tumultuous year for the Indian brokerage industry in 2025, anticipating a downturn in F&O volumes

- Zepto Takes Up IPO Mantle: Zepto is reportedly gearing up to file IPO draft papers in March or April this year, and is close to finalising its redomiciling from Singapore to India in the build up