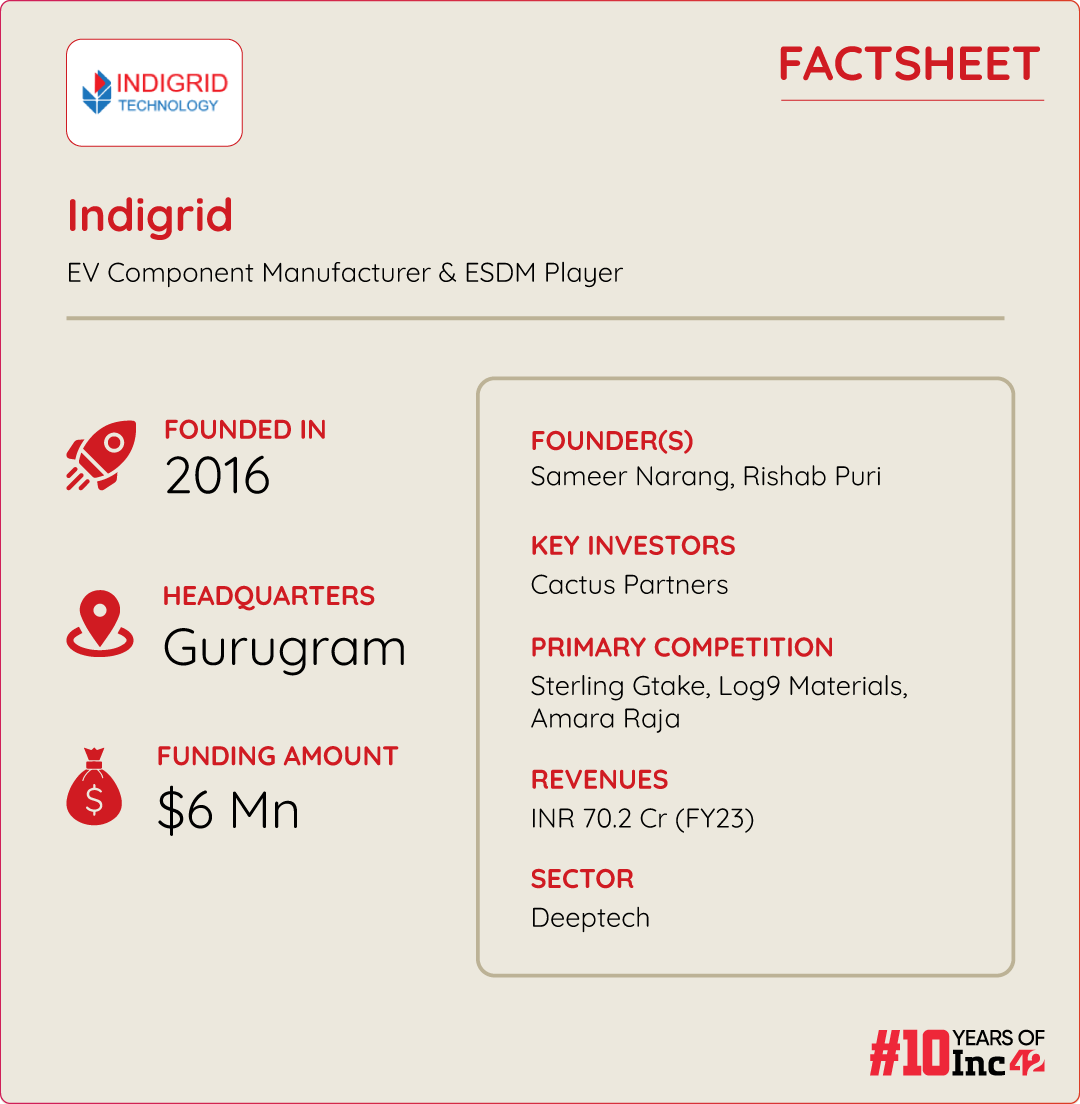

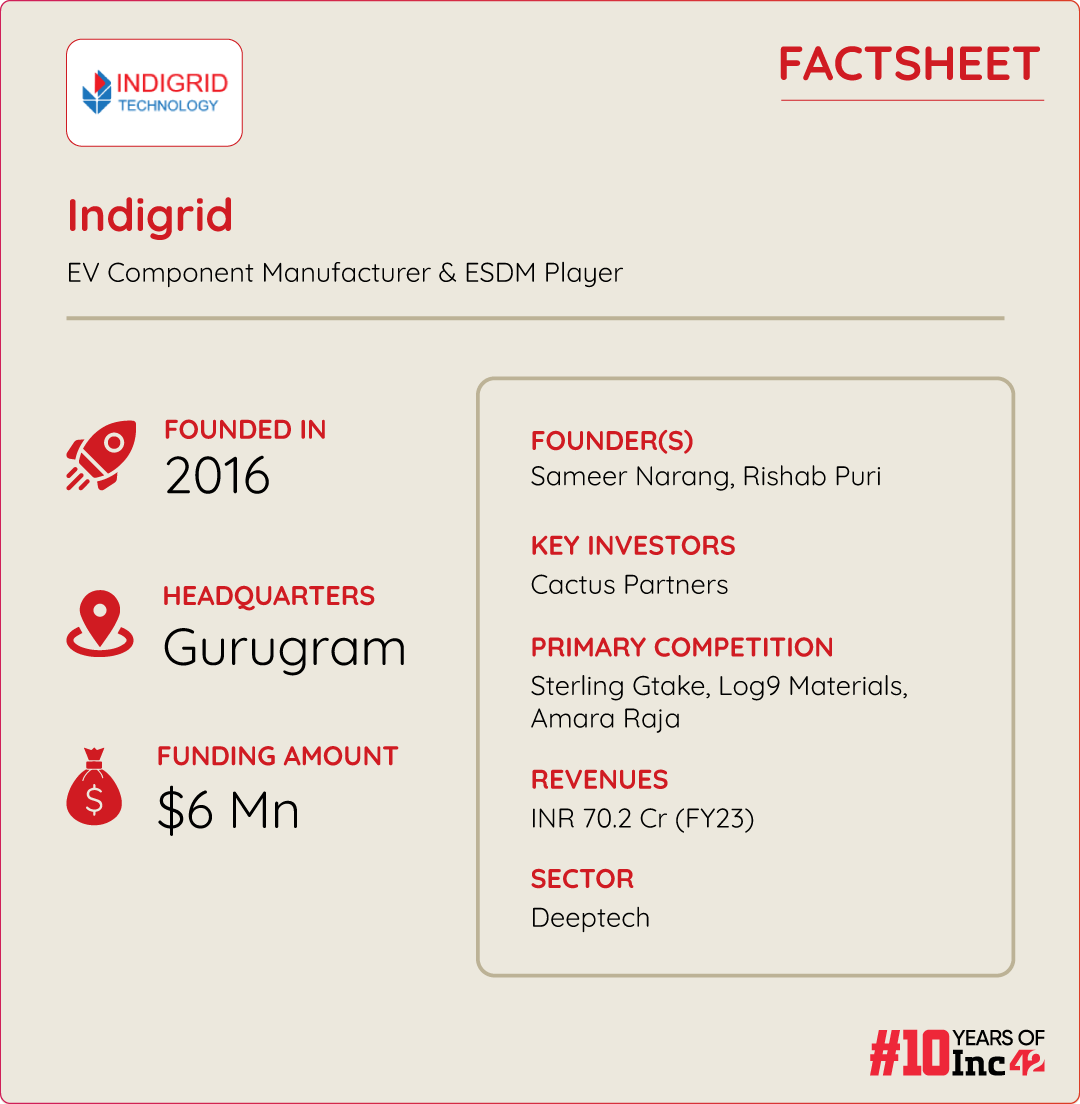

Founded in 2016 by Sameer Narang and Rishab Puri, Indigrid Technology is an ESDM startup, which entered the EV market to provide Indian OEMs with domestic power solutions to push electrification further

The startup clocked a revenue of INR 33.5 Cr in FY22, and its FY23 top line stood at INR 70.2 Cr. Its profit almost doubled to INR 80.7 Lakh in FY23 from INR 41.3 Lakh a fiscal ago

Indigrid faces significant competition from Amara Raja, Exide, and Log9 Materials in the battery space and companies like Sterling Gtake in the powertrain space

India’s electric vehicle (EV) boom has reshaped the country’s automotive industry in the last three to four years. Key stakeholders, from vehicle manufacturers to auto component makers and policymakers, have made electric mobility an integral part of their core strategies.

However, this shift was initially led by EV original equipment manufacturers (OEMs), while the focus on developing EV components domestically came later.

If we were to look back, the government’s policy incentives and subsidies have nudged both new-age tech startups and established automakers to invest heavily in EVs.

Many new players entered the market as EV OEMs on the back of a growing market opportunity and the simplicity of manufacturing EVs, which require fewer components compared to traditional internal combustion engine (ICE) vehicles.

Amid this rapid growth, core technologies like batteries and motors were initially overlooked. This followed several mishaps, many of which were attributed to the use of low-quality components from China.

However, a series of safety incidents, including fires in 2022, brought this issue to light and shifted the government’s focus to these critical areas.

By 2023, the government tightened regulations around domestic value addition, and the industry continued to face challenges in building a fully self-reliant EV supply chain due to significant gaps in component manufacturing.

To bridge this gap, Delhi NCR-based electronics system design and manufacturing (ESDM) startup Indigrid Technology entered the EV market to provide Indian OEMs with domestic power solutions to push electrification further.

Indigrid designs and manufactures most of the power electronics for EVs in-house, including battery packs, motor controllers, and vehicle control units. It offers a full-stack solution to two-wheeler EV OEMs, helping them comply with localisation norms.

While a handful of EV OEMs, including Ola Electric, Ather Energy, Matter, River, and Ultraviolette, have vertical integration as their strategy, most are still completely dependent on third-party manufacturers for EV components – a market Indigrid has started capturing.

The Genesis Of Indigrid

Founded in 2016 by Sameer Narang and Rishab Puri, Indigrid began its operations in 2017, focussing solely on electronics manufacturing. Gradually, the startup expanded its capabilities to include both electronic design and manufacturing.

As an ESDM startup, Indigrid has primarily built its business in the automotive sector, boasting a strong client base that includes top-tier companies like HELLA and Motherson Sumi. The startup offers a range of products to its automotive customers, including lighting solutions, engine control systems, and emission control components.

In addition to its automotive operations, Indigrid has a non-automotive vertical, which functions as a contract manufacturer for components used in refrigeration, IoT devices, and various industrial tools.

After nearly six years of building deep expertise in the automotive industry, Indigrid entered the EV components manufacturing space in late 2022, aiming to capitalise on the growing demand for locally produced components.

Speaking with Inc42, Indigrid’s cofounder Narang, said that before venturing into the EV space, the startup had built its foundation around power electronics for ICE vehicles, which immensely helped the company to start designing and manufacturing power electronics for EVs.

Indigrid’s EV vertical kicked off by building battery packs for EV two-wheelers. Its first two products were IGT RED and IGT Blu – a 48-volt and a 60-volt battery, respectively. It tied up with a Japanese company, Murata Business Engineering, which helped Indigrid design its first battery packs.

“The first thing we wanted to understand was how batteries power EVs. We also realised that all the products that were coming in from China were inefficient. This was when we started by making two battery packs for EVs, which were initially given to the fleet operators,” said Narang.

Soon, Indigrid came up with its in-house motor controllers for EVs and built a powertrain for these vehicles.

Although Indigrid still imports motors and a few other core components, it designs and manufactures the entire powertrain, EV electronics like the VCU and 4G tracker, as well as battery packs in-house.

The startup counts electric two-wheeler OEMs Revolt, Bounce, EV MOTO, and MECPower Mobility as its customers. Besides, Indigrid is working with a few two-wheeler players in retrofitting its EV solutions in their existing ICE vehicles to convert them into electric.

The company also provides batteries and powertrains for erickshaws and other electric three-wheelers. It also converts diesel vehicles used for airport ground support to electric.

Indigrid has raised more than $6 Mn since its inception. The startup recently raised $5 Mn led by Cactus Partners.

Indigrid’s Financial Health

As a contract manufacturer in the ESDM space, Indigrid claims to have grown significantly over the last few years. Notably, the startup clocked a revenue of INR 33.5 Cr in FY22 and its FY23 top line stood at INR 70.2 Cr. Its profit almost doubled to INR 80.7 Lakh in FY23 from INR 41.3 Lakh the year before. It is yet to file its FY24 earnings report.

Narang told Inc42 the startup clocked INR 47 Cr in revenue in the first half of FY25. It aims to close the fiscal with INR 120-INR 140 Cr in the top line. The company projects to clock revenue between INR 250 and INR 300 in FY26.

According to Narang, the startup’s ESDM vertical has contributed 80% to its top line so far this year. The split is expected to be 70-30 in FY25, with 30% coming from the EV solutions vertical.

“In the EV business, we see a customer being added at least every week, there is always a new product requirement where we have to slightly customise the software solution and provide it to the customer. So, there is a lot of traction here, and if the built-up happens, it will happen quickly,” Narang said.

Indigrid’s Next Milestones

While Indigrid is building a strong position in the EV sector, several challenges remain for EV OEMs, and, consequently, for power electronics providers like Indigrid.

According to the founder, one key hurdle is that EV OEMs need to opt for recertification of their vehicles every time they change the powertrain or the battery, which is not only cost-intensive but also a time-consuming process.

It is also pertinent to note that as a solution provider across multiple verticals, Indigrid faces significant competition from Amara Raja, Exide, and Log9 Materials in the battery space and companies like Sterling Gtake and Matter in the powertrain space.

Meanwhile, Indigrid expects to double its capacities in the EV components vertical in the next 12-18 months.

With ESDM continuing to be the largest contributor to its business, the startup aims to grow this capacity by 3X in the same timeframe.

Going forward, Indigrid has set an aggressive target of growing each of the sub-verticals of its two businesses into INR 100 Cr business within 18 months.

The founder said the company is witnessing significant traction on the ESDM front with growing demand for home appliances. Besides, Indigrid is increasingly focussing on the telecom sector. It could also raise funds after March 2025.

As of now, Indigrid Technology looks well-positioned to meet the demands of India’s booming EV sector and the traditional automotive sector.

By focussing on in-house design and manufacturing of essential power electronics, Indigrid not only addresses the growing demand for locally sourced components but also mitigates risks of low-quality imports.

However, the company faces significant challenges on the regulatory front and cut-throat competition. Despite the hurdles, its current growth path is reflective of its potential to become a key player in India’s EV ecosystem.

[Edited By Shishir Parasher]