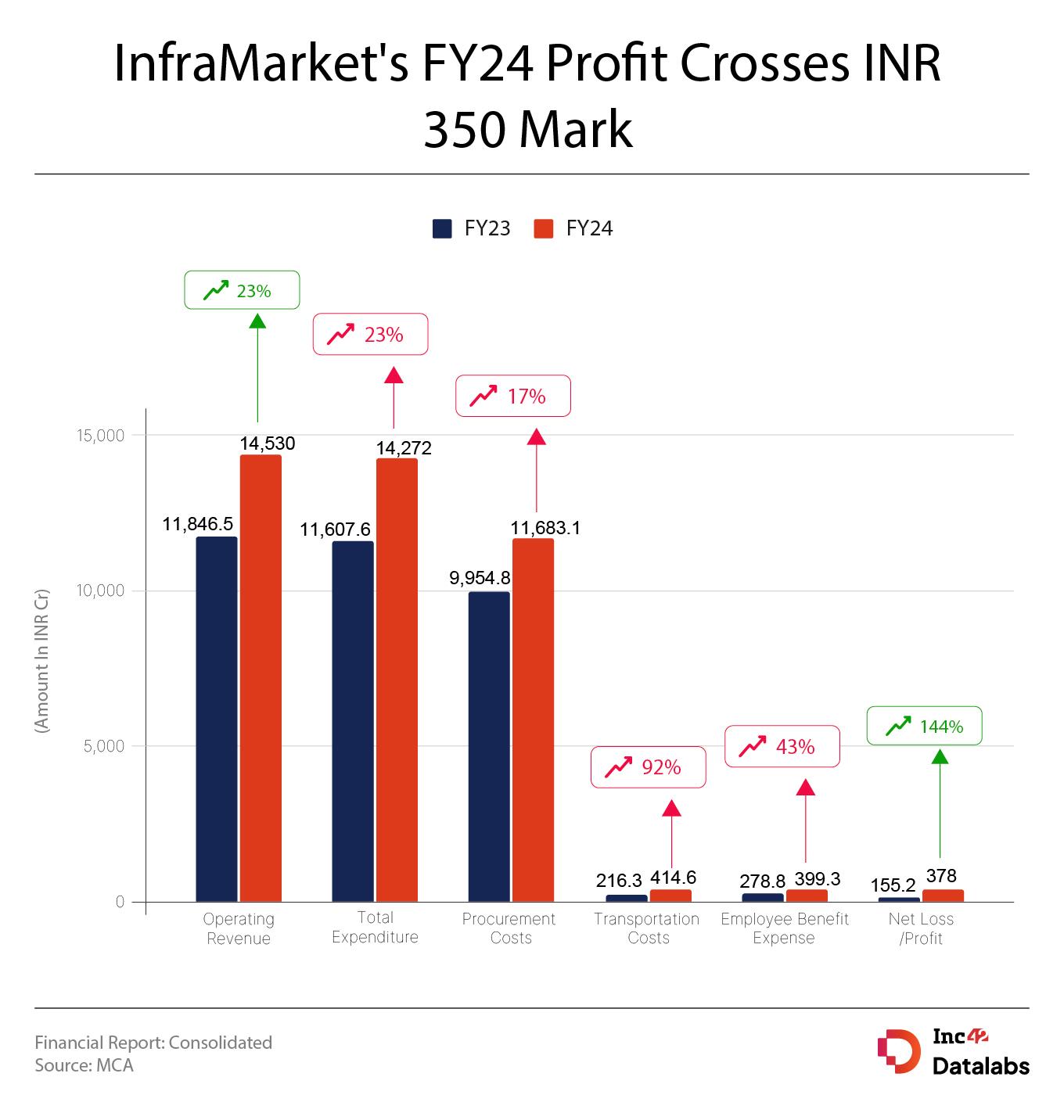

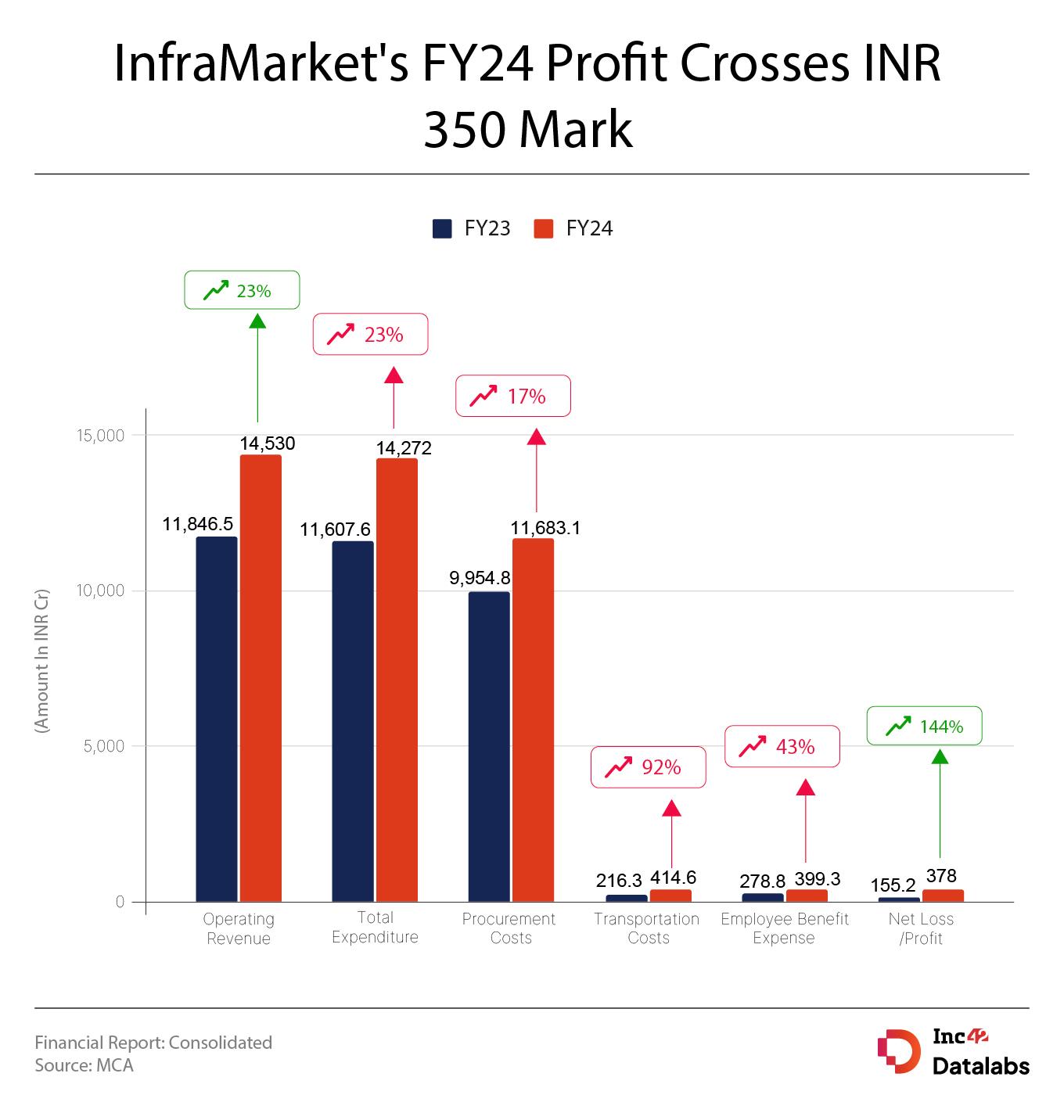

The IPO-bound startup has reported a profit of INR 378 Cr in FY24, a 144% higher than INR 155 Cr it had reported in the previous fiscal year

In FY24, the startup’s operating revenue stood at INR 14,530 Cr, a 23% higher than INR 11,846.5 Cr it reported in the previous year

In FY24, the startup’s total expenditure stood at INR 14,272 Cr, a 23% higher than INR 11,607.6 Cr in FY23

Mumbai-based B2B marketplace startup Infra.Market

The IPO-bound startup has reported a profit of INR 378 Cr in FY24, a 144% higher than INR 155 Cr it had reported in the previous fiscal year.

The startup’s rise in profit came on the back of its growing revenue. In FY24, the startup’s operating revenue stood at INR 14,530 Cr, a 23% higher than INR 11,846.5 Cr it reported in the previous year.

Infra.Market primarily earns revenue by selling construction materials including cement, paints, chemicals, and tools. The startup’s total revenue stood at INR 14,743.4 Cr, almost 25% higher than INR 11,890.8 Cr it had reported last year.

Founded in 2016 by Aaditya Sharda and Souvik Sengupta, Infra.Market manufactures construction materials under its private-label brands. It has a B2B, retail and B2C network and leverages technology to digitise the procurement process.

Where Did Infra.Market Spend?

While Infra.Market’s sales increased, so did its expenditure. In FY24, the startup’s total expenditure stood at INR 14,272 Cr, a 23% higher than INR 11,607.6 Cr in FY23.

Procurement Costs: Being a marketplace, Infra.Market’s biggest expenditure was its procurement costs to purchase products. The startup spent INR 11,683 Cr for procurement costs, a 17% higher than INR 9,954.8 Cr in FY23.

Transportation Costs: In FY24, the startup’s freight cost stood at INR 414.6 Cr, a 92% higher than 216 Cr it spent a year back.

Employee Benefit Expenses: In FY24, the startup’s employee costs stood at INR 399 Cr, 43% higher than INR 278.8 Cr reported last fiscal year. This indicates that the startup has increased its employee headcount.

The startup’s cash and cash equivalents stood at INR 275.1 Cr, a 26.4% higher than INR 217.5 Cr it reported last fiscal year.

Despite having money in the bank, the startup is eyeing to raise around $150 Mn – $200 Mn in funding. The startup’s existing investors including Tiger Global, Evolence, and Foundamental are likely to participate in the funding round.

The development came weeks after reports surfaced that Infa.Market is eyeing to rake up $700 Mn via IPO. The startup has also held talks with investment bankers including Kotak Mahindra Capital, Goldman Sachs, Jefferies, ICICI Securities for its IPO.

Infra.Market has become the latest startup in the B2B space to head towards IPO. While Asish Mohapatra led OfBusiness is going for an $1 Bn IPO, earlier Inc42 had exclusively reported that Zetwerk has begun its groundwork for IPO as it held talks with JP Morgan.